Individual investors’ greatest advantage is that they don’t have to fit into a “style box.”

If you can’t measure it, you can’t improve it. – Peter Drucker

The Industrial Revolution was fueled, in part, by the violent combination of applied statistics and physics. Rapidly improving methods of measurement lead to rapid innovation in both the underlying physics and the resulting machine. And in an era of rapid innovation, managers who could zero-in on the metrics that mattered the most and measure them with decent precision had a large competitive advantage over the innumerate. For instance, if a new type of cotton ginny was invented, you needed a quantitative method to figure out if it was worth replacing the existing ones.

Managers who measured well survived. And those who survived, preached.

Take education, for example. Before the Industrial Revolution, one would simply be an “Oxford graduate.” There were no grades. Once your advisor thought that you were “ready,” you graduated. It was the industrialists who demanded scoring and ranking as a way to fit graduates into roles. And educational institutions obliged.

And it was all downhill from there.

When a measure becomes a target, it ceases to be a good measure. – Goodhart’s Law

While measurement and metrics are helpful in the physical world, it tends to break apart in the social world.

Measuring Investments

The first modern mutual fund was launched in the U.S. in 1924.

CRSP completed the stock market database in 1964.

The CAPM was introduced between 1961 and 1966.

Morningstar Style Box for mutual funds was introduced in 1992.

SEBI finalizes the Categorization and Rationalization of Mutual Fund Schemes in 2017.

