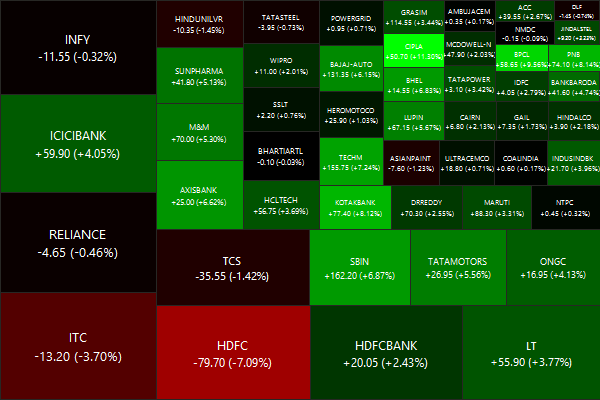

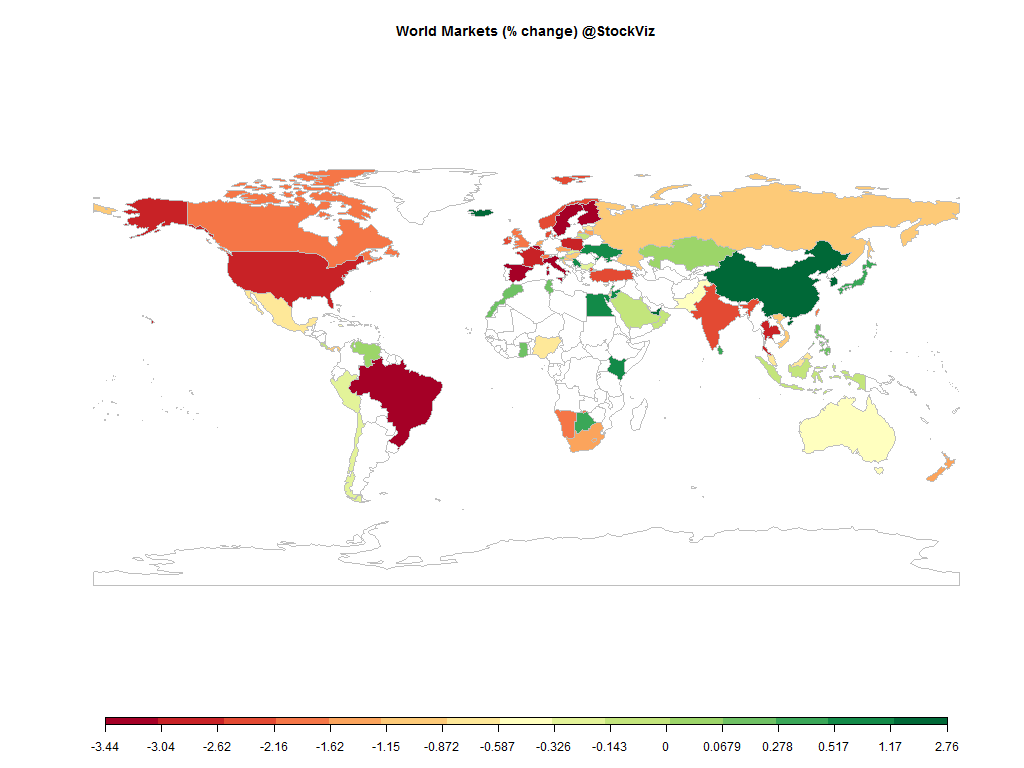

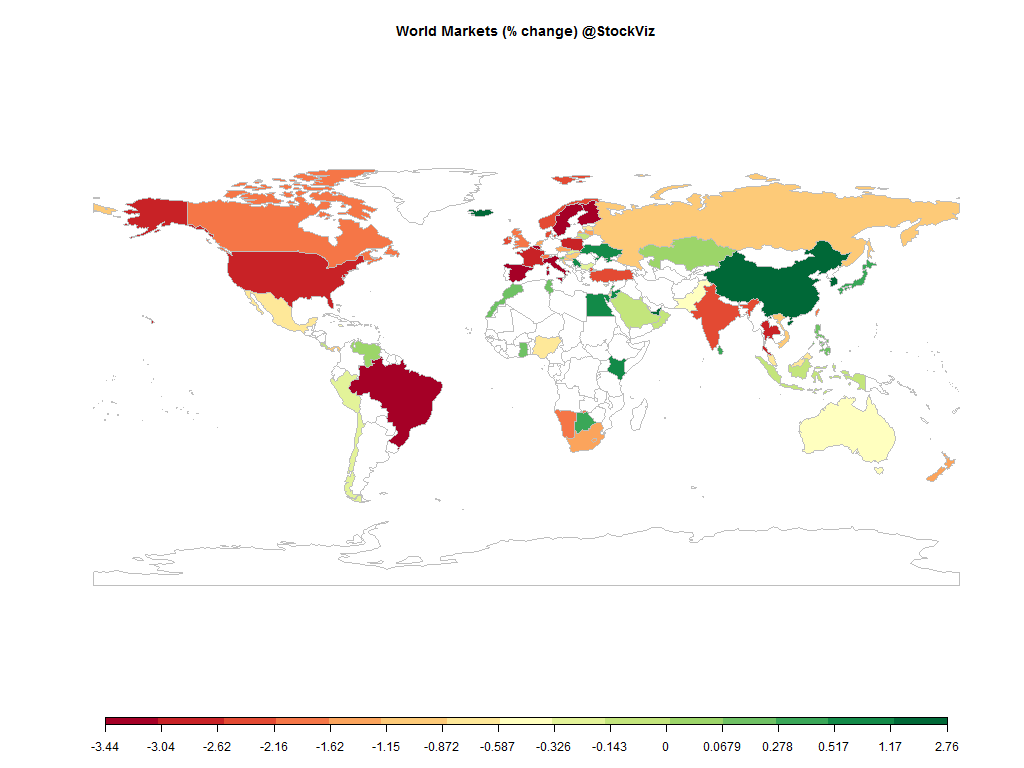

The Nifty ended the week -2.14% (-3.54% in USD terms.)

