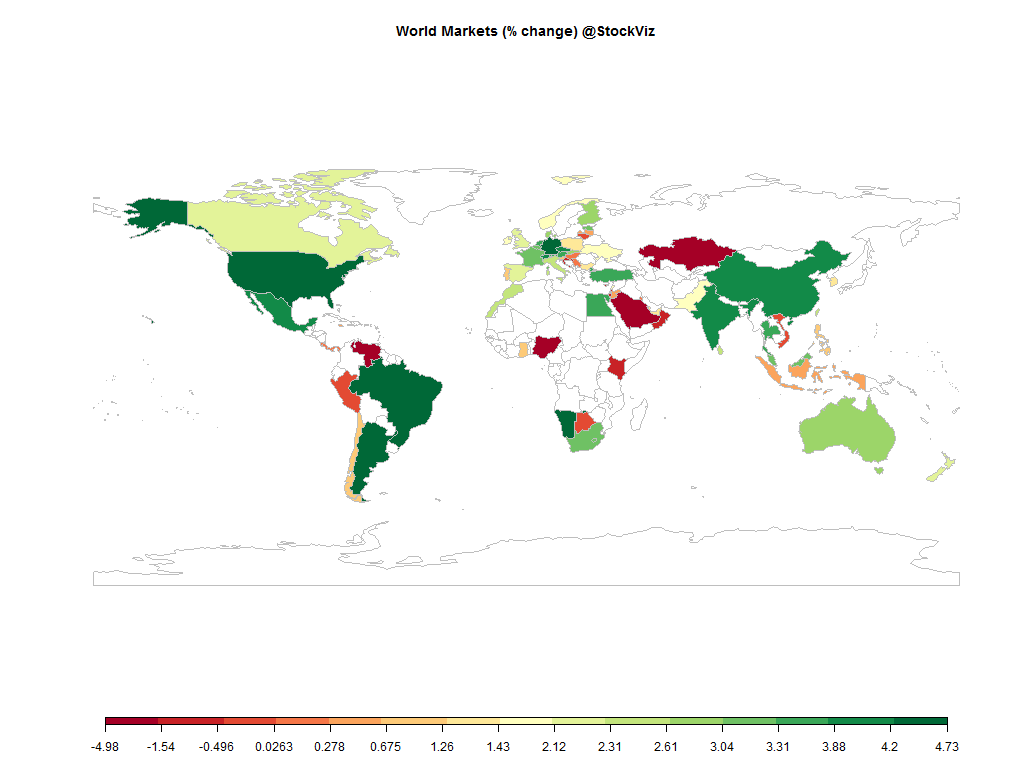

Equities

Commodities

| Energy |

| Brent Crude Oil |

+0.98% |

| Ethanol |

+3.33% |

| Heating Oil |

+1.93% |

| Natural Gas |

+5.71% |

| RBOB Gasoline |

-0.35% |

| WTI Crude Oil |

-2.17% |

| Metals |

| Copper |

+0.99% |

| Gold 100oz |

-6.21% |

| Palladium |

+2.45% |

| Platinum |

-2.39% |

| Silver 5000oz |

-9.14% |

| Agricultural |

| Cattle |

+1.19% |

| Cocoa |

-5.73% |

| Coffee (Arabica) |

-1.57% |

| Coffee (Robusta) |

+1.29% |

| Corn |

+6.31% |

| Cotton |

+2.32% |

| Feeder Cattle |

-2.09% |

| Lean Hogs |

-1.76% |

| Lumber |

-1.03% |

| Orange Juice |

-4.90% |

| Soybean Meal |

+14.76% |

| Soybeans |

+8.13% |

| Sugar #11 |

-3.09% |

| Wheat |

+1.82% |

| White Sugar |

