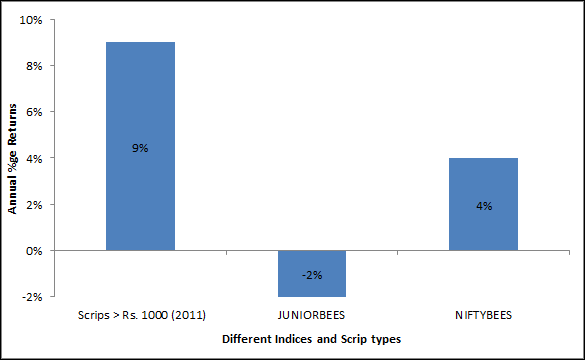

Stocks worth more than Rs.1000 a year ago show an average yearly return of 9%, versus the 4% and –2% of [stockquote]NIFTYBEES[/stockquote] and [stockquote]JUNIORBEES[/stockquote].

Tag: reading

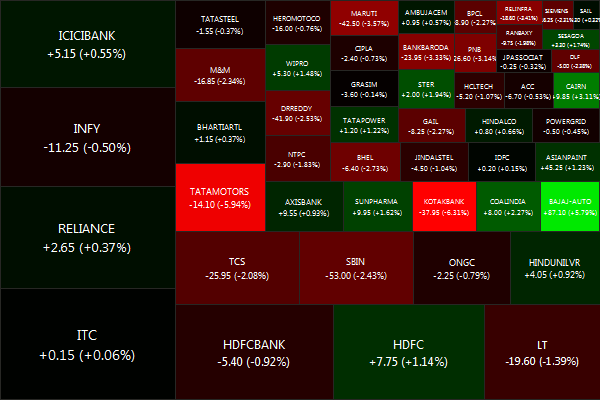

The NIFTY ended tepid, moving just +0.49% for the week.

Biggest losers were KOTAKBANK (-6.59%), TATAMOTORS (-5.32%) and RELINFRA (-3.79%).

And the biggest winners were BAJAJ-AUTO (+6.21%), CAIRN (+3.38%) and BHARTIARTL (+2.18%).

Decliners eclipsed advancers 31 vs 19

Gold: +0.22%, Banks: +0.08%. Infrastructure: -0.80%,

Could this be the first of many? Microsoft posted a rare quarterly loss, its first in its 26 years as a public company (WSJ)

Daily news summaries are here.

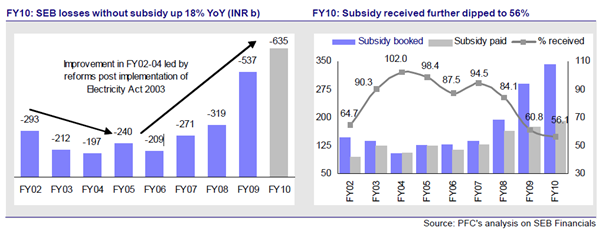

It’s do or die situation for the country’s precariously placed companies in the power sector, especially distribution companies (discoms) or state electricity boards (SEBs).

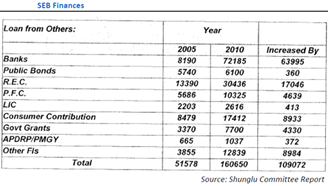

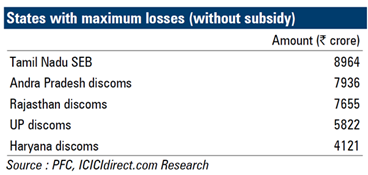

The Shunglu panel, set up by the Planning Commission, last year pegged accumulated losses of discoms at Rs 82,000 crore from 2006-10. The committee was set up to look into the financial health of discoms. The losses of SEBs indirectly impact the power producers since SEBs are the largest buyers of power in the country.

According to a report released by the 13th Finance Commission, these financial losses may increase to Rs. 116,089 crore by FY 2016-17, much higher than Rs 63,500 crore seen in FY 2010. Non-revision of tariffs and non-realisation of subsidies has severely plagued these entities.

According to a report released by the 13th Finance Commission, these financial losses may increase to Rs. 116,089 crore by FY 2016-17, much higher than Rs 63,500 crore seen in FY 2010. Non-revision of tariffs and non-realisation of subsidies has severely plagued these entities.