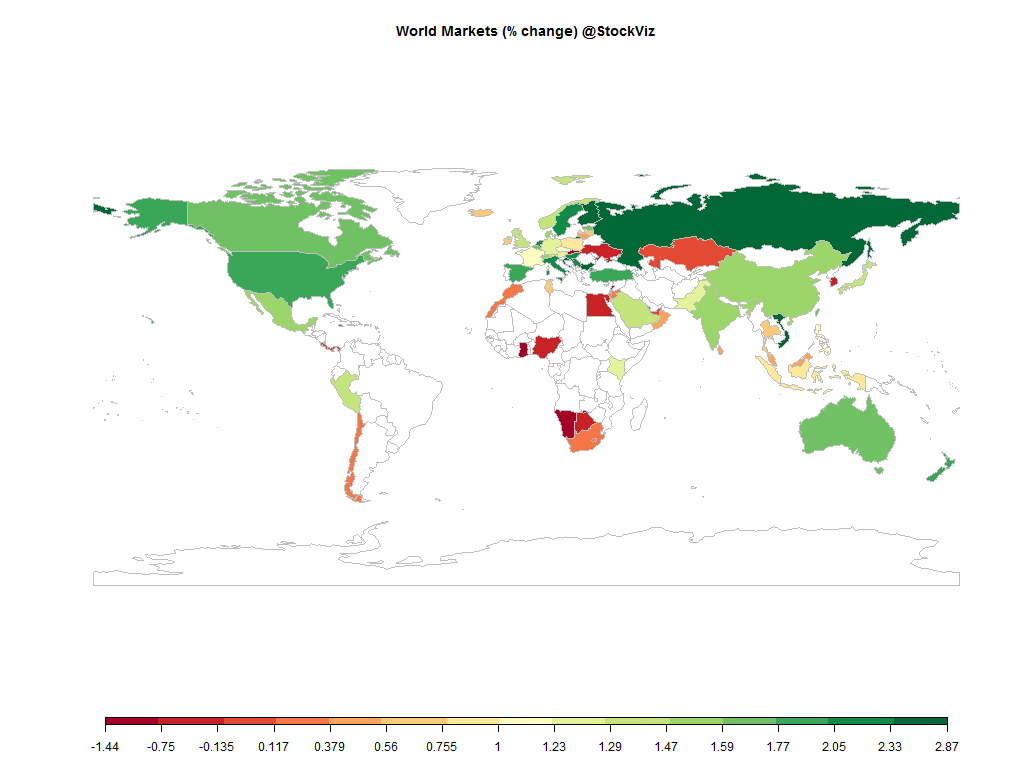

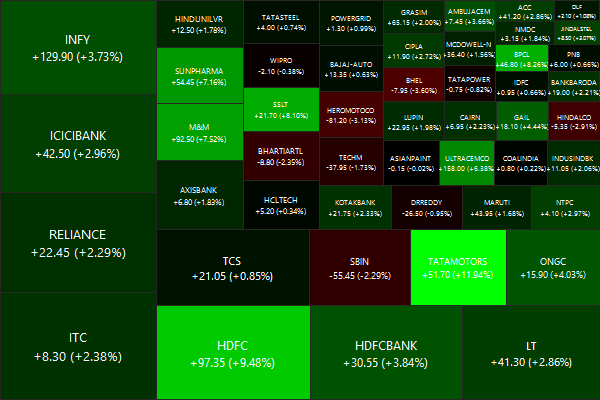

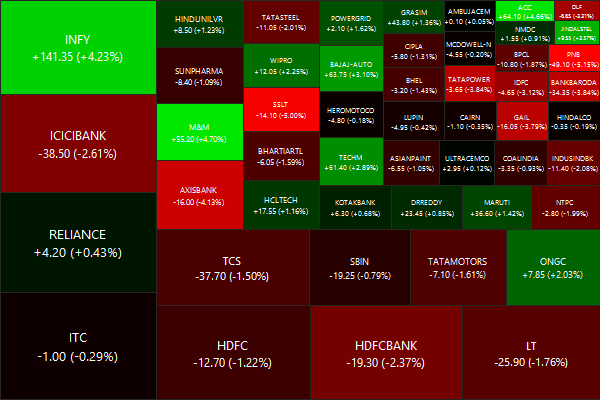

Equities

Commodities

| Energy |

| Brent Crude Oil |

-2.84% |

| Ethanol |

-2.66% |

| Heating Oil |

-1.56% |

| Natural Gas |

+0.37% |

| RBOB Gasoline |

-4.16% |

| WTI Crude Oil |

-3.86% |

| Metals |

| Copper |

-0.62% |

| Gold 100oz |

-0.13% |

| Palladium |

-1.51% |

| Platinum |

-0.85% |

| Silver 5000oz |

-1.46% |

| Agricultural |

| Cattle |

-0.95% |

| Cocoa |

+1.51% |

| Coffee (Arabica) |

+6.81% |

| Coffee (Robusta) |

+3.20% |

| Corn |

-3.23% |

| Cotton |

-3.52% |

| Feeder Cattle |

+1.02% |

| Lean Hogs |

-4.68% |

| Lumber |

-0.40% |

| Orange Juice |

