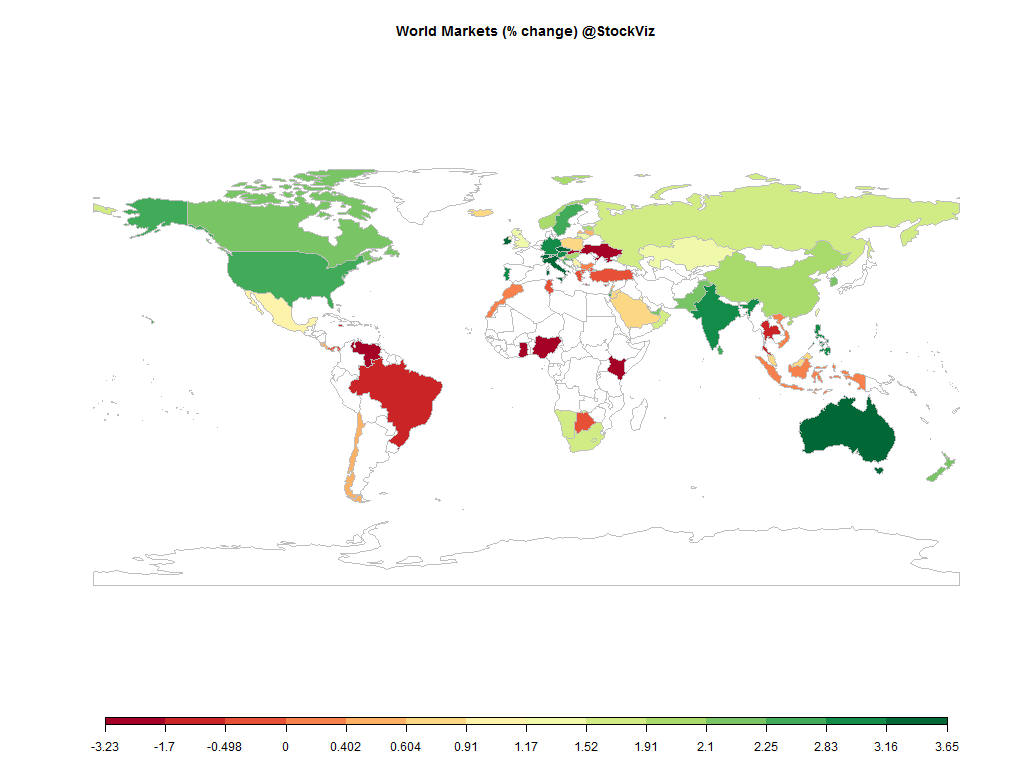

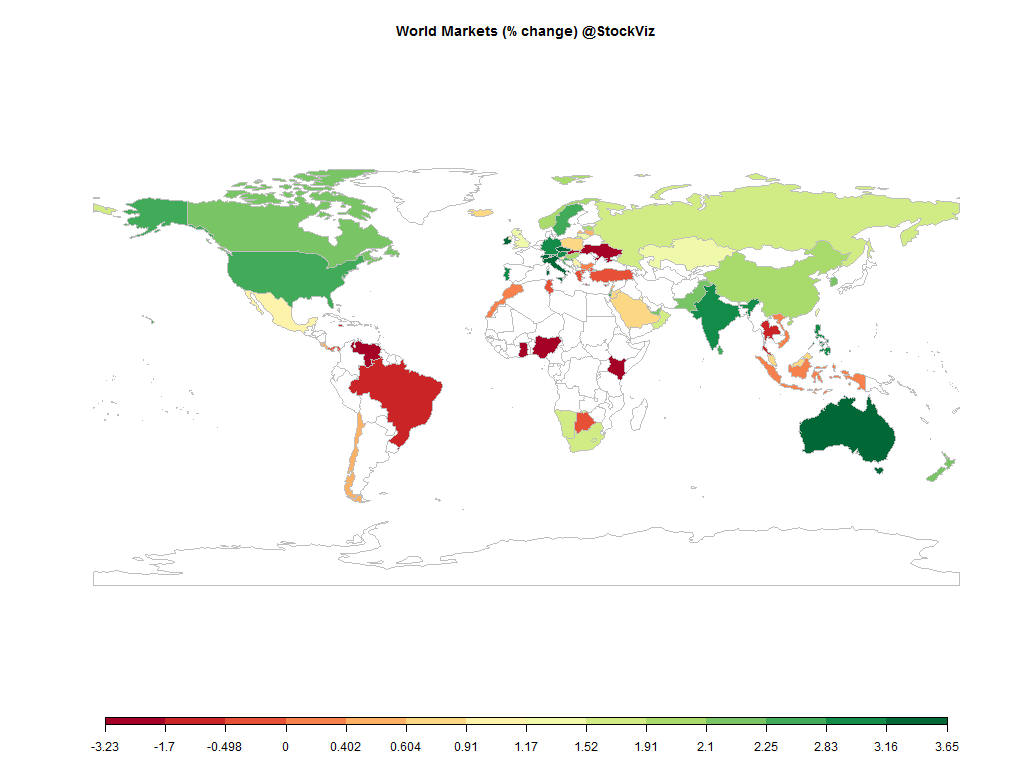

Equities

Commodities

| Energy |

| Ethanol |

-6.35% |

| Heating Oil |

-4.58% |

| Brent Crude Oil |

-2.84% |

| RBOB Gasoline |

-4.64% |

| WTI Crude Oil |

-3.77% |

| Natural Gas |

+4.26% |

| Metals |

| Gold 100oz |

-2.07% |

| Palladium |

-5.52% |

| Platinum |

-3.68% |

| Copper |

-1.57% |

| Silver 5000oz |

-5.13% |

| Agricultural |

| Cattle |

-0.42% |

| Cocoa |

+1.46% |

| Lean Hogs |

-4.47% |

| Lumber |

-6.25% |

| Orange Juice |

-0.12% |

| Soybean Meal |

-1.34% |

| White Sugar |

-4.23% |

| Corn |

-1.52% |

| Cotton |

+0.08% |

| Feeder Cattle |

+1.70% |

| Coffee (Arabica) |

+3.49% |

| Coffee (Robusta) |

-2.70% |

| Soybeans |

-2.78% |

| Sugar #11 |

-3.63% |

| Wheat |

-3.44% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.26% |

| Markit CDX NA HY |

+0.77% |

| Markit CDX NA IG |

-5.48% |

| Markit iTraxx Asia ex-Japan IG |

-5.65% |

| Markit iTraxx Australia |

-7.09% |

| Markit iTraxx Europe |

-10.49% |

| Markit iTraxx Europe Crossover |

-48.99% |

| Markit iTraxx Japan |

-5.36% |

| Markit iTraxx SovX Western Europe |

-4.75% |

| Markit LCDX (Loan CDS) |

+0.00% |

| Markit MCDX (Municipal CDS) |

-5.16% |

Can we get an encore? Or are we going to start worrying about flaccid earnings and get depressed all over again?

