Introduction

So far, we have focused on the NIFTY for selling butterflies (Part I, II, III.) How would this look on the BANKNIFTY?

CNX BANK Index Returns

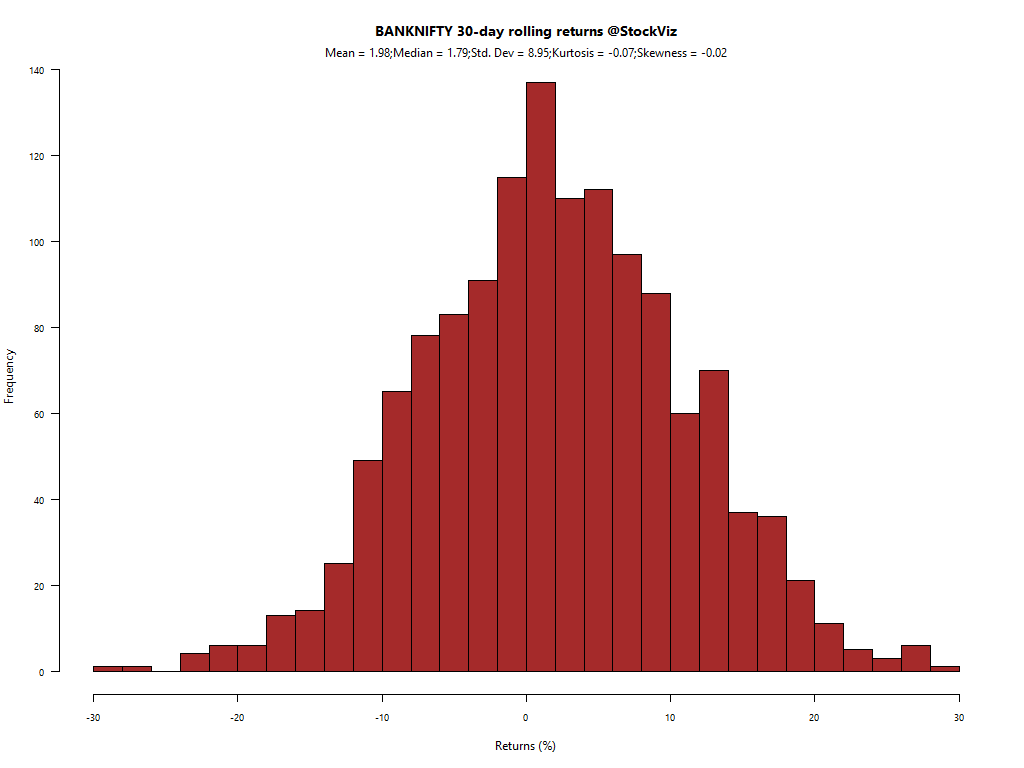

First, let’s have a look at the 30-day rolling returns of the CNX BANK Index, from 2010 to the present, the whole population:

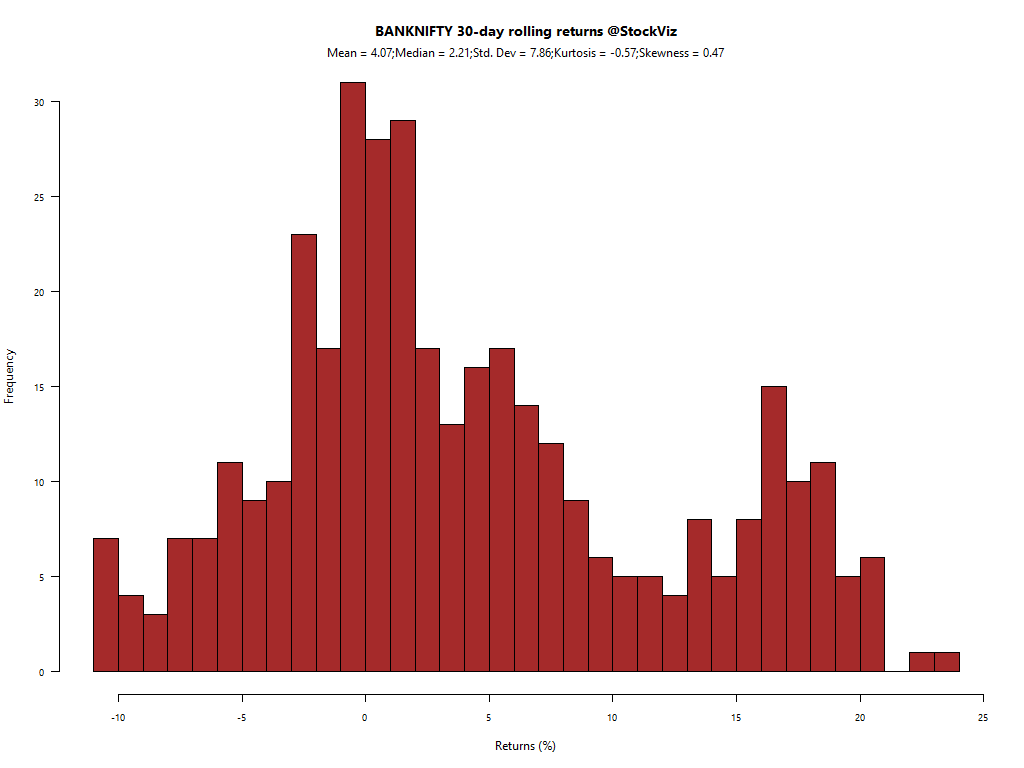

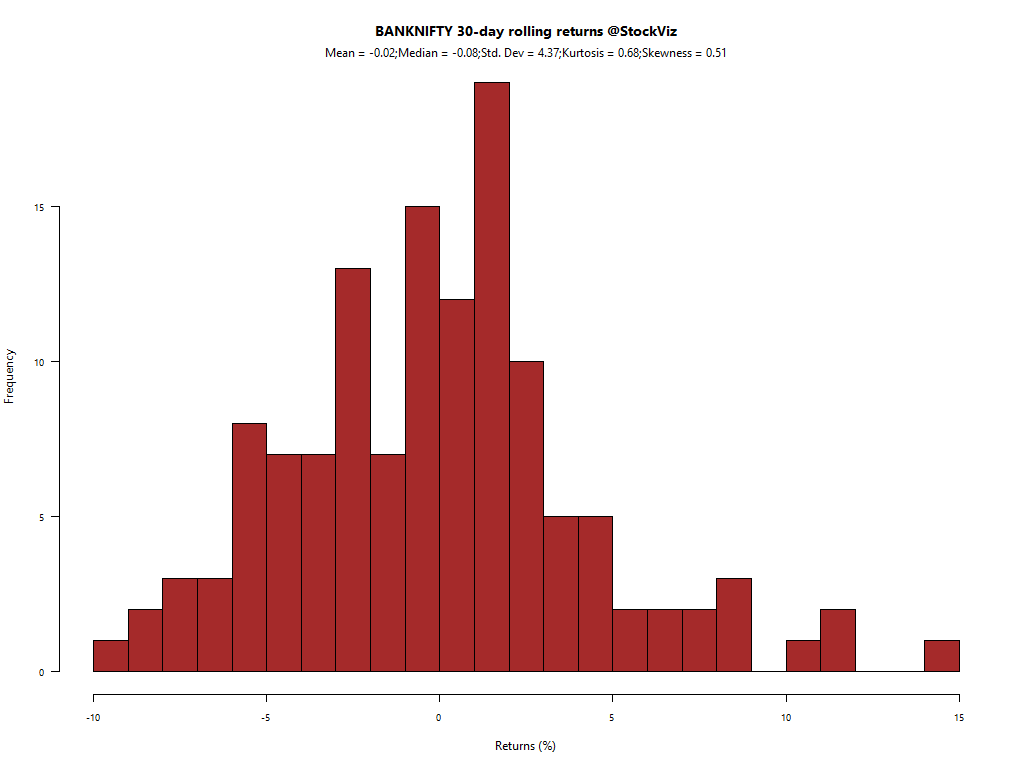

Beginning of 2015-present:

Median: flat

Currently, the index is around 18700. That means a 100-point move translates to 100/18700 ~0.5%

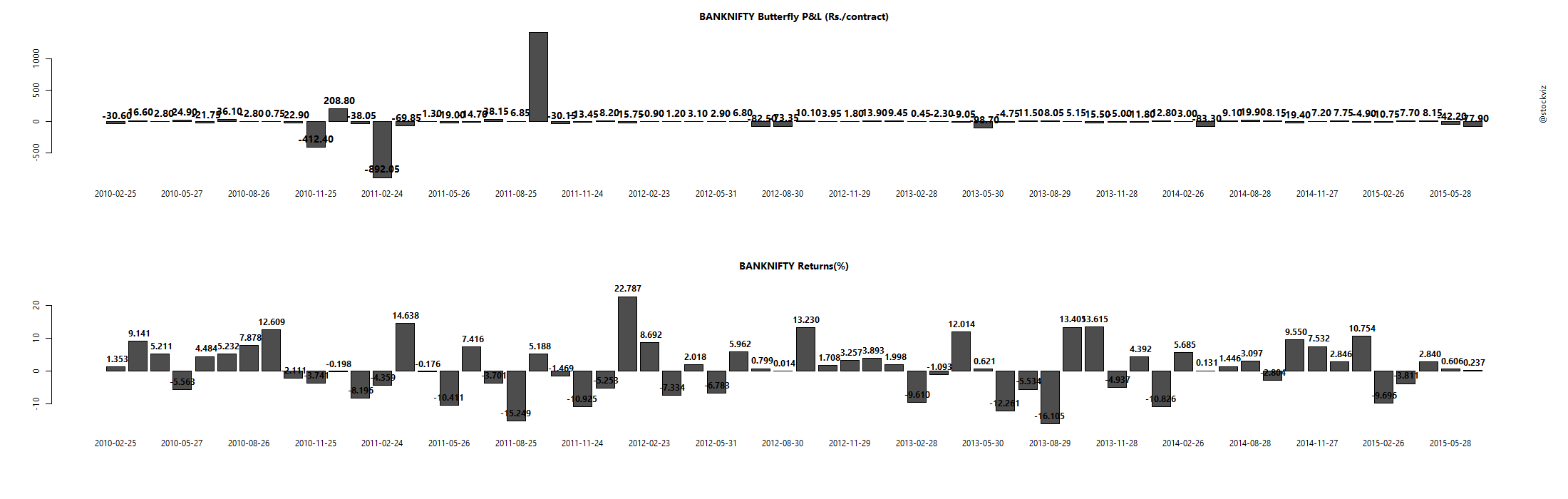

Expiry-to-Expiry Back-test

If we do the same back-test we did to the NIFTY, this is what we find:

Conclusion

As with the NIFTY, the trade makes money if you know how to cut your losses. However, when the trade is live, how do we know what the future volatility of the underlying is going to look like? Without risk-management, a short-call butterfly strategy will encounter out-sized losses that wipe out all prior incremental gains.