MOMENTUM

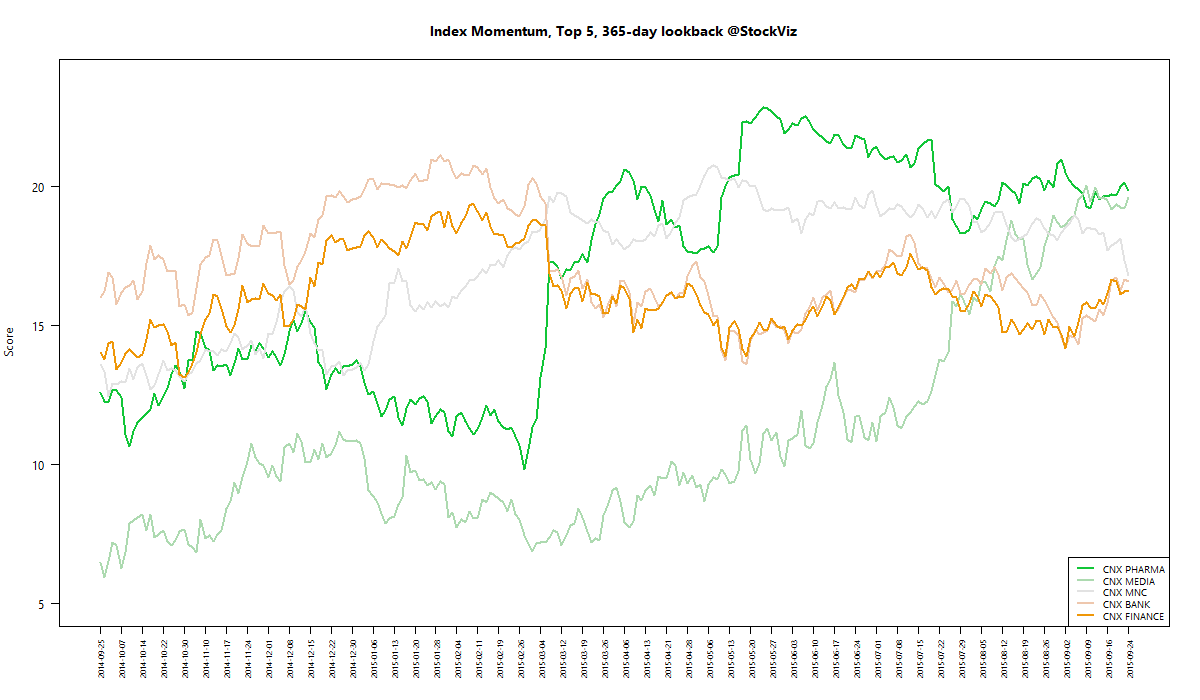

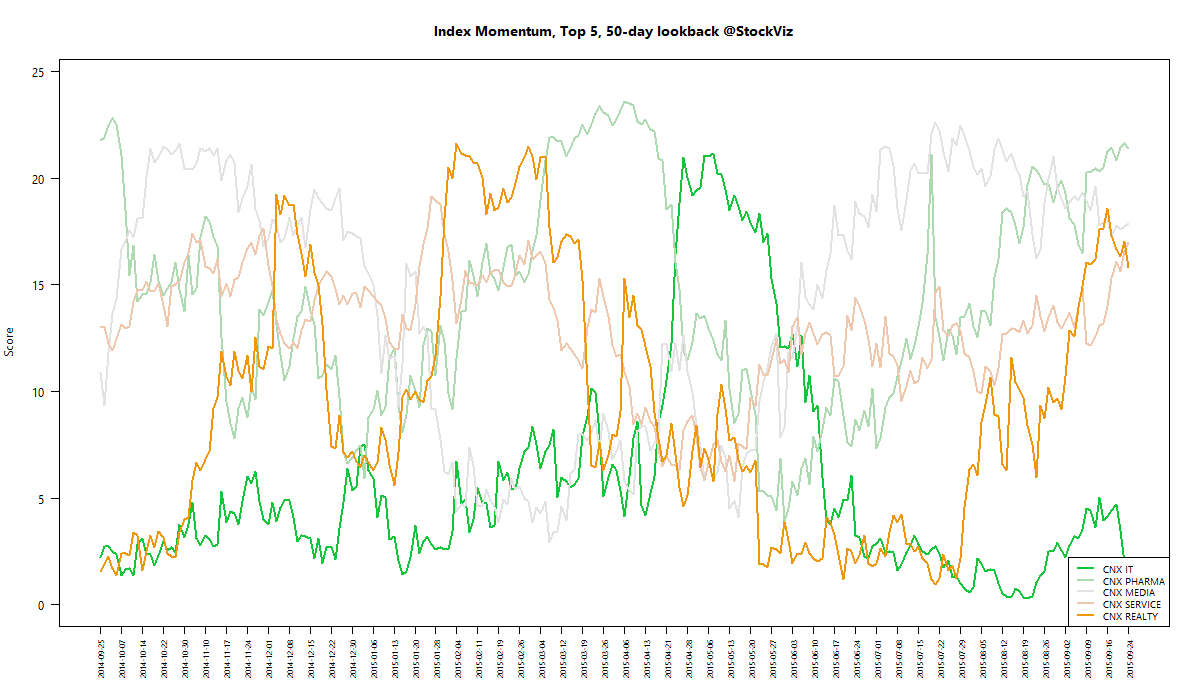

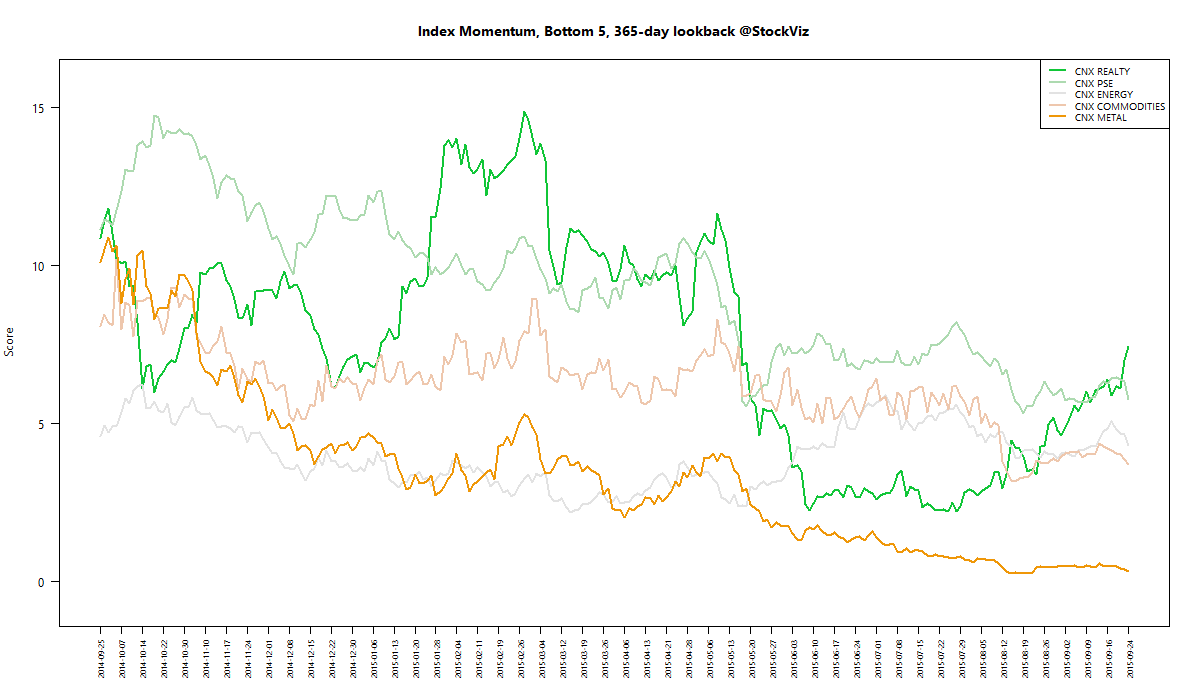

We run our proprietary momentum scoring algorithm on indices just like we do on stocks. You can use the momentum scores of sub-indices to get a sense for which sectors have the wind on their backs and those that are facing headwinds.

