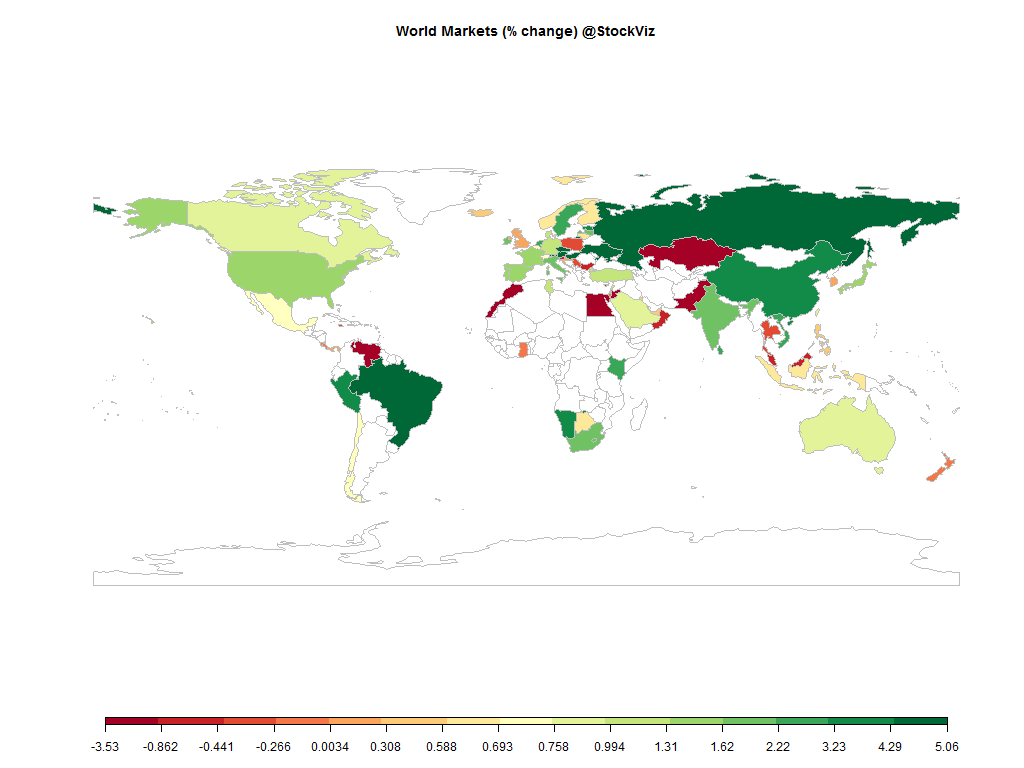

Equities

Commodities

| Energy |

| Heating Oil |

+6.49% |

| Brent Crude Oil |

+5.51% |

| RBOB Gasoline |

+3.90% |

| WTI Crude Oil |

+0.82% |

| Ethanol |

+0.91% |

| Natural Gas |

+8.33% |

| Metals |

| Copper |

+0.38% |

| Gold 100oz |

-0.19% |

| Palladium |

+1.06% |

| Platinum |

-1.06% |

| Silver 5000oz |

-1.16% |

| Agricultural |

| Coffee (Arabica) |

-2.40% |

| Cotton |

+2.06% |

| Soybeans |

+2.03% |

| Cocoa |

+3.01% |

| Coffee (Robusta) |

+3.88% |

| Corn |

+1.17% |

| Feeder Cattle |

+2.03% |

| Lean Hogs |

-3.62% |

| Sugar #11 |

+2.13% |

| Cattle |

+2.50% |

| Lumber |

-0.61% |

| Orange Juice |

+2.07% |

| Soybean Meal |

+1.28% |

| Wheat |

+1.52% |

| White Sugar |

+0.03% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.17% |

| Markit CDX NA HY |

-0.08% |

| Markit CDX NA IG |

+0.71% |

| Markit iTraxx Asia ex-Japan IG |

+0.07% |

| Markit iTraxx Australia |

-0.53% |

| Markit iTraxx Europe |

+3.69% |

| Markit iTraxx Europe Crossover |

+10.76% |

| Markit iTraxx Japan |

-1.11% |

| Markit iTraxx SovX Western Europe |

+0.75% |

| Markit LCDX (Loan CDS) |

+0.00% |

| Markit MCDX (Municipal CDS) |

-2.19% |

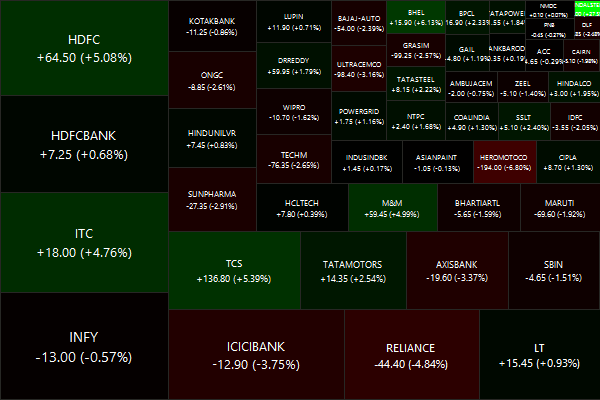

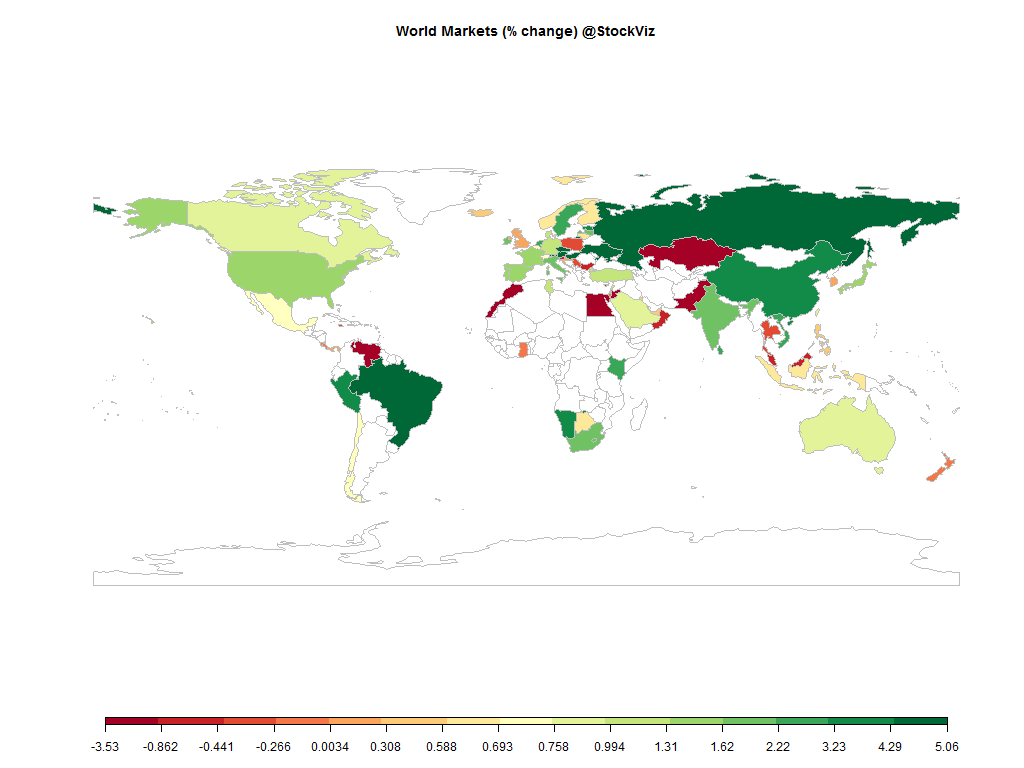

All in all, a good week for the equity markets.

The energy complex found a bid – remains to be seen if it was a dead cat bounce or something more significant.

Credit was mostly tighter – probably a reflection of the worsening finances of fracking cos.

