Our previous posts explored how swapping market-cap weighted indices with momentum indices considerably boosted returns in the classic GEM dual-momentum model. And we followed that up with a post comparing different momentum indices. Here, we try to address the quintessential question for times: which strategy should you bet on? Value or momentum?

Thankfully, MSCI has an exhaustive set of factor indices that cover both quantitative value and momentum. Going back to 1995.

MSCI Prime Value

MSCI Prime Value indices are a pretty good quality and value screen that cover a diversified universe of securities in a country/region.

From their factsheet about index construction methodology:

Quality scores are calculated for all Parent Index constituents. The Quality Z-scores are calculated using fundamental variables such as Return on Equity, Earnings Variability and Debt to Equity. The securities are sorted in descending order of the quality scores.

The Prime Value score for each security in the Quality Parent Universe is calculated by combining the z-scores of four value descriptors, namely Trailing Price to Earnings (P/E), Price to Book Value (P/B), Price to Sales (P/S) and Price to Cash Earnings (P/CE).

MSCI Momentum

MSCI Momentum indices are a pretty good momentum screen that covers a diversified universe of securities in a country/region.

From their factsheet about index construction methodology:

The Momentum value for each security is calculated by combining recent 12-month and 6-month local price performance of the security. The price performance is computed excluding recent 1-month. The Momentum value thus computed is further adjusted with corresponding volatility of the security.

Risk-adjusted Price Momentum (for the 6-month horizon and 12-month horizon) computed above are standardized into z-scores. The z-scores are combined in equal proportion and standardized to arrive at a single Momentum combined score.

Index coverage

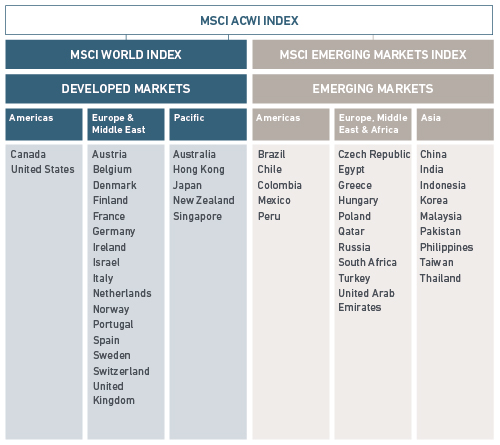

The MSCI ACWI is the mothership capturing all sources of equity returns in 23 developed and 24 emerging markets. Other indices feed into this. From their website:

The MSCI IMI – Investable Market Index – covers all investable large-, mid- and small-cap securities.

We went diving through their website to list those countries/regions that have all three of Prime Value, Momentum and IMI indices. We landed with: USA, UK, Europe, Japan, World, EM and ACWI.

Value vs. Momentum for both Developed and Emerging Markets

The ACWI pretty much covers everything under the sun, except Frontier markets. And here’s how Value, Momentum and All-Market strategies performed:

Momentum trumped Value.

Value vs. Momentum for Emerging Markets

Momentum and Value seem neck-and-neck with the former slightly ahead. Both trump All-Market.

Value vs. Momentum for Developed Markets

Once again, Momentum trumped Value.

Value vs. Momentum for US, UK and JP

Japan:

Take-away

Unless you expect the country/region you are planning to invest in to experience a Japanese style 20-year deflationary death spiral with zombie companies roaming about, you are better off with momentum.

Source and annual performance charts are on github.