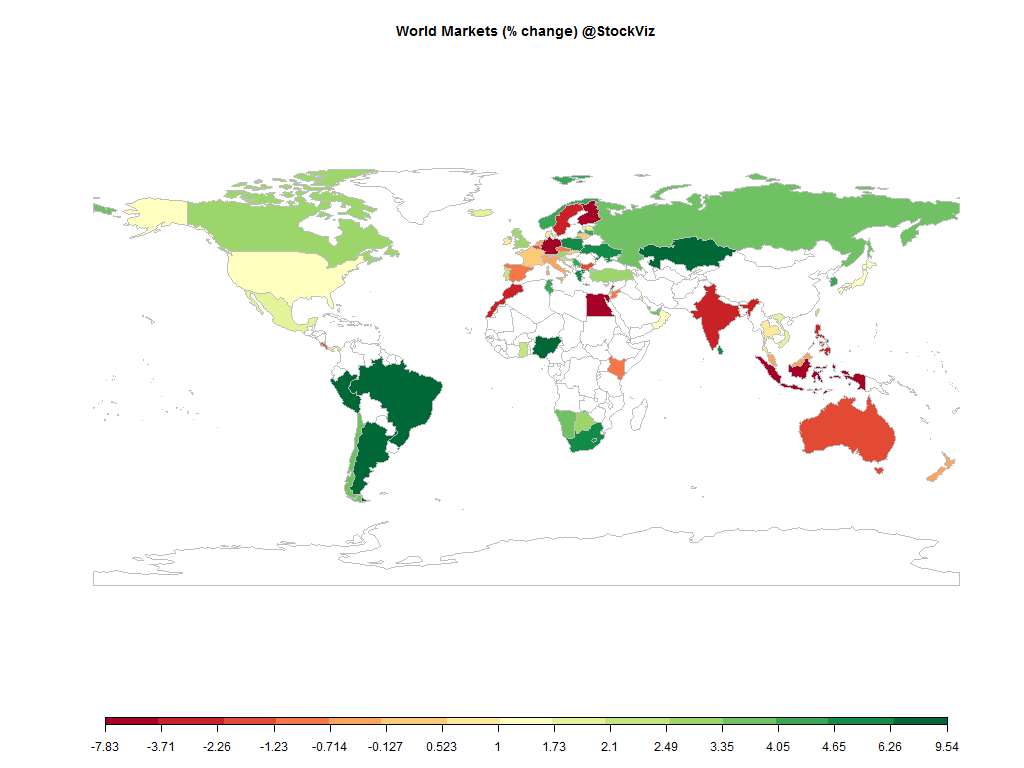

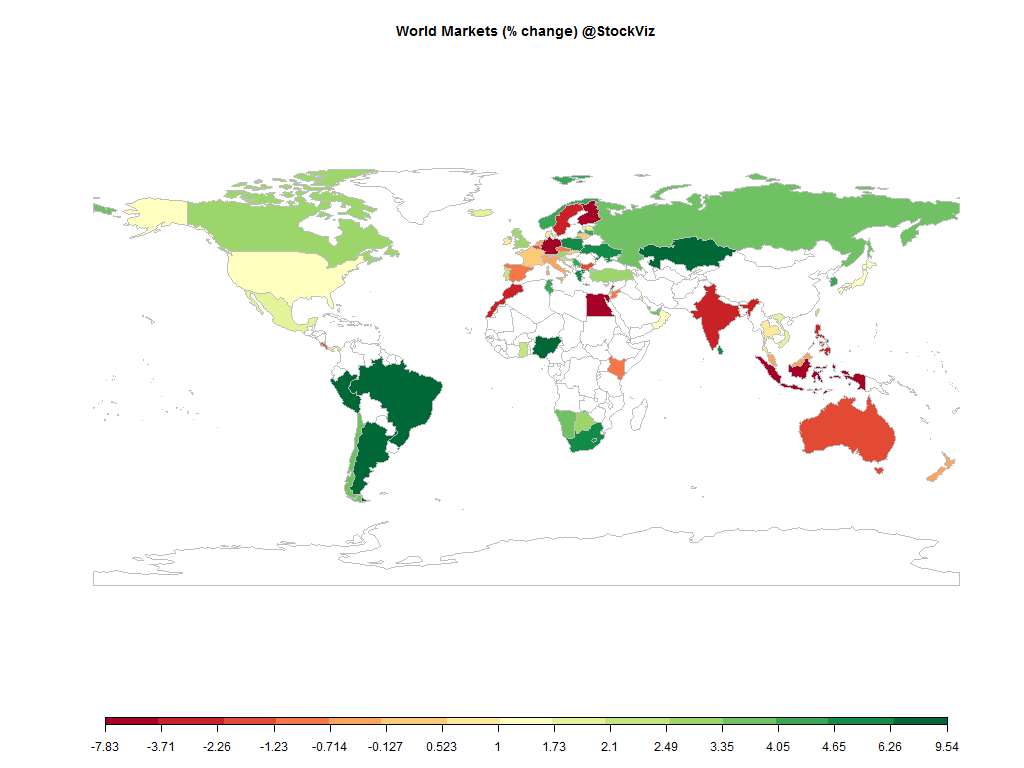

Equities

Commodities

| Energy |

| WTI Crude Oil |

+23.33% |

| Ethanol |

+7.84% |

| Heating Oil |

+15.86% |

| RBOB Gasoline |

+14.75% |

| Brent Crude Oil |

+19.90% |

| Natural Gas |

+4.57% |

| Metals |

| Copper |

+6.91% |

| Palladium |

+5.40% |

| Gold 100oz |

-0.37% |

| Silver 5000oz |

-3.01% |

| Platinum |

-0.82% |

| Agricultural |

| Cocoa |

+4.00% |

| Coffee (Arabica) |

-0.94% |

| Coffee (Robusta) |

+1.94% |

| Cotton |

+4.63% |

| Soybean Meal |

-3.44% |

| Corn |

-4.25% |

| Lean Hogs |

+22.47% |

| Lumber |

-8.52% |

| Orange Juice |

-8.61% |

| Soybeans |

-0.44% |

| Sugar #11 |

+7.58% |

| Feeder Cattle |

-2.02% |

| Wheat |

-8.19% |

| Cattle |

