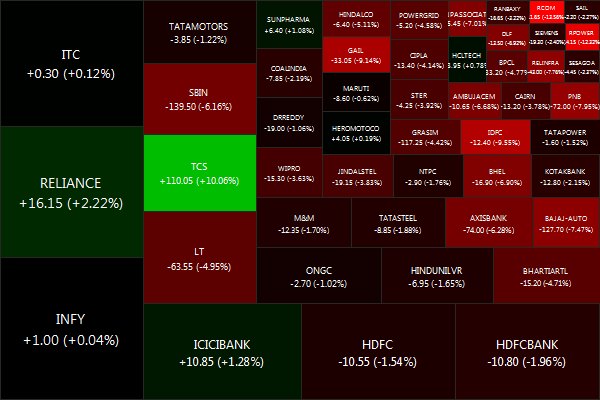

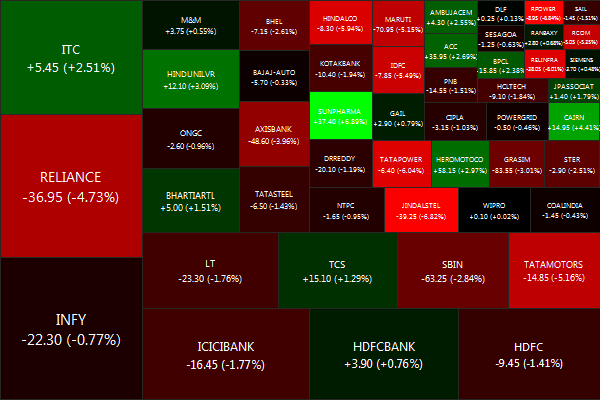

The NIFTY ended on a negative tone, drifting down -0.59% for the week.

Biggest losers were RCOM (-13.56%), RPOWER (-12.32%) and IDFC (-9.55%).

And the biggest winners were TCS (+10.06%), RELIANCE (+2.22%) and ICICIBANK (+1.28%).

Decliners eclipsed advancers 41 vs 8

If not for the stellar performance of TCS, the markets would have tanked much lower. Bad news from Europe continues to pour cold water over any resurgence and American growth seems to be faltering. This market is definitely not for the week hearted.

Gold: -0.76%, Infrastructure: -1.08%, Banks: -1.03%.

Daily news summaries are here.