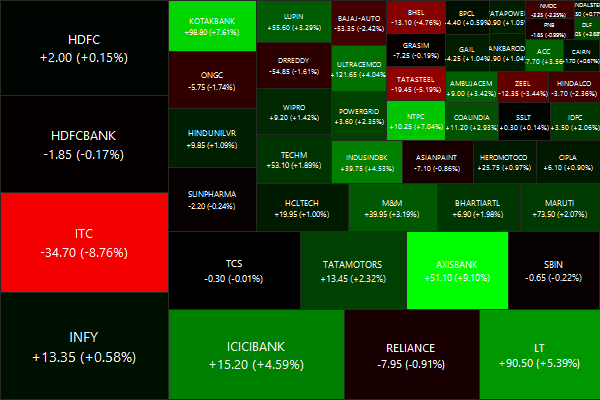

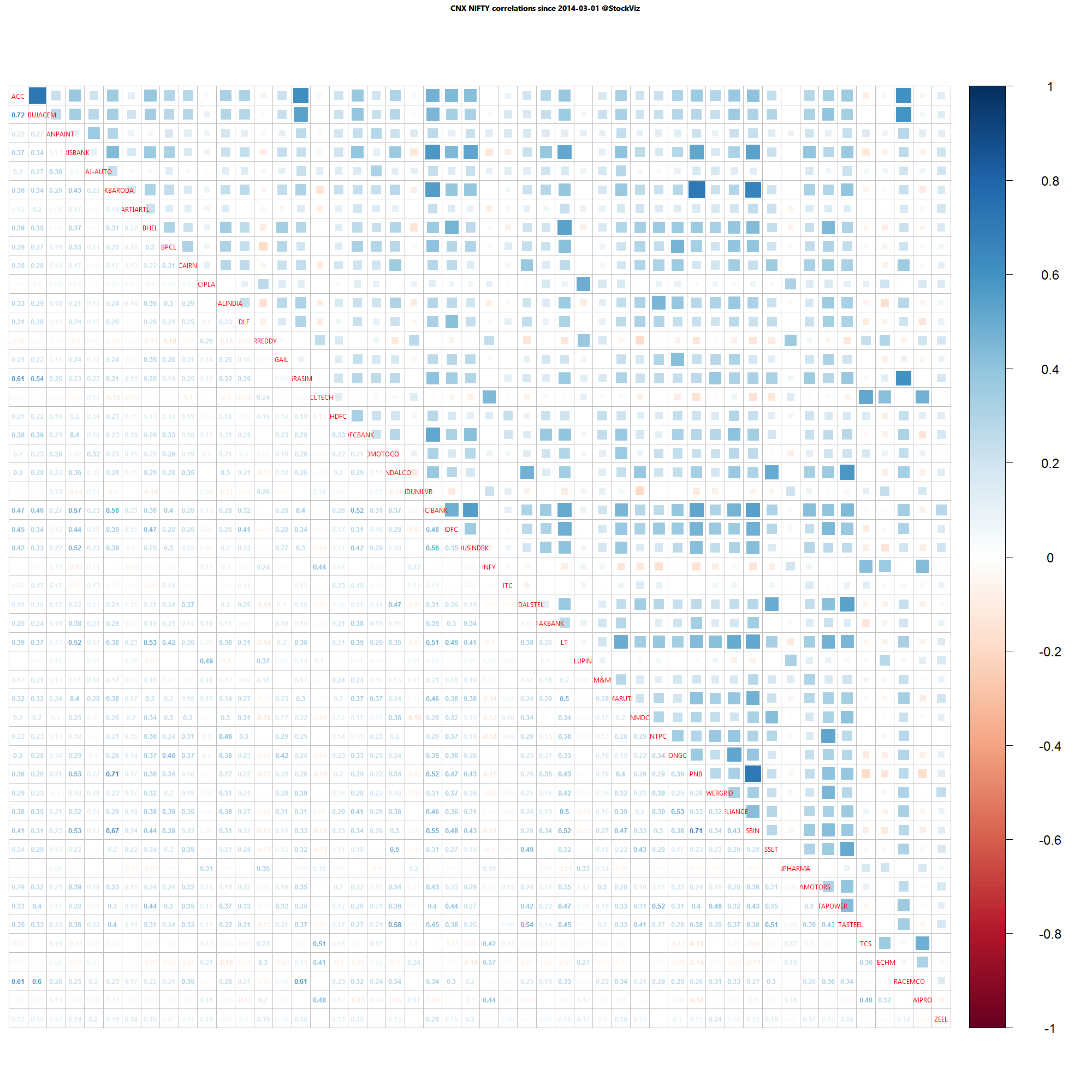