With debts at unmanageable levels and losses mounting, reports have hinted at a bailout for these distribution utilities that are tethering on the brink of bankruptcy. Is it a case of throwing good money after bad or will these companies get rid of their complacency and deliver hard-hitting reforms like raising power tariffs, eliminating theft and corruption through efficient delivery mechanisms?

Deteriorating financial position has handicapped SEBs ability to service debt. This has prompted banks to turn cautious in extending loans to the power sector as a whole. Nearly 70% of the SEB losses are financed by public sector banks. Some lenders have started insisting on riders like automatic pass-through of fuel costs and filing tariff petitions every year in their loan agreements with SEBs.

While a bailout is needed to avert a total blackout in the power sector, it must be backed by structural reforms like strict reduction in transmission and distribution losses and frequent revisions in tariffs to ease liquidity constraints faced by discoms.

Currently, regulatory framework for distribution utilities is marred due to political interference in tariff fixation.

The Shunglu panel has called for independence of the regulator, creation of a special purpose vehicle by the RBI to purchase the liabilities of distribution companies, non-creation of regulatory asset in the books of discoms, etc among other measures to prop up their finances.

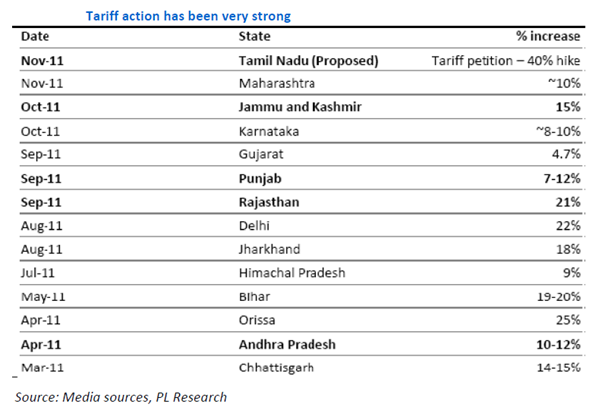

Several states have seen the writing on the wall. All the top 10 loss making states have revised tariffs in the past 18 months.

Several states have seen the writing on the wall. All the top 10 loss making states have revised tariffs in the past 18 months.

Delhi raised tariffs by 24% this week, the fourth such hike in the last 10 months, after distribution companies complained of severe financial strain due to the rising power purchase cost. Tamil Nadu proposed a tariff hike of 38% while Rajasthan raised rates by 24% in September 2011. The hikes will give some room for state distribution companies to repair their balance sheets.

While the recent tariff hikes have held out hope of a turnaround, SEBs must resort to sustainable measures like annual tariff petition filing, timely revision of tariff, increasing private participation in the distribution business, computerisation of accounts, better monitoring of funds, etc. The Shunglu committee has also called for stern action against state regulators if adequate tariff revisions are not undertaken and penal action against utilities for not filing annual accounts.

The financial health of distribution utilities is critical for the success of the power sector that will see a capacity addition of 85,000 mw during the 12th five-year plan.

Once the darling of the BRICs, India is now nothing more than a “gasping elephant” and is in danger of becoming the first ‘fallen angel’ among emerging economies.

Last week, Fraport AG, the world’s second-largest airport operator, said it plans to exit Delhi International Airport Ltd (DIAL) and will also shut its business development office in India due to lack of opportunities.

Contrast this with 2009 when the UPA won the elections with a decisive mandate, investors gave it a resounding thumbs up hoping that the new-found political stability would usher in a wave of reforms and revive investment climate.

Far from pushing the pedal to speed up reforms, the Manmohan Singh government has squandered the advantage it enjoyed by enmeshing itself in a series of scams, policy paralysis, ministerial tiffs, mismanagement of political events, fiscal profligacy, etc.

Far from pushing the pedal to speed up reforms, the Manmohan Singh government has squandered the advantage it enjoyed by enmeshing itself in a series of scams, policy paralysis, ministerial tiffs, mismanagement of political events, fiscal profligacy, etc.

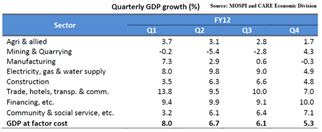

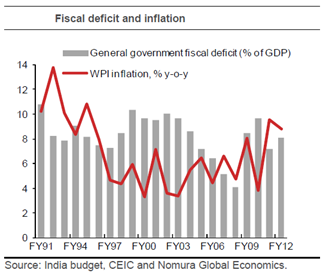

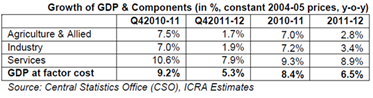

This has resulted in growth tumbling to a nine-year low in Jan-March quarter, fiscal slippages and inflation staying stubborn above 7% due to supply side bottlenecks, rendering monetary policy useless and hindering investments.

