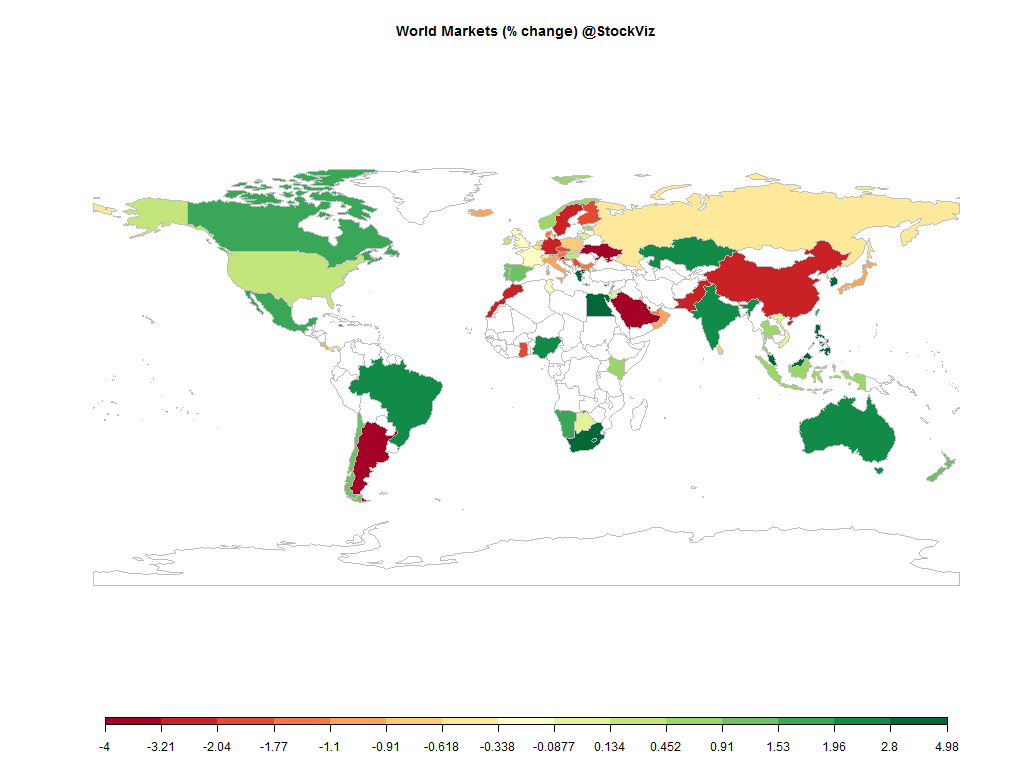

Equities

| MINTs | |

|---|---|

| JCI(IDN) | +0.46% |

| INMEX(MEX) | +1.72% |

| NGSEINDX(NGA) | +2.17% |

| XU030(TUR) | +5.25% |

| BRICS | |

|---|---|

| IBOV(BRA) | +2.11% |

| SHCOMP(CHN) | -3.20% |

| NIFTY(IND) | +2.47% |

| INDEXCF(RUS) | -0.42% |

| TOP40(ZAF) | +4.98% |

Commodities

| Energy | |

|---|---|

| RBOB Gasoline | -1.41% |

| WTI Crude Oil | -0.38% |

| Natural Gas | -3.41% |

| Brent Crude Oil | -2.43% |

| Heating Oil | -4.14% |

| Ethanol | +3.91% |

| Metals | |

|---|---|

| Gold 100oz | +3.22% |

| Copper | -2.85% |

| Palladium | +2.54% |

| Platinum | +1.58% |

| Silver 5000oz | +5.52% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | +0.37% |