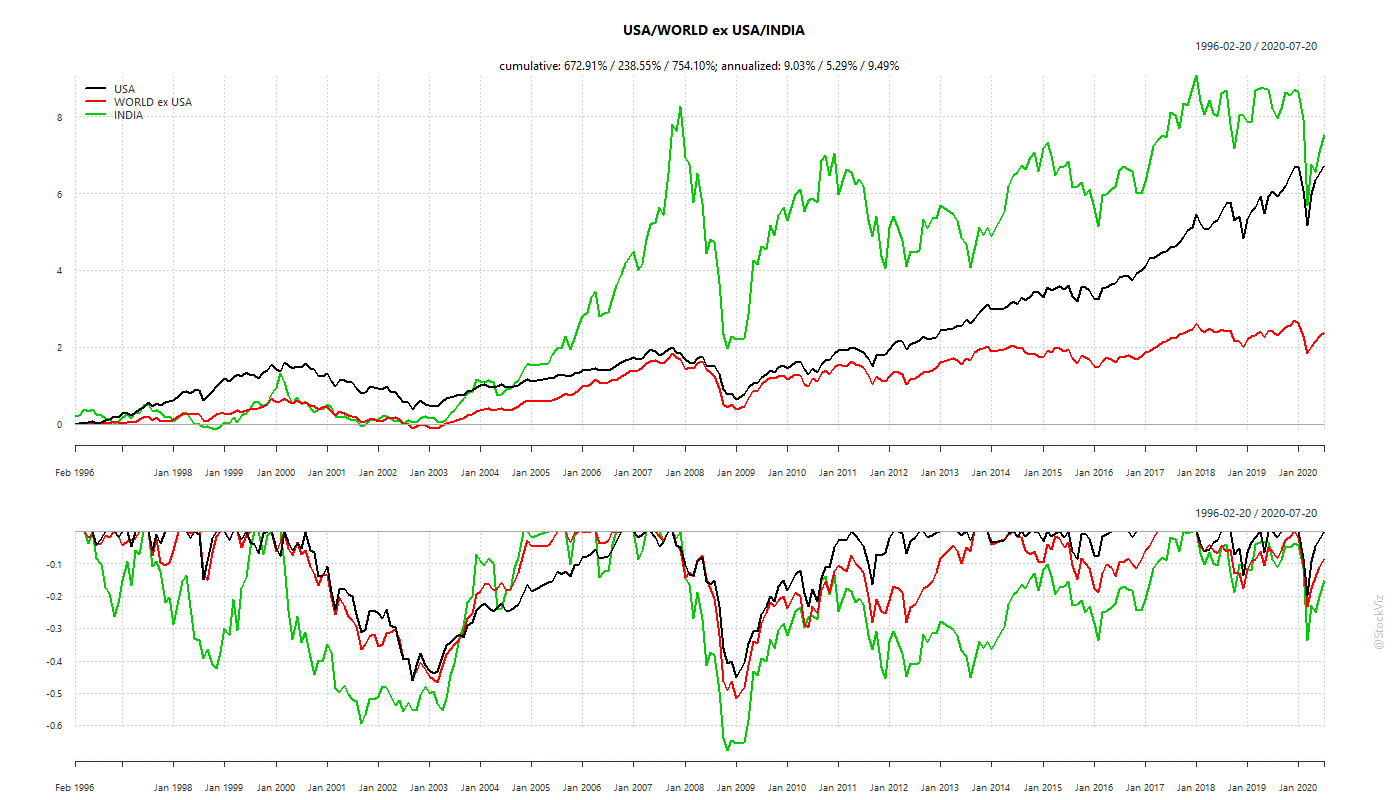

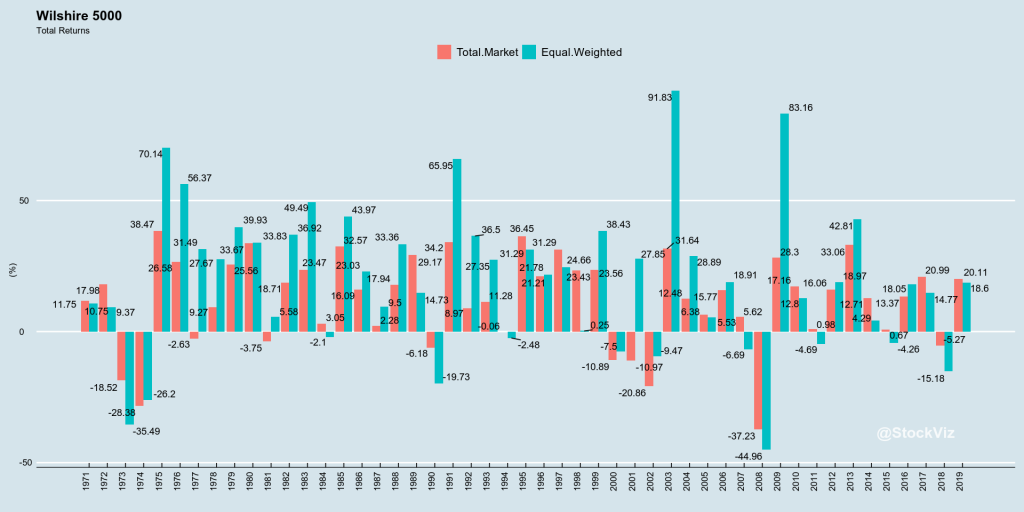

For more than 40 years, investors were happy knowing absolute returns – how much was invested, what it is worth now and how long it took. And they were plodding along just fine for more than 70 years without the Style Box. But now, there are a dozen different ways to measure investment returns across an equal number of investment styles. How did we get here?

The Agency Problem

The Agency Problem or the Principal-Agent Problem occurs when one person (the agent) is allowed to make decisions on behalf of another person (the principal).

Within asset management, compensation structures in large part drive managers’ interests, and if these contracts are not structured correctly, managers may have an incentive to act counter to the fiduciary duty they have to their investors. Furthermore, investors’ tendency to focus on short-term performance may indirectly provide managers with additional incentives that exacerbate this problem. The Principal–Agent Problem in Finance

