Mistakes Were Made (But Not by Me): Why We Justify Foolish Beliefs, Bad Decisions, and Hurtful Acts by Carol Tavris (Amazon,) shows how we self-justify the mistakes we make, blame it others and perpetuate a destructive cycle.

Almost all of us carry an image of ourselves that we are smart, and basically good. When me make decisions that lead to poor outcomes, it conflicts with this internal image. This dissonance, if left unchecked, is resolved by self-justification. And so, unconsciously, we create fictions that absolve us of responsibility, restoring our belief that we are smart, moral, and right – a belief that often keeps us on a course that is dumb, immoral, and wrong.

As investors, we aim to have “strong convictions that are weakly held.” But it is easier said than done. Even though we know to follow scientific process, while faced with disconcerting evidence, we tend to double down – “having the courage of one’s convictions.”

It is part of the scientific attitude to change one’s beliefs once they are discredited. Well, it’s not an easy thing to do. Combine invested time, invested money, high hopes, high expectations, and a relative amount of pride, and you’re up for quite a challenge when confronted with contradicting evidence.

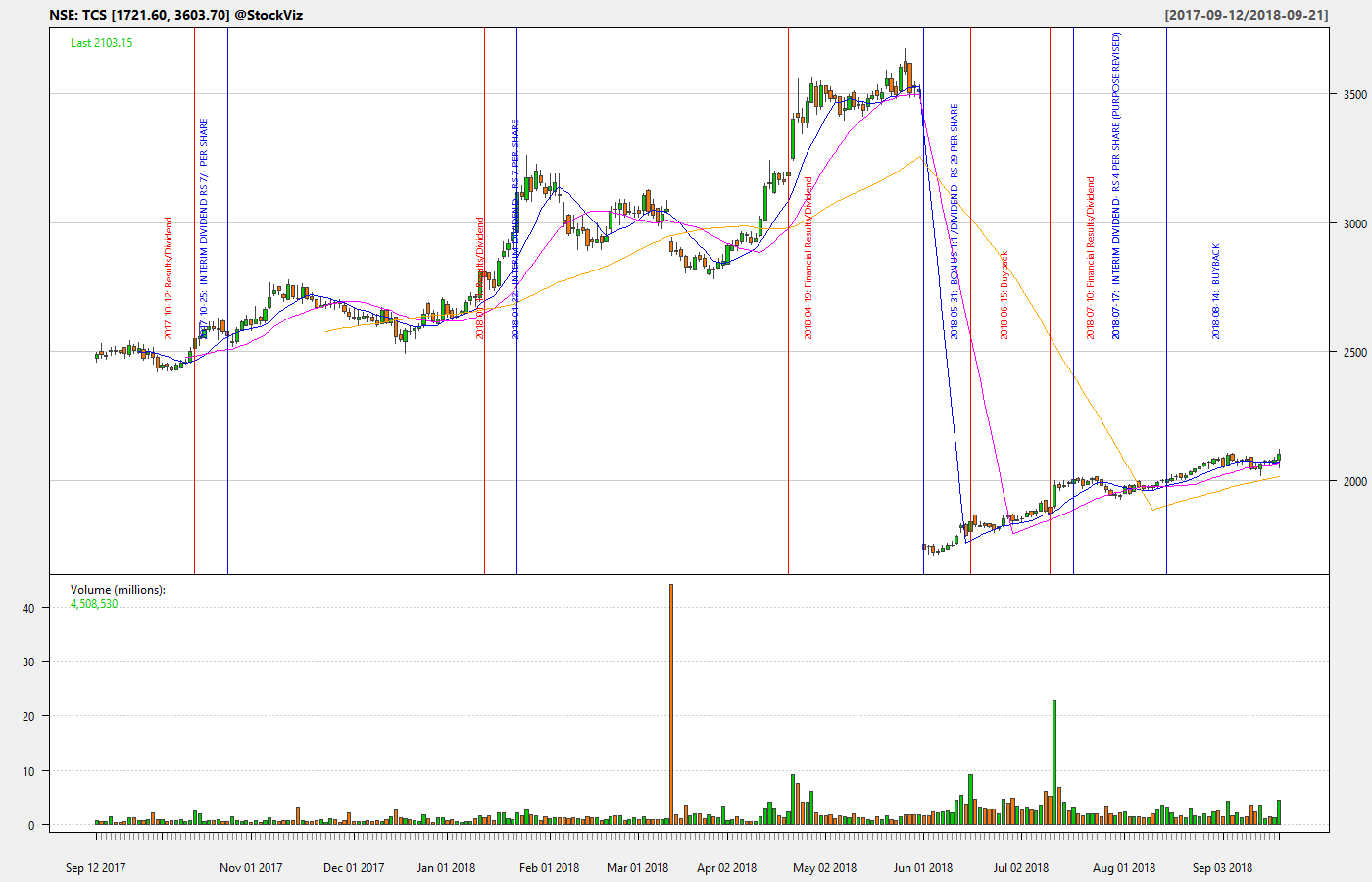

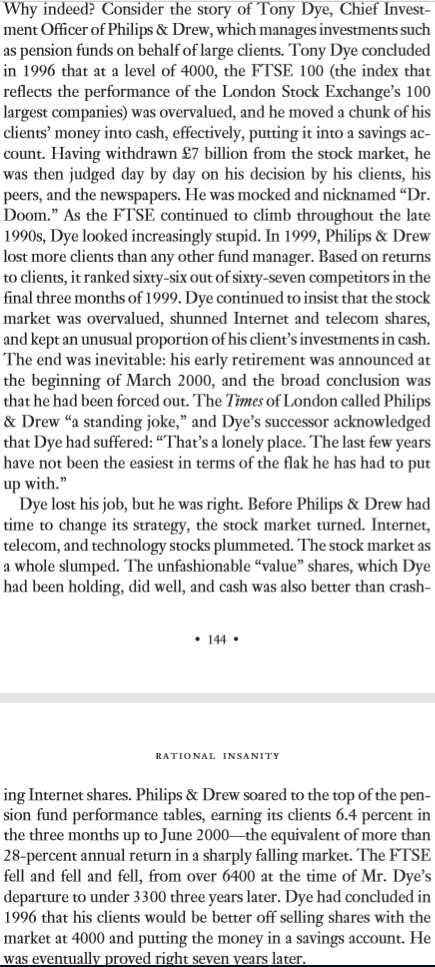

In investing, there are examples where both “sticking to ones guns” and “be like water, my friend” have worked. Here’s an example of the former: Tony Dye (from the Undercover Economist) stuck to his guns, lost his job, but was eventually proven right.

