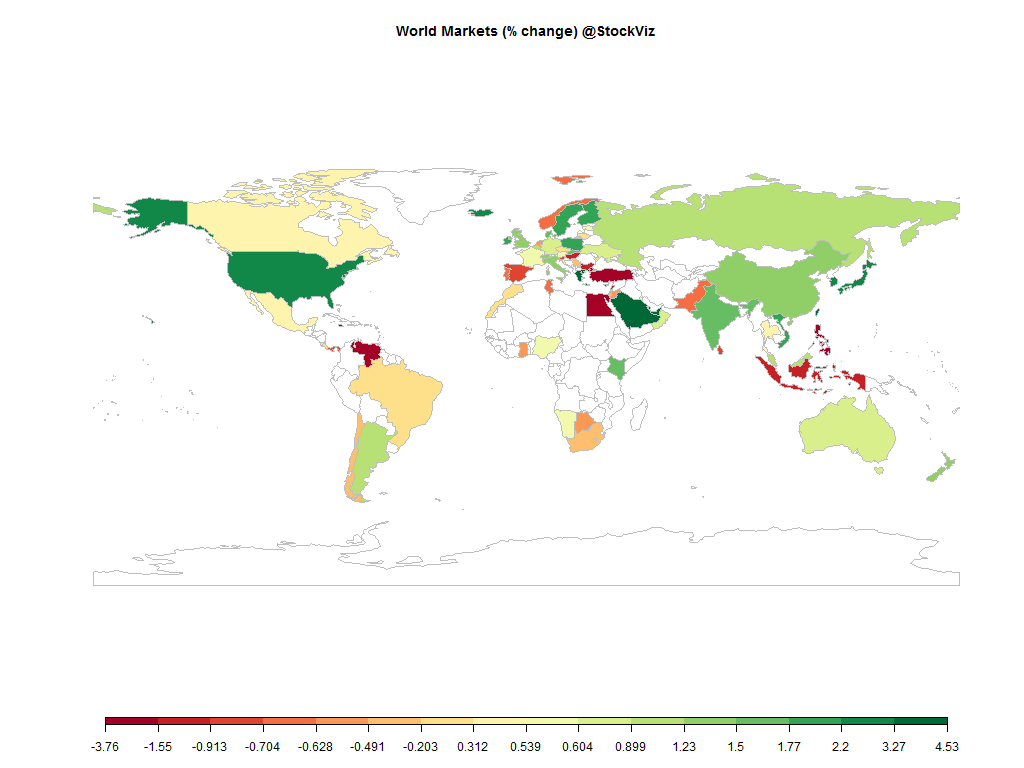

Equities

Commodities

| Energy |

| Brent Crude Oil |

-3.80% |

| WTI Crude Oil |

-3.66% |

| Heating Oil |

-3.50% |

| RBOB Gasoline |

-3.51% |

| Ethanol |

+2.12% |

| Natural Gas |

+1.02% |

| Metals |

| Palladium |

+2.49% |

| Platinum |

-2.16% |

| Silver 5000oz |

-0.68% |

| Copper |

+6.47% |

| Gold 100oz |

-1.58% |

| Agricultural |

| Coffee (Arabica) |

-2.16% |

| Cotton |

+2.60% |

| Sugar #11 |

+4.19% |

| White Sugar |

-0.09% |

| Corn |

+7.38% |

| Cocoa |

+2.20% |

| Feeder Cattle |

-0.42% |

| Lean Hogs |

-2.41% |

| Soybean Meal |

+0.22% |

| Soybeans |

+1.34% |

| Wheat |

+3.44% |

| Cattle |

+0.06% |

| Coffee (Robusta) |

-3.02% |

| Lumber |

+6.22% |

| Orange Juice |

-5.97% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.04% |

| Markit CDX NA HY |

+0.30% |

| Markit CDX NA IG |

-1.02% |

| Markit iTraxx Asia ex-Japan IG |

-5.46% |

| Markit iTraxx Australia |

-2.71% |

| Markit iTraxx Europe |

-2.42% |

| Markit iTraxx Europe Crossover |

-11.48% |

| Markit iTraxx Japan |

-1.82% |

| Markit iTraxx SovX Western Europe |

-0.17% |

| Markit LCDX (Loan CDS) |

+0.00% |

| Markit MCDX (Municipal CDS) |

-0.27% |

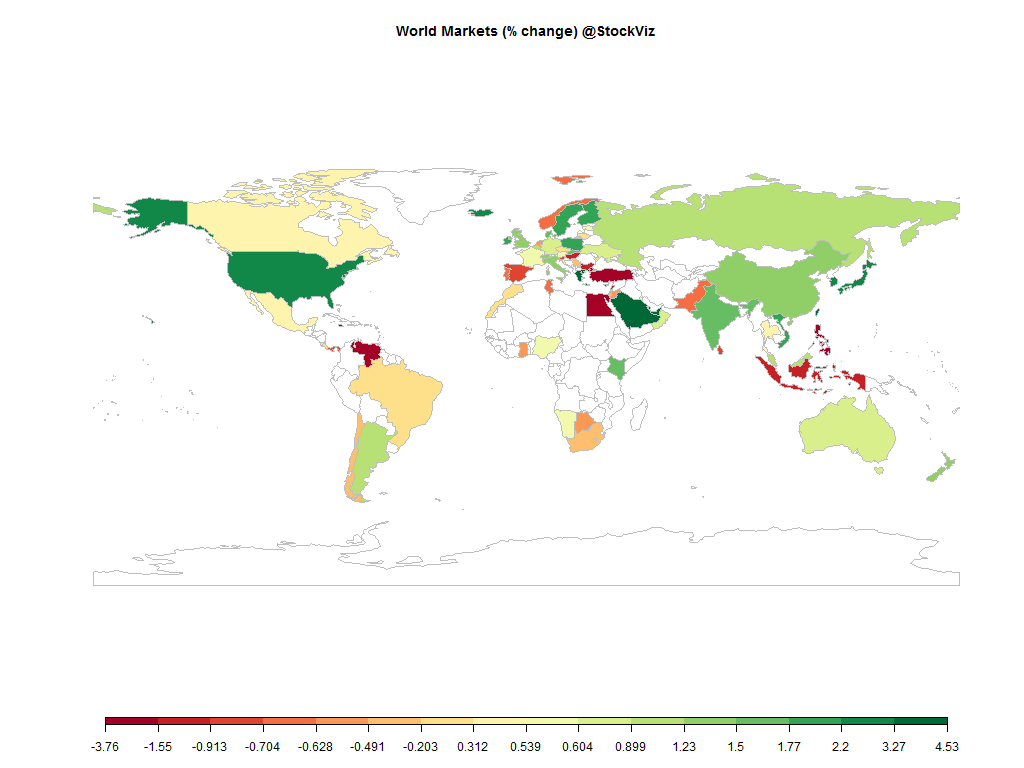

Markets ended in the green after the brutal beating it took the

previous week. The

VIX ended below 25 but is still way about its long-run average. The next week is going to be all about the US Fed – and maybe a short-covering rally ahead of Thursday’s meeting.