-5.47% |

| Soybean Meal |

-2.24% |

| Soybeans |

+0.21% |

| Sugar #11 |

-4.90% |

| Wheat |

-0.65% |

| White Sugar |

-2.59% |

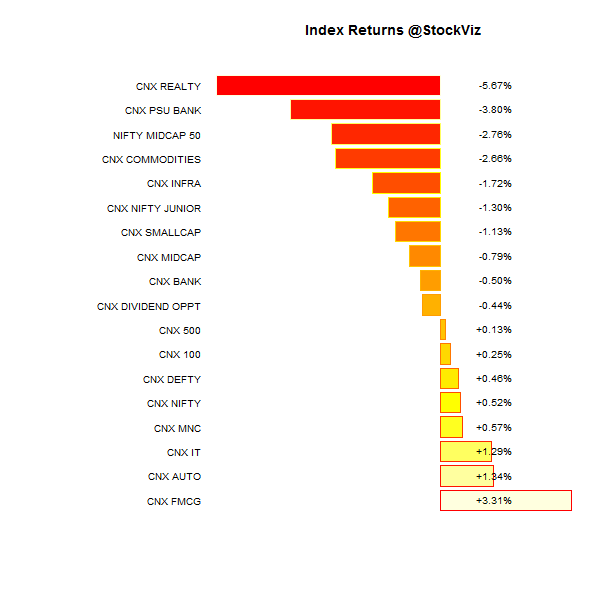

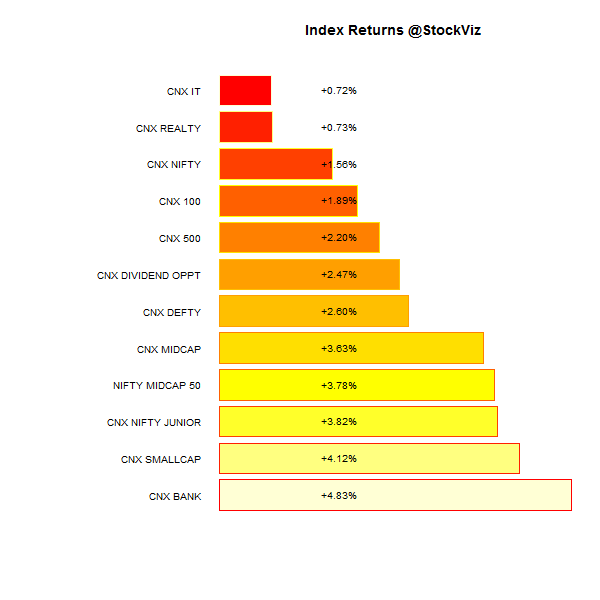

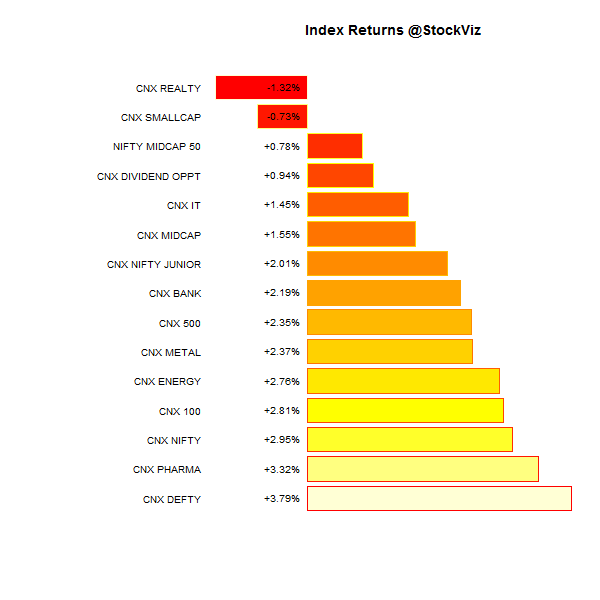

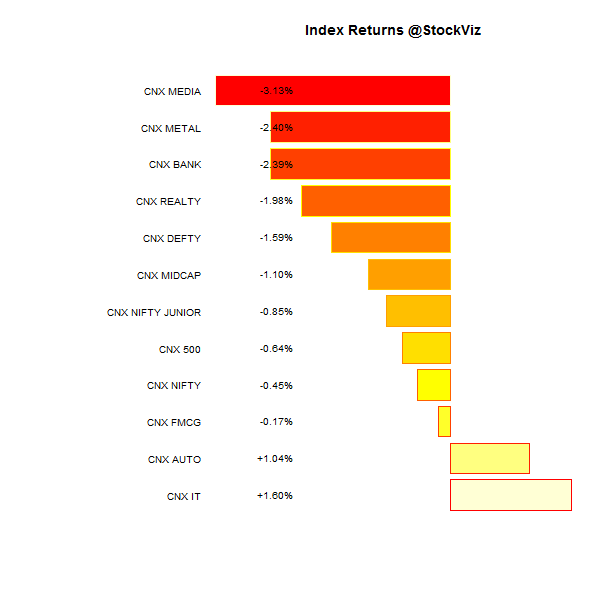

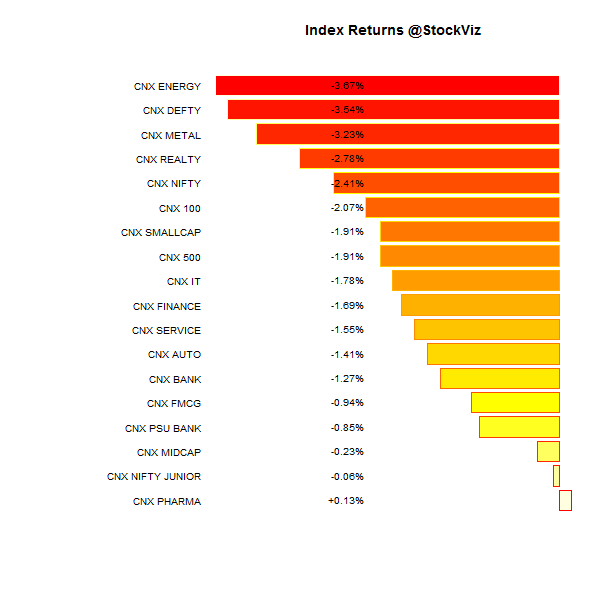

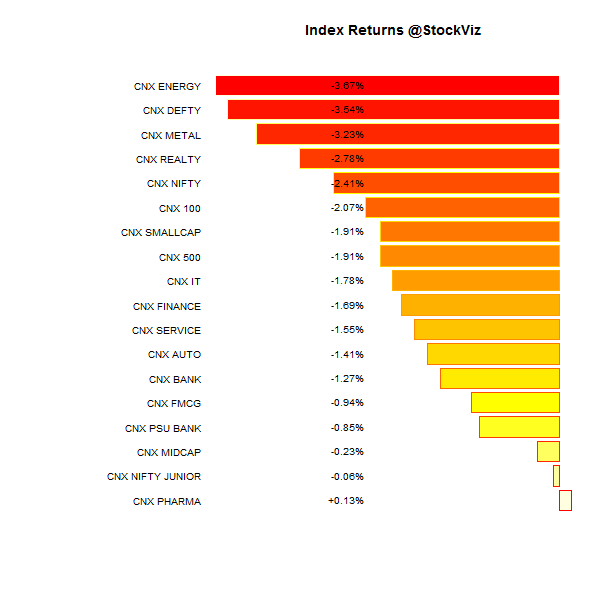

Index Returns

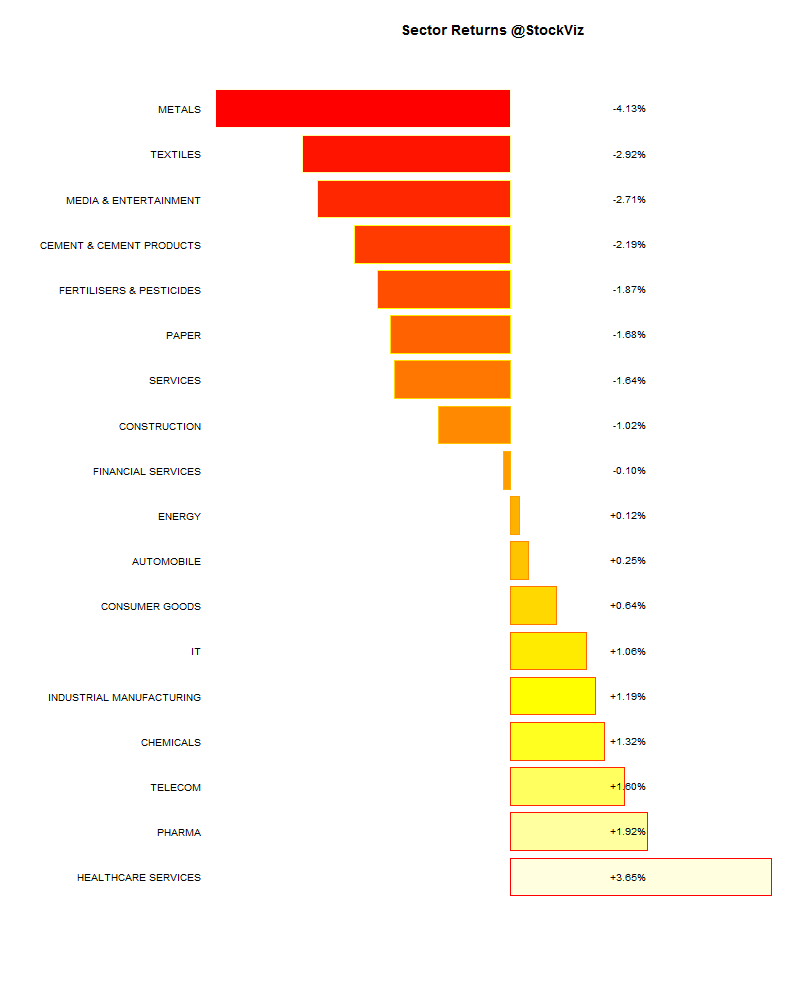

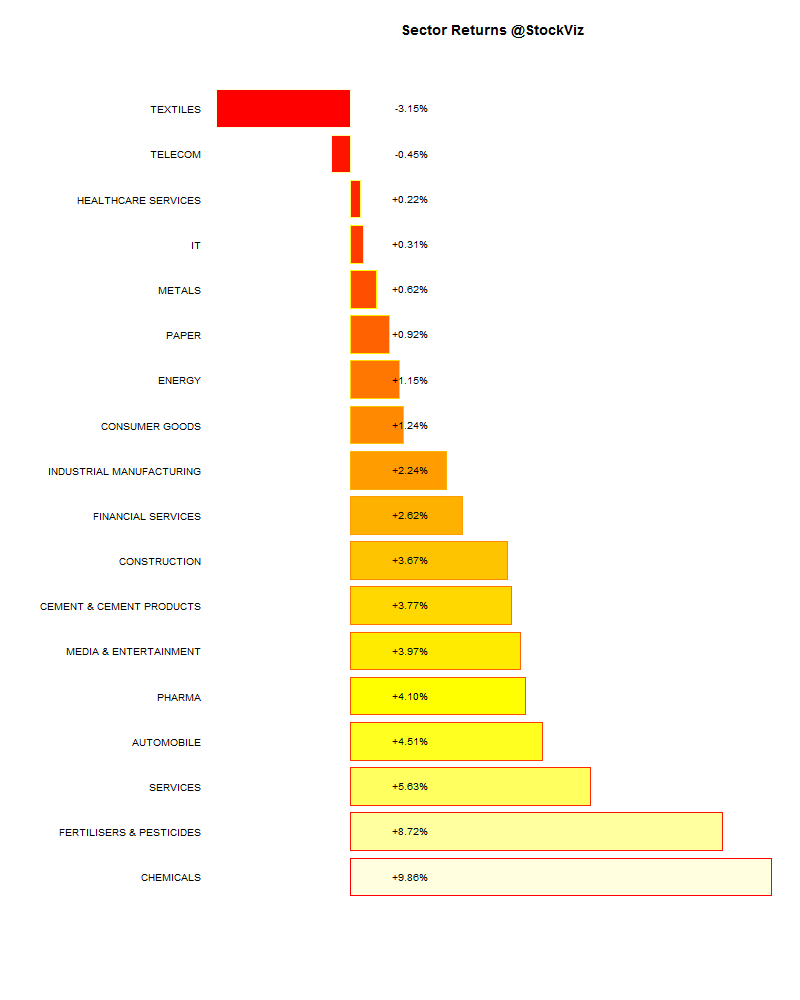

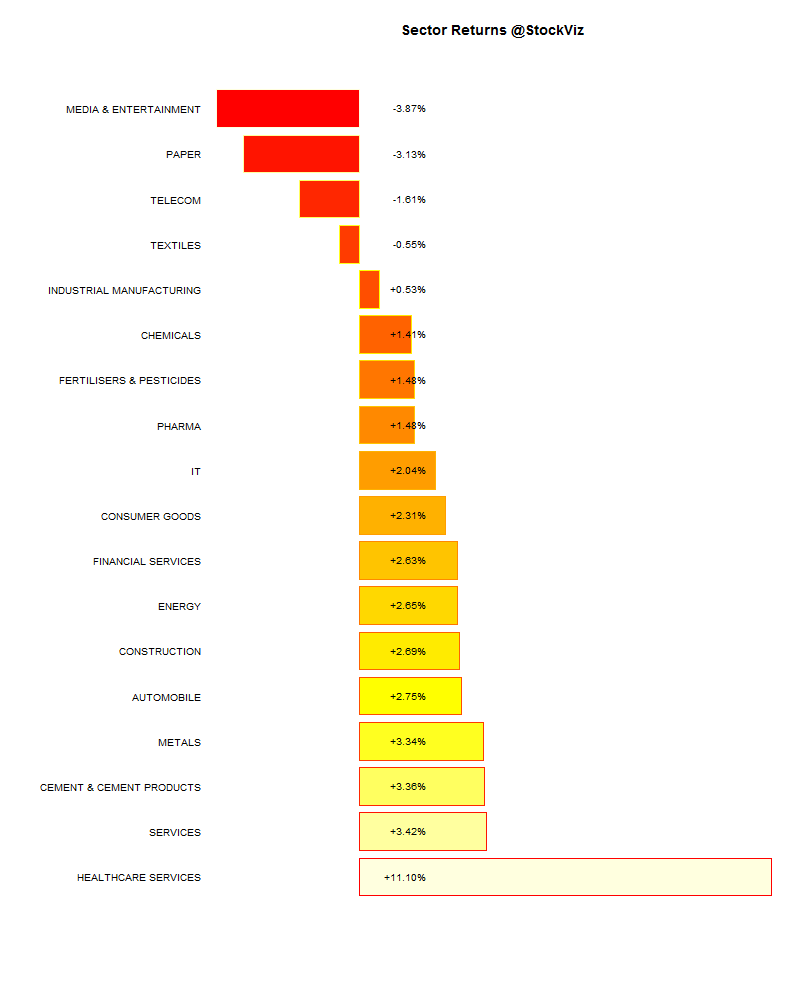

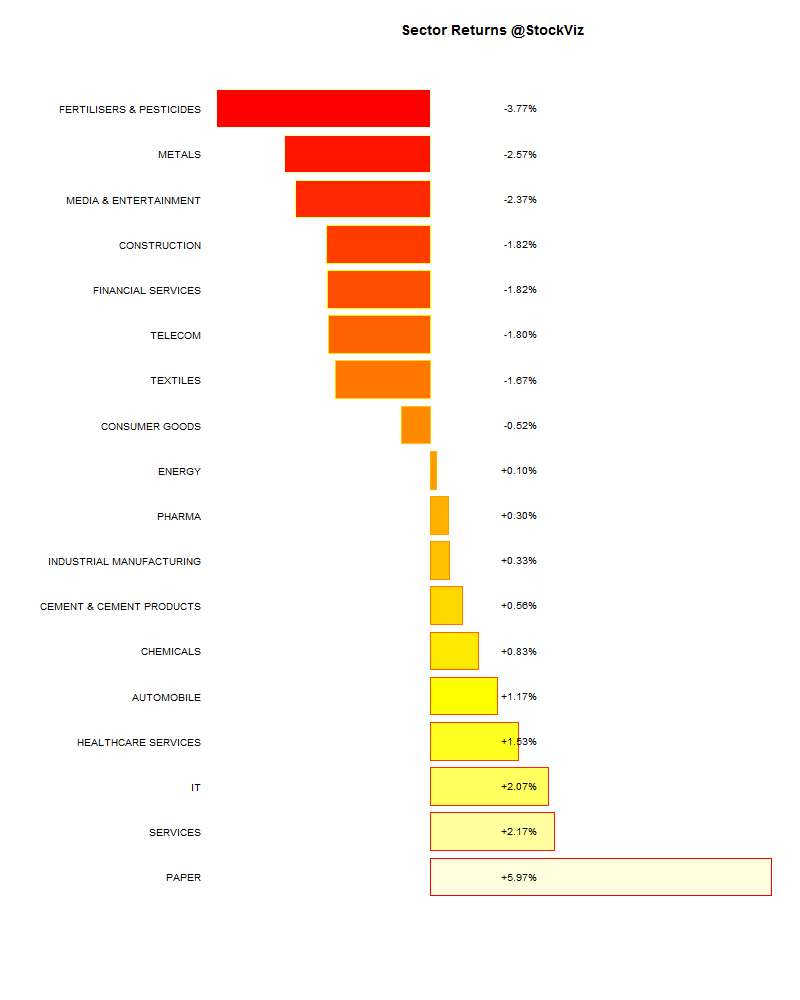

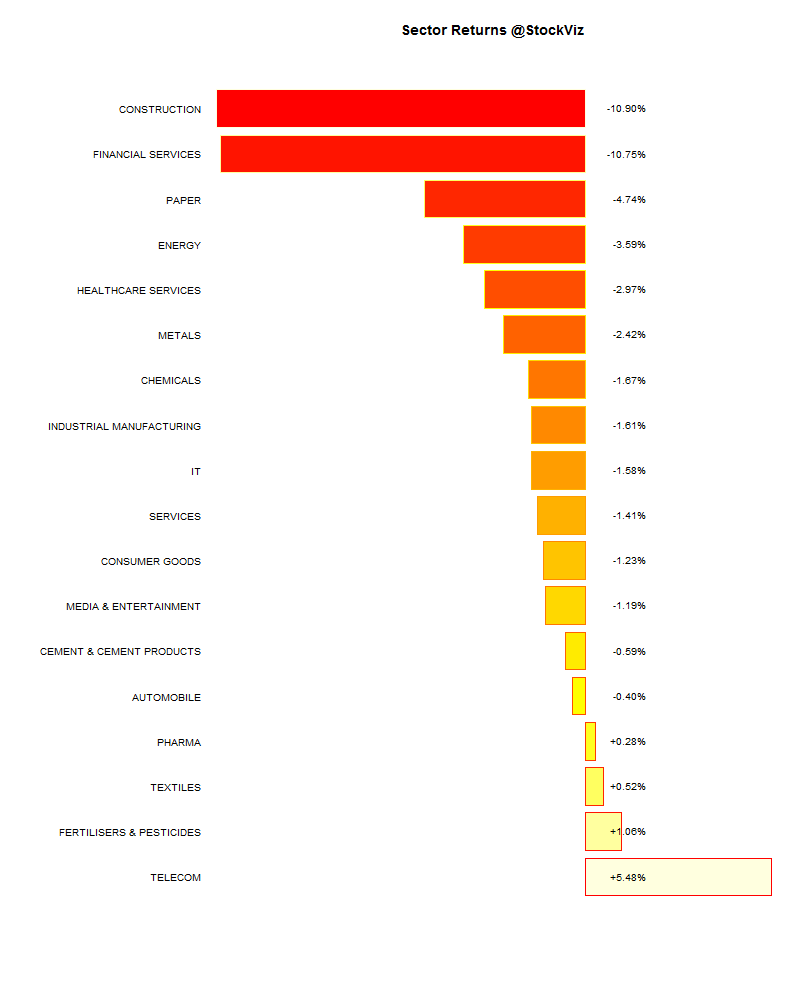

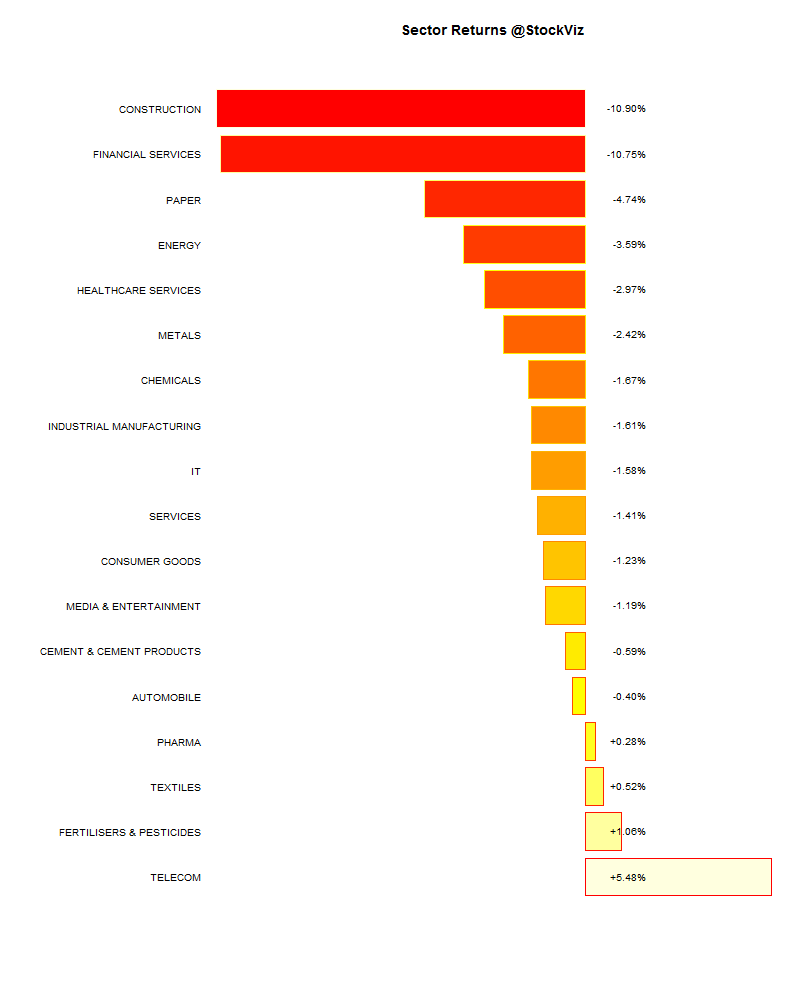

Sector Performance

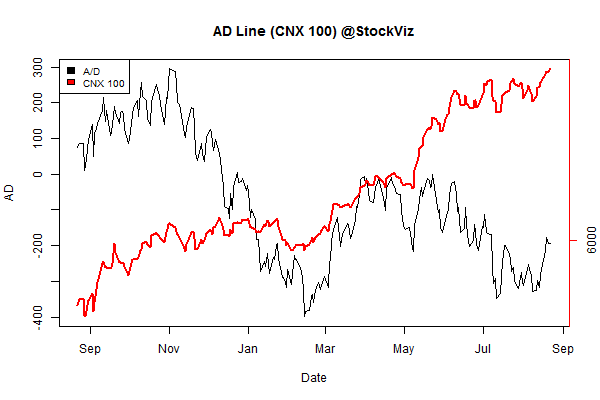

