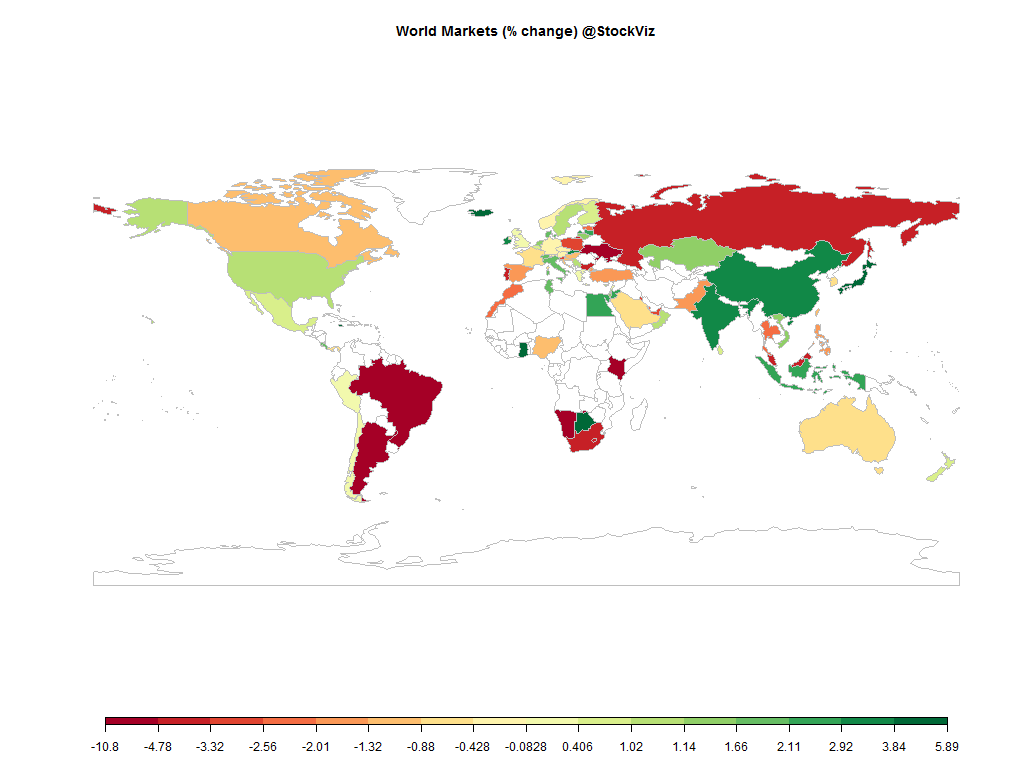

Equities

Commodities

| Energy |

| Natural Gas |

-2.94% |

| Brent Crude Oil |

-1.50% |

| Heating Oil |

-1.61% |

| WTI Crude Oil |

+1.09% |

| Ethanol |

-4.82% |

| RBOB Gasoline |

+0.90% |

| Metals |

| Gold 100oz |

+0.67% |

| Palladium |

-0.28% |

| Platinum |

-2.68% |

| Copper |

-4.50% |

| Silver 5000oz |

+3.73% |

| Agricultural |

| Cattle |

-4.39% |

| Cocoa |

+5.87% |

| Coffee (Arabica) |

-7.84% |

| Coffee (Robusta) |

-6.74% |

| Sugar #11 |

-8.74% |

| Wheat |

+1.92% |

| Feeder Cattle |

+2.52% |

| Lean Hogs |

+9.14% |

| Lumber |

+7.22% |

| Orange Juice |

+1.92% |

| White Sugar |

