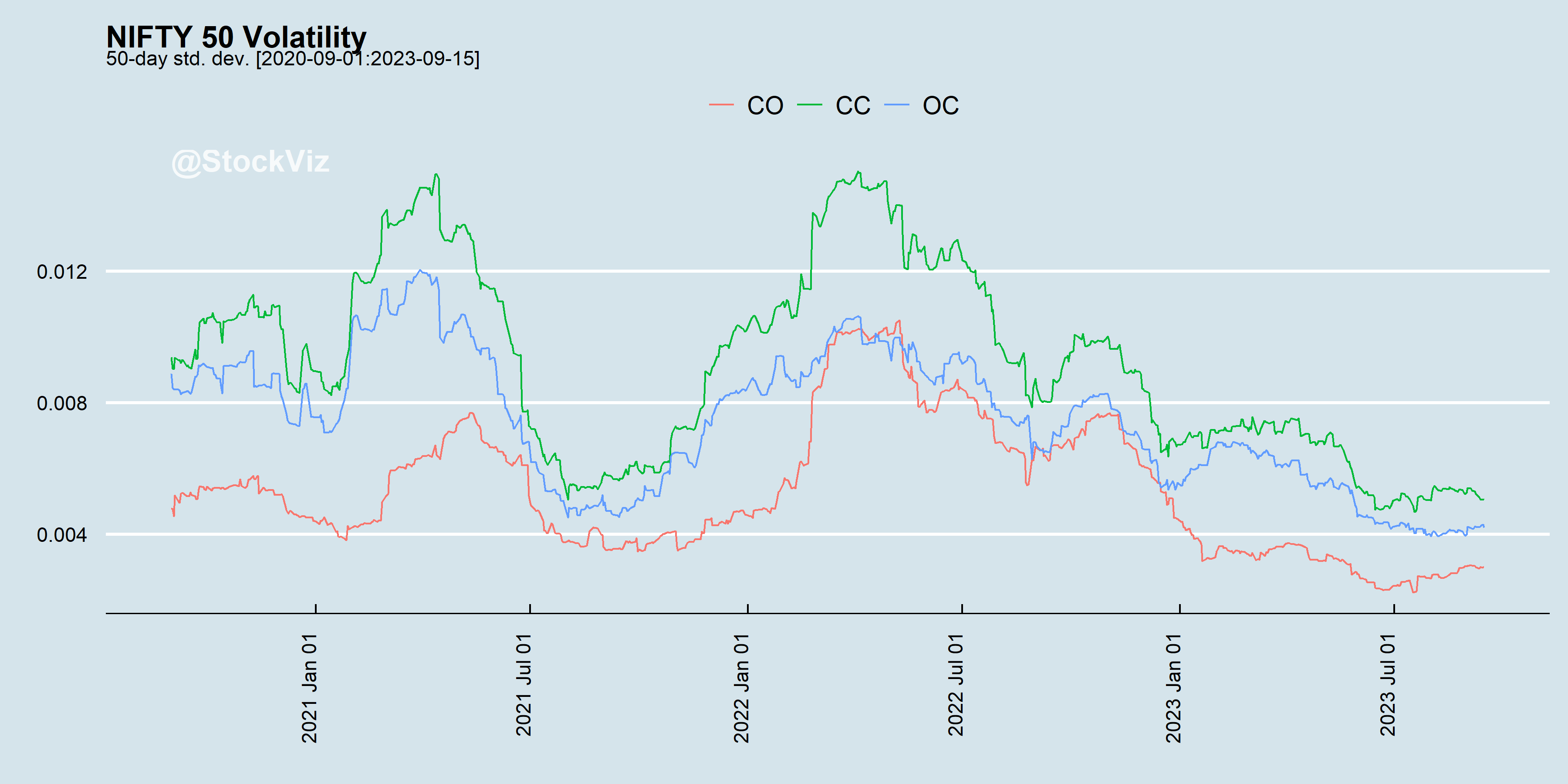

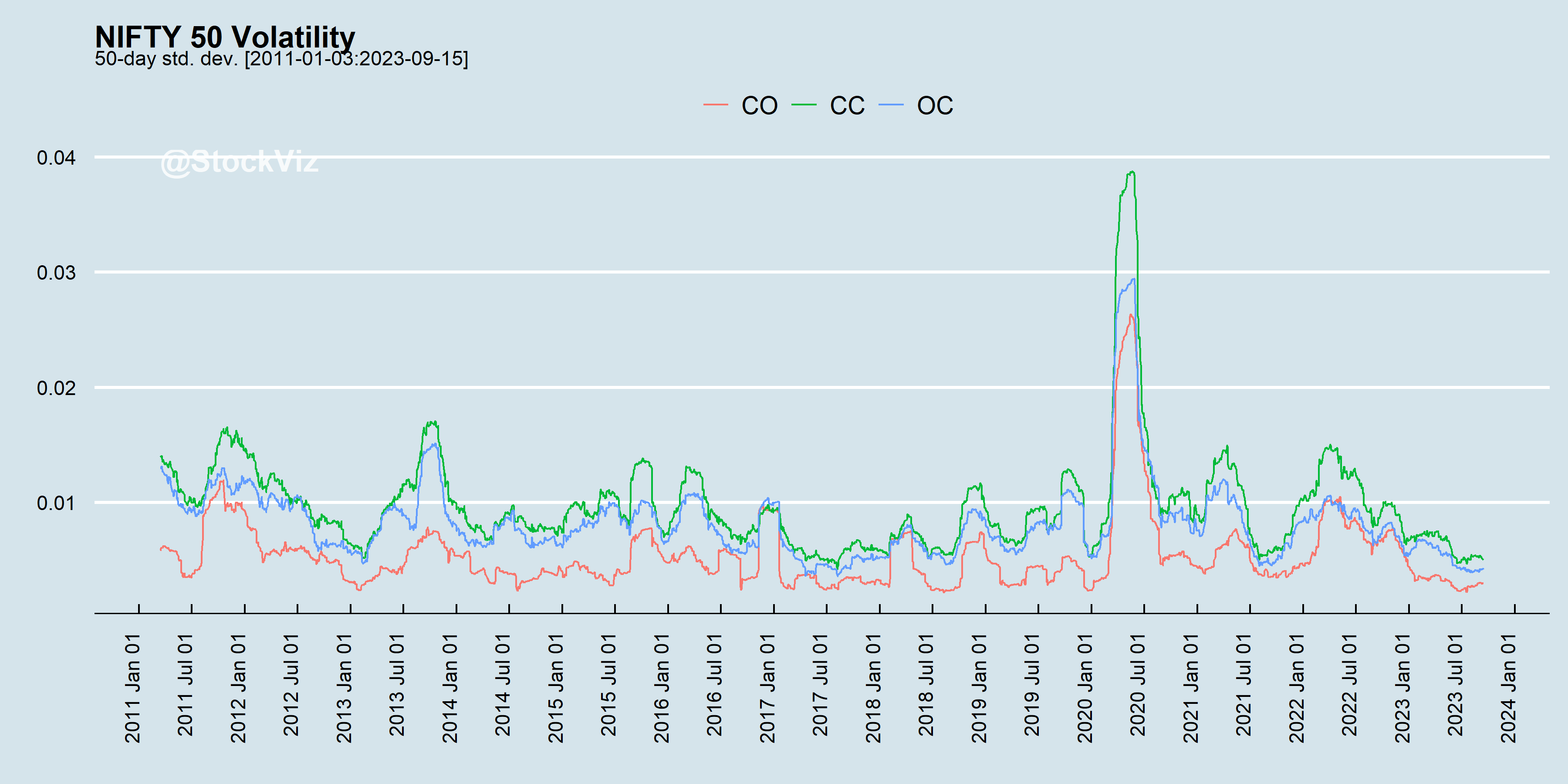

India VIX is a volatility index computed by NSE based on the order book of NIFTY Options. For this, the best bid-ask quotes of near and next-month NIFTY options contracts. India VIX indicates the investor’s perception of the market’s volatility in the near term i.e. it depicts the expected market volatility over the next 30 calendar days. Higher the India VIX values, higher the expected volatility and vice versa. (NSE)

Does the actual volatility come close what the VIX was implying 30 calendar days before? Not always and probably never.

What if it’s pricing something more immediate? Here’s the regression with a 10-day lag:

Regression with no lag:

The relationship between implied and historical is one of those things that are directionally true… sometimes.

Code and charts on github.