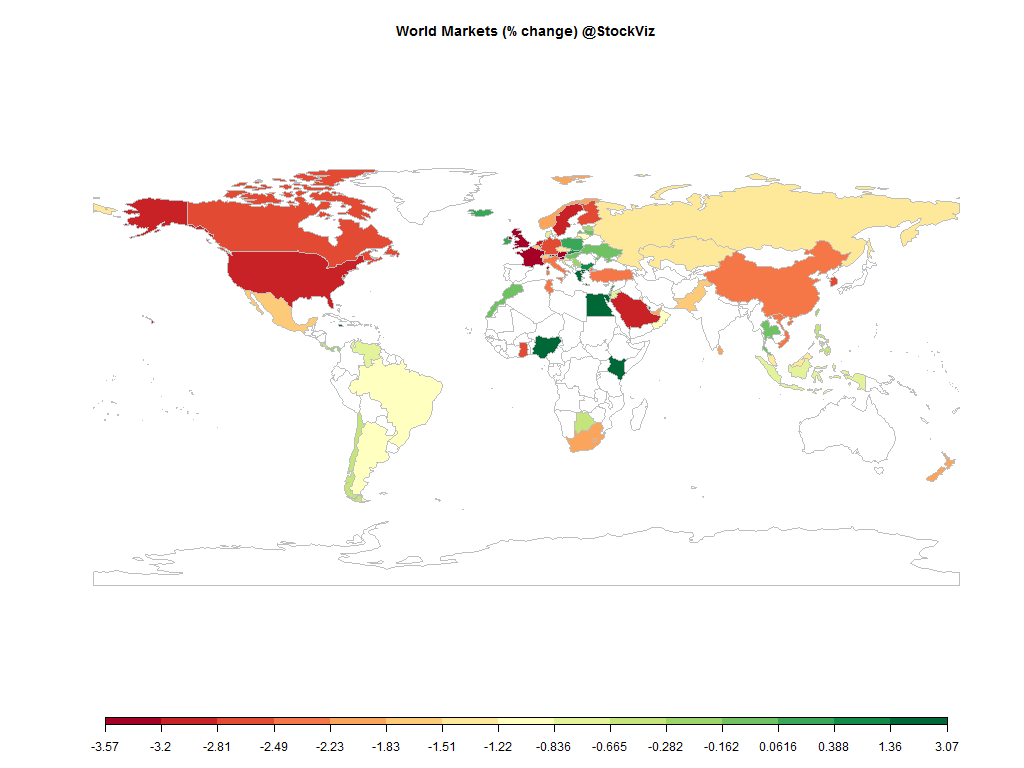

Equities

Commodities

| Energy |

| RBOB Gasoline |

-7.45% |

| Ethanol |

+1.32% |

| Natural Gas |

-2.28% |

| WTI Crude Oil |

+1.10% |

| Brent Crude Oil |

-1.08% |

| Heating Oil |

+0.74% |

| Metals |

| Gold 100oz |

-0.98% |

| Platinum |

-2.53% |

| Silver 5000oz |

+0.69% |

| Copper |

-0.43% |

| Palladium |

-2.30% |

| Agricultural |

| Cattle |

-3.81% |

| Lean Hogs |

+3.91% |

| Lumber |

-1.47% |

| Sugar #11 |

+2.65% |

| White Sugar |

+2.26% |

| Cocoa |

+2.79% |

| Orange Juice |

+1.51% |

| Soybean Meal |

-2.37% |

| Coffee (Arabica) |

-4.06% |

| Soybeans |

-1.96% |

| Wheat |

-4.08% |

| Coffee (Robusta) |

+1.66% |

