Factors are short-cuts

Analyzing financial statements is a cumbersome process for most retail investors. Many don’t have the time, patience or expertise to dig through balance-sheets, income and cashflow statements. Most don’t find joy in reflecting on the many footnotes that accompany such statements. Here lies the attraction of single-factor investing.

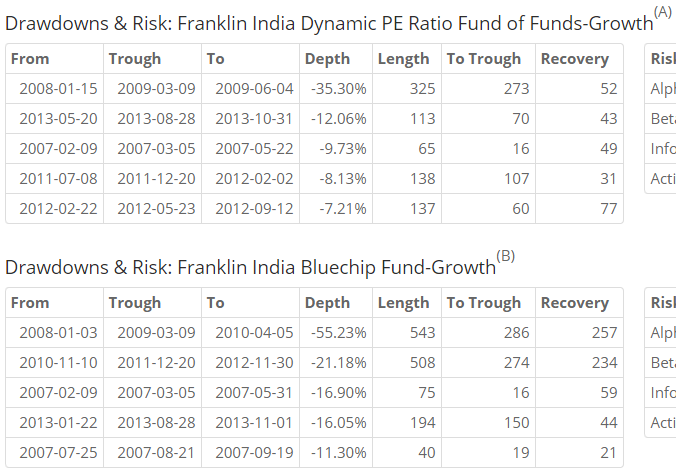

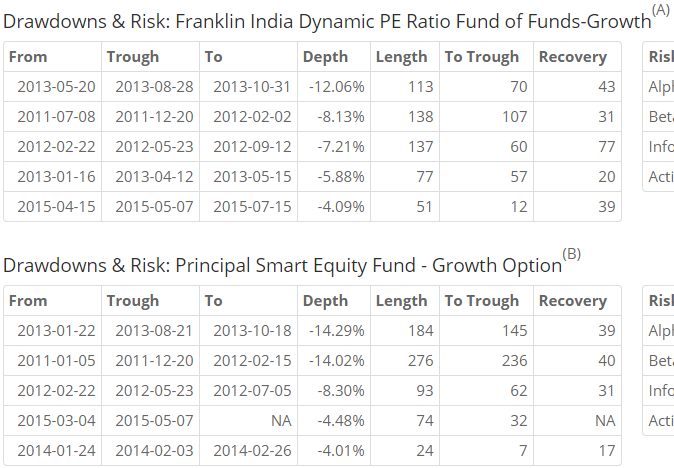

Price-to-Earnings (PE) ratio is one such factor. We recently saw how there was no great advantage in investing in mutual funds that use PE to switch between debt and equity. It is a poor market timing indicator even when practiced by professional fund managers.

The ‘E’ in PE

The ‘earnings’ line-item is an accounting driven artifact that is easily gamed and has very little relationship with the company’s value. Here’s what Michael J. Mauboussin has to say about earnings, see appendix for the full note:

Even Shiller’s cyclically-adjusted P/E (or “CAPE”) has little predictive value in the short term. Shiller CAPE shows its strongest correlation to nominal returns over an 8-year time horizon, and is actually most predictive of real returns over an *18* year time horizon. (Kitces)

Some investors also look at Price to Book and Return on Capital Employed. These ratios provide a convenient short-hand but are far from adequate in forecasting future earnings.

Besides what does the ratio of total assets to total liabilities measure anyway? Intangibles can’t be quantified. Are inventories adjusted to current market prices? Is the loan loss reserve adequate?

Bottom line: Assets are often overstated and liabilities understated. (Fool)

What does “capital employed” mean anyway?

- No general agreement exists on how capital employed should be calculated, on whether initial or average capital employed should be used or on how profit should be defined.

- Often, accounting profit rather than cash flow is used as the basis of evaluation.

- It ignores the time value of money.

Take away

Every style of investing – value, momentum or factor – depends on finding historical patterns and extending them into the future.

Every valuation metric comes with a “yes, but…”

No single factor is a predictor of future returns.