-0.40% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

+0.71% |

| Markit CDX NA HY |

-0.05% |

| Markit CDX NA IG |

-0.50% |

| Markit CDX NA IG HVOL |

-3.58% |

| Markit iTraxx Asia ex-Japan IG |

-6.34% |

| Markit iTraxx Australia |

-6.48% |

| Markit iTraxx Europe |

-1.58% |

| Markit iTraxx Europe Crossover |

-0.61% |

| Markit iTraxx Japan |

-6.54% |

| Markit iTraxx SovX Western Europe |

-0.61% |

| Markit LCDX (Loan CDS) |

+0.08% |

| Markit MCDX (Municipal CDS) |

-2.24% |

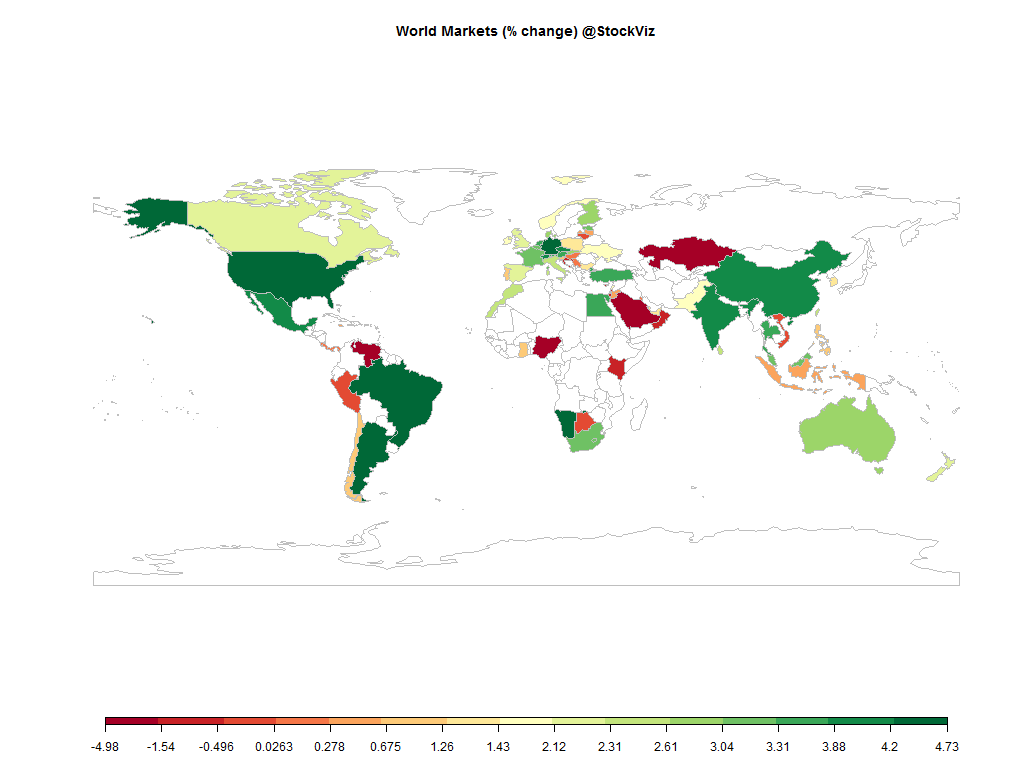

So what if the US Fed stopped QE? Japan rode to the rescue in style. If you thought that the Fed buying up treasuries was skewing the market, wait until Japan’s public pension fund starts buying equities and foreign bonds. The markets understandably went “yipi ka yei” on the news.