-7.19% |

| Corn |

-2.83% |

| Cotton |

-5.45% |

| Soybean Meal |

-4.16% |

| Soybeans |

-4.69% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.52% |

| Markit CDX NA HY |

-0.09% |

| Markit CDX NA IG |

+0.14% |

| Markit iTraxx Asia ex-Japan IG |

+0.03% |

| Markit iTraxx Australia |

+2.12% |

| Markit iTraxx Europe |

+0.71% |

| Markit iTraxx Europe Crossover |

+2.06% |

| Markit iTraxx Japan |

+2.85% |

| Markit iTraxx SovX Western Europe |

-1.04% |

| Markit LCDX (Loan CDS) |

-0.05% |

| Markit MCDX (Municipal CDS) |

+4.83% |

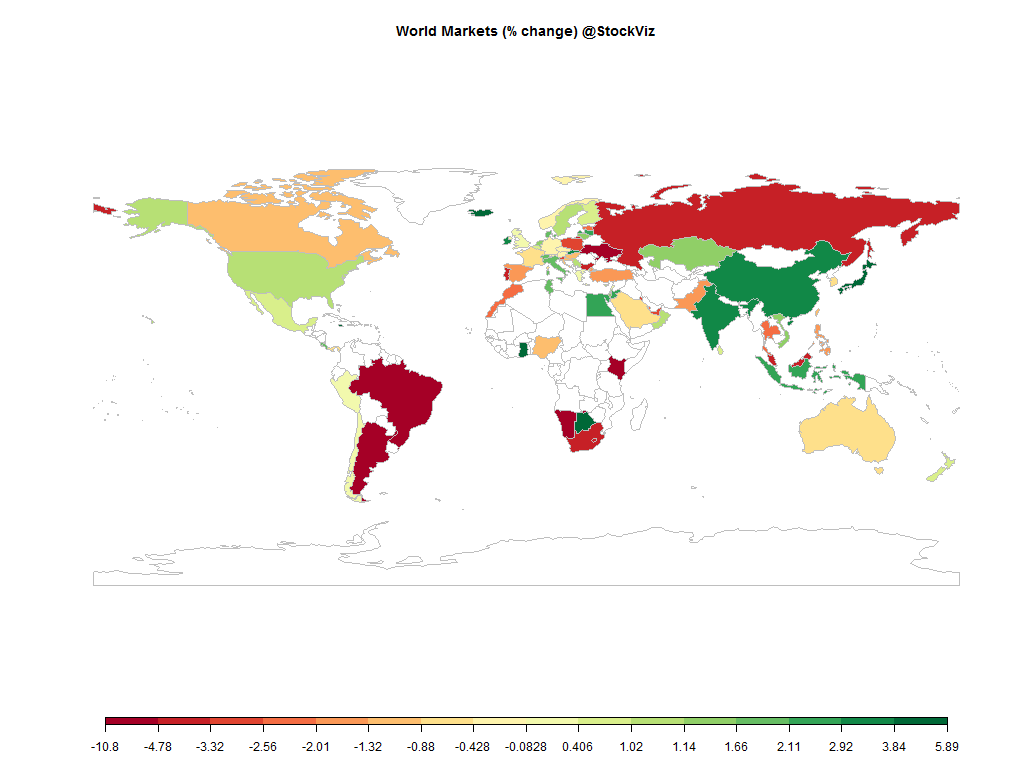

The US Dollar rallied, Nifty put in a decent show and gold flat lined.