-7.48% |

| White Sugar |

+4.89% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+3.58% |

| Markit CDX NA HY |

-0.55% |

| Markit CDX NA IG |

-2.44% |

| Markit iTraxx Asia ex-Japan IG |

+7.09% |

| Markit iTraxx Australia |

+6.74% |

| Markit iTraxx Europe |

+9.57% |

| Markit iTraxx Europe Crossover |

+1.39% |

| Markit iTraxx Japan |

-3.23% |

| Markit iTraxx SovX Western Europe |

+2.17% |

| Markit LCDX (Loan CDS) |

-0.11% |

| Markit MCDX (Municipal CDS) |

+1.70% |

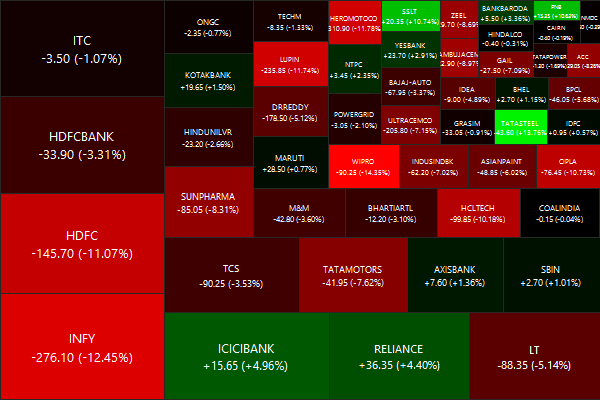

Both the NIFTY and the rupee put in performances that they sooner forget. Stretched evaluations met a tepid earnings season and retroactive tax demands on FIIs. May will see more firms coming out earnings and we expect the markets to remain choppy.