| Corn |

-3.79% |

| Cotton |

-1.87% |

| Feeder Cattle |

-0.74% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.65% |

| Markit CDX NA HY |

-1.01% |

| Markit CDX NA IG |

+3.80% |

| Markit iTraxx Asia ex-Japan IG |

+9.23% |

| Markit iTraxx Australia |

+3.94% |

| Markit iTraxx Europe |

+3.26% |

| Markit iTraxx Europe Crossover |

+16.42% |

| Markit iTraxx Japan |

+2.03% |

| Markit iTraxx SovX Western Europe |

+0.09% |

| Markit LCDX (Loan CDS) |

+0.00% |

| Markit MCDX (Municipal CDS) |

-1.50% |

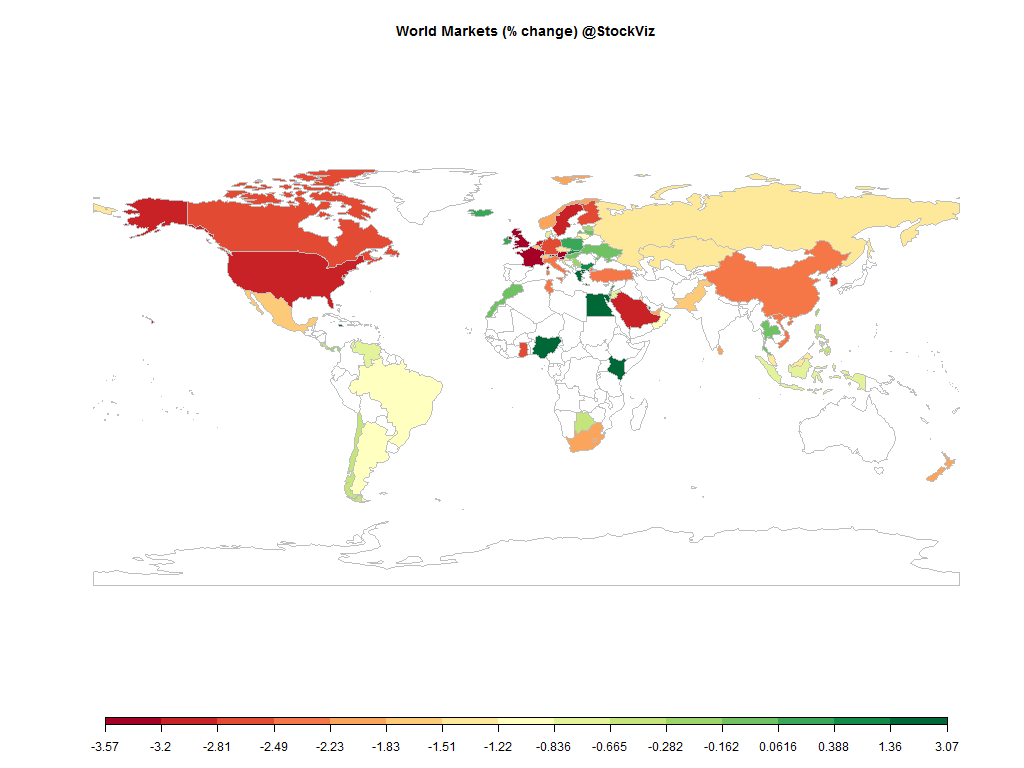

Markets ended the week in an ocean of red ink. Being “better” than other EMs may mean just that we tank 10% while others tank 20%…