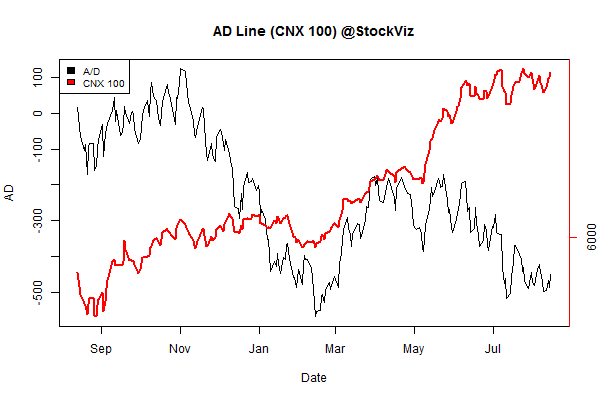

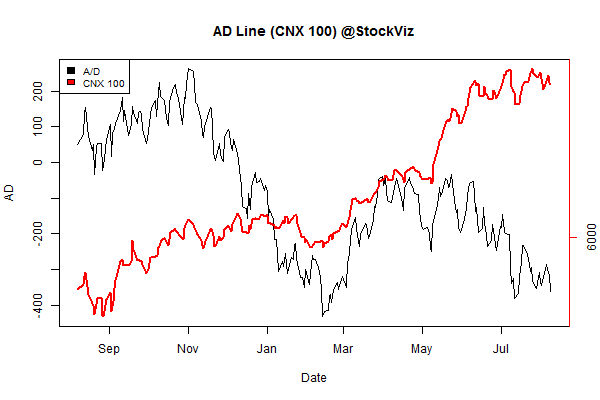

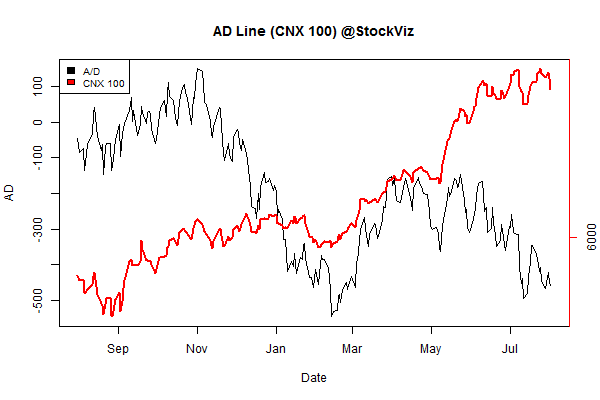

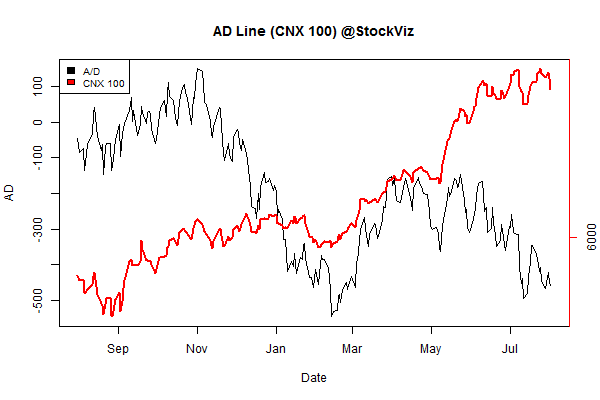

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Advance/Decline |

| 1 (micro-cap) |

-9.60% |

68/68 |

| 2 |

-3.10% |

65/70 |

| 3 |

-1.94% |

64/72 |

| 4 |

-2.75% |

67/68 |

| 5 |

-1.07% |

65/71 |

| 6 |

-0.65% |

64/71 |

| 7 |

-1.76% |

58/78 |

| 8 |

-2.03% |

65/70 |

| 9 |

-1.99% |

66/70 |

| 10 (mega-cap) |

-1.93% |

69/67 |

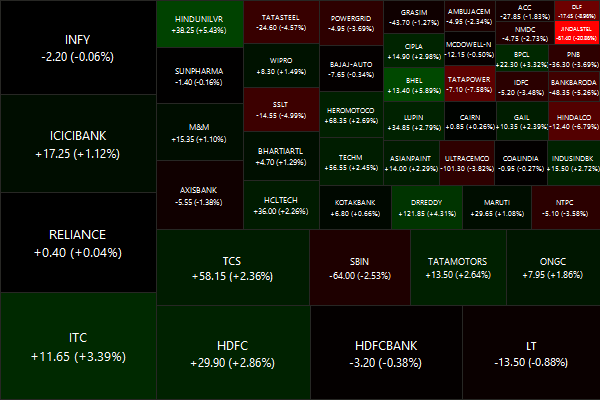

A winner for every loser…

Top winners and losers

Apparently people expected a lot from L&T’s first quarter but were left wondering about “acche dins”