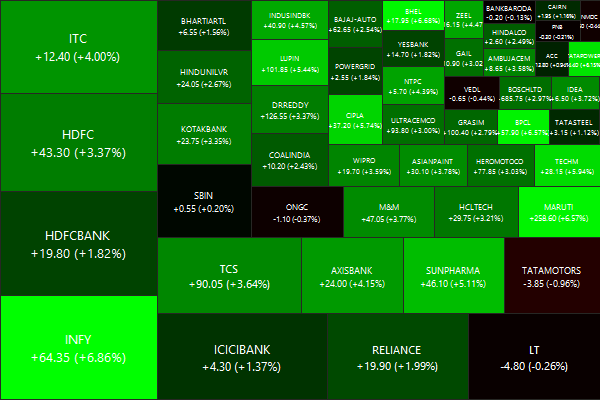

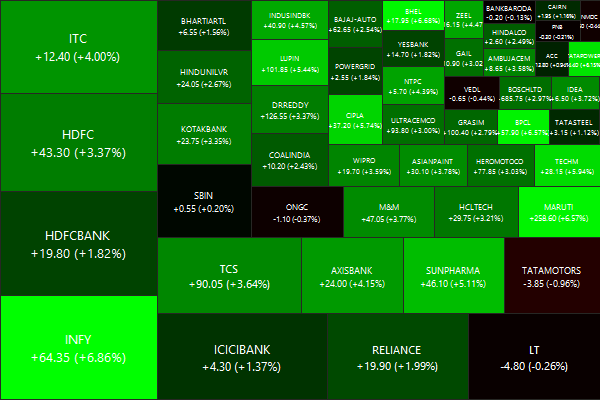

Nifty Heatmap

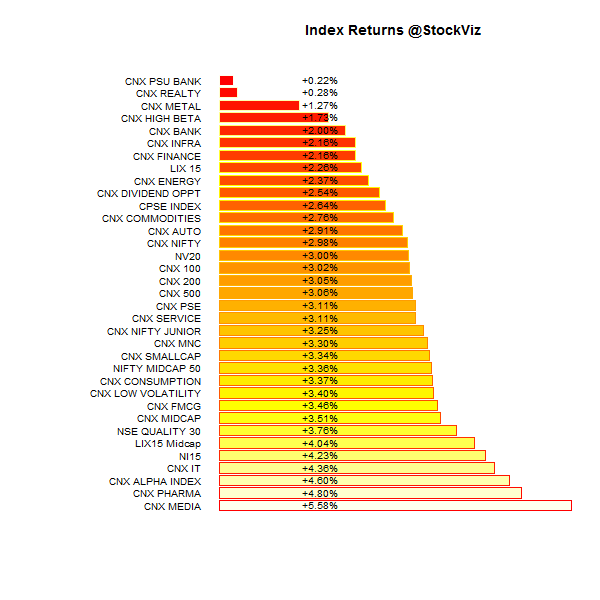

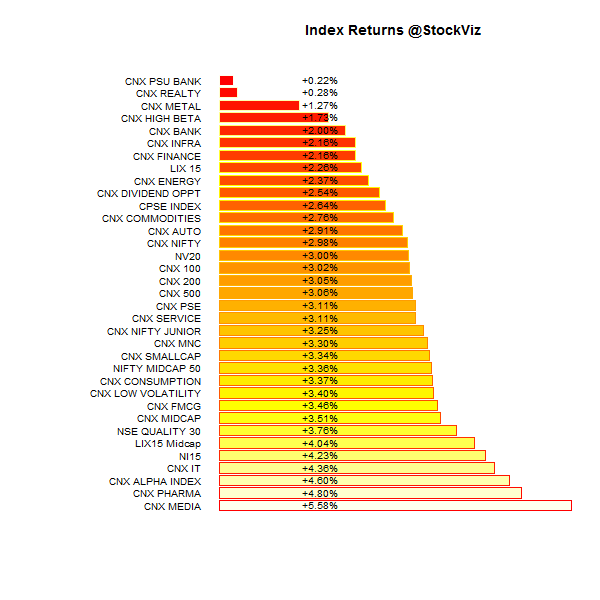

Index Returns

For a deeper dive into indices, check out our weekly Index Update.