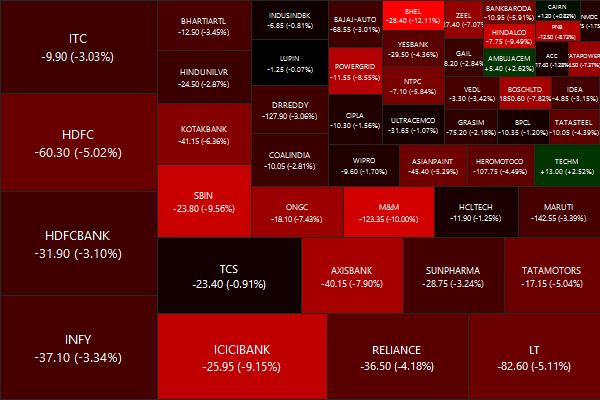

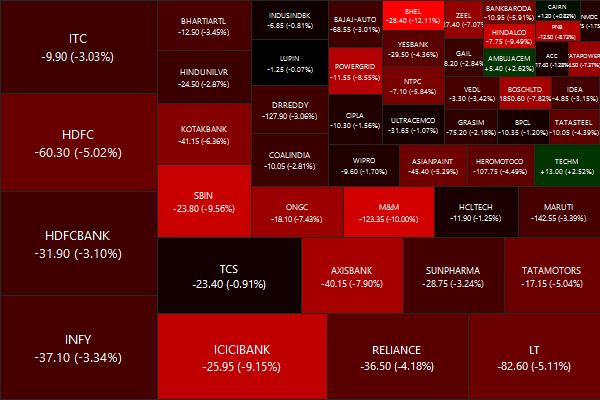

Nifty Heatmap

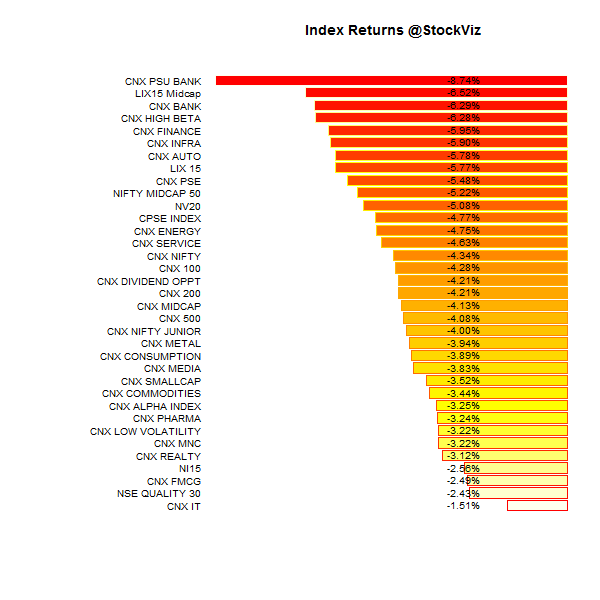

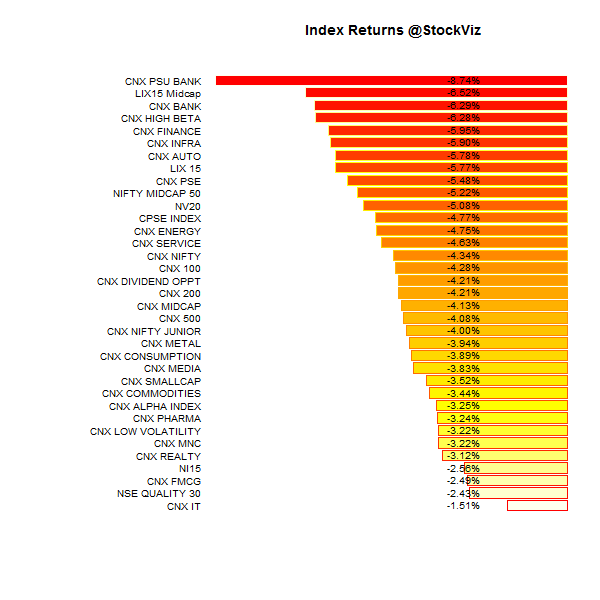

Index Returns

For a deeper dive into indices, check out our weekly Index Update.