ETFs

No love for infrastructure, banks barely held on…

Investment Theme Performance

It was a brutal week for any strategy that wasn’t short…

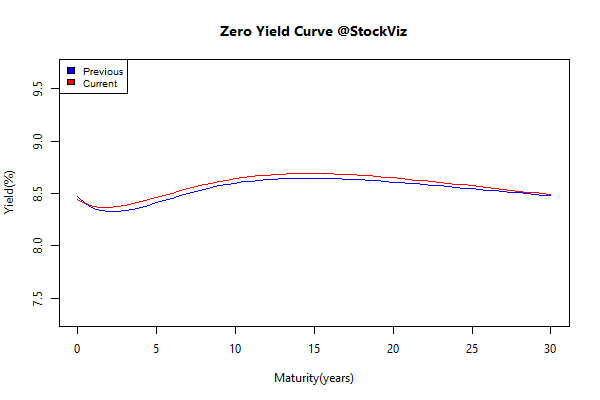

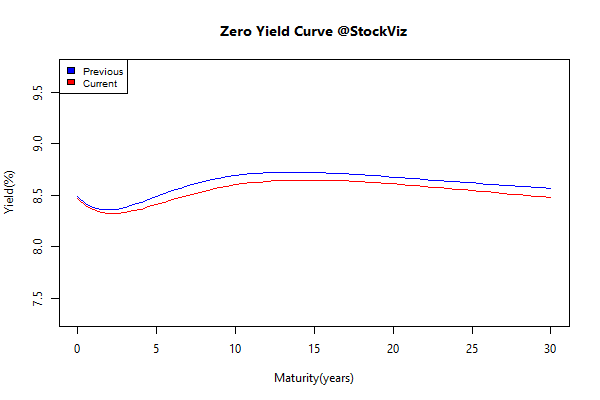

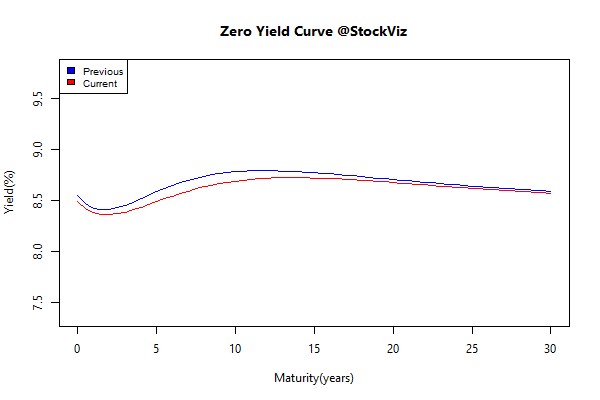

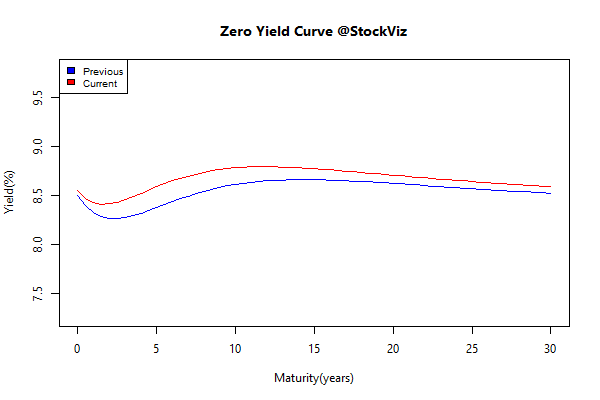

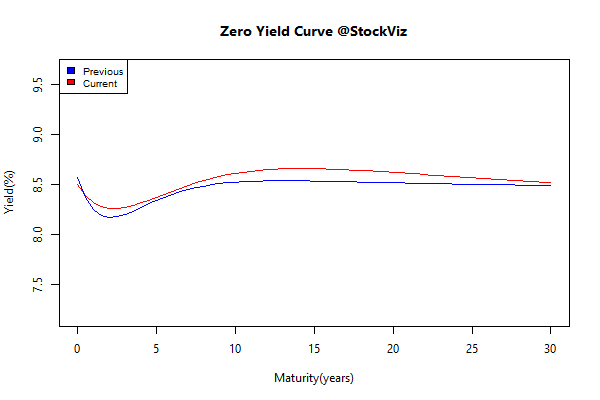

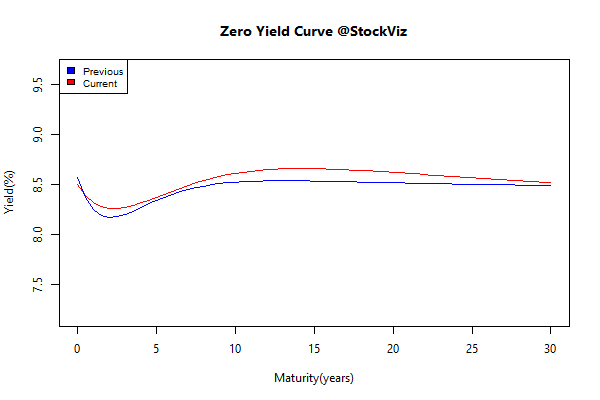

Yield Curve

Total return bond indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