| USDMXN(MEX) | -0.95% |

| USDNGN(NGA) | -0.01% |

| USDTRY(TUR) | -1.30% |

| BRICS | |

|---|---|

| USDBRL(BRA) | +1.76% |

| USDCNY(CHN) | -0.17% |

| USDINR(IND) | -1.30% |

| USDRUB(RUS) | -1.73% |

| USDZAR(ZAF) | -1.82% |

| Agricultural | |

|---|---|

| Cattle | -3.34% |

| Feeder Cattle | -3.78% |

| Sugar #11 | -5.90% |

| White Sugar | -1.24% |

| Cocoa | +1.15% |

| Soybeans | -2.28% |

| Wheat | +2.85% |

| Coffee (Robusta) | +1.36% |

| Lean Hogs | +5.91% |

| Lumber | -5.86% |

| Orange Juice | -1.46% |

| Soybean Meal | -1.46% |

| Coffee (Arabica) | +4.42% |

| Corn | +0.73% |

| Cotton | -7.91% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | +0.87% |

| Markit CDX NA HY | +0.25% |

| Markit CDX NA IG | -2.42% |

| Markit iTraxx Asia ex-Japan IG | -6.65% |

| Markit iTraxx Australia | -1.53% |

| Markit iTraxx Europe | -0.30% |

| Markit iTraxx Europe Crossover | -2.09% |

| Markit iTraxx Japan | -1.94% |

| Markit iTraxx SovX Western Europe | -0.41% |

| Markit LCDX (Loan CDS) | +0.00% |

| Markit MCDX (Municipal CDS) | -0.22% |

Did the Fed just yell “FIRE” in a crowded room? Their decision to hold rates at zero on Thursday seemed to have shifted the market’s worry on the slowing world economy…

International ETFs (in USD)

