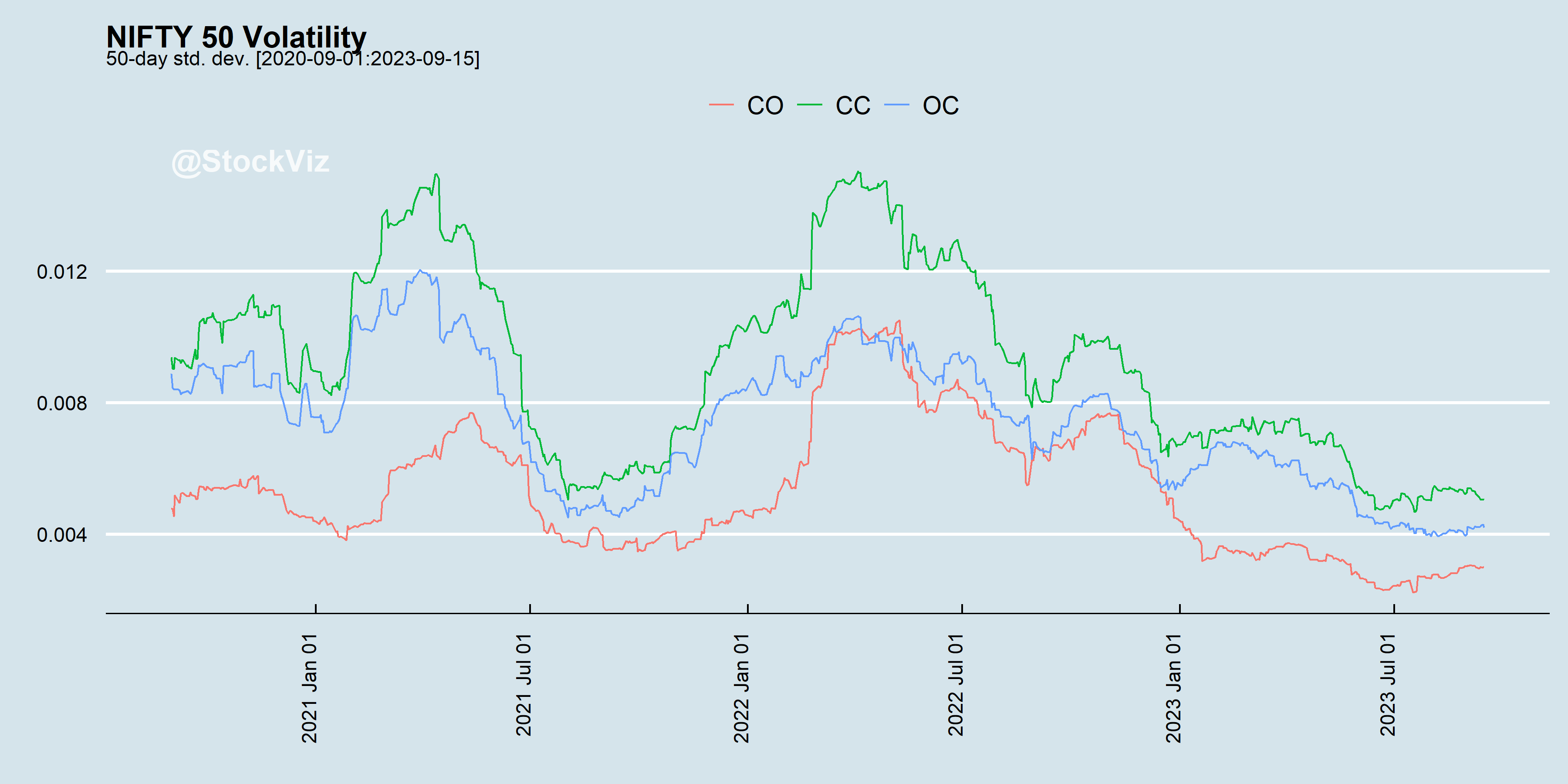

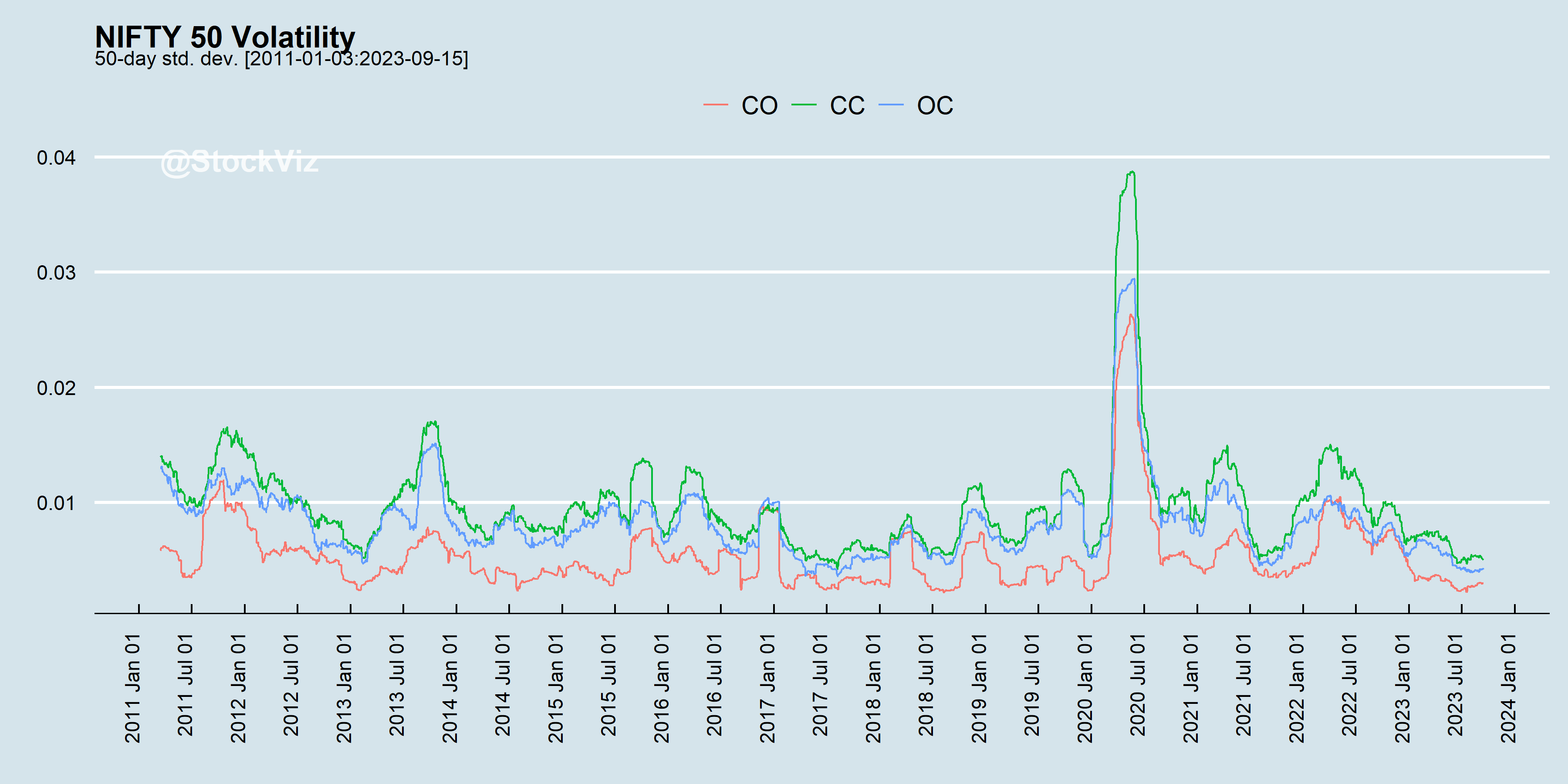

Currently, Indian markets are open for 6.5 hours. During that time, global commodity markets are largely closed and overnight US futures markets are barely coming to life. This exposes positions carried forward to the next day to event risks. How is this risk priced?

Surprisingly, Close-Open (next-day) (CO) volatility is less than Open-Close (same-day) (OC) volatility. This doesn’t quite jive with the intuition about large overnight risks. This holds even if you include pre-pandemic data.

If you believe that overnight risks are larger than what the market perceives, then buying strangles at the close surprisingly doesn’t cost you much. A naïve strategy should breakeven after costs and occasionally, you might get lucky.

The unknown-unknown is scarier than the known-unknown. However, it is the known-unknown that you should be worried about more.

Comments are closed, but trackbacks and pingbacks are open.