-0.04 |

+0.17% |

| GSEC SUB 1-3 |

+0.13 |

+0.04% |

| GSEC SUB 3-8 |

+0.19 |

-0.53% |

| GSEC SUB 8 |

+0.23 |

-1.46% |

Long bonds fell…

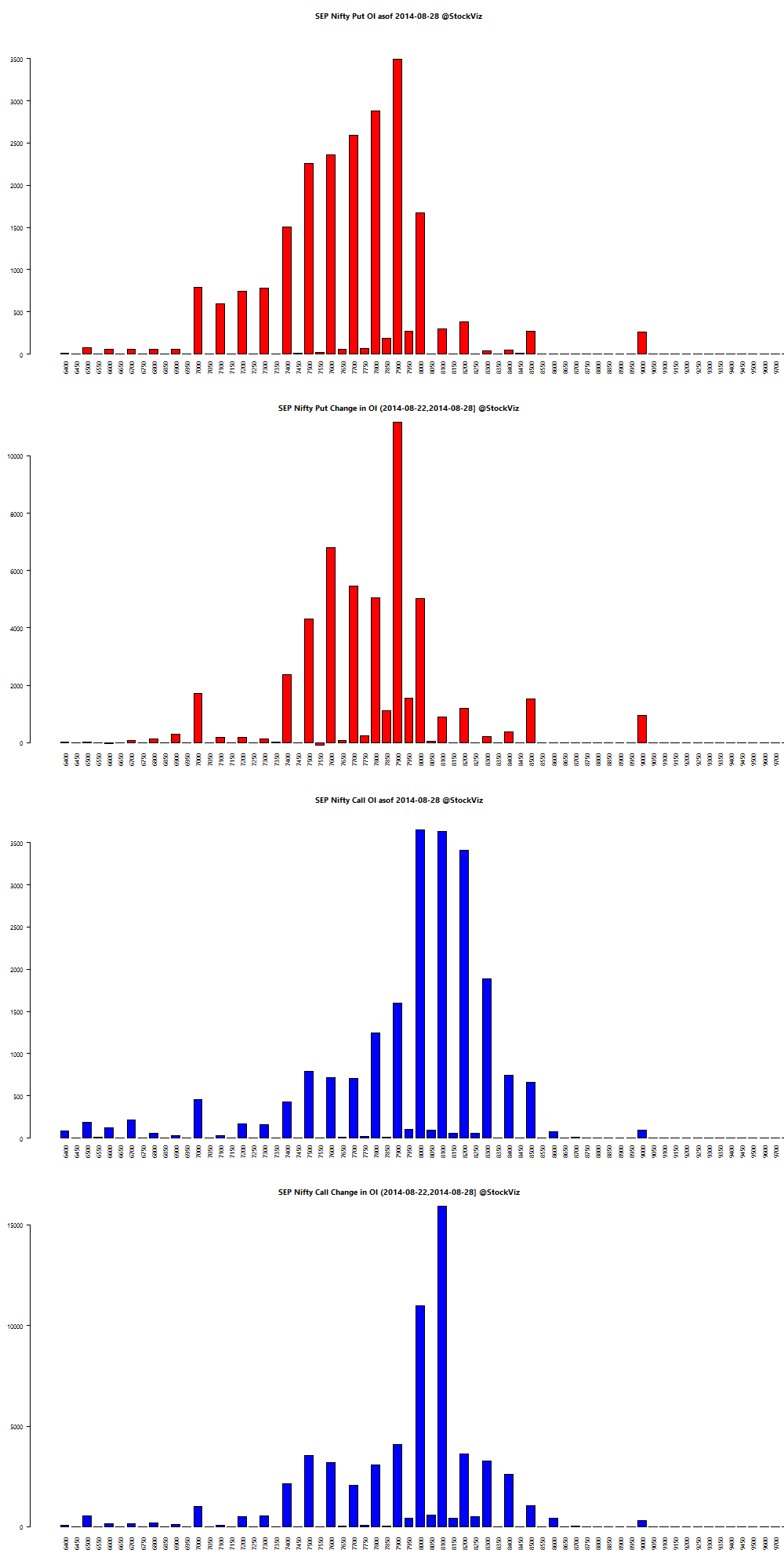

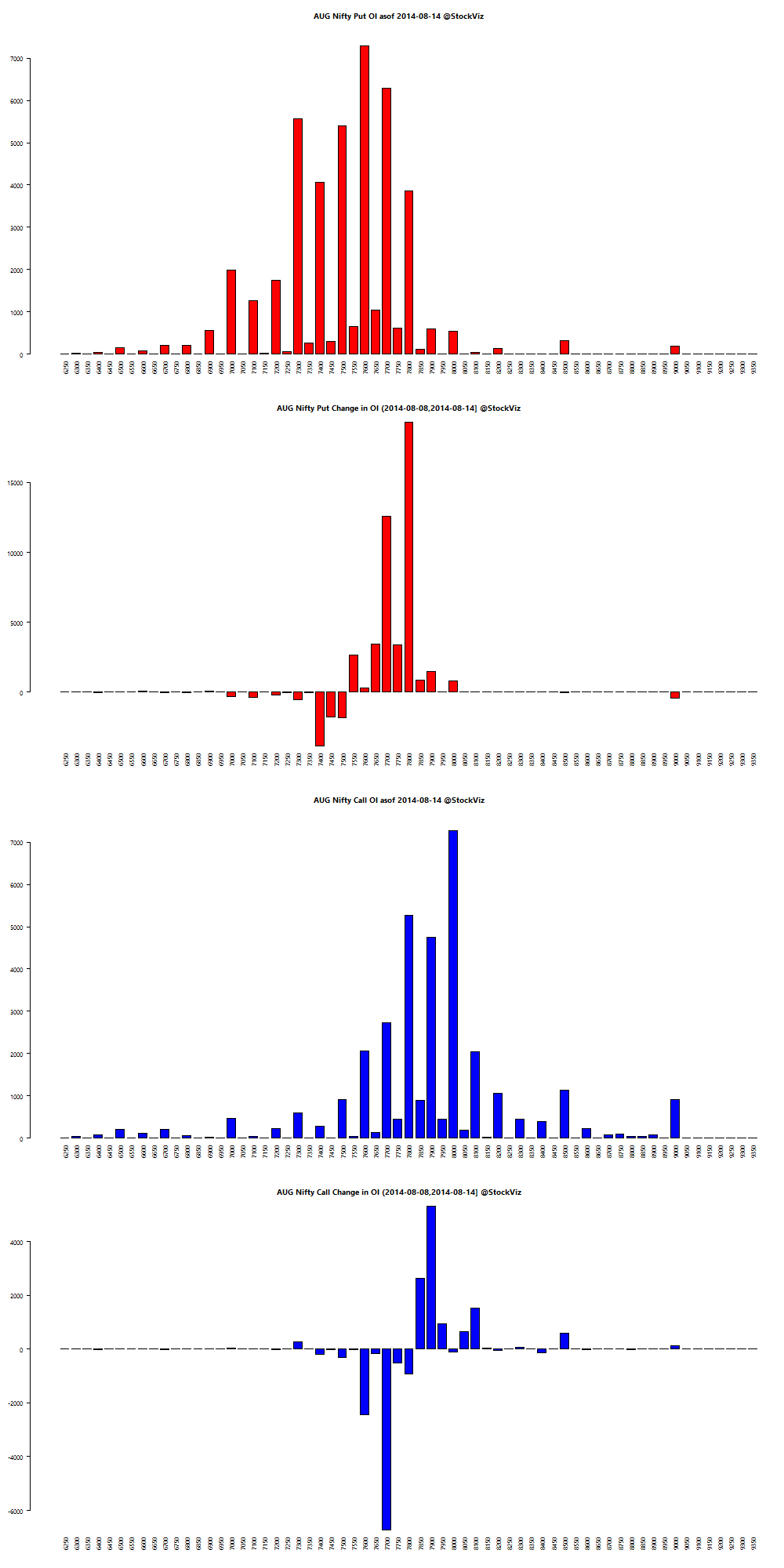

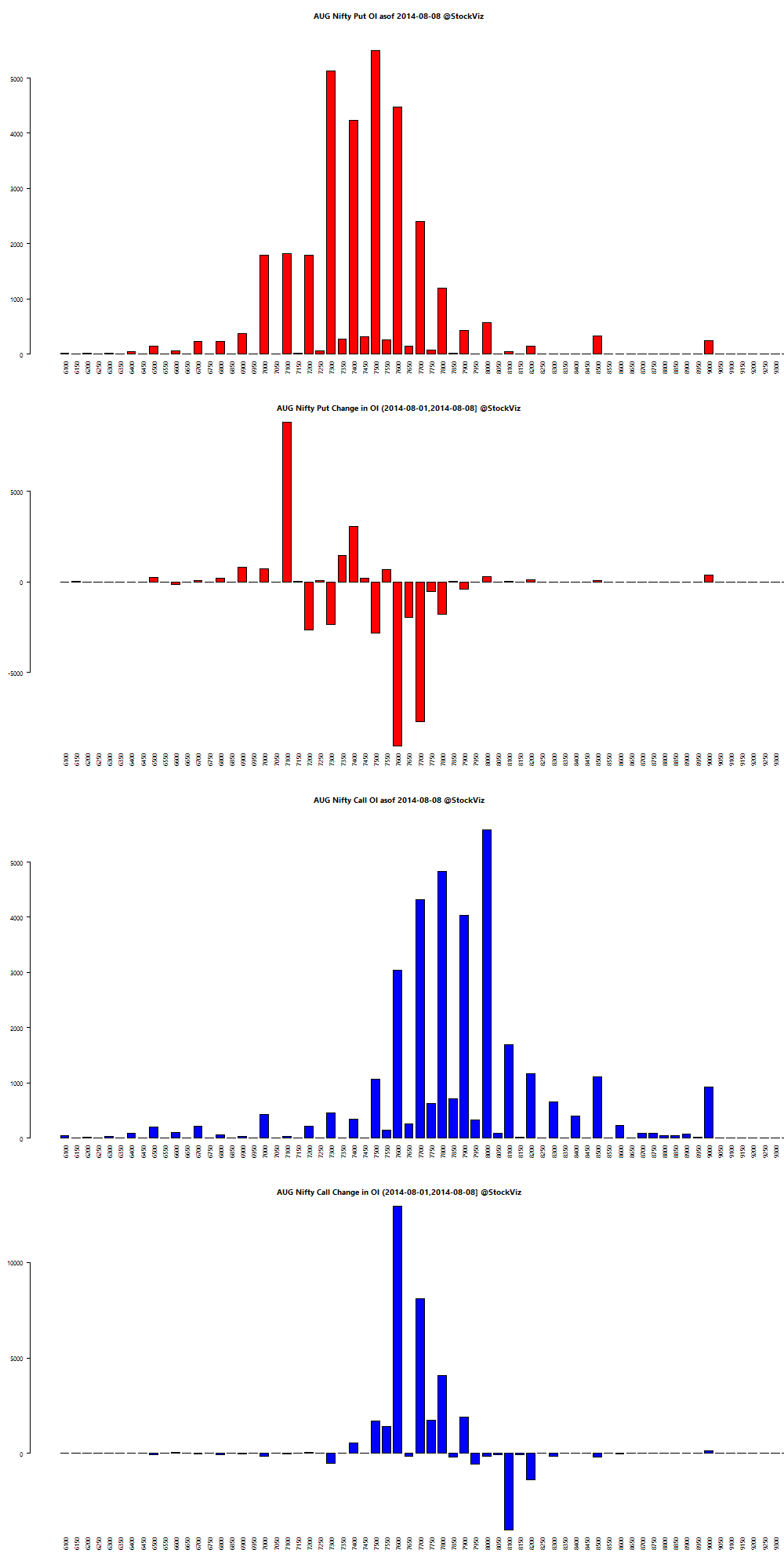

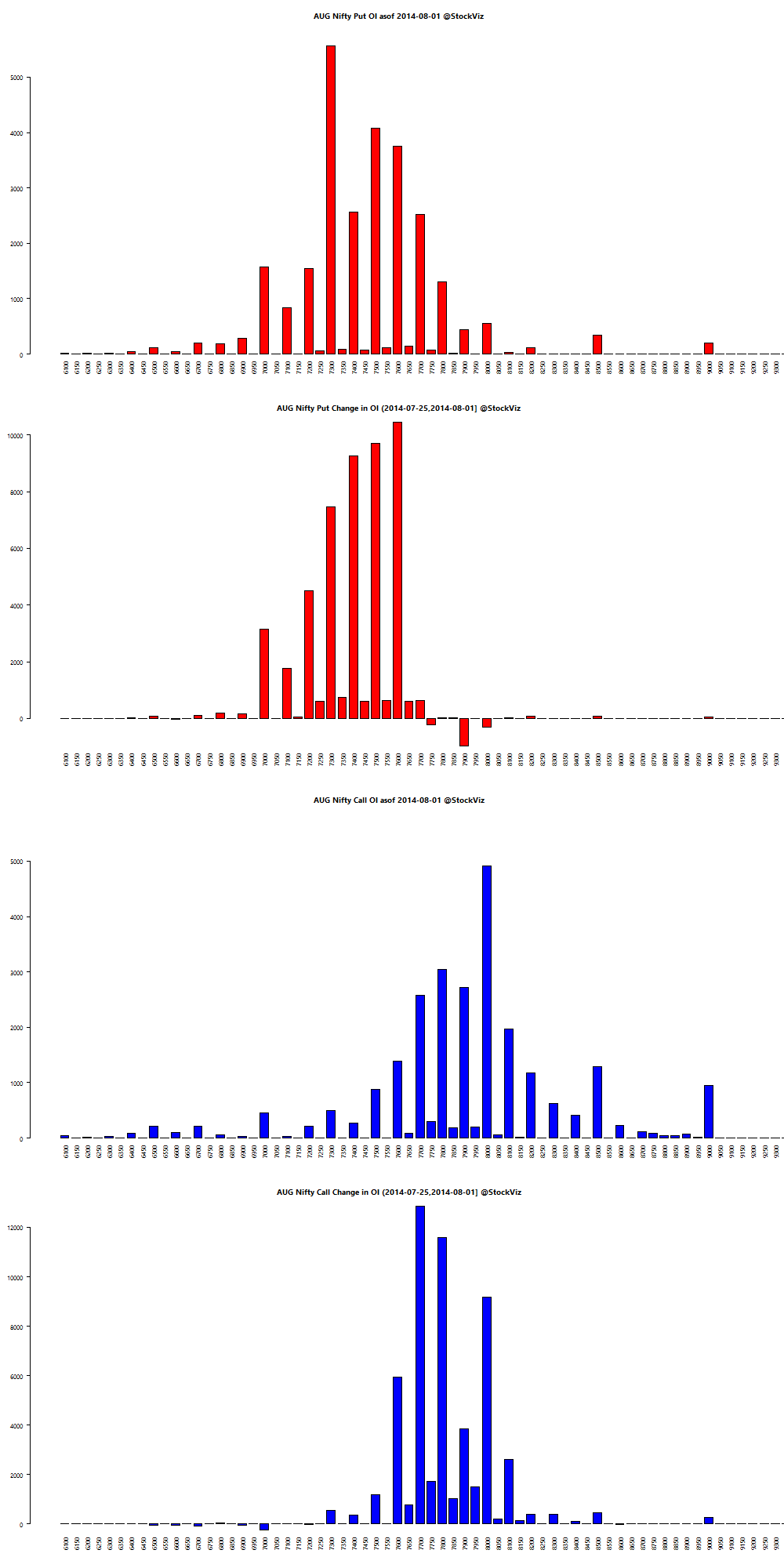

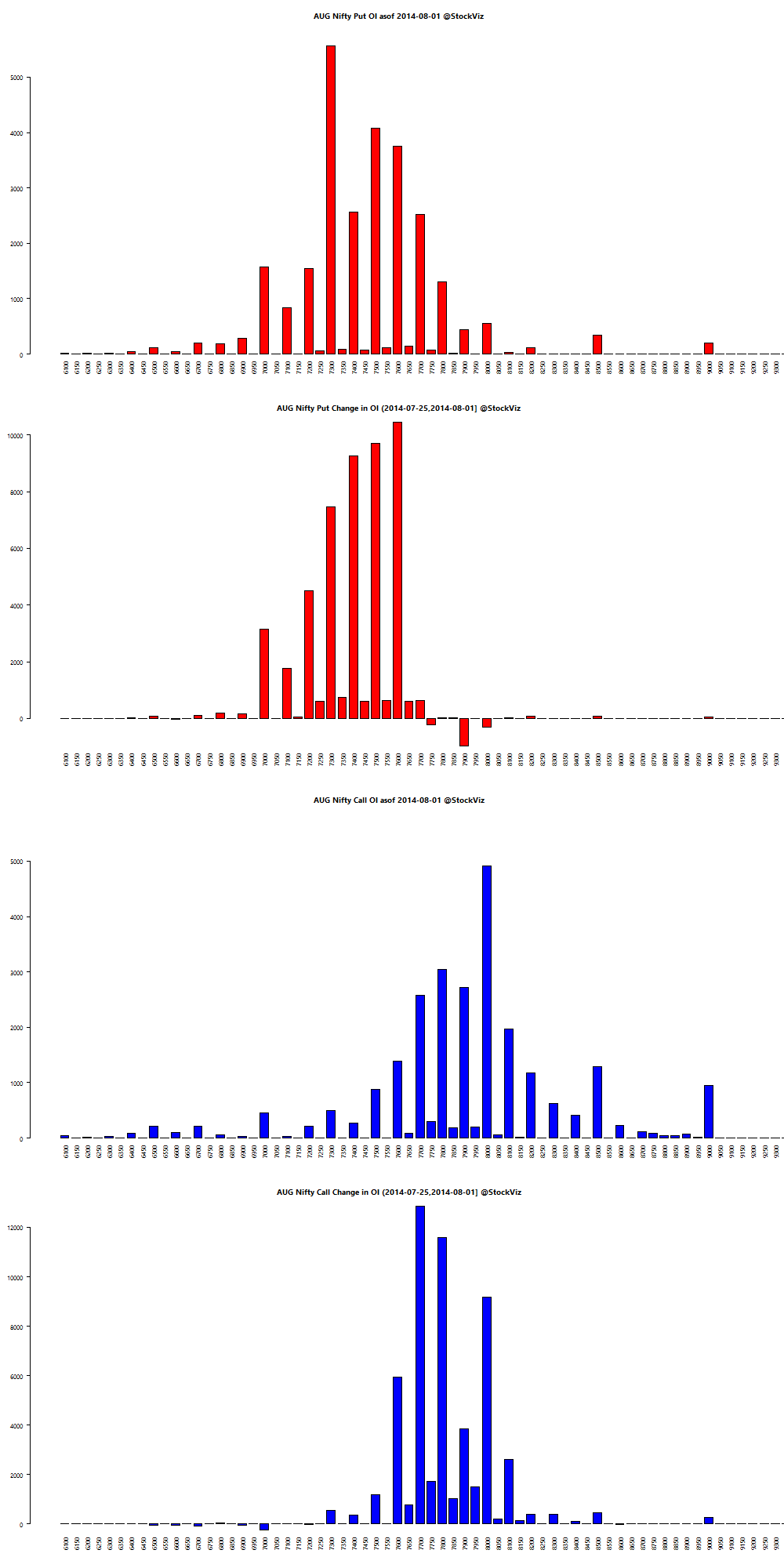

August Nifty OI

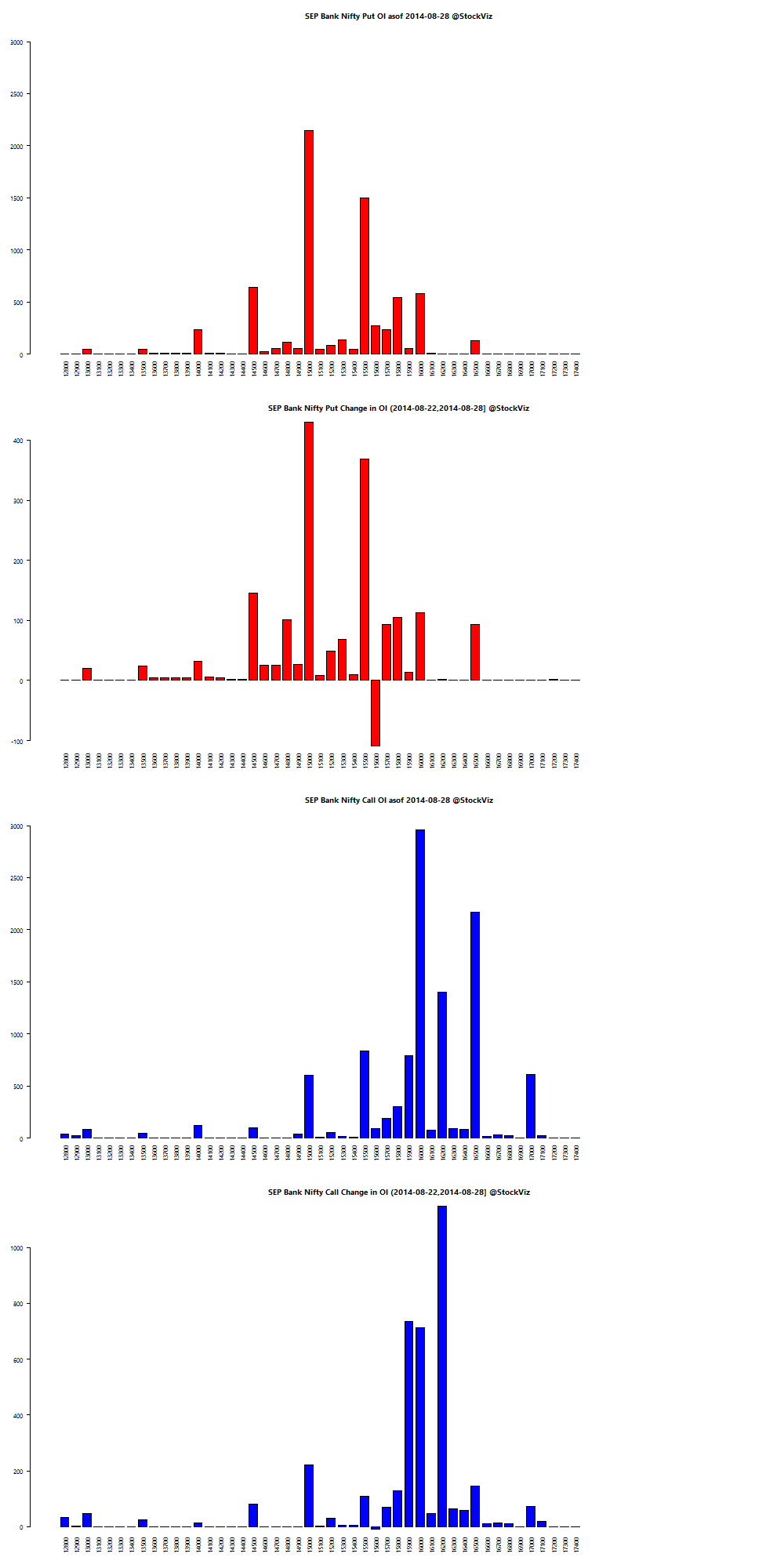

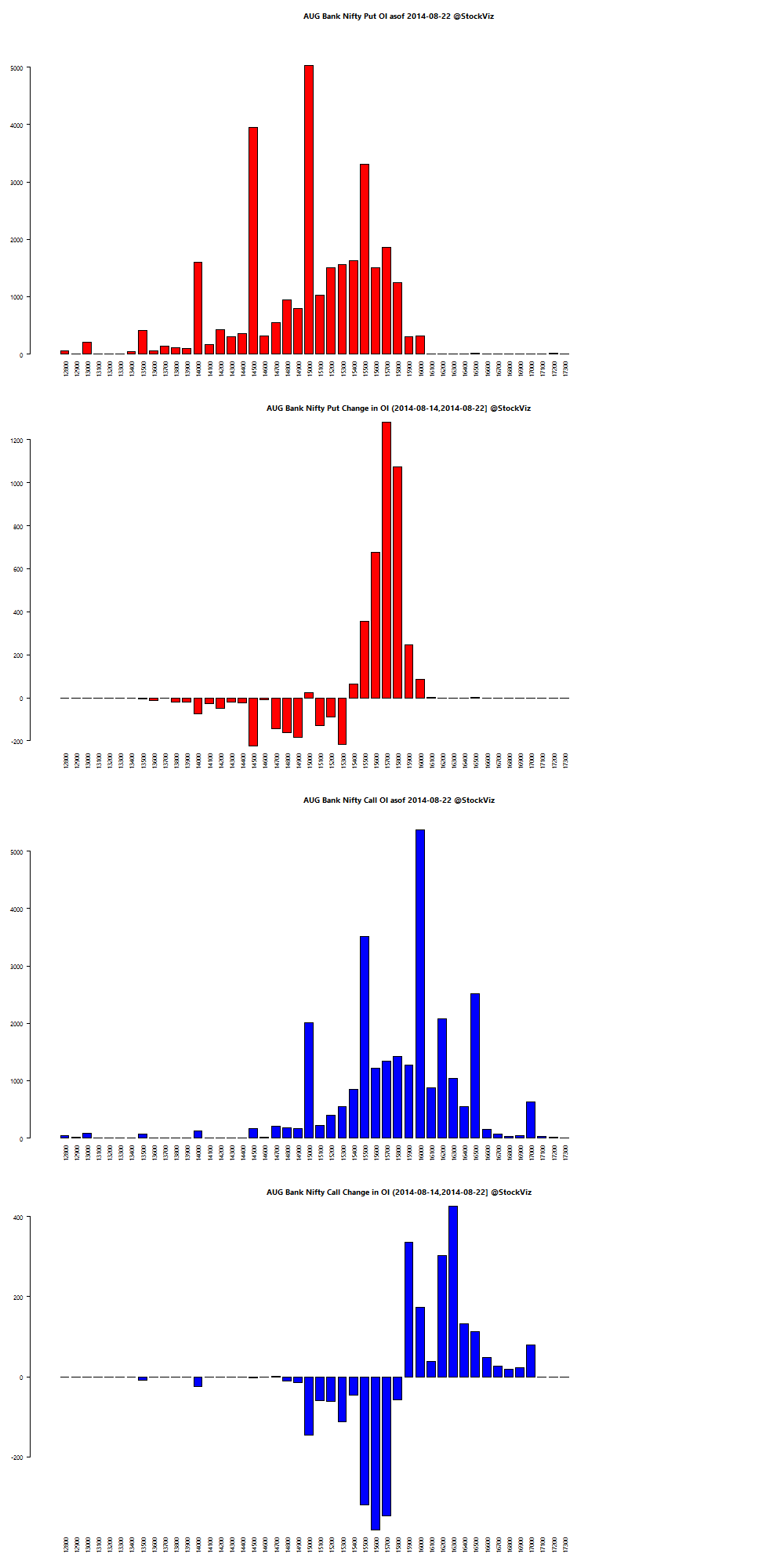

