Monthly moves

We saw that the NIFTY’s median move over a 30-day period is over 1% and that is all that is required to make a short-call butterfly strategy profitable. Let us now do a quick back-test to check if it is indeed the case.

Back-test

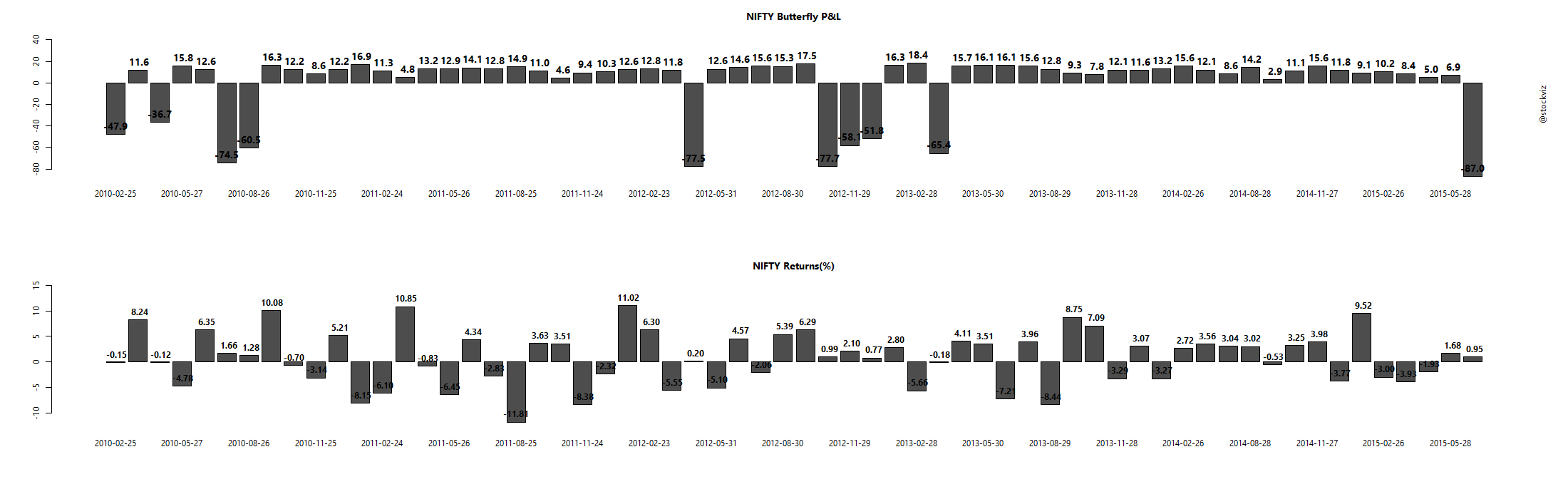

Here is the short-call butterfly back-test from 2010 through now. You basically sell the closest expiry butterfly at each expiry (click to embiggen):

Summary

While it is true that a 1% move in the NIFTY results in a profitable trade, there are instances where the NIFTY doesn’t move +/-1%. When the NIFTY ends flat, you end up losing all your prior profits. Understanding what drives NIFTY to move is key to managing your risk while running this strategy.