Traders can pick their longs in sectors with high short-term momentum and their shorts in sectors with low momentum. Investors can use the longer lookback scores to position themselves using our re-factored index Themes.

You can see how the momentum algorithm has performed on individual stocks here.

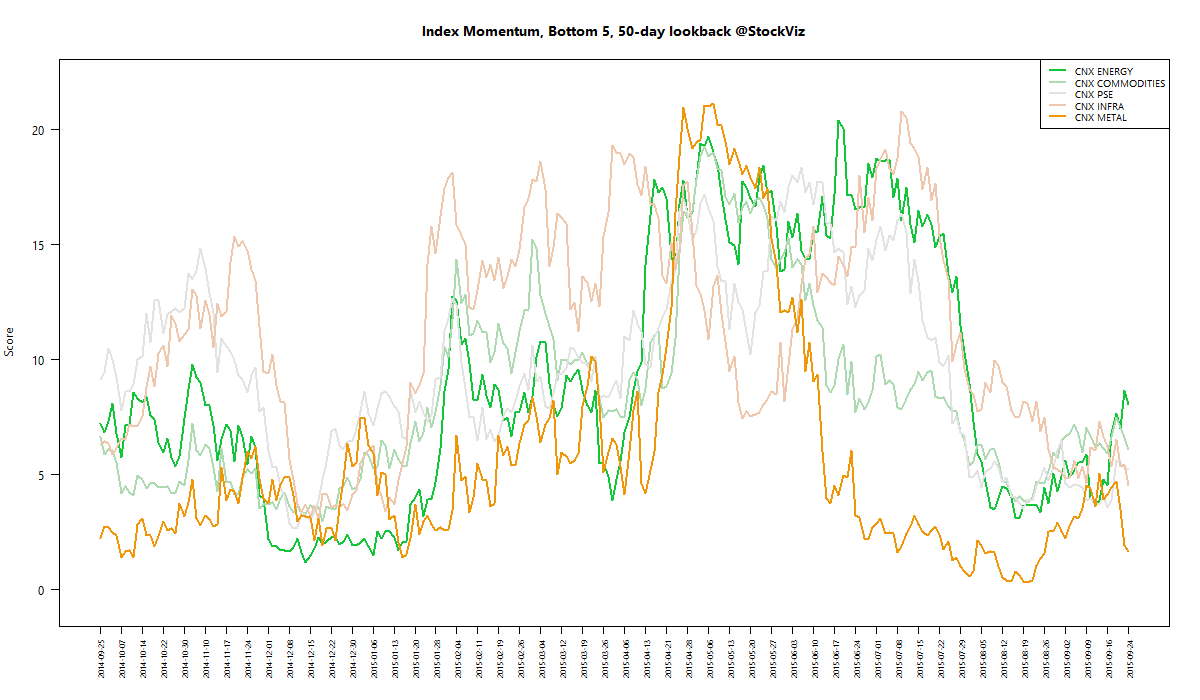

Here are the best and the worst sub-indices:

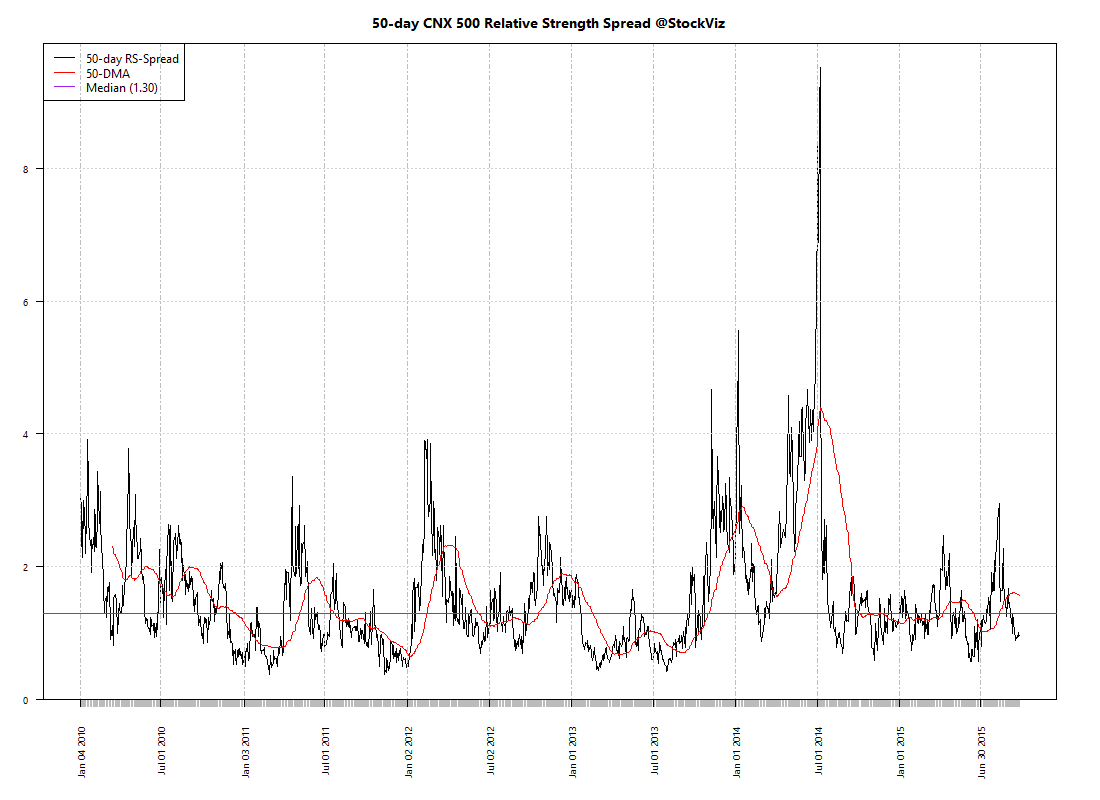

Relative Strength Spread

Refactored Index Performance

50-day performance, from July 16, 2015 through September 24, 2015:

Trend Model Summary

| Index | Signal | % From Peak | Day of Peak |

|---|---|---|---|

| CNX AUTO | SHORT |

15.15

|

2015-Jan-27

|

| CNX BANK | LONG |

16.34

|

2015-Jan-27

|

| CNX COMMODITIES | SHORT |

38.78

|

2008-Jan-04

|

| CNX CONSUMPTION | SHORT |

9.43

|

2015-Aug-05

|

| CNX ENERGY | SHORT |

37.64

|

2008-Jan-14

|

| CNX FMCG | LONG |

12.60

|

2015-Feb-25

|

| CNX INFRA | SHORT |

55.65

|

2008-Jan-09

|

| CNX IT | LONG |

87.48

|

2000-Feb-21

|

| CNX MEDIA | SHORT |

18.71

|

2008-Jan-04

|

| CNX METAL | SHORT |

69.33

|

2008-Jan-04

|

| CNX MNC | SHORT |

10.28

|

2015-Aug-10

|

| CNX NIFTY | SHORT |

12.54

|

2015-Mar-03

|

| CNX PHARMA | LONG |

7.26

|

2015-Apr-08

|

| CNX PSE | SHORT |

36.45

|

2008-Jan-04

|

| CNX PSU BANK | LONG |

41.91

|

2010-Nov-05

|

| CNX REALTY | LONG |

90.96

|

2008-Jan-14

|

| CNX SERVICE | LONG |

11.70

|

2015-Mar-03

|

Relative strength spread continues to be in negative momentum territory. Contrarians can use this moment to load up on momentum strategies and ride the bounce…