Adding to the gloom, global ratings agency S&P rubbed salt into the wounds of investors when it warned that it could downgrade India’s credit rating to junk due to slowing GDP growth and political roadblocks to economic policymaking.

The agency, in its report titled “Will India be the first BRIC fallen angel?”, said that the main reason behind the country’s political impediment to economic liberalization was the nature of the leadership within the Centre and not the allies supporting it or the “unhelpful” Opposition.

The agency, in its report titled “Will India be the first BRIC fallen angel?”, said that the main reason behind the country’s political impediment to economic liberalization was the nature of the leadership within the Centre and not the allies supporting it or the “unhelpful” Opposition.

Apart from asking RBI to cut policy rates and make credit cheaper, Pranab and his economic battery of advisors have done little to steer the economy from its troubles. Given India’s external financing needs, augmenting foreign inflows are crucial.

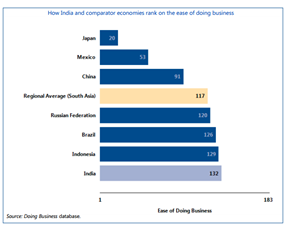

But the about-face in foreign direct investment policy for retail and insurance sectors coupled with uncertain regulatory actions like GAAR and retrospective amendments have scared foreign investors, drying up fund flows.

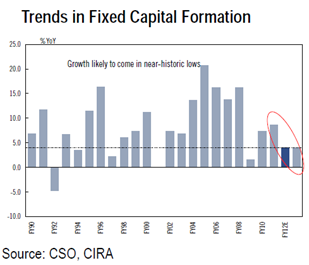

Infrastructure projects have missed deadlines due to policy hurdles/ inaction and power and coal shortages. Investment growth has decelerated sharply as rising interest rates and policy paralysis stifled gross fixed capital formation with trends slowing from the 17%YoY CAGR seen during FY04-08 to 4% y-o-y in FY12.

India’s problems are entirely self-inflicted as policy making has come to a standstill. Instead of setting its house in order by addressing power distribution losses, meeting infrastructure project deadlines and plugging the twin deficits, the government has taken the easy way out, i.e., blamed its ills on overseas problems like the sovereign debt crisis in Europe and a slowing US economy.

India’s problems are entirely self-inflicted as policy making has come to a standstill. Instead of setting its house in order by addressing power distribution losses, meeting infrastructure project deadlines and plugging the twin deficits, the government has taken the easy way out, i.e., blamed its ills on overseas problems like the sovereign debt crisis in Europe and a slowing US economy.

And now it is betting on lower oil prices and a normal monsoon to revive the economy. Failure on these coupled with a bad external shock and weak economic management could see growth falling to 4-5% levels, a ‘remote’ scenario that S&P feels is possible.

feels is possible.

Placating foreign investors by harping on long-term fundamentals and growth dynamics have run their course. Time has come to get rid of policy bottlenecks by addressing land acquisition and environmental clearance problems, policy and execution reforms, taking steps to enhance farm productivity, eliminating supply-side constraints, etc.

On the expenditure front, credible fiscal consolidation is needed. Failure to meet the projected 5.1% deficit target will damage India’s standing and deepen the crisis of confidence.

The writing on the wall is clear and there is no simple fix- it is either perform or perish.

(Photo credit: Wikipedia)

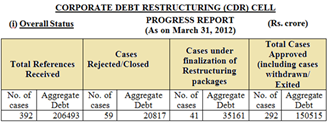

Headwinds from struggling domestic economy as a result of rising inflation, interest rates, lower profitability and weak demand continue to weigh on corporate India. This has severely impaired their ability to service debt and a record number of companies are knocking on the doors of corporate debt restructuring (CDR) cell to recast their loans.