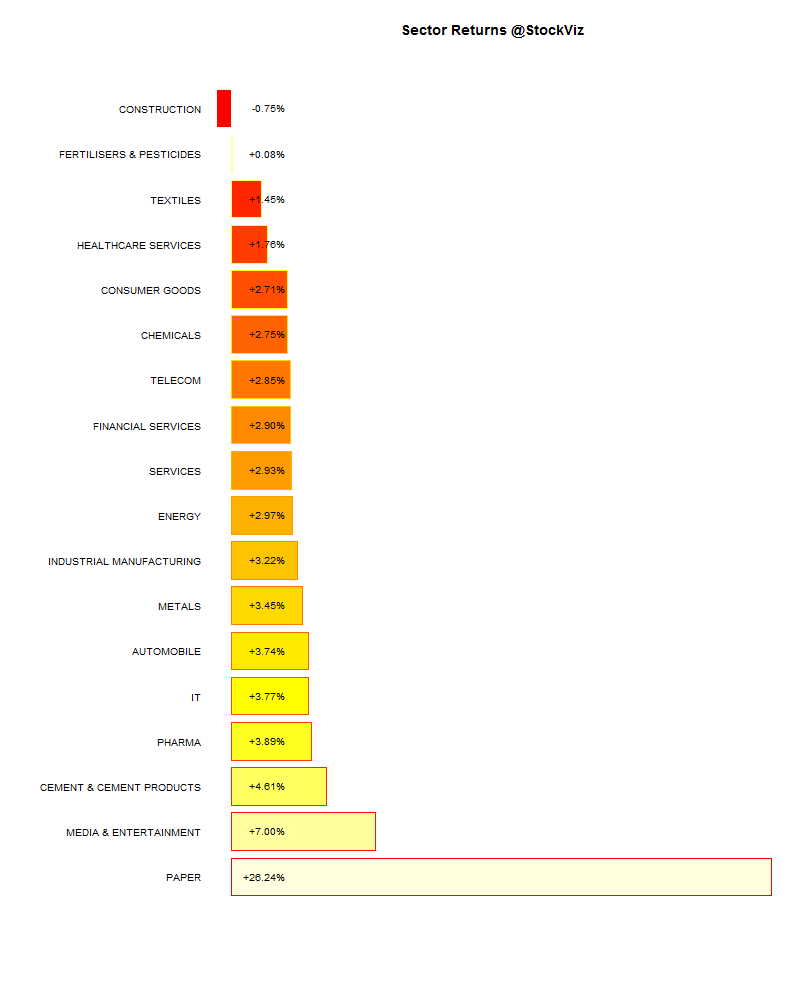

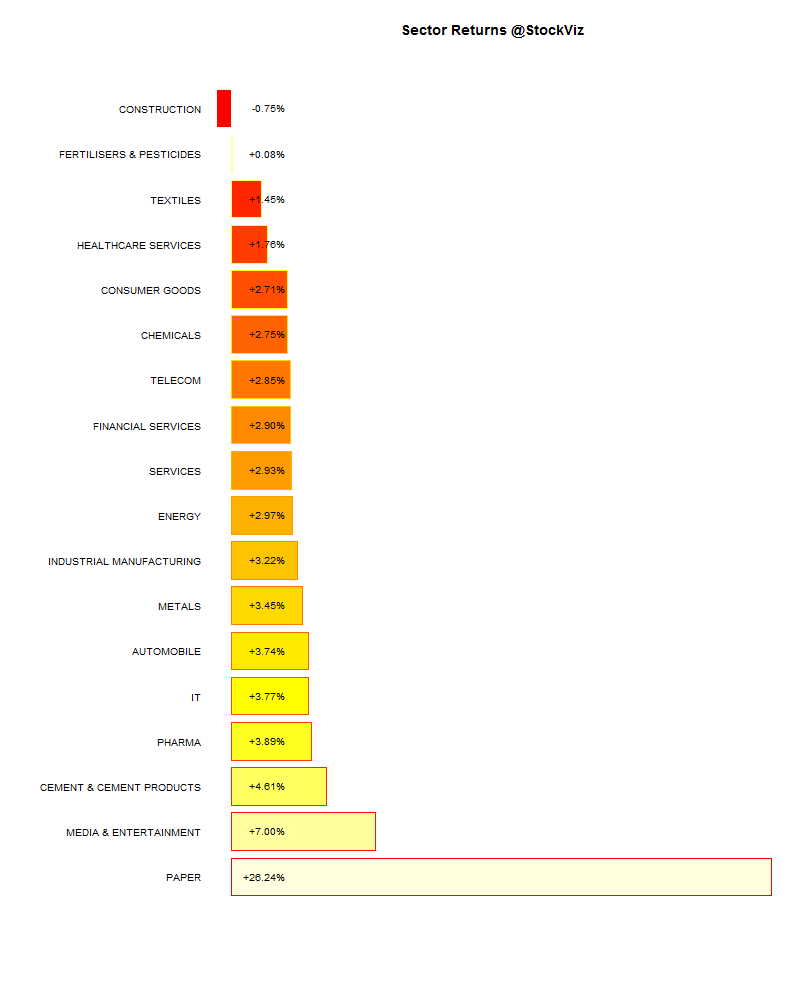

Sector Performance

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-3.26% |

74/60 |

| 2 |

+3.45% |

77/57 |

| 3 |

+5.42% |

71/62 |

| 4 |

+4.33% |

78/56 |

| 5 |

+3.93% |

69/64 |

| 6 |

+3.81% |

76/58 |

| 7 |

+3.51% |

68/66 |

| 8 |

+4.40% |

75/58 |

| 9 |

+2.30% |

69/65 |

| 10 (mega) |

+3.07% |

69/65 |

An across the board rally…

Top Winners and Losers

Fall in oil prices lifted OMC stocks…

ETF Performance

Large-caps dominated mid-caps. Gold hit 5-year lows in USD…

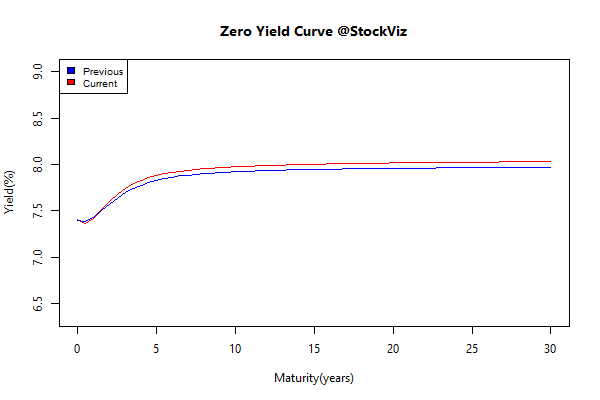

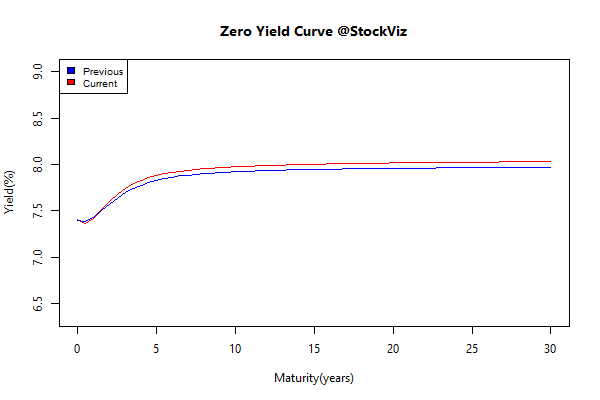

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| 0 5 |

+0.04 |

+0.04% |

| 5 10 |

+0.05 |

-0.12% |

| 10 15 |

+0.04 |

-0.16% |

| 15 20 |

+0.06 |

-0.40% |

| 20 30 |

+0.04 |

-0.28% |

Long bonds got shellacked…

Investment Theme Performance

No Theme left behind. A broad-based rally lifted all investment strategies.

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

Mutual fund performance is similar to the performance of stocks. As a company matures and grows, more investors become aware of it, and its share price better reflects its prospects. This explains the phenomenon of how valuations and returns of benchmark indexes for smaller companies are usually higher than larger companies. Of course, they’re also riskier.

In the case of mutual funds, impressive alpha attracts more investor money to a fund, and that makes it more difficult to produce alpha since taking larger positions in stocks is going to have a greater impact on share prices.

Source: Can active managers beat dart-throwing monkeys?