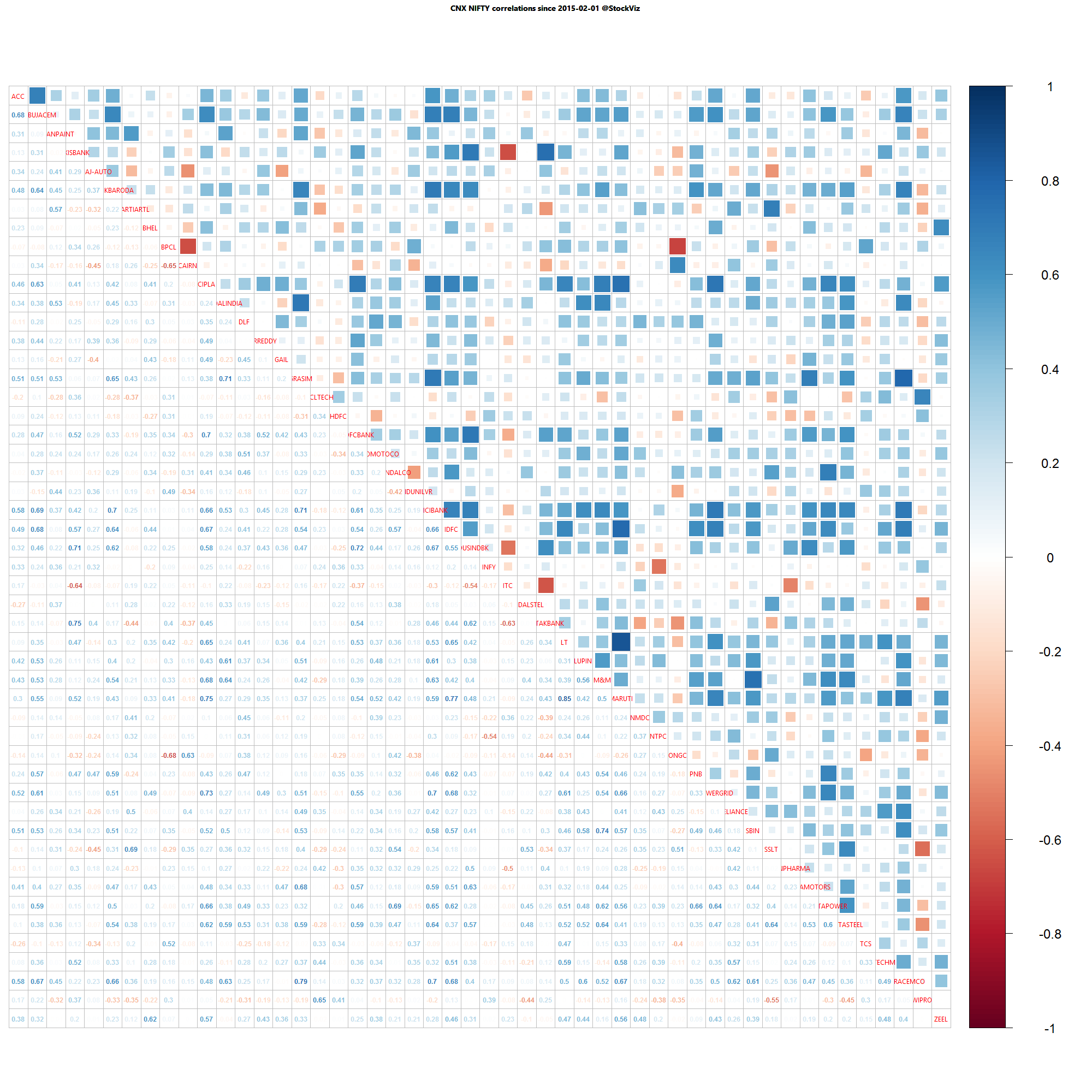

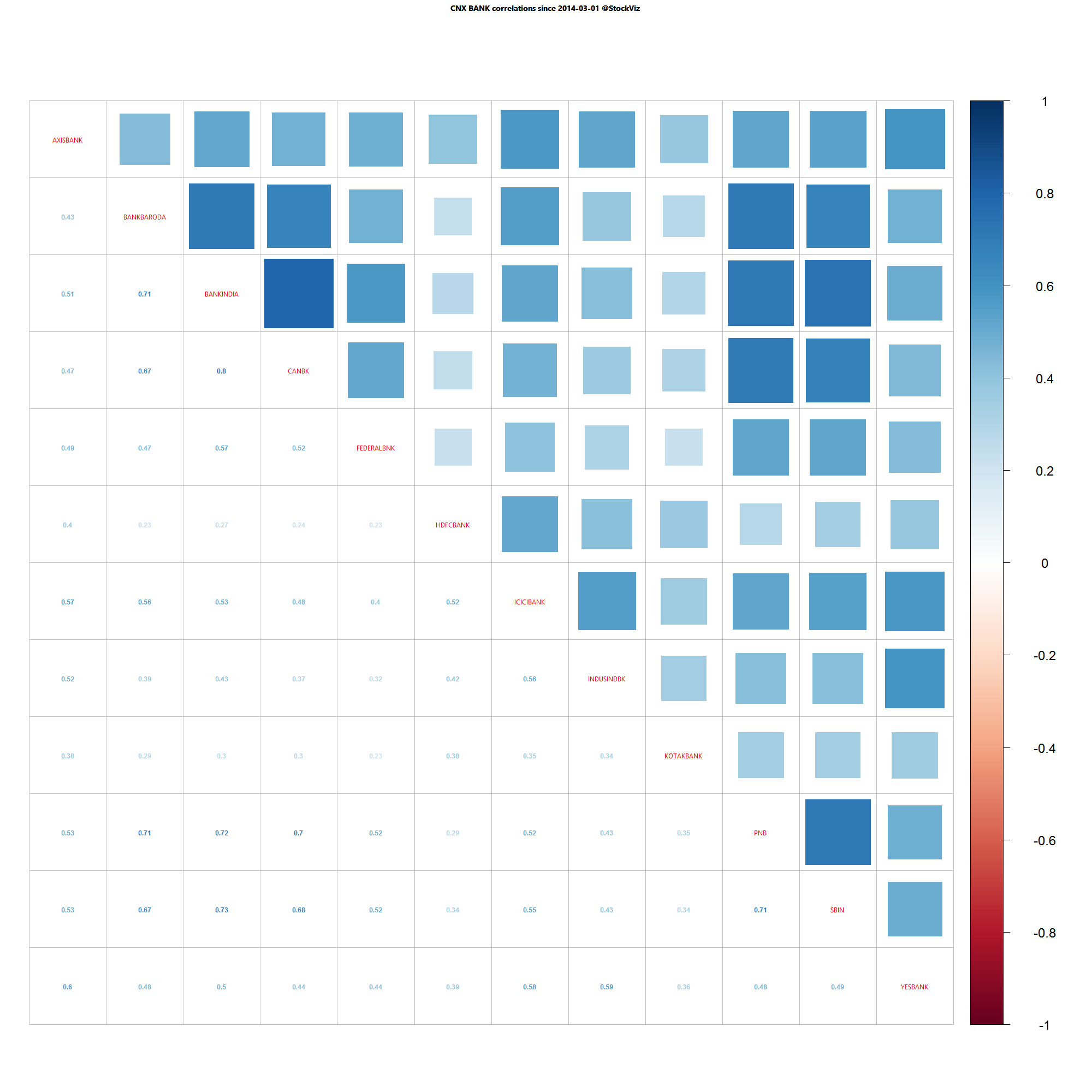

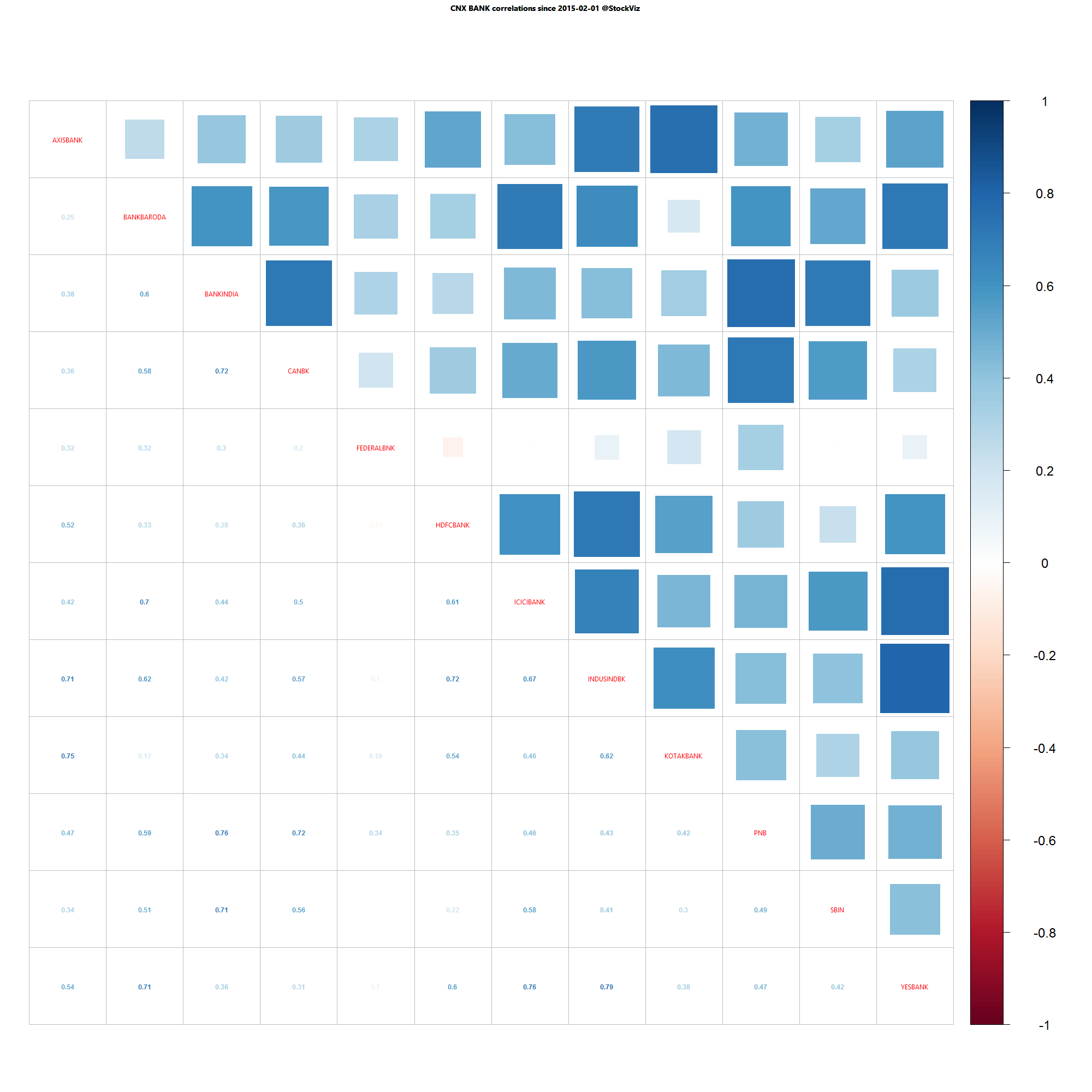