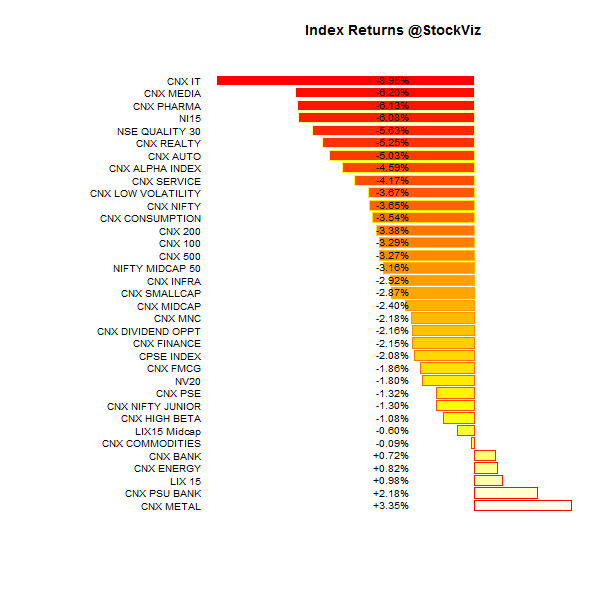

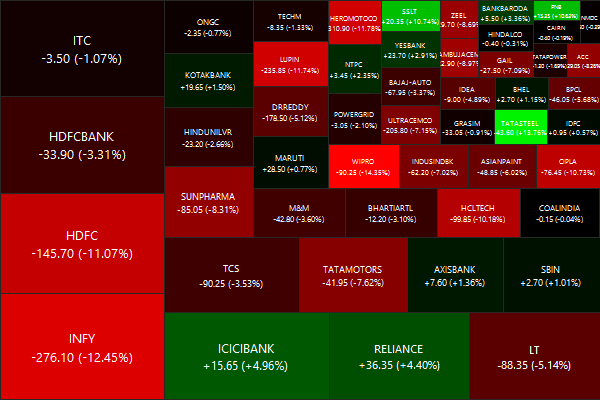

Nifty Heatmap

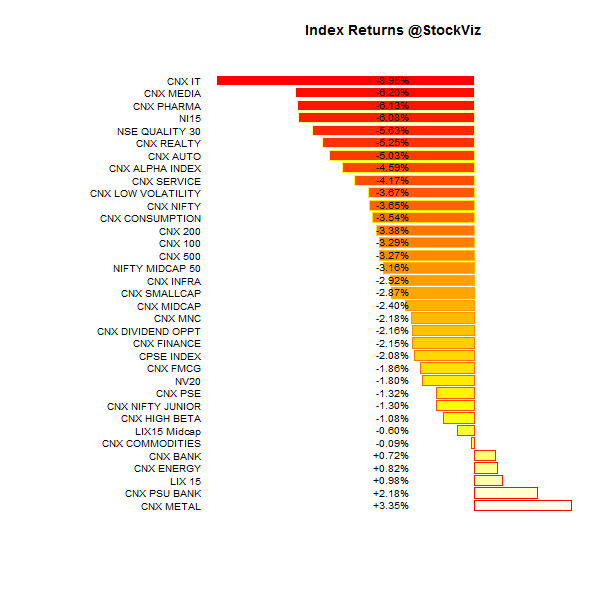

Index Returns

For a deeper dive into indices, check out our weekly Index Update.

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+3.97% |

82/50 |

| 2 |

+10.85% |

82/49 |

| 3 |

+7.66% |

78/53 |

| 4 |

+6.24% |

68/64 |

| 5 |

+4.32% |

72/59 |

| 6 |

+2.89% |

68/63 |

| 7 |

+2.84% |

71/61 |

| 8 |

-2.06% |

66/65 |

| 9 |

-3.55% |

64/67 |

| 10 (mega) |

-2.64% |

58/74 |

This doesn’t make any sense…

Top Winners and Losers

A smorgasbord of performance…

ETF Performance

Infrastructure got whipped…

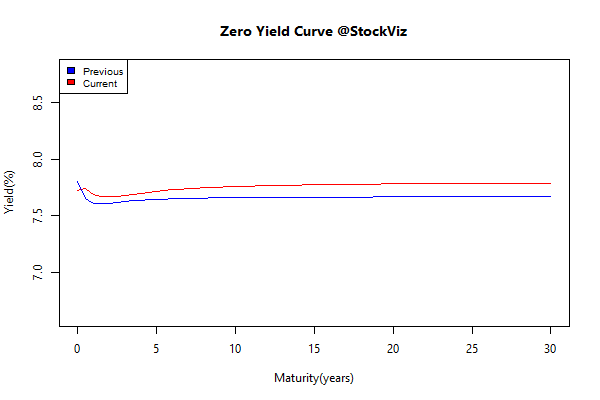

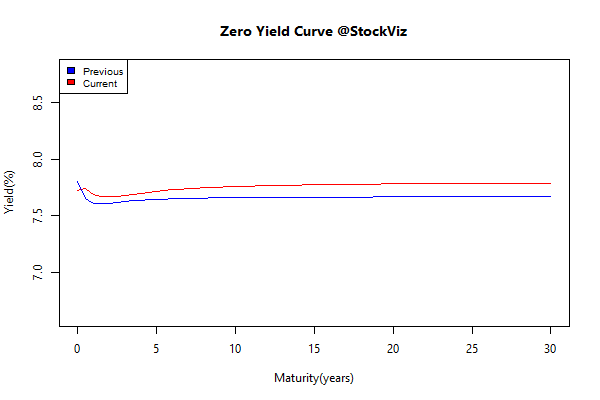

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.09 |

+0.66% |

| GSEC SUB 1-3 |

-0.60 |

+0.25% |

| GSEC SUB 3-8 |

+0.04 |

+0.20% |

| GSEC SUB 8 |

+0.16 |

-0.07% |

Listless…

Investment Theme Performance

Drawdowns galore across investment strategies…

Equity Mutual Funds

Bond Mutual Funds

Thought to sum up the month

Good investing hurts. Investors pay a high price for comfort and get paid a high price for doing what few others will. That will always be the case.

Source: This Was Never Easy