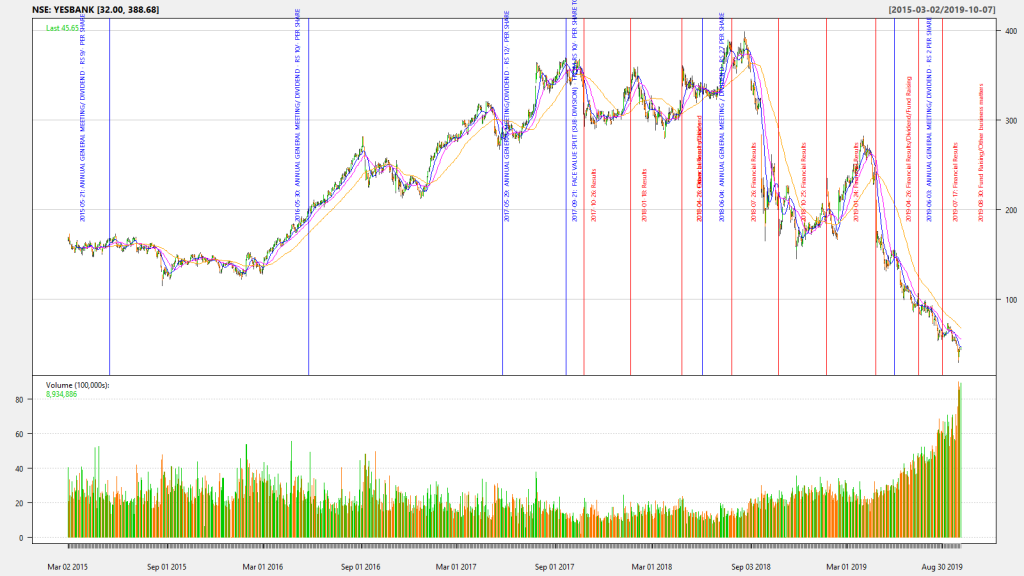

In every bull market, there are a certain class of funds that focus on the meme stocks of that period. These “go-go” funds, focused on growth stocks and other high-risk securities, offer higher risks, but also higher potential returns. Typically, when the bull market eventually comes to an end, investors end up holding the bag while the asset manager would’ve earned enough in fees to retire.

Stakeholder Rights and Obligations

There are quite a few stakeholders in the asset management industry:

The buyer/investor.

The seller/manager.

Independent/Sell-side/Buy-side analysts.

Rating agencies.

The broker/distributor.

The advisor/allocator/consultant.

The regulator.

The tax-payer/government.

As the asset management industry grew, the number of people involved in creating, (re)packaging, advising and selling them grew as well. Often, the interests of each of these stakeholders are in conflict. Increasing popularity of metrics and measurement in the industry is essentially an attempt at keeping these stakeholders honest.

Mandates

A barometer measures pressure. A thermometer measures temperature. Pressure and temperature exist independently of barometers and thermometers. This is true about any physical environment. Social environments are different. Measuring something could very well alter the very thing being measured. This is true about asset management as well.

For example, how should a bond fund manager be incentivized? If it were only to beat an index, then he could just play Russian-roulette with risky high yield bonds – he gets paid for excess returns (every year) when they work and you hold the bag when it blows up (eventually, some time in the future.) So, you put some restrictions on what he can do: only AA or higher with durations less than 3 years; not more than 10% of the fund in the same issuer/promoter, etc.

These restrictions are called mandates.

Mandates drive everything in professional asset management. It sets down a common operating principle and a set of metrics that all stakeholders can agree on.

In fact, the failure of the Indian mutual fund industry to narrow down mandates led to SEBI fixing it themselves. Before SEBI’s edict, it was common for fund houses to have multiple funds in the same category and play the survivorship bias game.

The rational behind Morningstar’s Style Box was the same as well.

Metrics that sit on top of mandates allow stakeholders to rank how individual managers have performed.

Where there is a Match, there is Match-fixing

The problem with mandates is that if you make it too strict, then beating the benchmark becomes nearly impossible and if you make it too lax, then agency problems raise their ugly heads.

US bond fund managers were able to beat their benchmarks mostly by taking additional risks: term risk, corporate credit risk, emerging markets risk, and volatility risk. Traditional discretionary active bond strategies offer little in the way of true alpha. AQR, 2018.

Given that investors care primarily about the most recent three-year performance, the pressure to front-load returns is huge. A case in point is the recent Franklin Templeton debt funds fiasco.

Despite the regulations being clear, some mutual fund schemes seem to have chosen to have high concentrations of high risk, unlisted, opaque, bespoke, structured debt securities with low credit ratings and seem to have chosen not to rebalance their portfolios even during the almost 12 months available to them so far. SEBI’s statement on Franklin Templeton dated May 7, 2020

Metrics are notoriously unstable

Finance doesn’t have immutable laws of nature. The “physics envy” that finance academics have is obvious in the body of research they have produced – precise equations modeling a complex-dynamic-adaptive system. But the desire to tame the beast that is the asset-management industry has lead to too many rigid frameworks and restrictions placed on all the stakeholders.