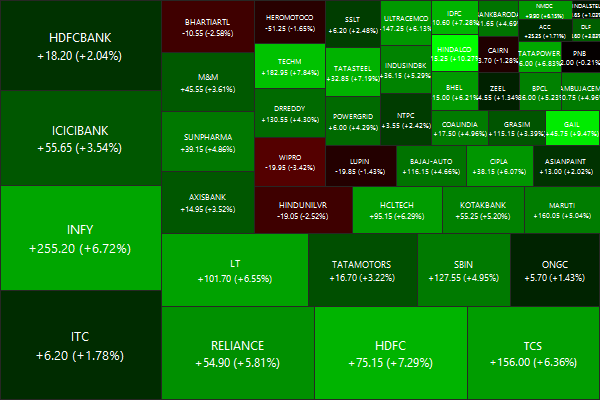

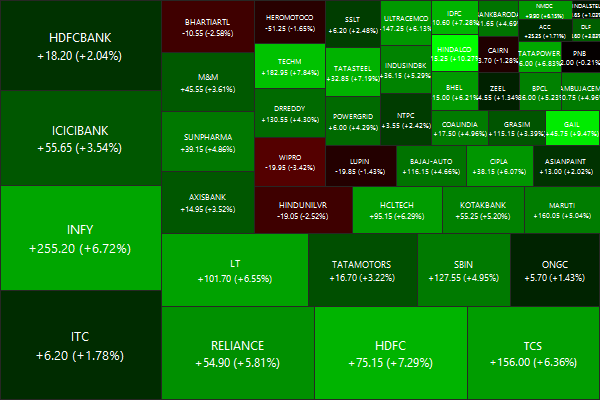

Nifty Heatmap

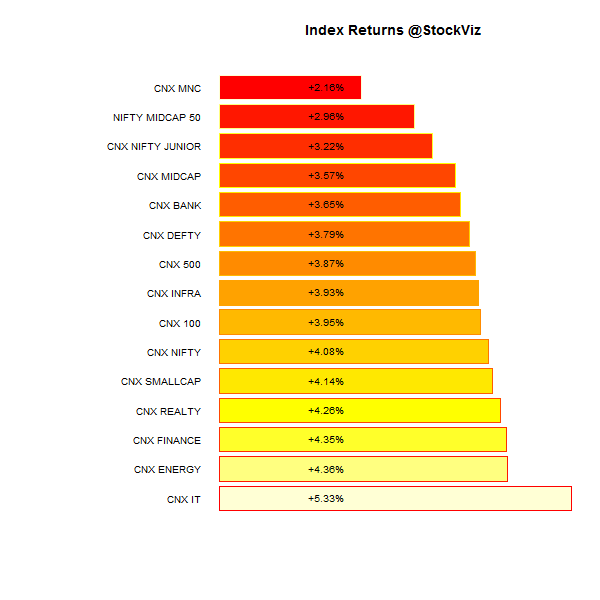

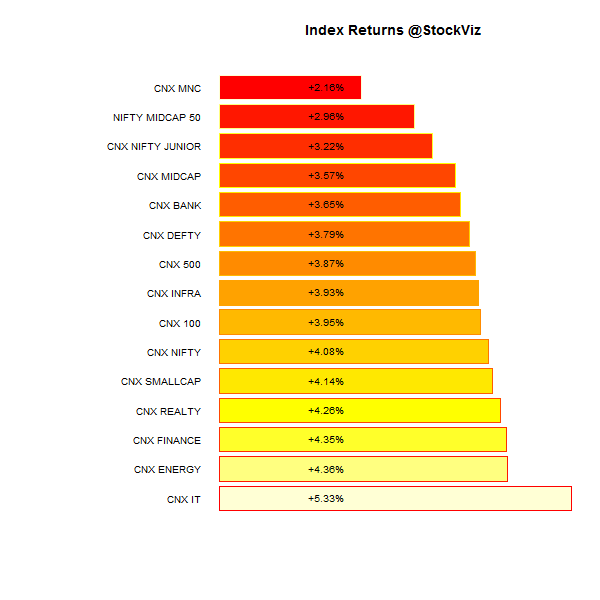

Index Returns

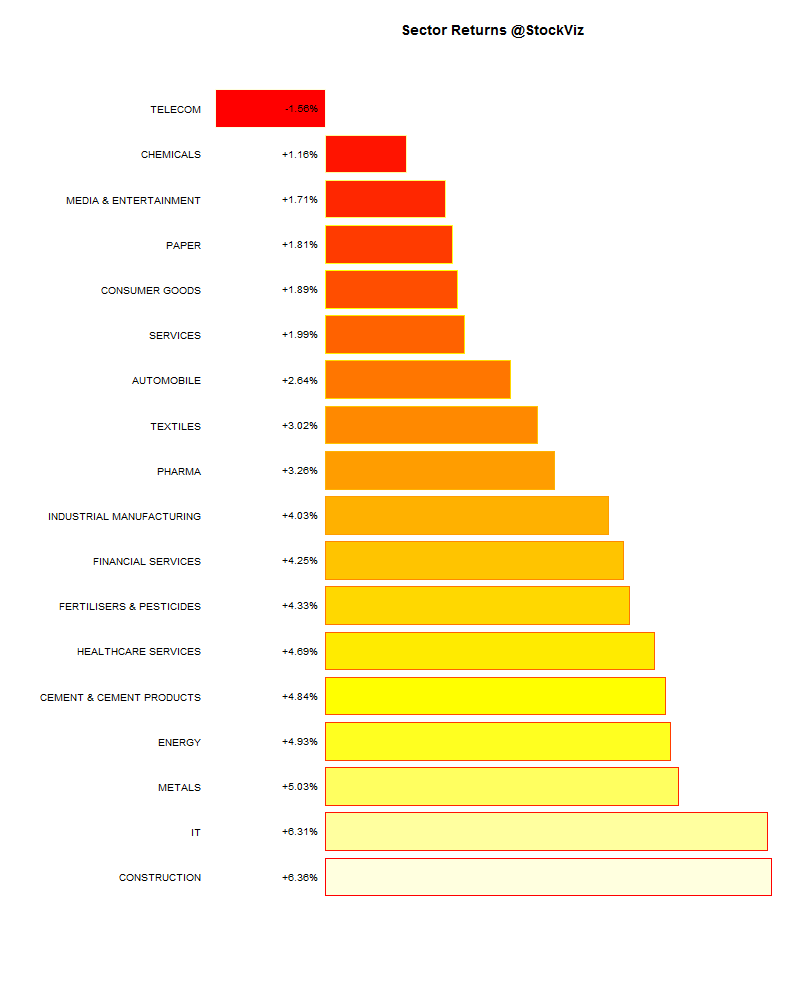

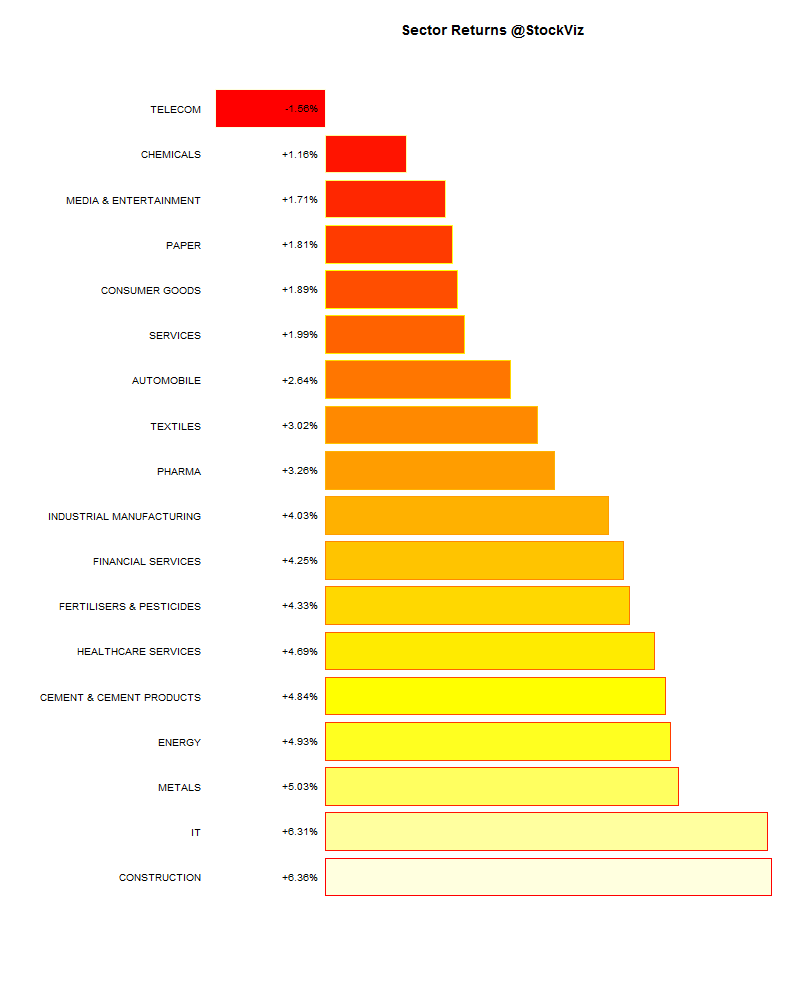

Sector Performance

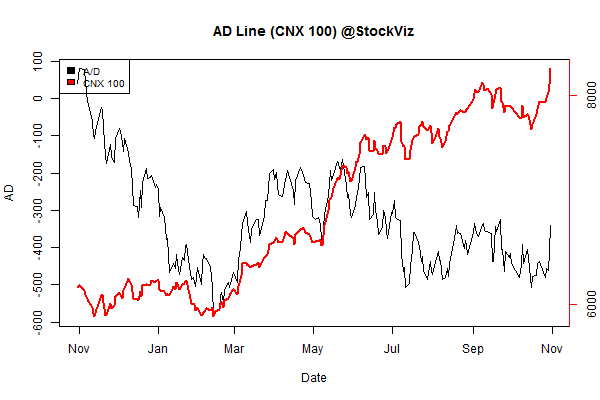

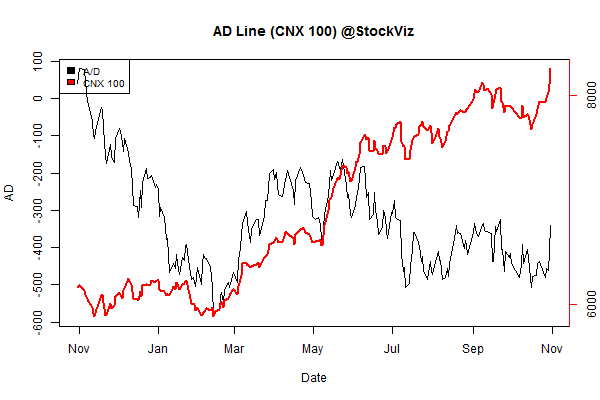

Advance Decline

Market Cap Decline Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

+1.38% |

68/62 |

| 2 |

+6.38% |

78/53 |

| 3 |

+4.52% |

74/58 |

| 4 |

+4.30% |

71/60 |

| 5 |

+4.00% |

70/62 |

| 6 |

+3.98% |

74/58 |

| 7 |

+3.13% |

75/56 |

| 8 |

