Equities

Commodities

| Energy |

| Brent Crude Oil |

-1.56% |

| Heating Oil |

-2.21% |

| RBOB Gasoline |

-2.52% |

| Ethanol |

+0.80% |

| Natural Gas |

-13.76% |

| WTI Crude Oil |

-1.88% |

| Metals |

| Copper |

-2.06% |

| Palladium |

+1.23% |

| Gold 100oz |

-0.23% |

| Platinum |

+1.37% |

| Silver 5000oz |

+1.26% |

| Agricultural |

| Cattle |

+1.66% |

| Cotton |

+1.63% |

| Feeder Cattle |

-3.89% |

| Lumber |

-0.24% |

| Orange Juice |

-0.87% |

| White Sugar |

+0.23% |

| Coffee (Robusta) |

-1.84% |

| Corn |

+1.35% |

| Wheat |

-2.81% |

| Cocoa |

+0.00% |

| Lean Hogs |

-1.17% |

| Soybean Meal |

+3.90% |

| Sugar #11 |

-1.41% |

| Coffee (Arabica) |

-4.22% |

| Soybeans |

+2.05% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+1.37% |

| Markit CDX NA HY |

+0.34% |

| Markit CDX NA IG |

-0.81% |

| Markit iTraxx Asia ex-Japan IG |

-4.39% |

| Markit iTraxx Australia |

-4.03% |

| Markit iTraxx Europe |

-4.00% |

| Markit iTraxx Europe Crossover |

-20.00% |

| Markit iTraxx Japan |

-1.28% |

| Markit iTraxx SovX Western Europe |

-2.25% |

| Markit LCDX (Loan CDS) |

+0.00% |

| Markit MCDX (Municipal CDS) |

+1.08% |

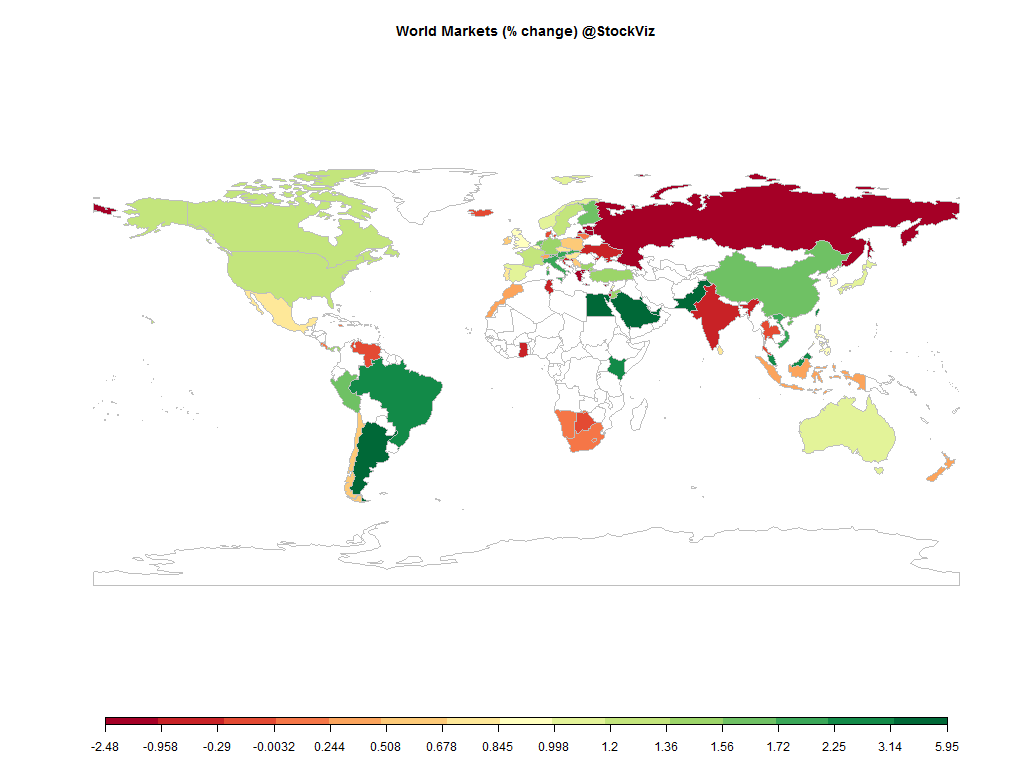

It was one heckuva week with the upside surprise in US GDP, thin holiday trading and a volatile expiry.