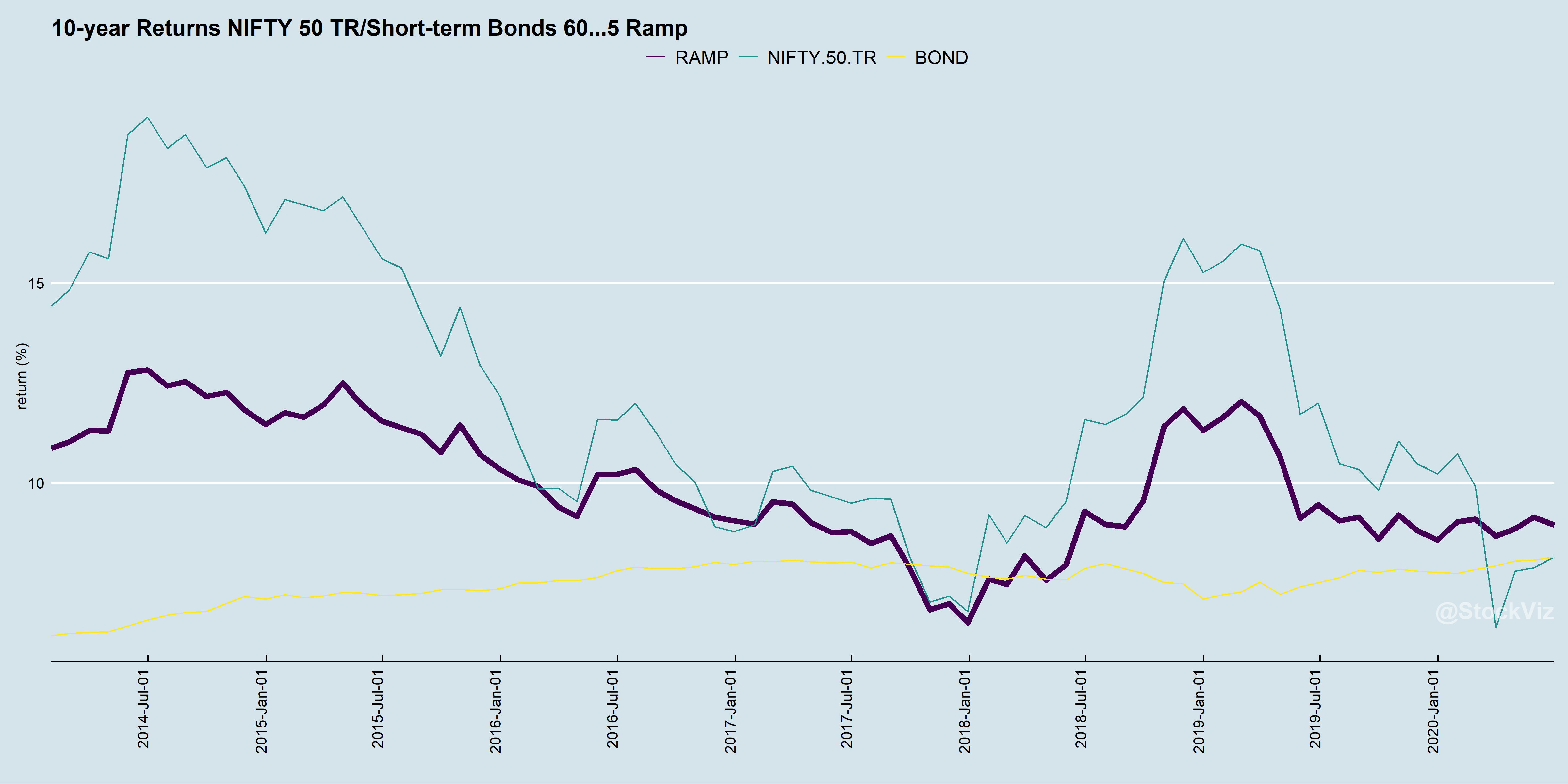

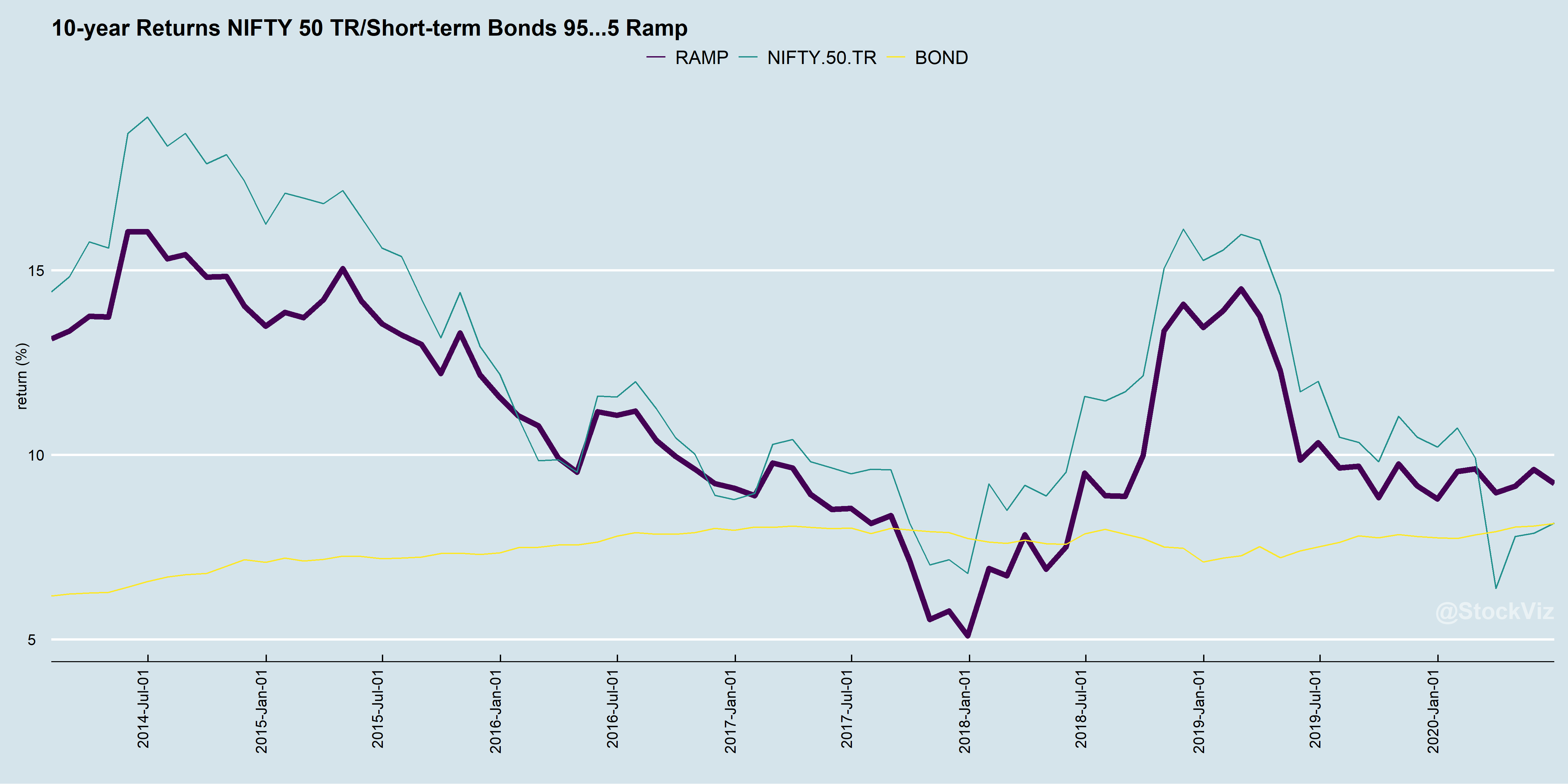

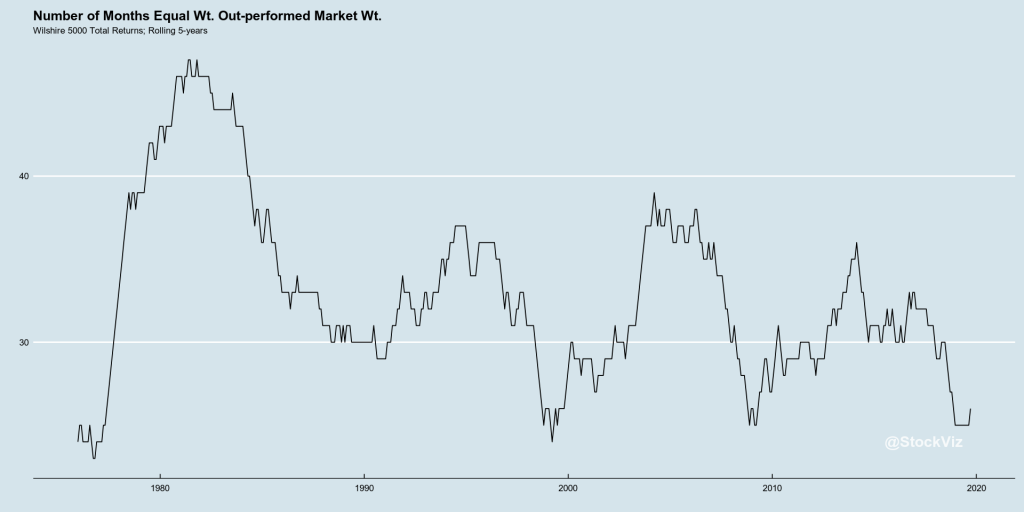

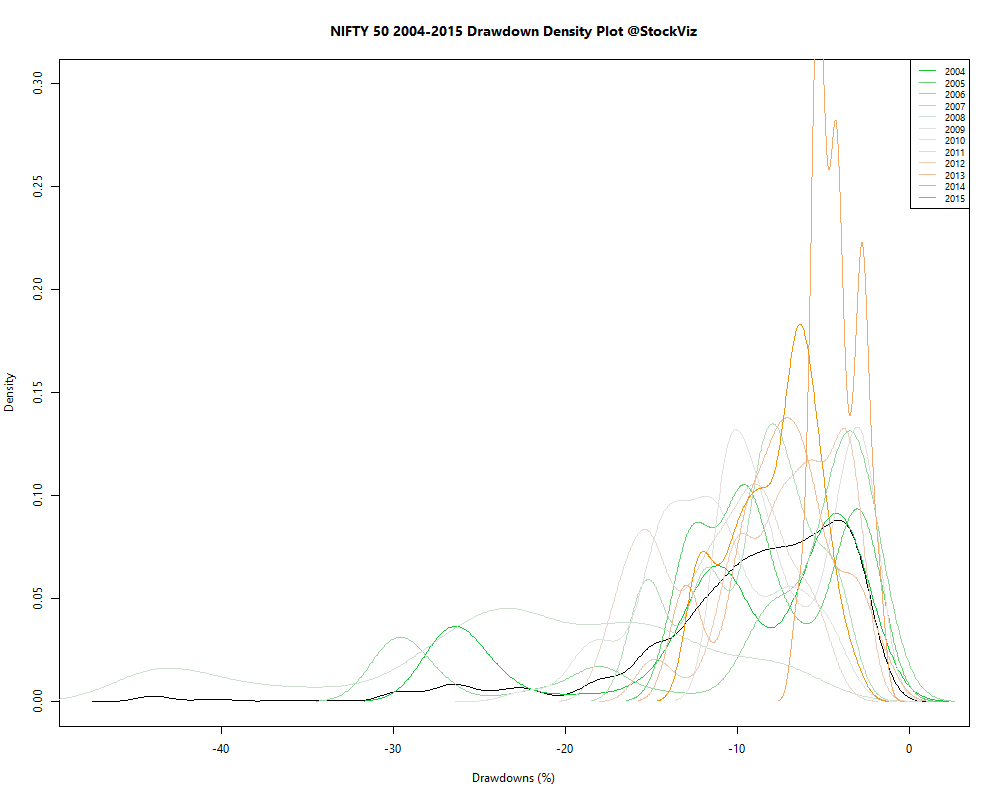