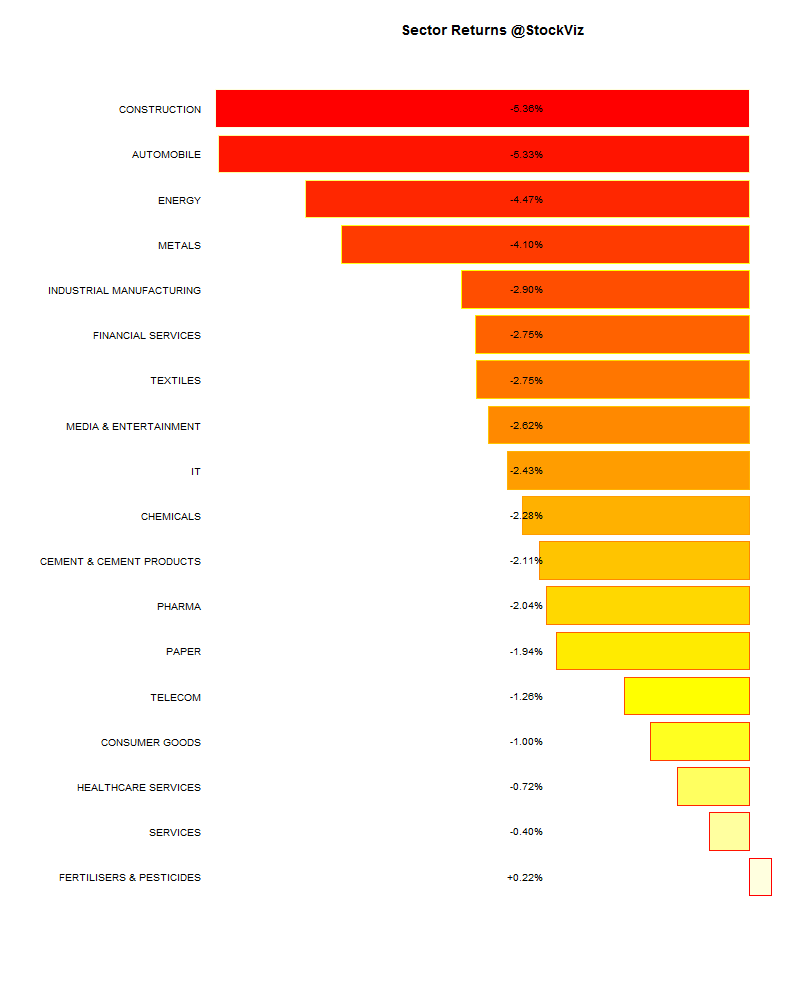

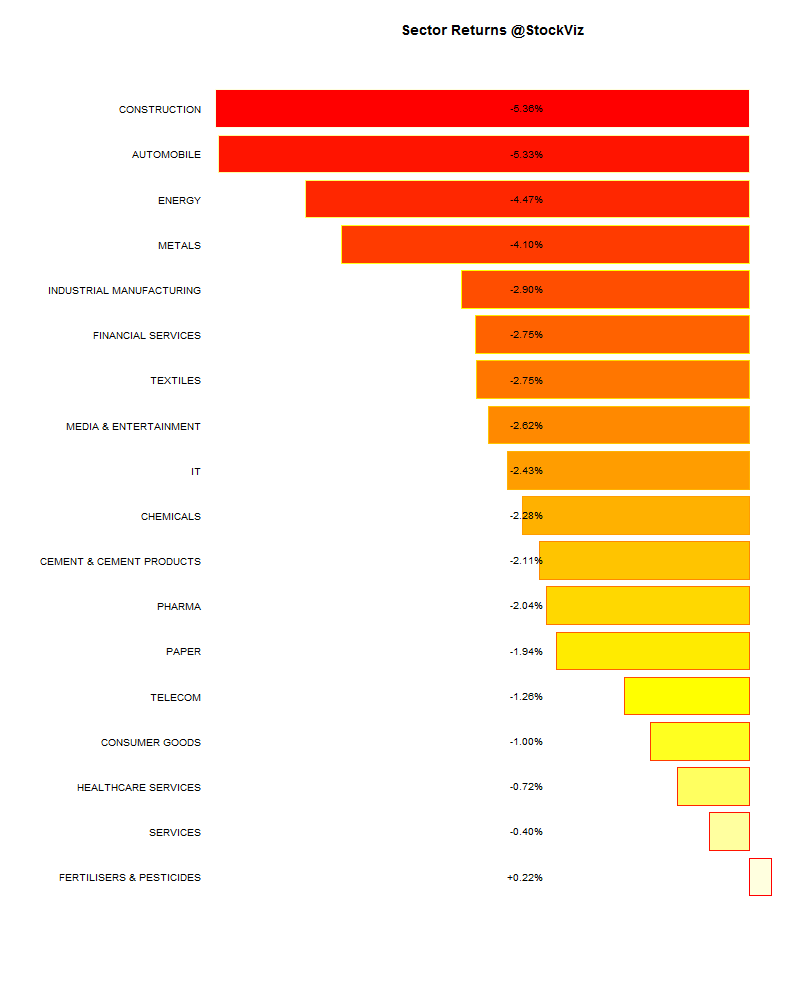

Sector Performance

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-3.55% |

74/61 |

| 2 |

-3.57% |

65/69 |

| 3 |

-1.10% |

68/66 |

| 4 |

-1.12% |

70/65 |

| 5 |

-1.60% |

65/69 |

| 6 |

-1.91% |

65/69 |

| 7 |

-1.03% |

63/72 |

| 8 |

-0.72% |

69/65 |

| 9 |

-0.28% |

70/64 |

| 10 (mega) |

-1.63% |

68/67 |

Stocks were punished across the board…

Top Winners and Losers

ETF Performance

PSBs got shellacked… Gold didn’t escape the selling pressure either…

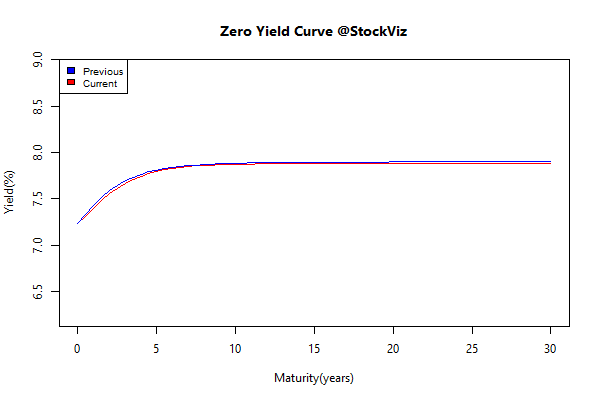

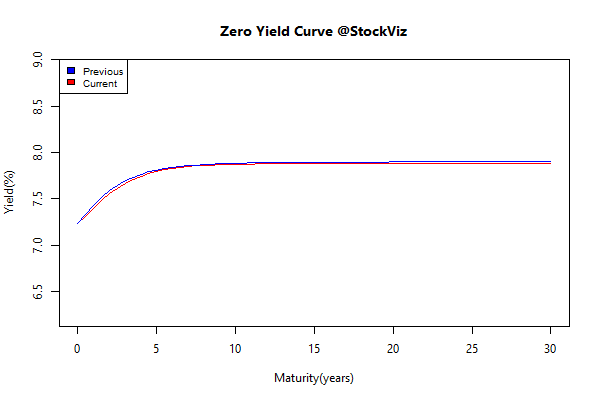

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

-0.01 |

+0.15% |

| 5 10 |

-0.02 |

+0.23% |

| 10 15 |

+0.02 |

+0.02% |

| 15 20 |

-0.06 |

+0.67% |

| 20 30 |

-0.01 |

+0.20% |

Bonds went up a smidgen…

Investment Theme Performance

No investment strategy escaped the relentless selling pressure…

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

For publicly listed companies, its owners are its shareholders. It is they who claim the profits of the company, potentially in perpetuity. It is they who exercise control rights over the management of the company from whom they are distinct. And it is they whose objectives have primacy in the running of the company.

Yet despite its durability and success, across countries and across time, this corporate model has not gone unquestioned. Recently, these questions have come thick and fast, with a rising tide of criticism of companies’ behaviour, from excessive executive remuneration, to unethical practices, to monopoly or oligopoly powers, to short-termism. These concerns appear to be both strongly-felt and widely-held.

So who owns them?

Source: Andrew G Haldane: Who owns a company?