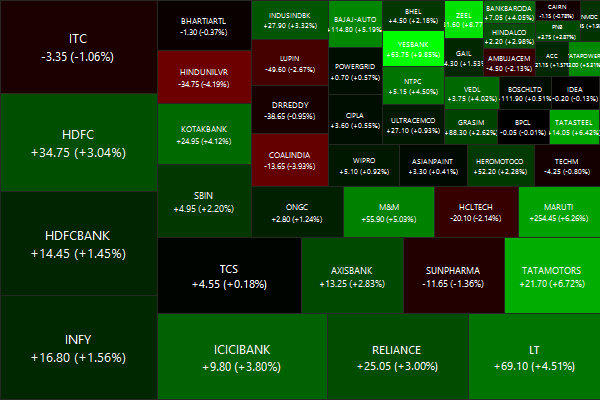

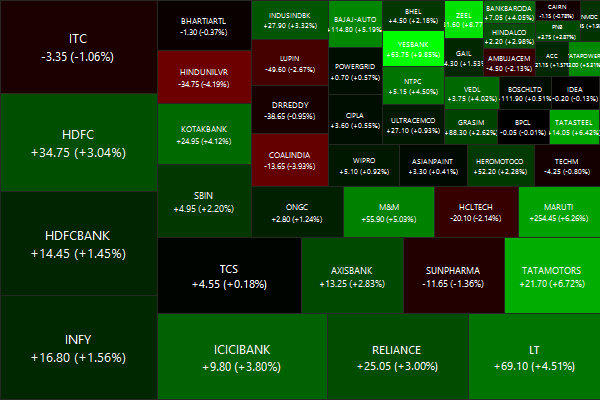

Nifty Heatmap

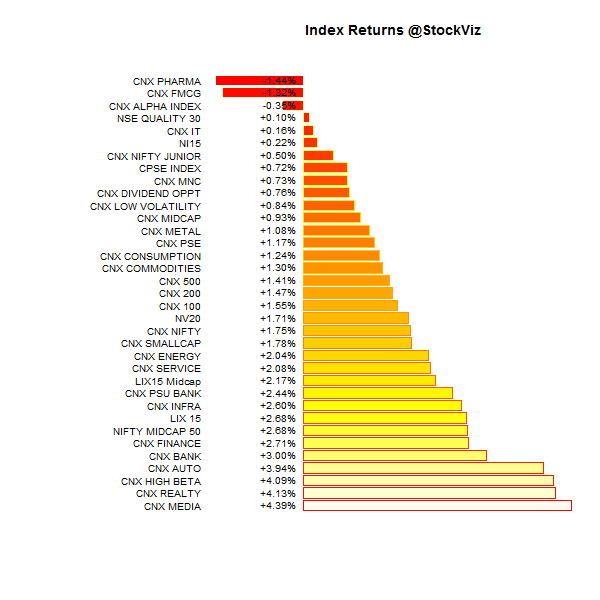

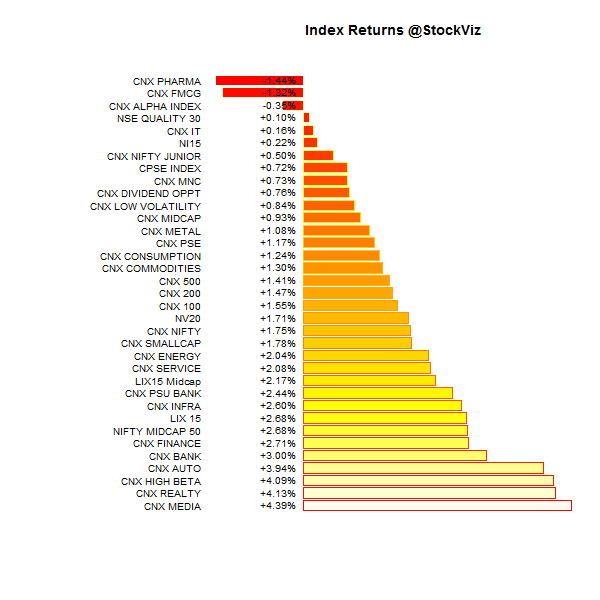

Index Returns

For a deeper dive into indices, check out our weekly Index Update.

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-5.60% |

60/73 |

| 2 |

-3.21% |

59/74 |

| 3 |

-3.70% |

58/76 |

| 4 |

-2.97% |

59/74 |

| 5 |

-2.98% |

59/74 |

| 6 |

-3.00% |

63/71 |

| 7 |

-3.32% |

57/76 |

| 8 |

-2.20% |

65/69 |

| 9 |

-1.38% |

59/74 |

| 10 (mega) |

-0.37% |

65/69 |

Overall, markets were down – NIFTY’s performance did not bleed into the rest of the market…

Top Winners and Losers

ETF Performance

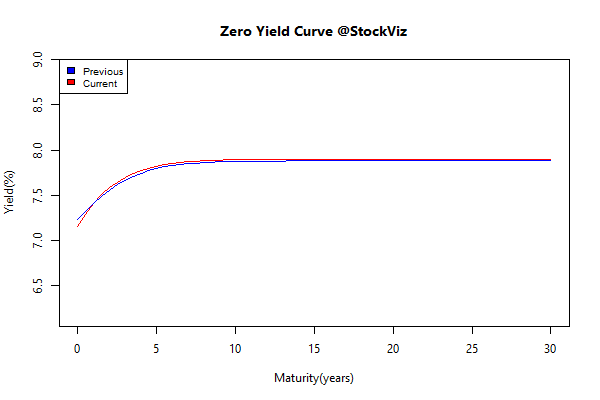

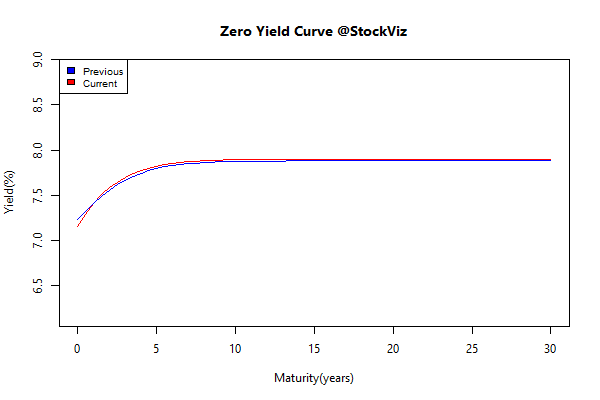

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

+0.01 |

+0.12% |

| 5 10 |

+0.03 |

-0.01% |

| 10 15 |

+0.02 |

+0.02% |

| 15 20 |

+0.04 |

-0.18% |

| 20 30 |

+0.01 |

-0.02% |

Bond yields ticked up marginally…

Investment Theme Performance

Hopefully, in the first stages of recovering from their drawdowns…

Equity Mutual Funds

Bond Mutual Funds

Thoughts for the weekend

Charlie Munger on Risk:

- Risk to us is a) the risk of permanent loss of capital, or b) the risk of inadequate return.

- Using a stock’s volatility as a measure of risk is nuts.

- Volatility is an overworked concept. You shouldn’t be imprisoned by volatility.

- Someone will always be getting richer faster than you. This is not a tragedy.

- When any person offers you a chance to earn lots of money without risk, don’t listen to the rest of their sentence.

Source: A Dozen Things I’ve Learned from Charlie Munger about Risk