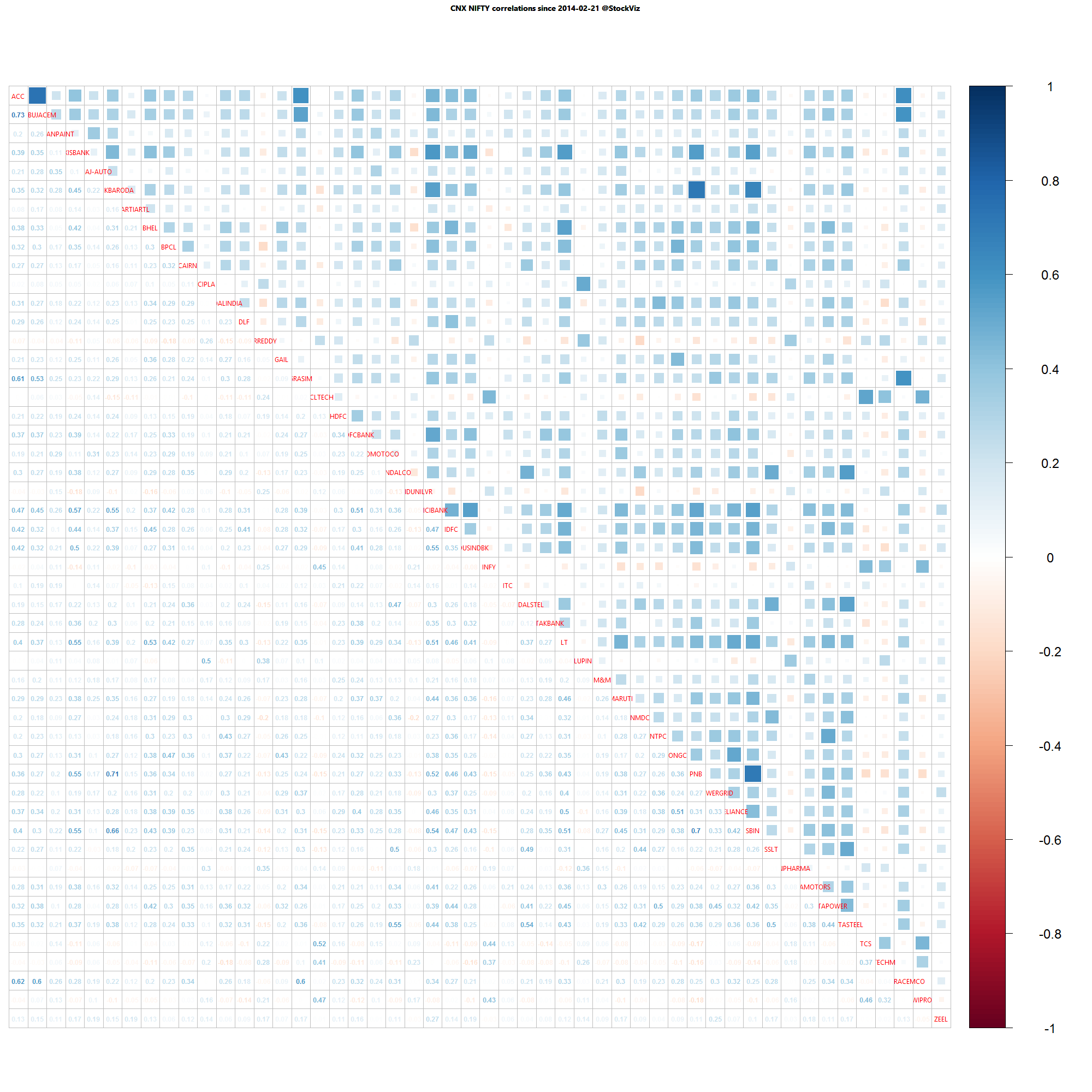

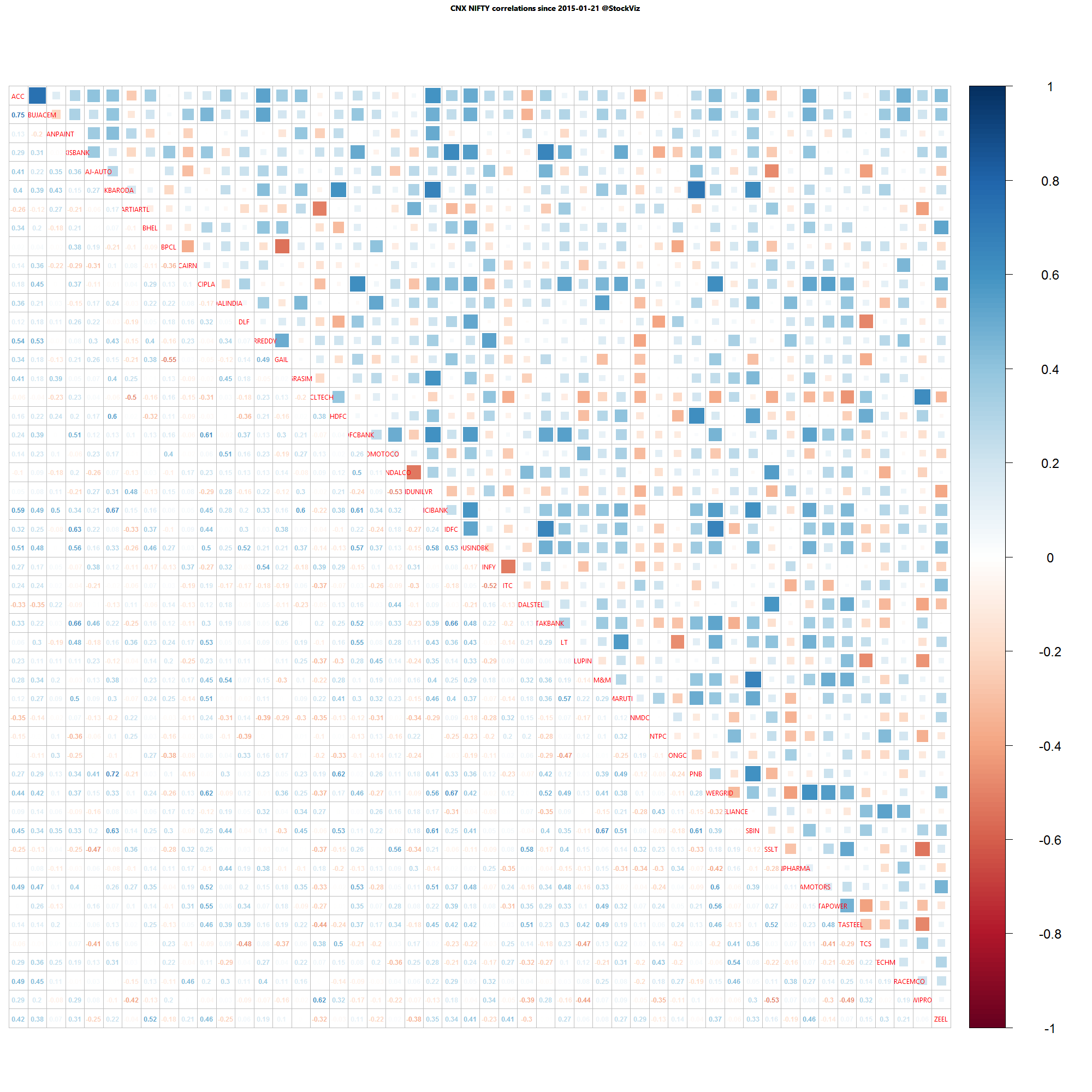