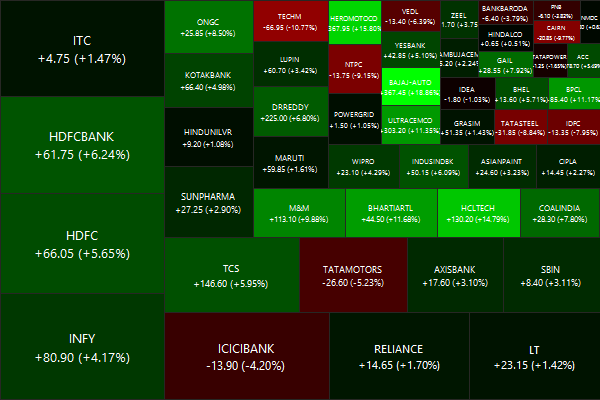

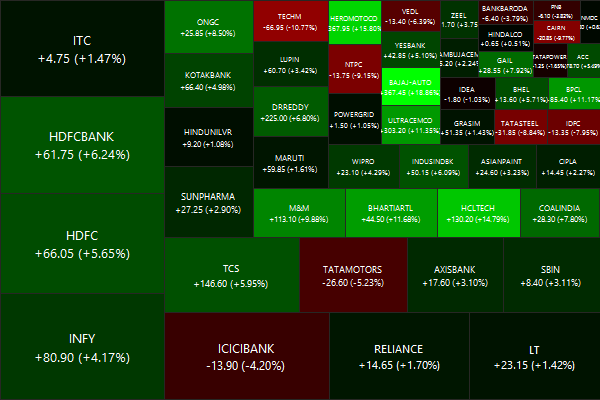

Nifty Heatmap

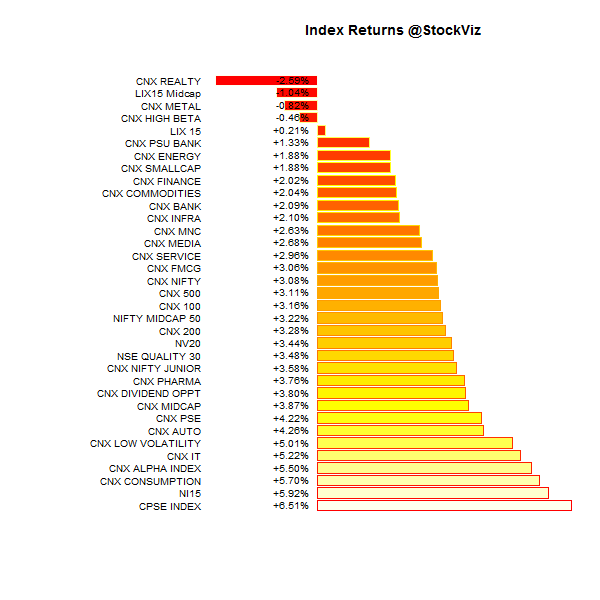

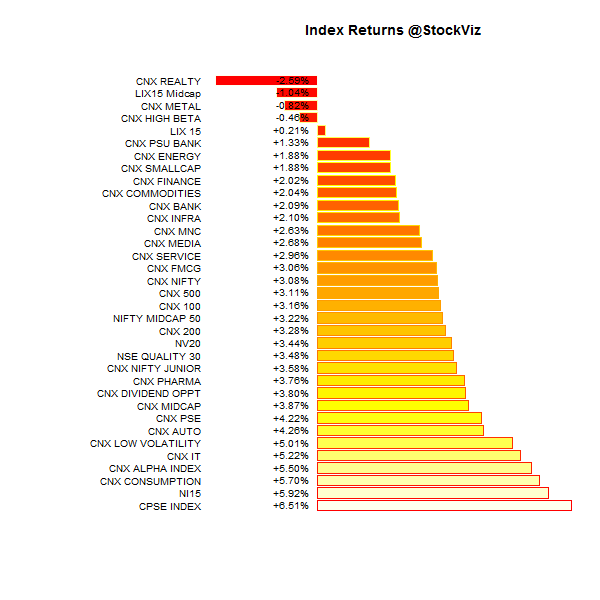

Index Returns

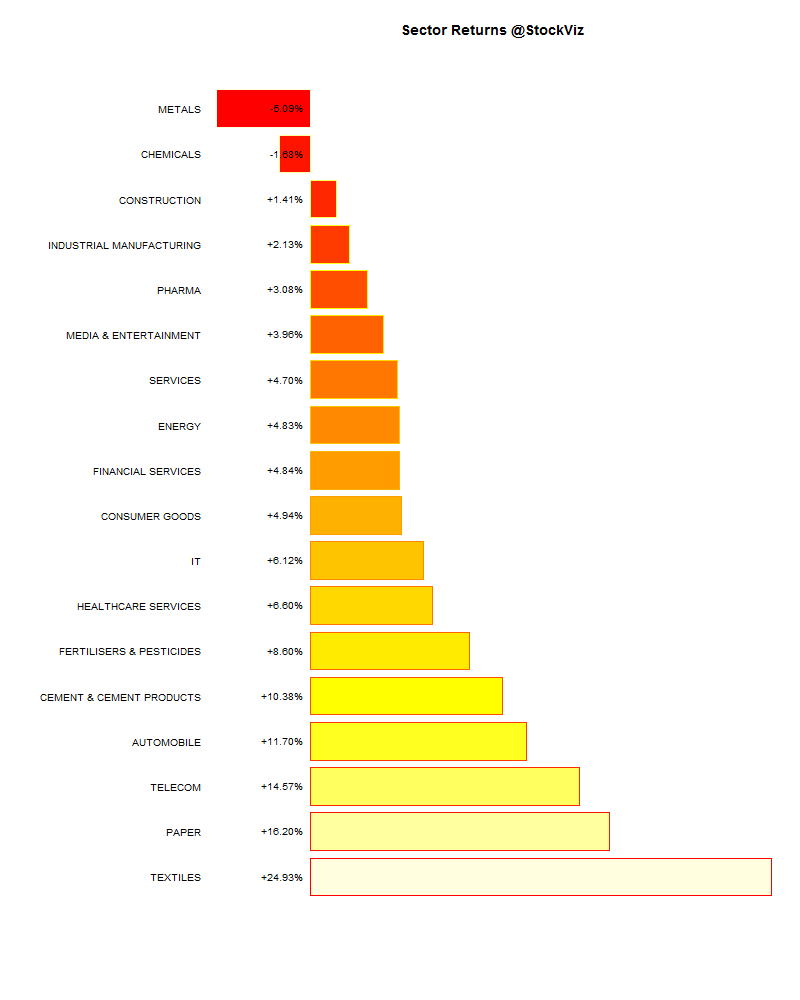

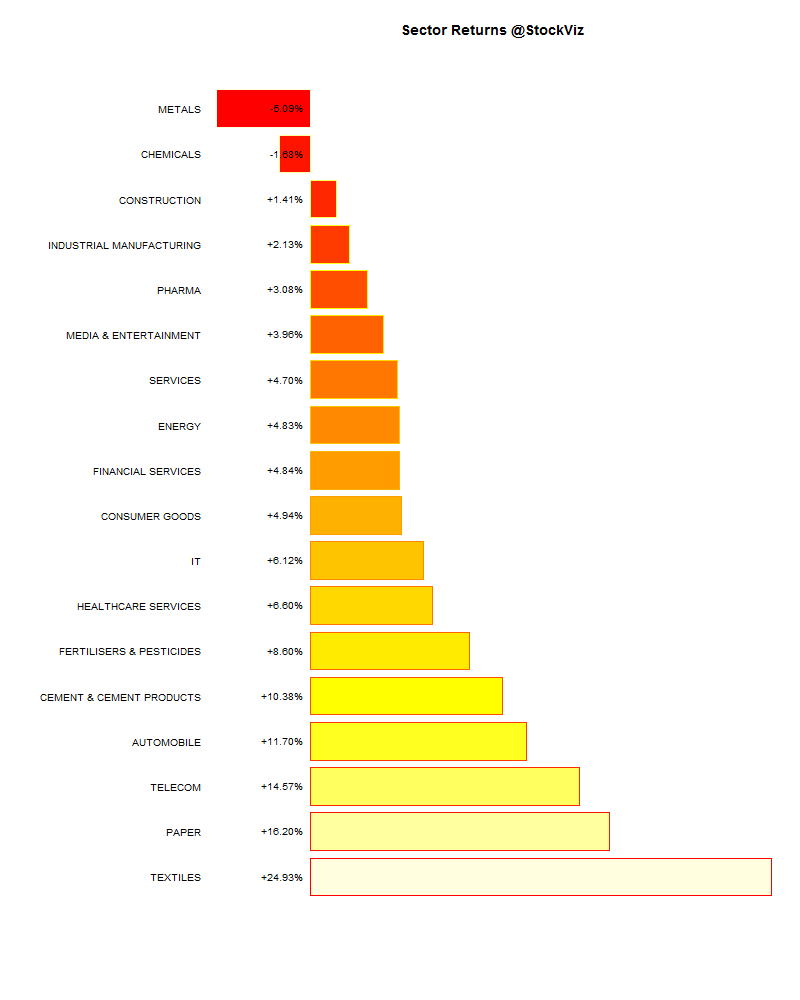

Sector Performance

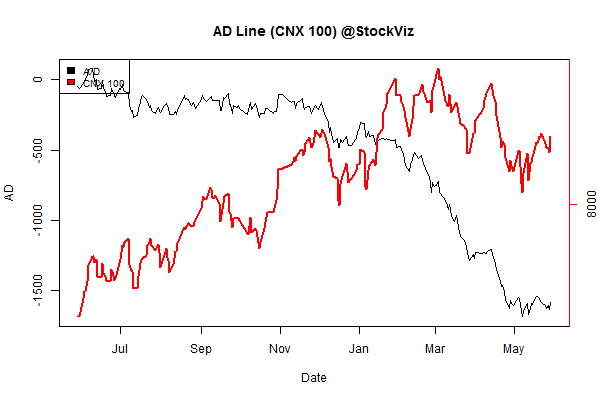

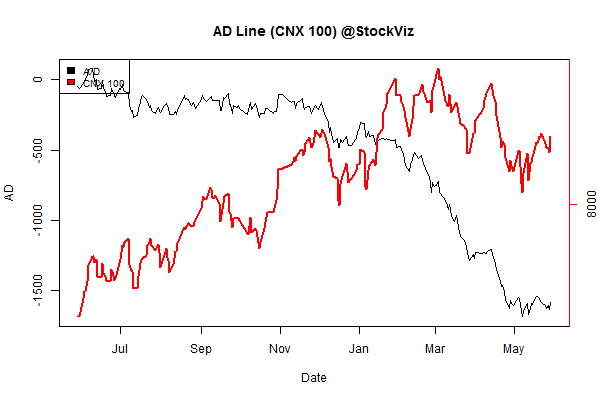

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-2.14% |