|

5yr

|

2yr

|

1yr

|

1wk

|

|

|---|---|---|---|---|

| EWM iShares MSCI Malaysia |

-11.55%

|

-30.48%

|

-30.9%

|

+5.64%

|

| GREK Global X FTSE Greece 20 |

-45.28%

|

-45.54%

|

+4.76%

|

|

| NGE Global X MSCI Nigeria |

-37.25%

|

-40.9%

|

+4.22%

|

|

| EZA iShares MSCI South Africa |

-0.41%

|

-14.19%

|

-16.79%

|

+3.5%

|

| TUR iShares MSCI Turkey |

-41.1%

|

-37.41%

|

-30.19%

|

+3.15%

|

| EWY iShares MSCI South Korea Capped |

+0.4%

|

-20.12%

|

-20.37%

|

+3.11%

|

| GXG Global X MSCI Colombia |

-52.87%

|

-53.55%

|

-52.94%

|

+2.99%

|

| ICOL iShares MSCI Colombia Capped |

-53.45%

|

-53.5%

|

+2.58%

|

|

| EPHE iShares MSCI Philippines |

-2.17%

|

-8.73%

|

+2.57%

|

|

| INDA iShares MSCI India |

+18.41%

|

-10.88%

|

+2.35%

|

|

| EGPT Market Vectors Egypt |

-37.94%

|

-9.32%

|

-43.79%

|

+2.2%

|

| ENZL iShares MSCI New Zealand Capped |

+47.44%

|

-9.44%

|

-14.61%

|

+2.1%

|

| ECH iShares MSCI Chile Capped |

-49.65%

|

-33.38%

|

-18.67%

|

+1.63%

|

| EIRL iShares MSCI Ireland Capped |

+128.56%

|

+26.76%

|

+16.69%

|

+1.56%

|

| RSX Market Vectors Russia |

-43.09%

|

-42.19%

|

-29.21%

|

+1.39%

|

| EWA iShares MSCI Australia |

-1.38%

|

-23.64%

|

-24.2%

|

+1.36%

|

| ERUS iShares MSCI Russia Capped |

-42.52%

|

-27.7%

|

+1.14%

|

|

| EWT iShares MSCI Taiwan |

+16.88%

|

-0.86%

|

-12.23%

|

+1.1%

|

| PGAL Global X FTSE Portugal 20 |

-27.98%

|

+0.99%

|

||

| FXI iShares China Large-Cap |

-4.75%

|

-4.27%

|

-8.7%

|

+0.72%

|

| EWC iShares MSCI Canada |

-5.21%

|

-14.43%

|

-25.55%

|

+0.72%

|

| EWH iShares MSCI Hong Kong |

+27.47%

|

+1.13%

|

-6.89%

|

+0.41%

|

| EWG iShares MSCI Germany |

+32.24%

|

-6.97%

|

-12.02%

|

-2.72%

|

| EWI iShares MSCI Italy Capped |

+0.48%

|

+3.26%

|

-9.28%

|

-2.28%

|

| FEZ SPDR Euro STOXX 50 |

+13.31%

|

-7.27%

|

-14.7%

|

-2.16%

|

| EWD iShares MSCI Sweden |

+23.83%

|

-11.94%

|

-11.29%

|

-1.89%

|

| EWJ iShares MSCI Japan |

+24.7%

|

-2.62%

|

-1.79%

|

-1.88%

|

| EWZ iShares MSCI Brazil Capped |

-63.52%

|

-52.16%

|

-52.42%

|

-1.81%

|

| QAT iShares MSCI Qatar Capped |

-20.51%

|

-1.57%

|

||

| EWQ iShares MSCI France |

+18.69%

|

-6.81%

|

-9.71%

|

-1.56%

|

| EIDO iShares MSCI Indonesia |

-31.34%

|

-32.2%

|

-34.27%

|

-1.39%

|

| EWO iShares MSCI Austria Capped |

-9.4%

|

-17.77%

|

-10.68%

|

-1.23%

|

| EPOL iShares MSCI Poland Capped |

-16.52%

|

-22.39%

|

-23.13%

|

-1.09%

|

| EWU iShares MSCI United Kingdom |

+22.5%

|

-9%

|

-14.92%

|

-0.71%

|

| THD iShares MSCI Thailand Capped |

+25.81%

|

-18.42%

|

-22.42%

|

-0.63%

|

| NORW Global X MSCI Norway |

-29.21%

|

-32.51%

|

-0.56%

|

|