+2.85% |

71/61 |

| 9 |

+3.03% |

74/58 |

| 10 (mega) |

+3.59% |

68/64 |

Stocks rallied across the board after

last week’s bloodbath.

Top Winners and Losers

The first week of November is going to see a lot of earnings announcements. Expect a lot of them to miss estimates, given how weak the overall economy was in the last quarter.

ETFs

If Fed QE was bullish for gold, shouldn’t Japanese QE also be bullish? Apparently not.

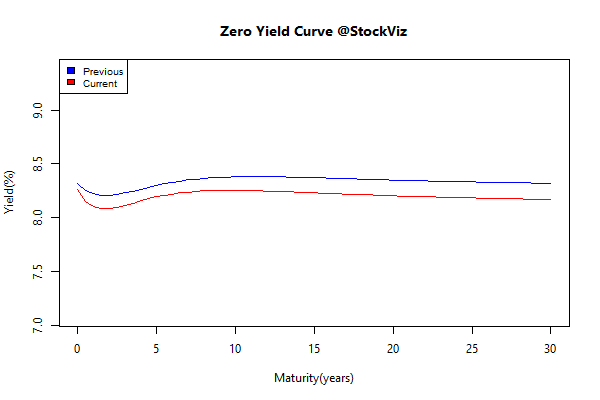

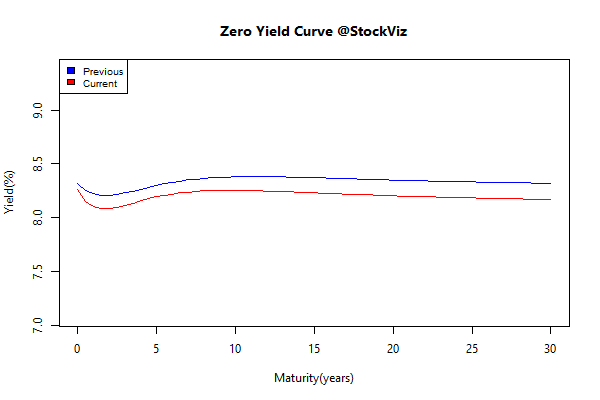

Yield Curve

Quick! The Japanese are coming!

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.24 |

+0.13% |

| GSEC SUB 1-3 |

+0.27 |

-0.09% |

| GSEC SUB 3-8 |

+0.08 |

+0.04% |

| GSEC SUB 8 |

-0.06 |

+0.89% |

Long bonds FTW!

Theme Performance

Diwali fireworks meets Japanese QE. All Themes rejoice!

Thought for the weekend

The chief virtue of AIs will be their alien intelligence. An AI will think about food differently than any chef, allowing us to think about food differently. Or to think about manufacturing materials differently. Or clothes. Or financial derivatives. Or any branch of science and art. The alienness of artificial intelligence will become more valuable to us than its speed or power.

Source: The Three Breakthroughs That Have Finally Unleashed AI on the World