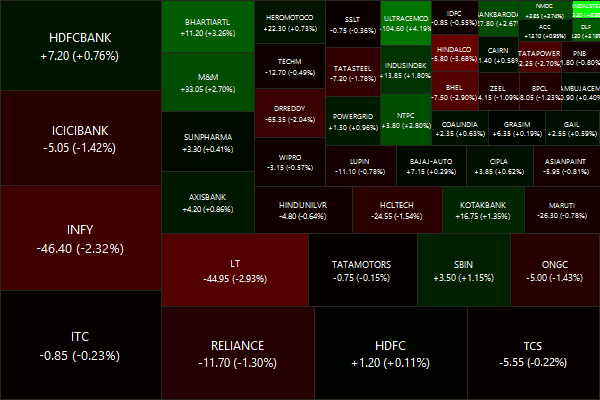

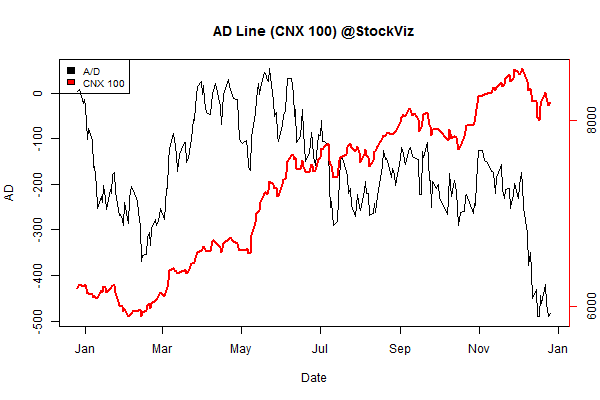

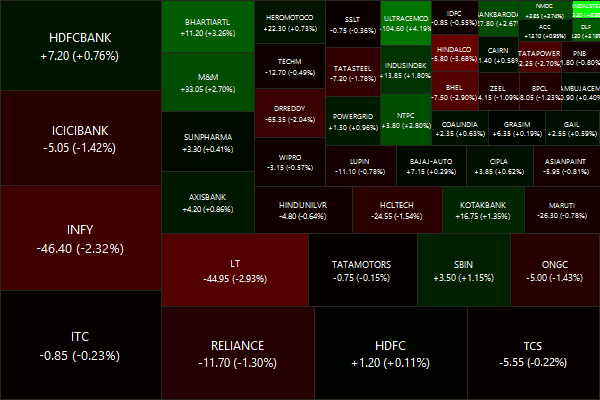

Nifty Heatmap

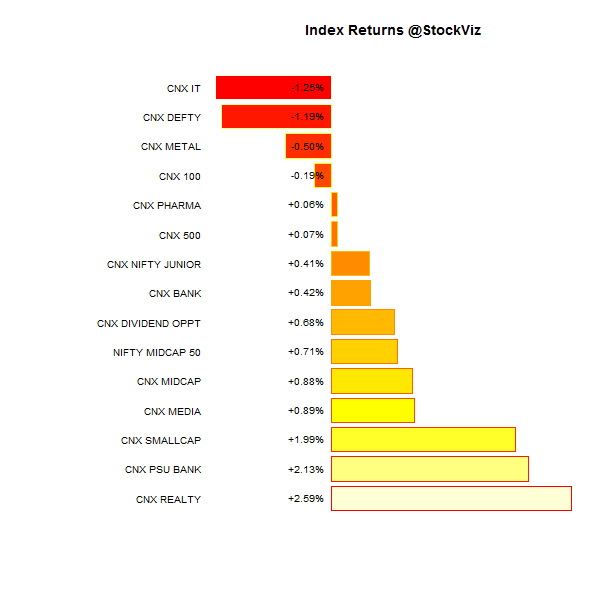

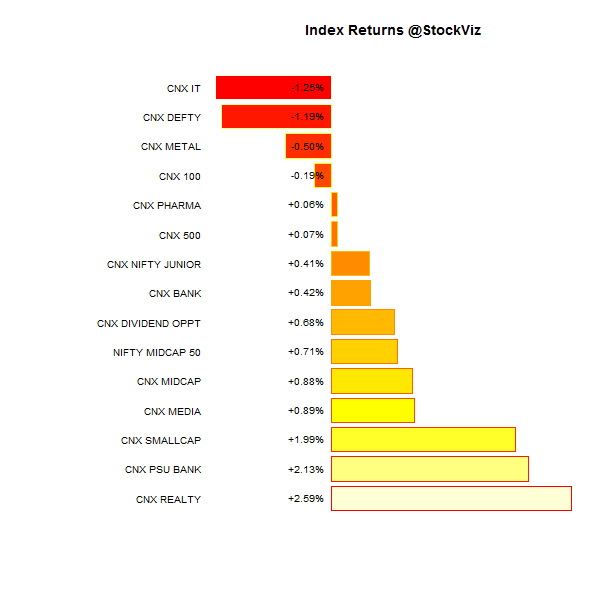

Index Returns

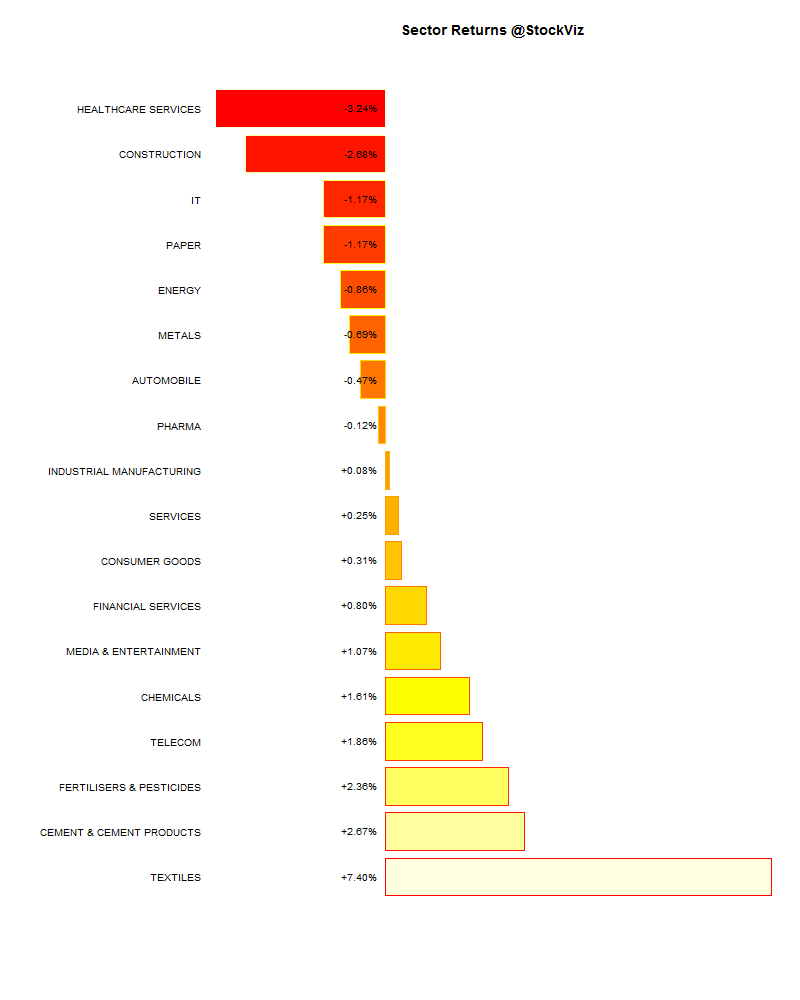

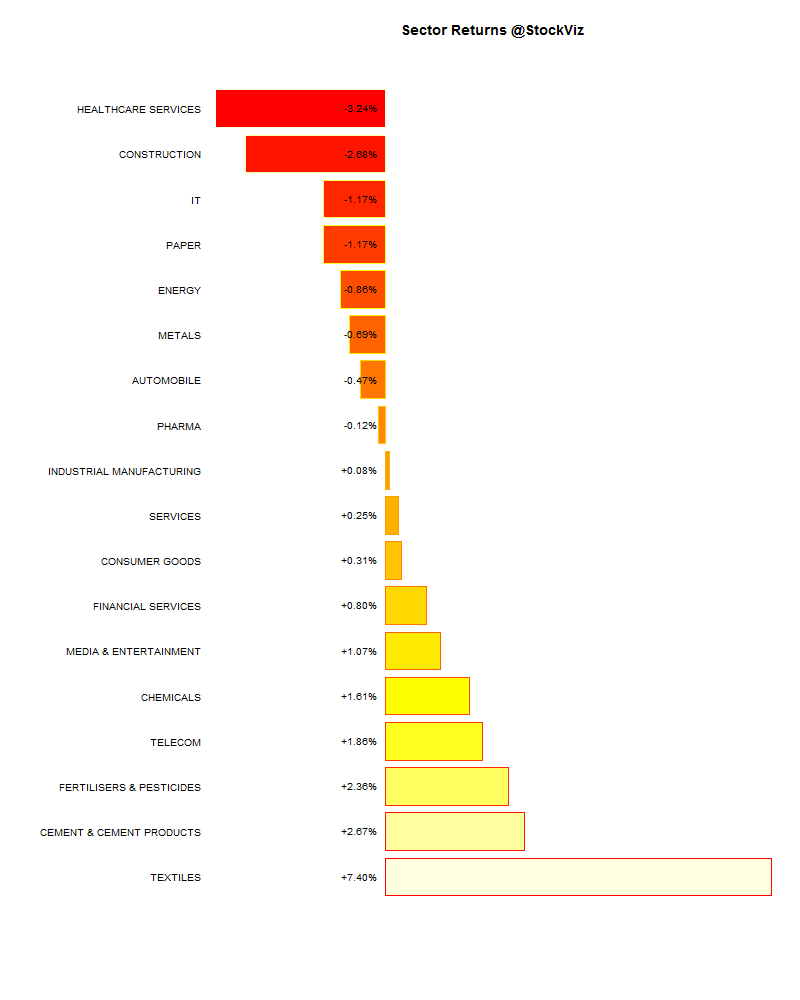

Sector Performance

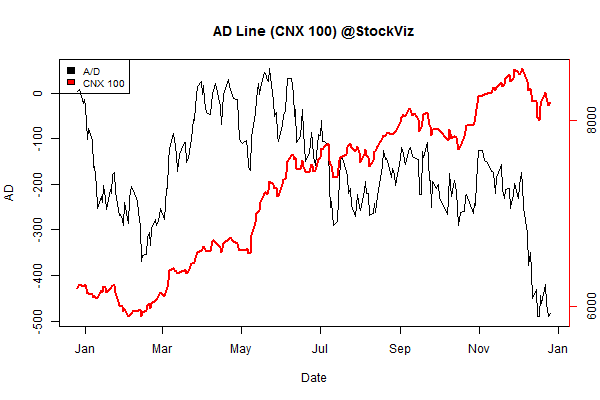

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-3.05% |

66/70 |

| 2 |

-0.47% |

63/72 |

| 3 |

-0.82% |

64/72 |

| 4 |

-0.50% |

65/69 |

| 5 |

-1.73% |

64/72 |

| 6 |

-0.27% |

67/68 |

| 7 |

+1.35% |

75/61 |