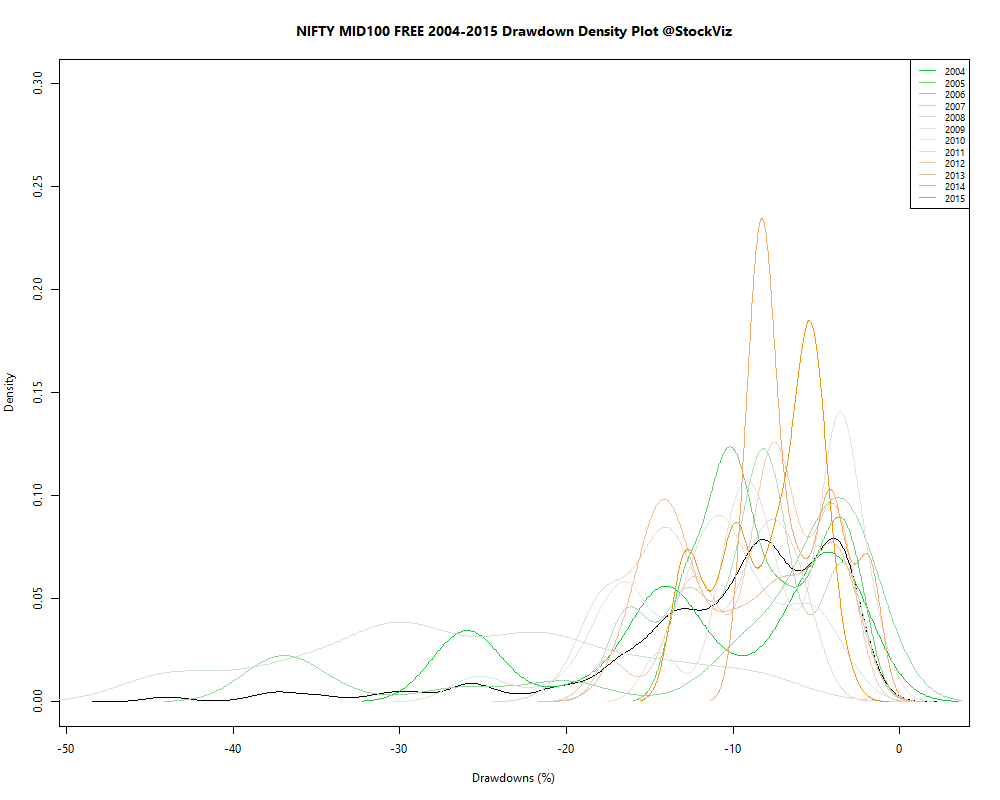

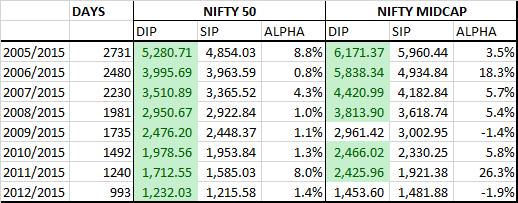

There is absolutely zero stability in metrics used to analyze mutual fund performance. Whether it is alpha, beta or information ratio, they all vary over time and across market environments. Using them to pick the next “winning” fund is pointless. They are, at best, a measure of what happened in the past. – A quick note on performance metrics