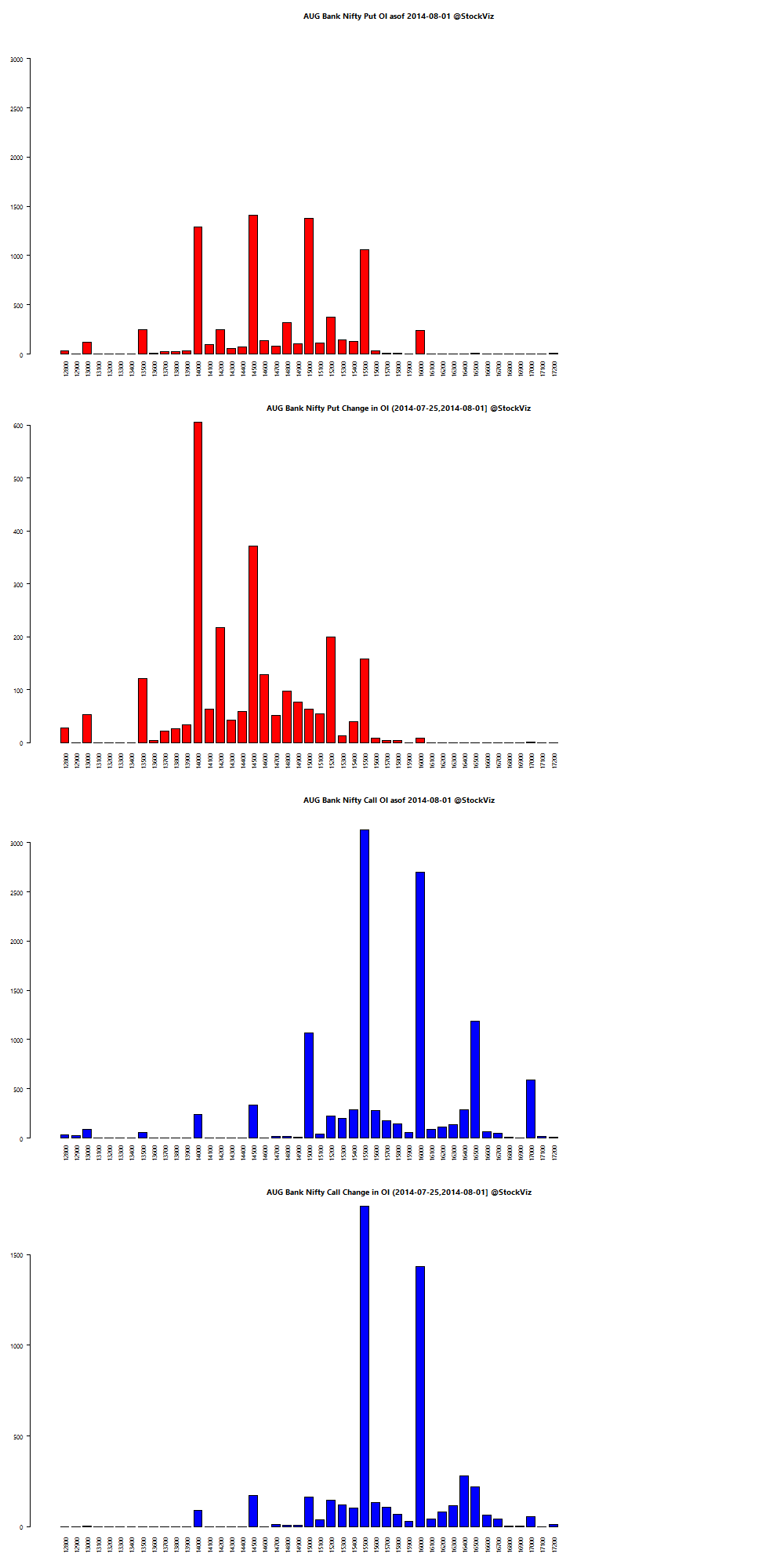

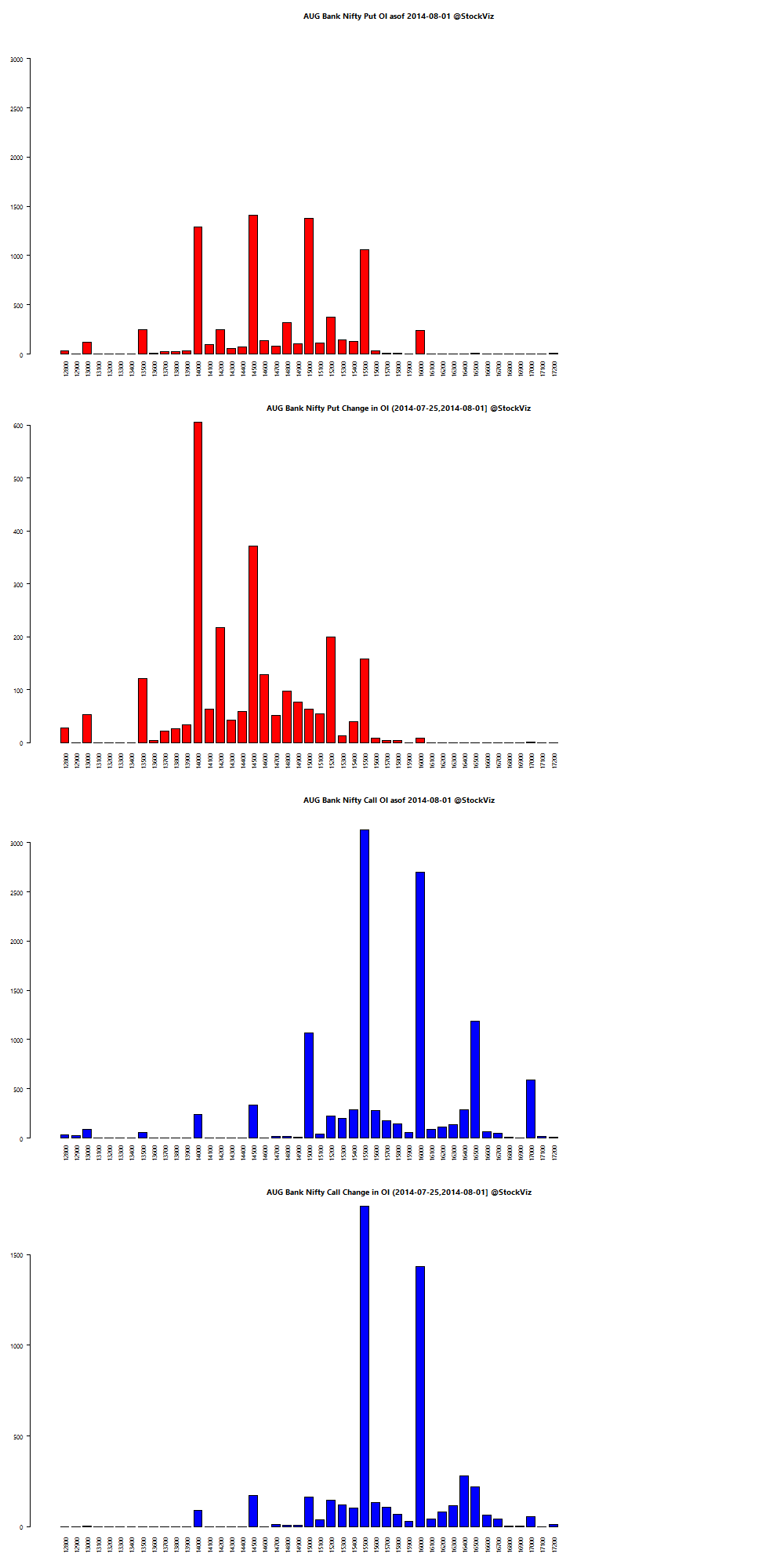

August BankNifty OI

Thought for the weekend

Here’s the tl;dr, but read the entire article at your leisure this weekend.

Panopticon: a way for a (prison) guard to see others without being seen himself. Follows a principle that power should be visible and unverifiable.

Visible: the inmate will constantly have before his eyes the tall outline of the central tower from which he is spied upon.

Unverifiable: the inmate must never know whether he is being looked at at any one moment; but he must be sure that he may always be so.

Eventually guards discovered that, after a period of consistent monitoring and prompt punishment against perpetrators, inmates began to regulate their own behaviour.

Applicable to how regulators, like SEBI and the RBI, can get market participants to regulate their own behavior.

Source: Michel Foucault on the Panopticon Effect