Escaping the worst days

We had discussed how, by escaping the worst days, even if it means missing out on the best days, you can protect your portfolio from drawdowns and get superior results compared to a naive buy-and-hold strategy. See: The SMA Risk On/Off Switch

We ran the same filter on the CNX 100 index.

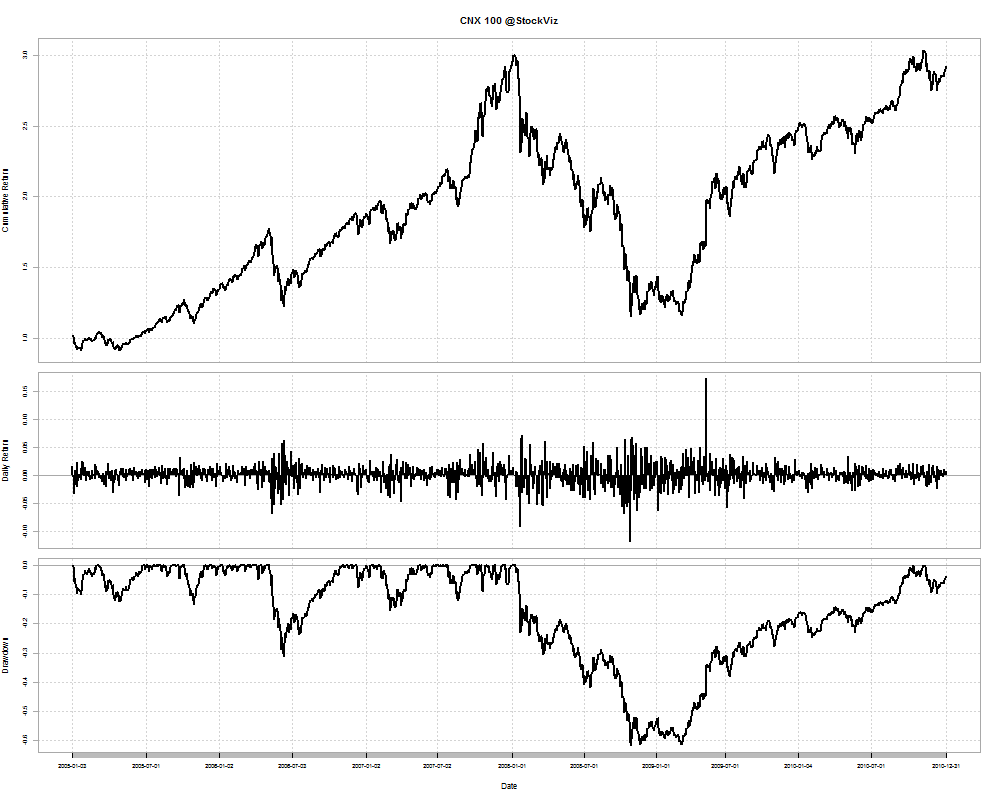

CNX 100 between 2005 and 2010

Naive Buy and Hold