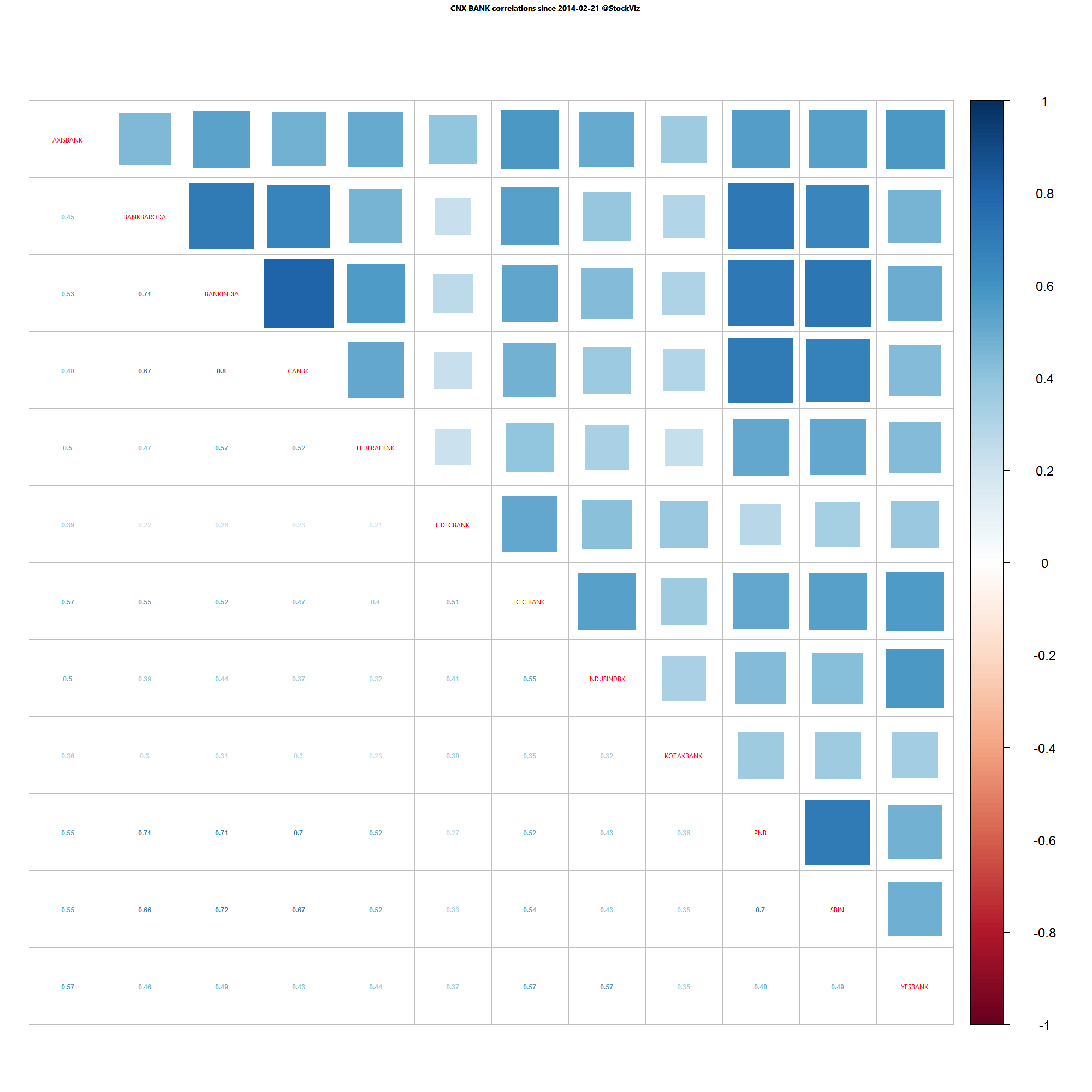

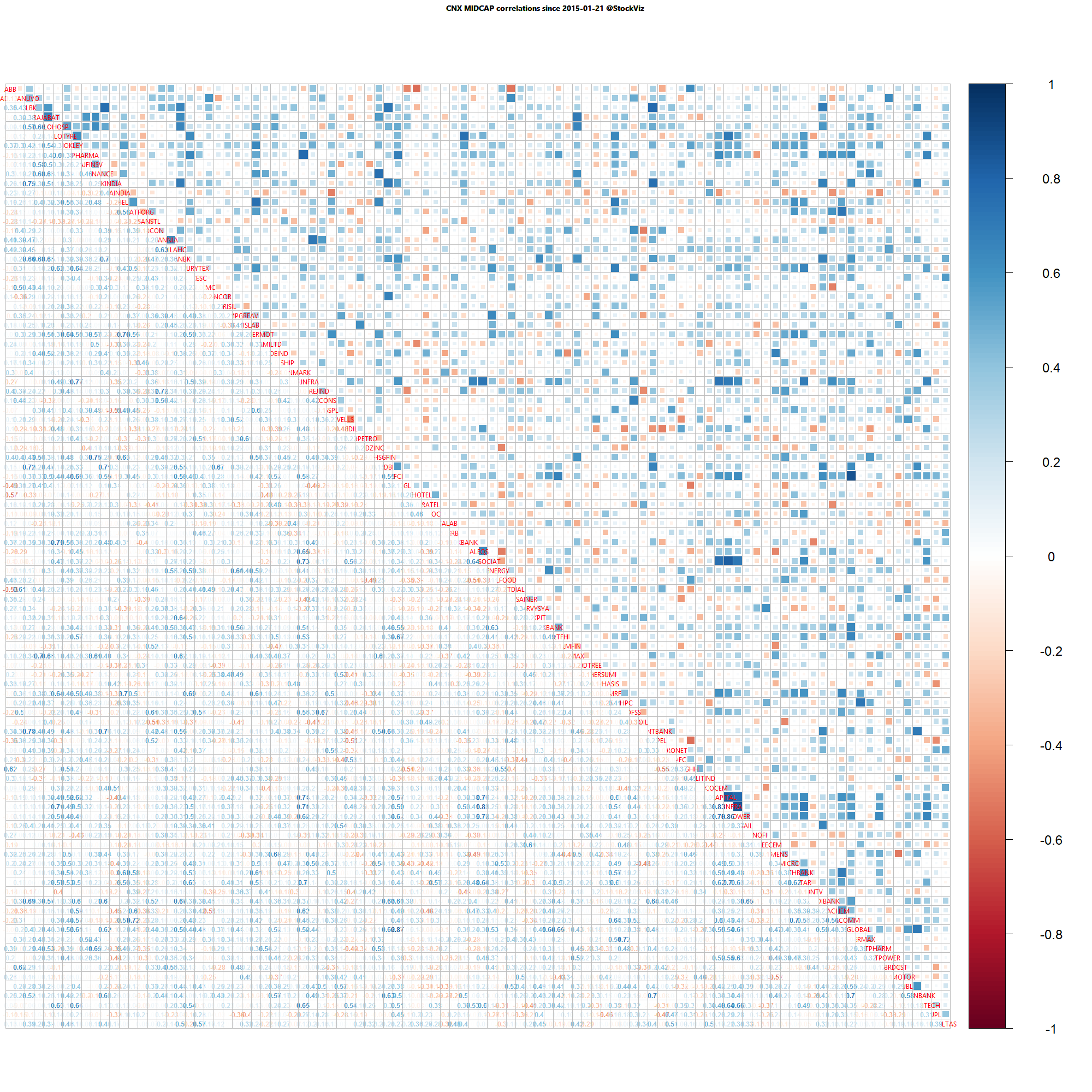