| UAE iShares MSCI UAE Capped |

-28.03%

|

-0.53%

|

||

| EDEN iShares MSCI Denmark Capped |

+36.37%

|

+7.13%

|

-0.48%

|

|

| SPY SPDR S&P 500 |

+87.49%

|

+16.81%

|

-1.77%

|

-0.25%

|

| ISRA Market Vectors Israel |

+15.03%

|

-0.1%

|

-0.19%

|

|

| EWL iShares MSCI Switzerland Capped |

+52.24%

|

+2.83%

|

-5.36%

|

-0.13%

|

| EPU iShares MSCI All Peru Capped |

-37.31%

|

-31.38%

|

-36.47%

|

-0.04%

|

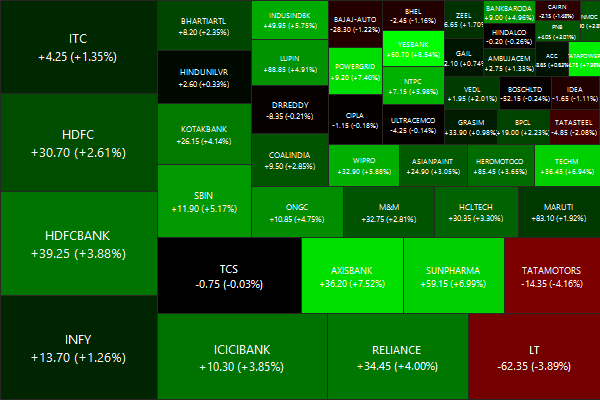

Nifty Heatmap

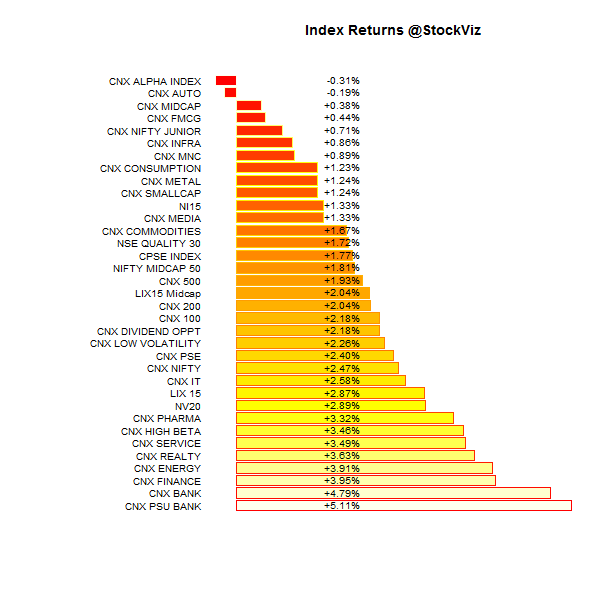

Index Returns

For a deeper dive into indices, check out our weekly Index Update.

Market Cap Decile Performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 | +1.75% | 63/66 |

| 2 | +1.78% | 70/59 |

| 3 | +2.87% | 67/62 |

| 4 | +2.11% | 75/54 |

| 5 | +2.82% | 75/54 |

| 6 | +2.10% | 62/67 |

| 7 | +0.92% | 65/65 |

| 8 | +1.20% | 64/64 |

| 9 | +0.90% | 64/65 |

| 10 | +1.03% | 59/71 |

A broad based rally on the back of ZIRP…

Top Winners and Losers

| TATAPOWER | +7.98% |

| YESBANK | +8.54% |

| CROMPGREAV | +9.17% |

| BHARATFORG | -10.20% |

| CONCOR | -5.10% |

| UPL | -5.02% |

Bharat Forge got dinged pretty bad…

ETF Performance

| PSUBNKBEES | +4.89% |

| BANKBEES | +4.76% |

| JUNIORBEES | +2.18% |

| NIFTYBEES | +1.98% |

| CPSEETF | +1.75% |

| GOLDBEES | +1.26% |

| INFRABEES | -0.14% |

Banks caught a rally on the back of rumors of FDI being hiked to 100%…

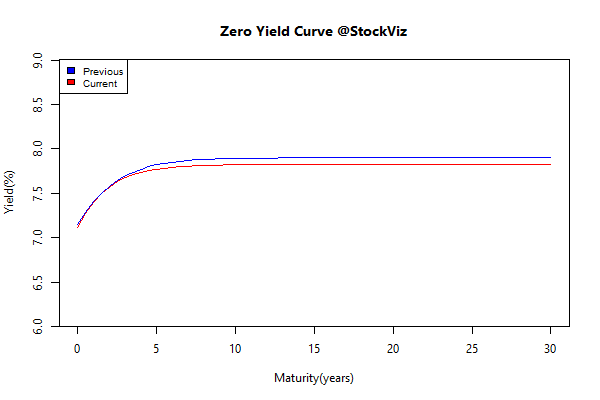

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| 0 5 | -0.05 | +0.29% |

| 5 10 | -0.05 | +0.43% |

| 10 15 | -0.06 | +0.62% |

| 15 20 | -0.06 | +0.72% |

| 20 30 | -0.06 | +0.79% |

The bond market has factored in a rate-cut later this month…

Investment Theme Performance

| The RBI Restricted List | +4.69% |

| High Beta | +4.09% |

| Momentum | +3.30% |

| Velocity | +2.85% |

| ADAG stocks | +2.44% |

| PPFAS Long Term Value | +2.08% |

| Quality to Price | +2.07% |

| ASK Life | +1.35% |

| Balance Sheet Strength | +1.00% |

| Low Volatility | +0.91% |

| CNX 100 Enterprise Yield | +0.83% |

| Magic Formula | +0.70% |

| Financial Strength Value | +0.23% |

| Tactical CNX 100 | -0.00% |

| Next Trillion | -0.86% |

Momentum caught a break as midcaps rallied…

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

The golden age of the Western corporation was the product of two benign developments: the globalisation of markets and, as a result, the reduction of costs. Now a more difficult era is beginning. More than twice as many multinationals are operating today as in 1990, making for more competition. Margins are being squeezed and the volatility of profits is growing. Many companies in labour- and capital-intensive industries have been slaughtered by foreign competitors. What next?

Source: Death and transfiguration