Cumulative Return: 1.92

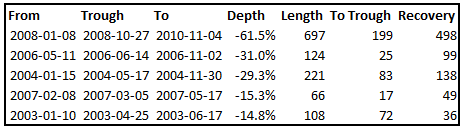

DrawDowns

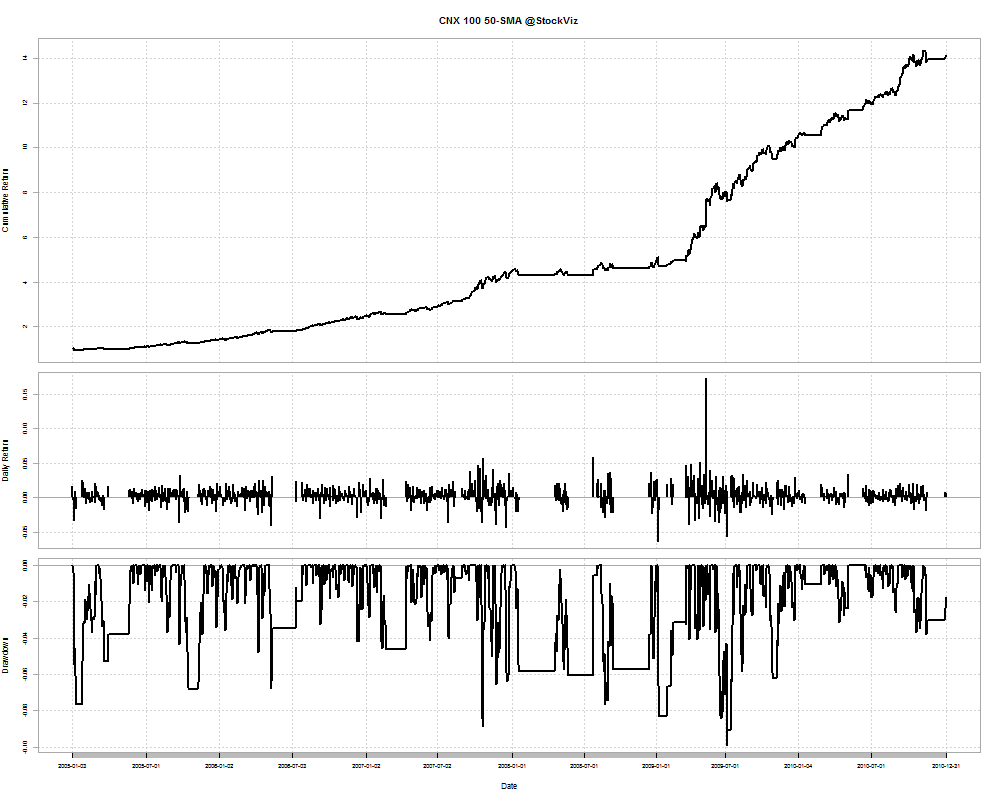

50-day SMA On/Off

Cumulative Return: 13.12

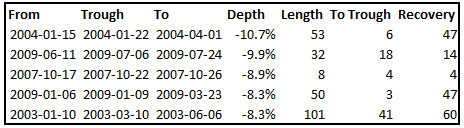

DrawDowns

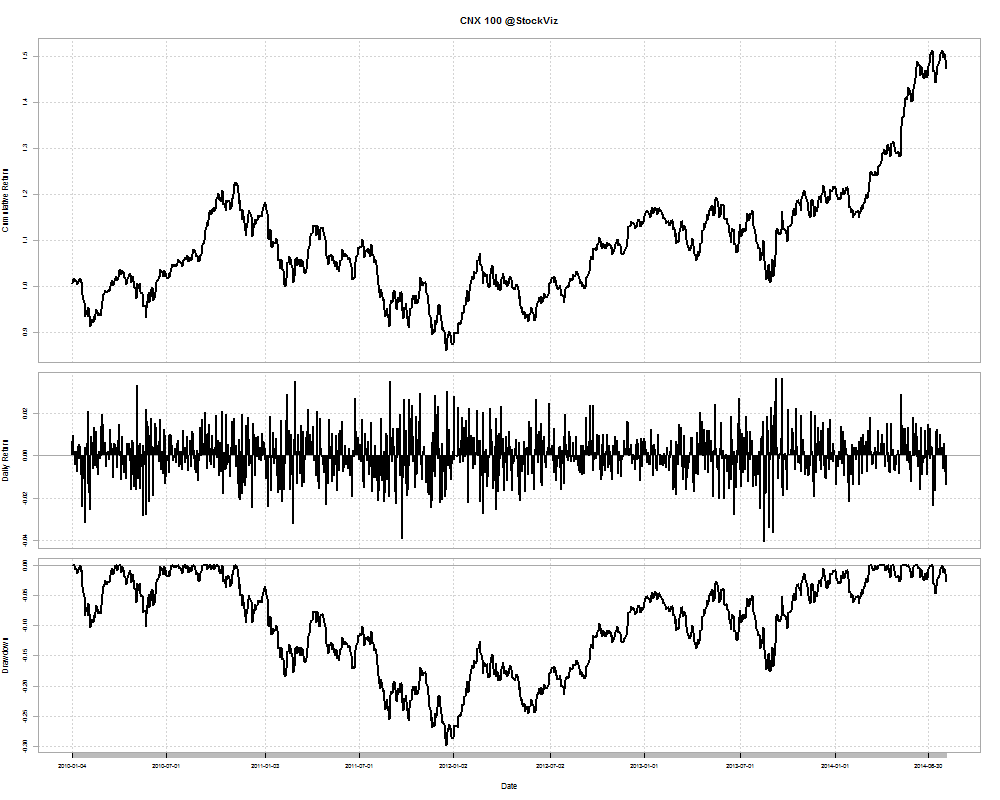

CNX 100 from 2010 to now

Naive Buy and Hold

Cumulative Return: 0.473696

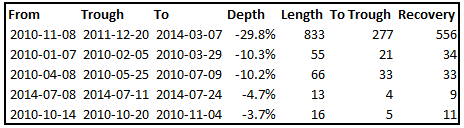

DrawDowns

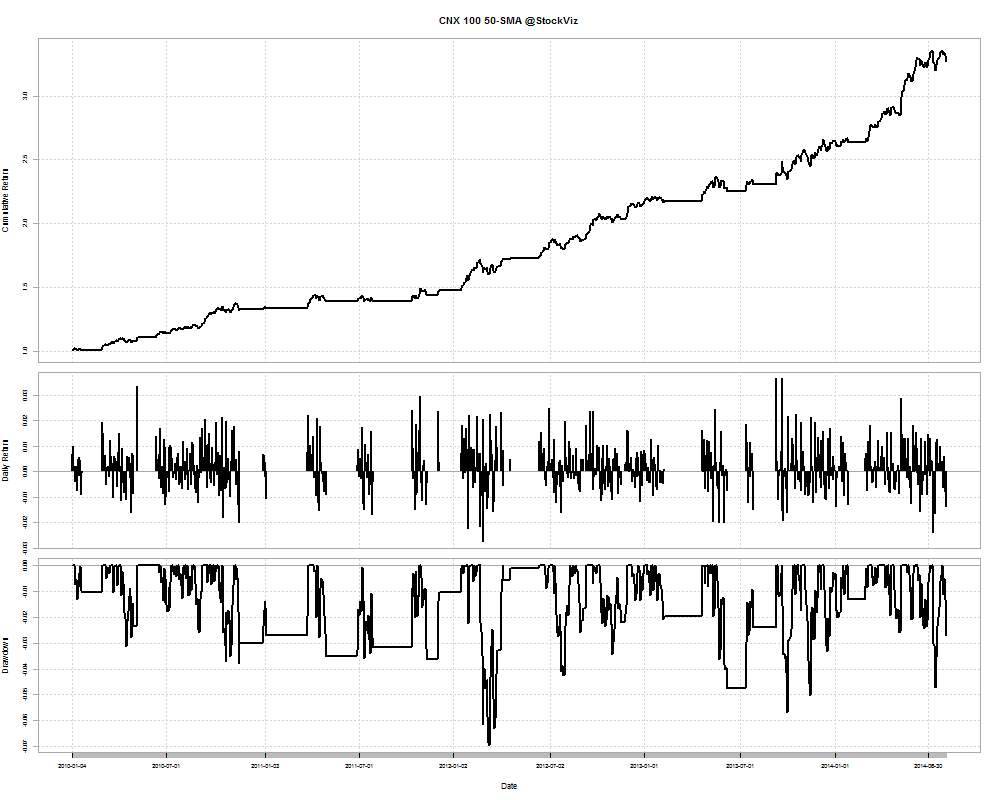

50-day SMA On/Off

Cumulative Return: 2.270039

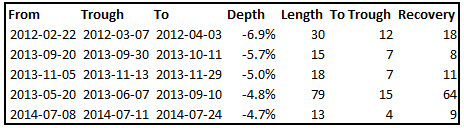

DrawDowns

The CNX 100 50-Day Tactical Theme

The 50-day signal can be used to go “risk on” and “risk off” between the NIFTYBEES and JUNIORBEES ETFs. When “risk on”, the Theme allocates equally between NIFTYBEES and JUNIORBEES and when “risk off”, moves to LIQUIDBEES.

You can follow the theme here.