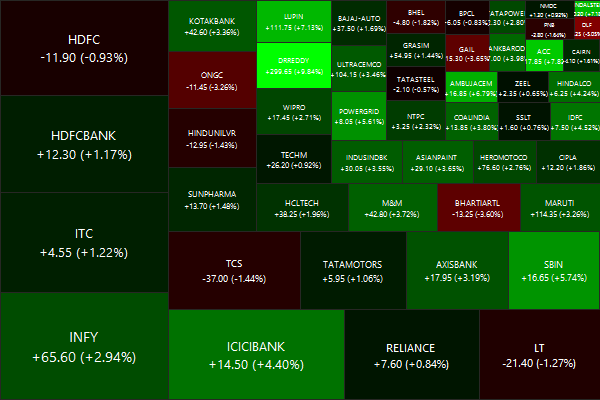

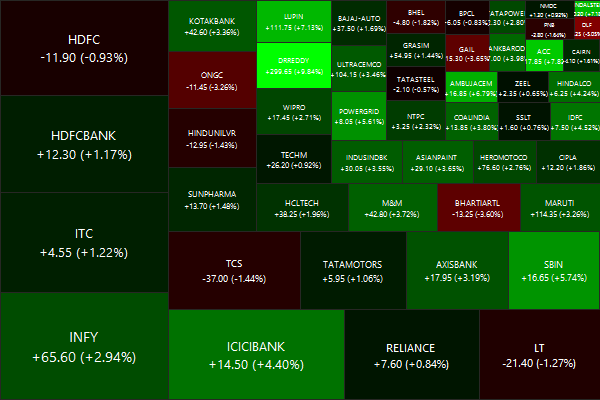

Nifty Heatmap