| 8 |

+0.02% |

69/66 |

| 9 |

+1.19% |

62/74 |

| 10 (mega) |

-0.43% |

72/64 |

One big nothingburger.

Top Winners and Losers

No bombs feel, computers did not take control…

ETF Performance

… and PSU banks outperformed.

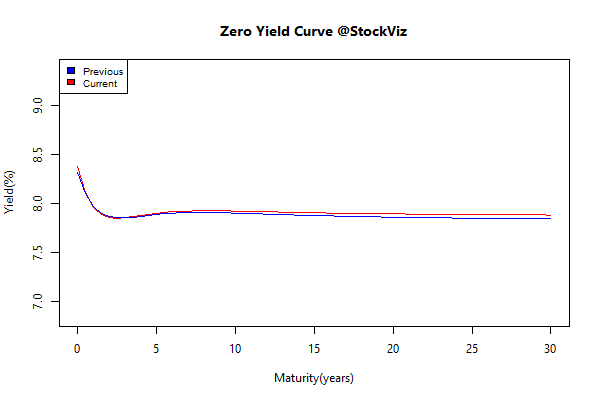

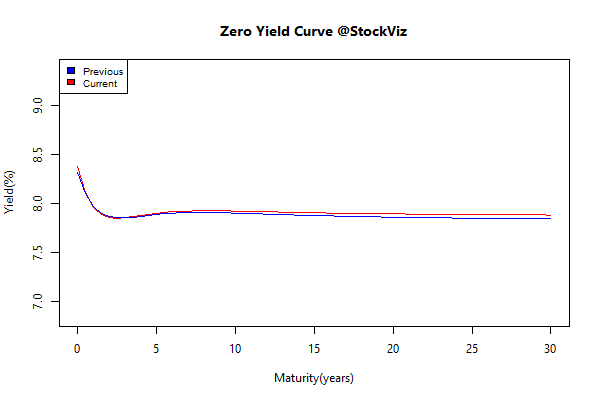

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.42 |

+0.27% |

| GSEC SUB 1-3 |

-0.15 |

+0.60% |

| GSEC SUB 3-8 |

+0.02 |

+0.22% |

| GSEC SUB 8 |

+0.07 |

-0.40% |

The long bond gave up some ground (FIIs selling?)

Investment Theme Performance

A mixed week for investment strategies…

Thought for the weekend

The most important thing to understand is that both bear markets and volatility are inevitable. In fact, they are the true source of the equity risk premium, and why it has historically been so large.

Stocks are riskier than bonds. Thus, investors demand a premium, in the form of a higher expected return, as compensation for taking the greater risk stocks entail. The key word is “expected.” If stocks always outperformed, there would be no risk in purchasing them. It’s the risk of the unexpected happening that leads to the equity risk premium.

Source: How To Think About Bear Markets