At the launch of Nifty Midcap Select Index futures, we had pointed out that strategies that work on the broader Midcap 150 index should work on it as well. Since then, MIDCPNIFTY has had a colorful journey with the exchange experimenting with different tenures and expiries. However, the experimentation phase seems to be over and volumes have steadily improved with the product finding decent traction.

Some quick thoughts on liquidity:

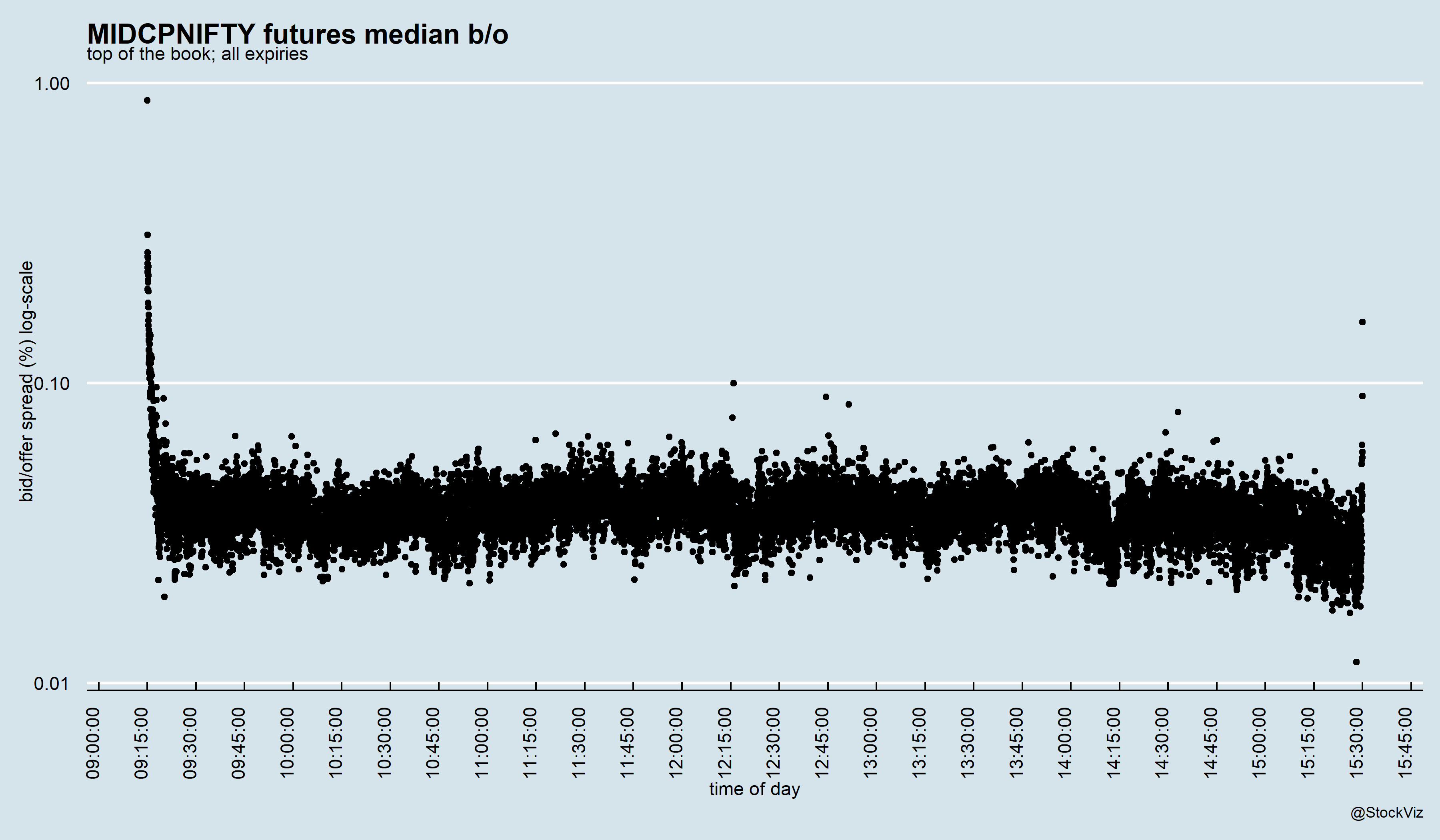

- Simply don’t trade the opening and closing stubs and you are golden.

