We often hear about portfolio hedging – how you can short NIFTY futures or buy puts – to reduce portfolio losses. The chapter, Hedging with Futures on Varsity, is a good introduction to the mechanics involved. However, real life involves tradeoffs.

How much to hedge?

This one is pretty straightforward. A fully hedged portfolio means that your total returns are driven purely by excess returns. Given that excess returns are typically not more than 5%, it may not make sense for most investors. So, most do a partial hedge. And a partial hedge means that when volatility strikes, you are still exposed to downside risks.

The other problem with hedges is that most investors think of risk in terms of absolute draw-downs (not volatility.) i.e., “My portfolio is down 15%,” not “My portfolio lost half of what the market lost.” So hedging first requires a change in how investors perceive risk.

Portfolio betas are not invariant

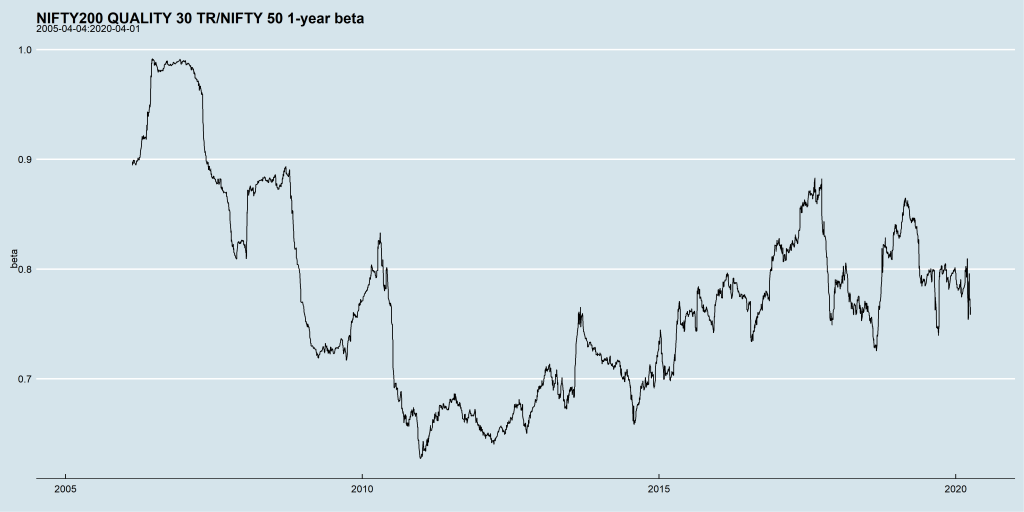

Suppose you want to be long quality stocks but want to hedge part of the portfolio by shorting the NIFTY, then how do you go about calculating the portfolio’s beta? Your assumptions of the risk-free rate and the look-back period will greatly influence the final value. Also, beta is not a static number that you can assume and keep unchanged through time.

Hedging costs increase with volatility

Volatility is huge part of derivative pricing. When you trade futures, you have to post margin to your broker and options have an implied volatility baked into their premiums. So irrespective of how you choose to hedge your portfolio, you will find that when volatility arrives, hedging costs increase.

For example, the margin requirement for a single lot of NIFTY futures in late December was roughly Rs. 1,05,000/- With NIFTY ~12,100, that is roughly 11.5% of notional. But now, because of the virus induced spike in volatility, the margin requirement has gone up to about Rs. 1,50,000/- with NIFTY ~8250, or 24.25% of notional.

So, when you want your portfolio to be hedged the most, the cost of doing so has more than doubled. To fund this, you now have to choose between reducing the hedge ratio (and taking on more market risk) and liquidating the long-side of the portfolio to the extent of the deficit (while selling in a down market.)

Take-away

There are no simple answers and each investor needs to arrive at these trade-offs based on their risk perception and tolerance.