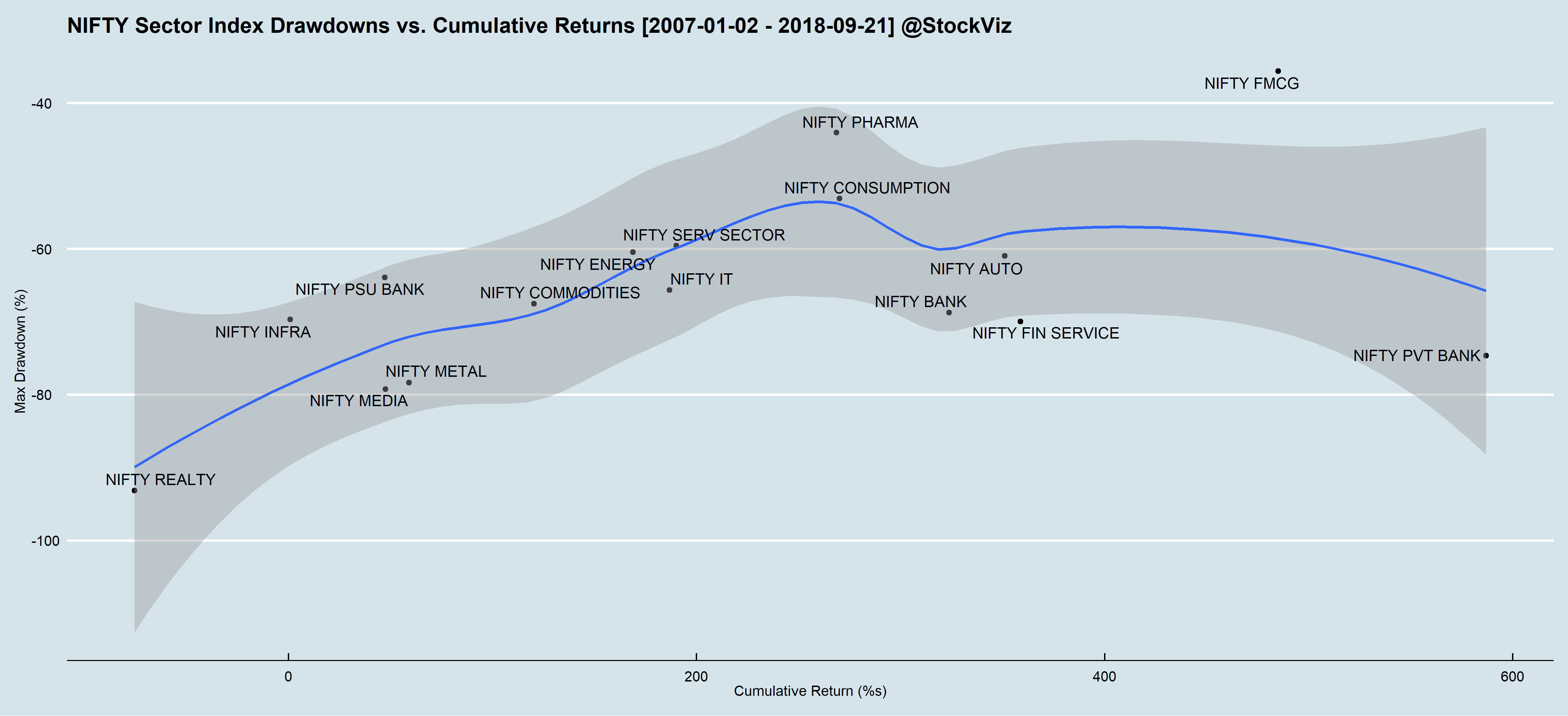

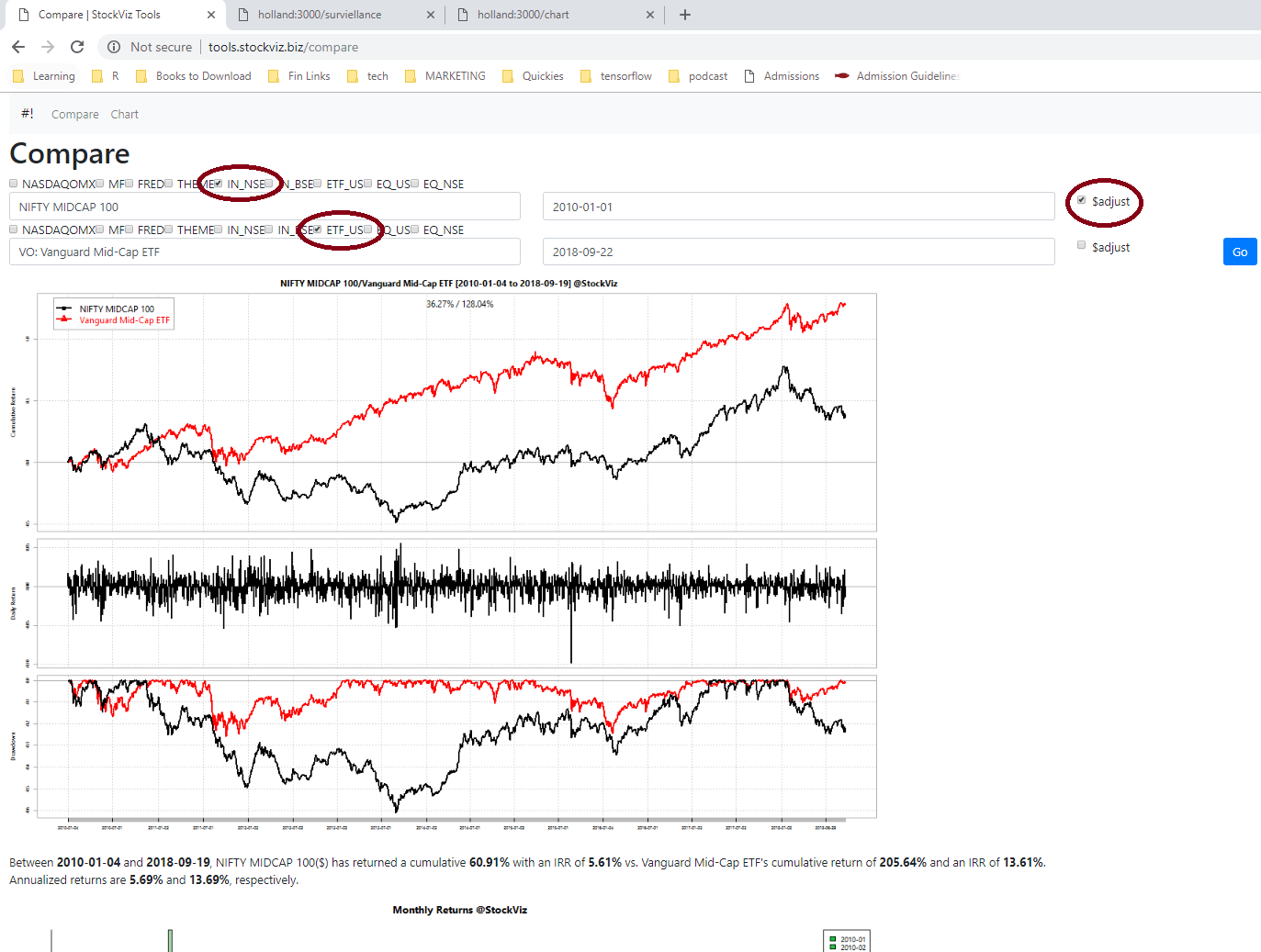

And as an example of why you shouldn’t stick to your guns: The Half-Life of Investment Strategies

And when you are wrong, even the best of us try to reduce dissonance by blaming somebody else: This Angry Stock Picker Says Trump Tweets Are Hurting His Investments

How do you change your mind?

Recommendation: Worth a read.