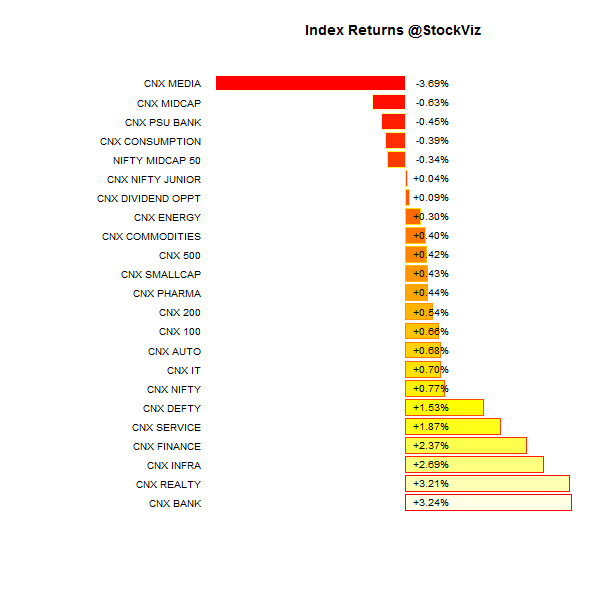

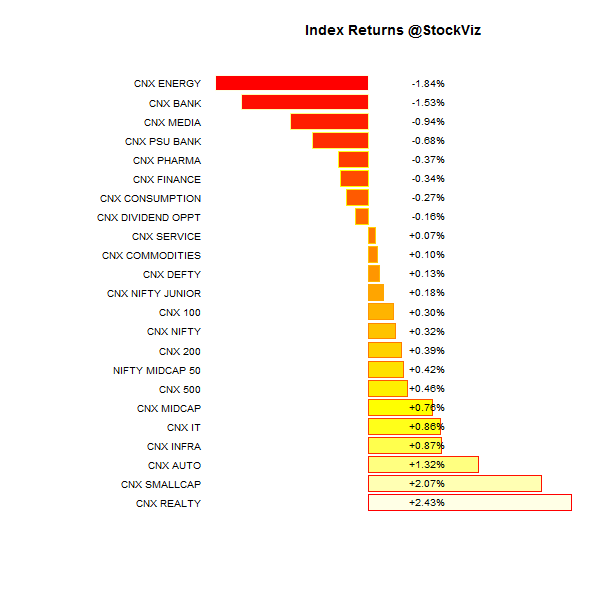