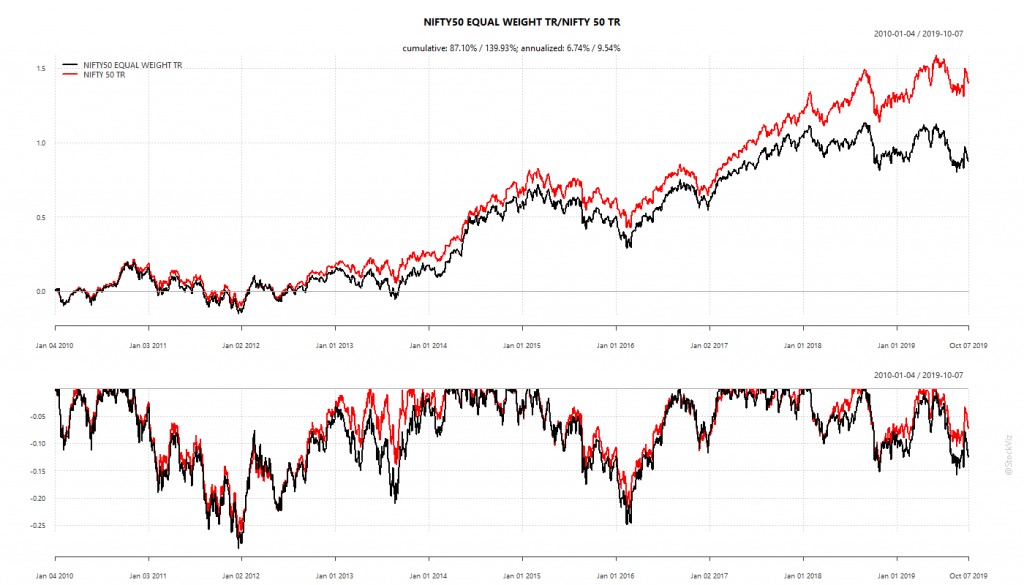

So you have tighter mandates and unstable metrics. But the bigger question is: as an investor, do you want relative performance or absolute returns?

Free your mind

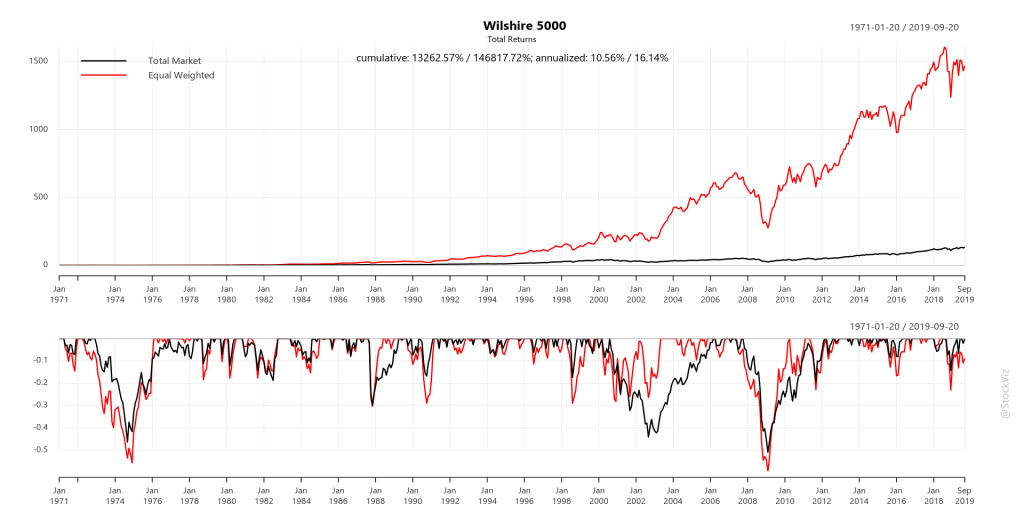

The problem with bucketing yourself as a “value investor,” “contrarian,” “growth,” or “momentum guy” is that you lose the biggest advantage that you have: flexibility and the ability to adapt to the market.

Fund managers, at the end of the day, are only human. They too suffer from confirmation bias. And to make matters worse, once they reach a certain level of fame, all their holdings are closely tracked and their decisions questioned. Once publicly committed to a position, they find it very difficult to backtrack and admit mistakes. You, as an individual investor, have no such pressure.

To top it all, the fund management business is geared towards the accumulation of assets. They are paid a % of assets under management (AUM,) after all. However, size is the enemy of outperformance. With break-evens running at Rs. 100 crore per fund, the “no-go” zones for managers are pretty large. You, as an individual investor, have no such constraints.

There is an oft repeated cliché that you should invest within your “circle of competence.” Most people use this as an excuse to keep fishing in the same pond till the water is dry and the fish are dead. Instead, you should think of it as a call to action. If you are not constantly learning and increasing your circle of competence, then what exactly are you doing with your life?