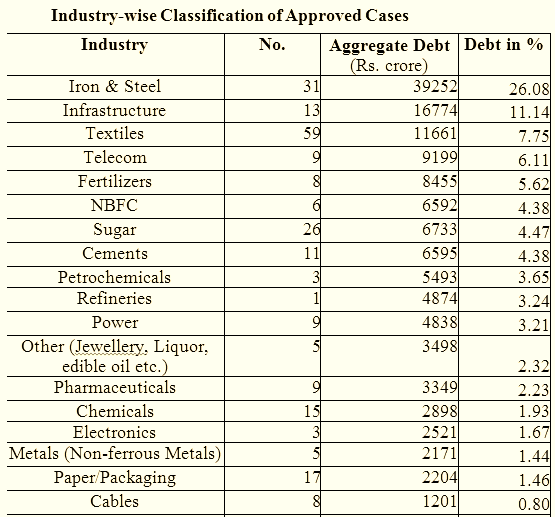

The total number of debt restructuring cases received by the CDR cell increased from 305 (debt aggregating Rs 1,38,600 crore) as on March-end 2011 to 392 (debt aggregating Rs 2,06,493 crore) at the end of March this year.

The total amount of debt approved for recast by the CDR cell was Rs.1,50,515 crore as of March 31, with new debt of Rs.39,601 crore adding to the sticky loan amount in 2011-12, the highest since the CDR cell was launched in 2001.

Creditors bring cases to the CDR cell, an informal forum of bankers approved by the Reserve Bank of India, to renegotiate repayment terms with struggling borrowers and help them avert the defaulters tag.

Creditors bring cases to the CDR cell, an informal forum of bankers approved by the Reserve Bank of India, to renegotiate repayment terms with struggling borrowers and help them avert the defaulters tag.

A large number of iron and steel, infrastructure, telecom and textiles companies are in the danger zone. Some of the big-ticket cases that have taken the restructuring route include telecom tower services provider GTL [stockquote]GTLINFRA[/stockquote], shipbuilder Bharati Shipyard [stockquote]BHARTISHIP[/stockquote], Air India, Kingfisher Airlines [stockquote]KFA[/stockquote], Hindustan Construction [stockquote]HCC[/stockquote], Leela Hotel [stockquote]HOTELEELA[/stockquote] and several sugar and steel mills. Jindal Stainless [stockquote]JSL[/stockquote] is the latest entrant to this infamous club. It has approached lenders to reschedule repayments of its over Rs 9,000 crore debt.

Bank loans to large airlines and State Electricity Boards (SEBs) and Discoms (distribution companies) also face the risk of default, though these are currently not under CDR restructuring. Air India’s Rs 22,000 crore CDR and those of SEBs, which is close to Rs.30,000 crore, were restructured outside the cell.

The slowdown in industrial growth resulted from rising input and borrowing costs, due to which investment and consumption growth moderated in interest-sensitive sectors.

While a slowing economy hurts the ability of companies to repay their debt, some bankers feel many promoters, who have got their loans restructured, are misusing the corporate debt restructuring (CDR) mechanism by passing on their burden to the lenders.

While a slowing economy hurts the ability of companies to repay their debt, some bankers feel many promoters, who have got their loans restructured, are misusing the corporate debt restructuring (CDR) mechanism by passing on their burden to the lenders.

Amidst such dire situations, the government is only doing more harm to lenders. Last month, the centre directed lenders to rejig Rs 35,000 crore of loans to textile firms, adding more restructuring burden on banks. Ideally, the minimum interest rate to which the coupon is reduced to in a restructuring package is the base rate. The package involves bringing debt service coverage ratio to a respectable level, converting part of loan into equity etc.

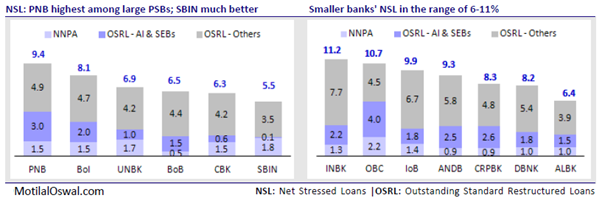

Public sector banks [stockquote]PSUBNKBEES[/stockquote] continued to witness a rise in bad loans during the March quarter due to restructured assets. During the March quarter, SBI [stockquote]SBIN[/stockquote] recast loans worth Rs 5,100 crore against Rs 2,100 crore in the December quarter. Banks have to set aside more money in the form of provisioning on restructured advances, which affects profitability.

The macro environment remains challenging with sluggish business outlook, policy uncertainties, limited access to fund raising avenues for highly leveraged companies and project implementation delays. Clearly, we have not yet seen the worst on bad loans front.