64/65 |

| 2 |

-0.23% |

64/64 |

| 3 |

-0.66% |

60/68 |

| 4 |

+3.15% |

68/60 |

| 5 |

-0.13% |

61/67 |

| 6 |

-0.16% |

66/62 |

| 7 |

-0.04% |

61/67 |

| 8 |

+1.24% |

67/61 |

| 9 |

+0.23% |

58/70 |

| 10 (mega) |

+2.38% |

70/59 |

Large and mid-caps turned in a good show…

Top Winners and Losers

ETF Performance

Interesting to see Nifty out-performing private banks…

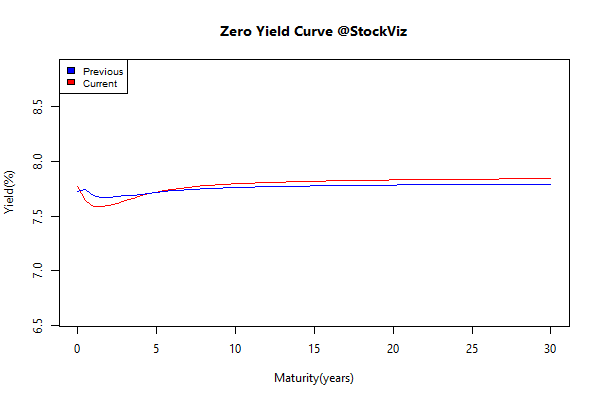

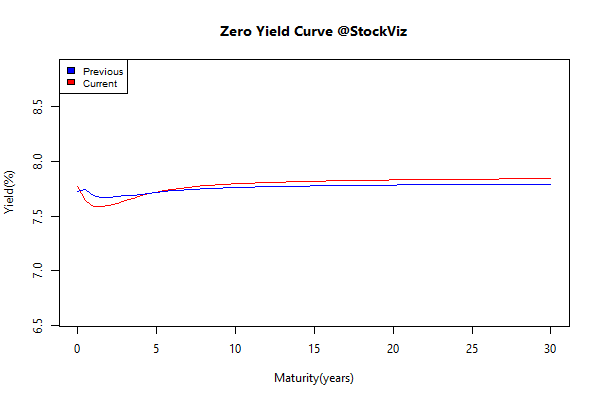

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.24 |

+0.56% |

| GSEC SUB 1-3 |

+0.53 |

+0.31% |

| GSEC SUB 3-8 |

-0.05 |

-0.27% |

| GSEC SUB 8 |

+0.09 |

-0.05% |

Indian gilts were not immune to the global dislocations in the bond market…

Investment Theme Performance

Momentum strategy took some volatility but seems to be on a path to recovery…

Equity Mutual Funds

Bond Mutual Funds

Thought to sum up the month