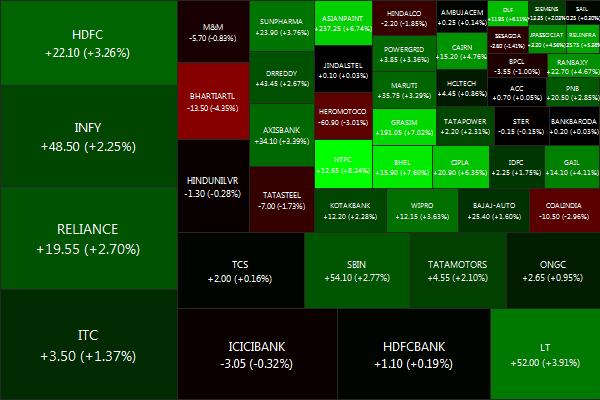

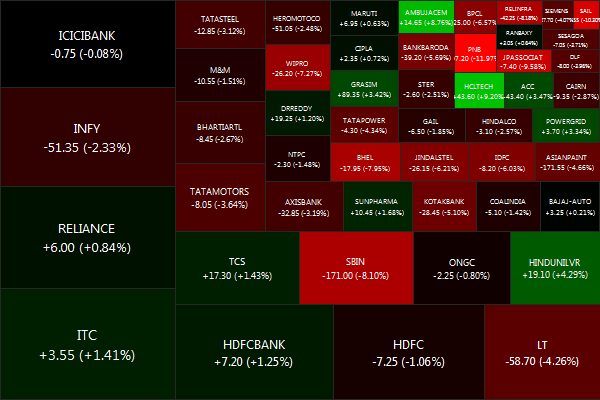

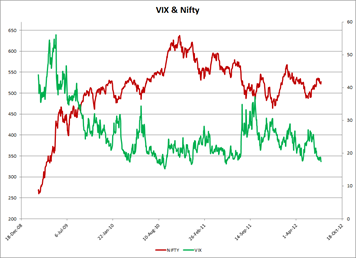

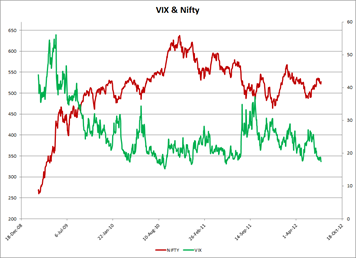

We discussed historical and implied volatility previously. The question now is how to profit from it. As you can see from the chart on the left, the market implied volatility (VIX) keeps oscillating (greed-fear-greed-fear…) A simple strategy could be to sell when VIX is at its lows (greed is predominant) and buy when VIX peaks (fear is predominant). Notice the (loose) correlation between Nifty peaks/troughs with the VIX troughs/peaks.

We discussed historical and implied volatility previously. The question now is how to profit from it. As you can see from the chart on the left, the market implied volatility (VIX) keeps oscillating (greed-fear-greed-fear…) A simple strategy could be to sell when VIX is at its lows (greed is predominant) and buy when VIX peaks (fear is predominant). Notice the (loose) correlation between Nifty peaks/troughs with the VIX troughs/peaks.

Buy why trade the underlying (in this case, the Nifty), when you can trade volatility directly? Using stock & index option strategies, you can profit from volatility while being indifferent to the actual underlying scrip. For example, you can buy Straddles (Nifty August 5200 Long Straddle) that appreciate in value if volatility increases, irrespective of whether the underlying stock increases or decreases in value. Ditto with Strangles (Nifty August 5200/5300 Strangles).

Caveat: it depends on how much you pay to put on the trade. If increasing volatility is “priced-in”, then the trade may not be profitable even if the target volatility level is reached, as the following pay-off diagram illustrates.

Nifty Strangle & Straddle

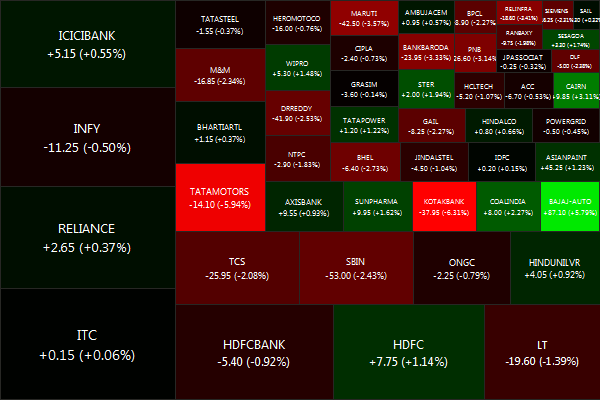

Volatility strategies are often used when the fundamentals of the underlying scrip is in doubt. For example, there was a fair amount of uncertainty around INFY results: global IT spending slowdown plus company specific problems. However, it has a track record of execution and is considered to have good corporate governance (ie, a good company to own long term.) So instead of taking a directional bet on the stock, traders put on straddles betting on volatility instead.

To conclude our discussion:

- Choose low-volatility stocks for your long-term portfolio

- Know the difference between historical volatility and implied volatility

- Know what you are trading (fundamentals vs. technicals)

- Be aware of the different trading instruments available to you and know when to use them

Understanding what volatility is and isn’t is key to understand options. You can refer back to this series using the “volatility” shortcode: http://stockviz.biz/go/volatility We will be discussing options next. Stay tuned!

![]() icon and subscribe to the feed in our favorite news reader.

icon and subscribe to the feed in our favorite news reader.