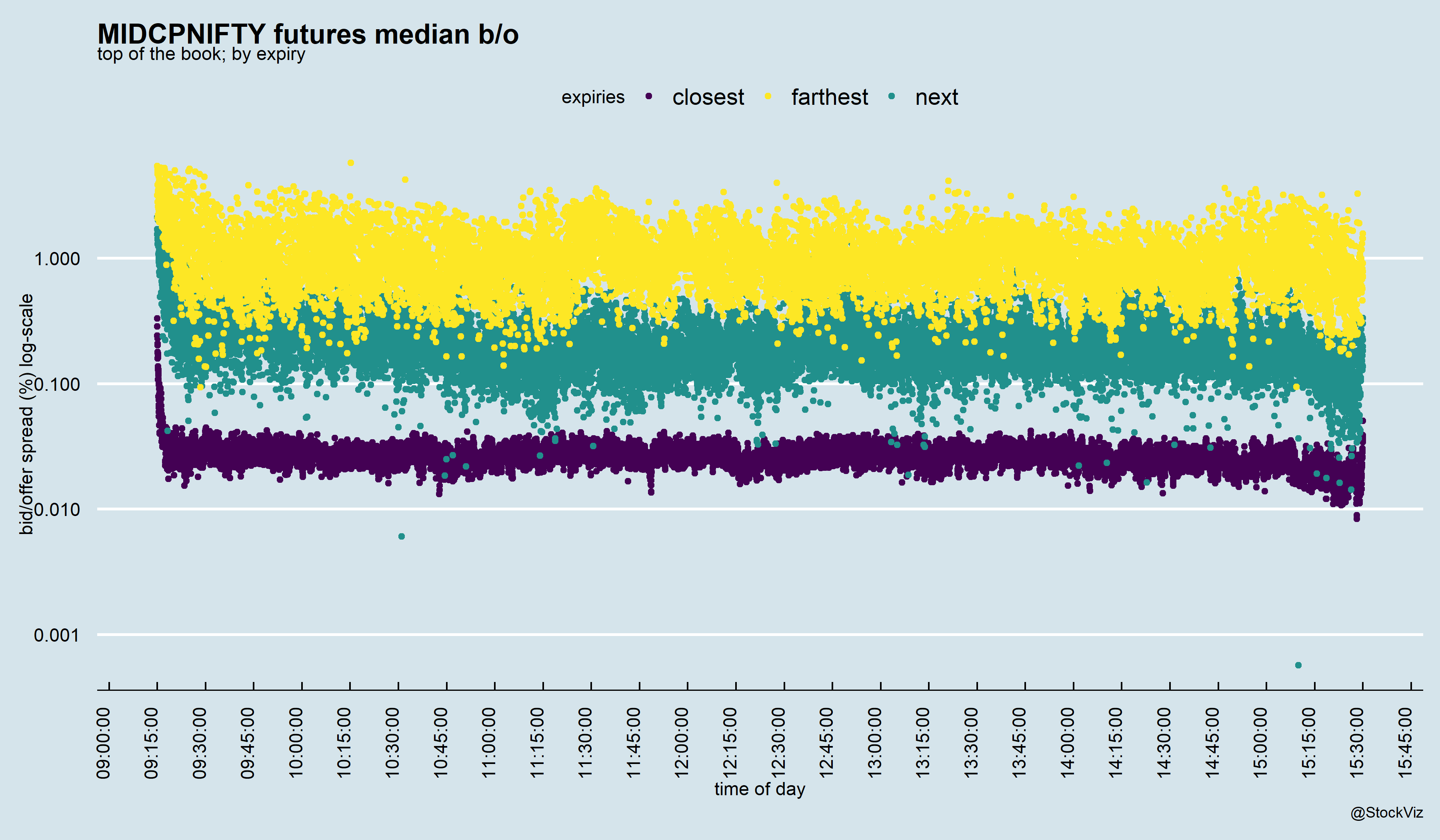

- Also, stick to the nearest expiry – the spreads on the other two will make your eyes bleed.

- The tightest spreads can be usually found around 15 minutes to close – great if you are taking positional trades end-of-the-day.

On the face of it, MIDCPNIFTY futures look good enough to trade. Happy hunting!

Comments are closed, but trackbacks and pingbacks are open.