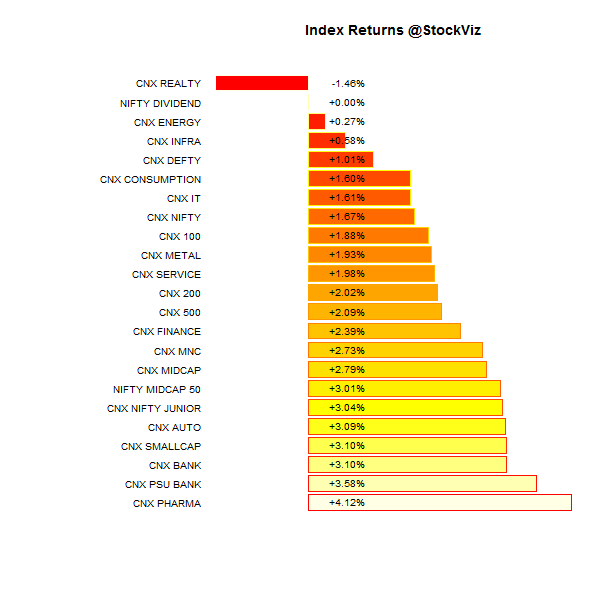

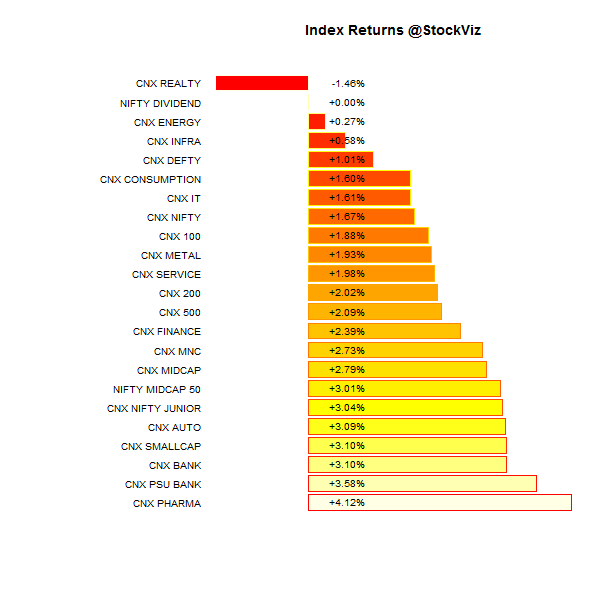

Index Returns

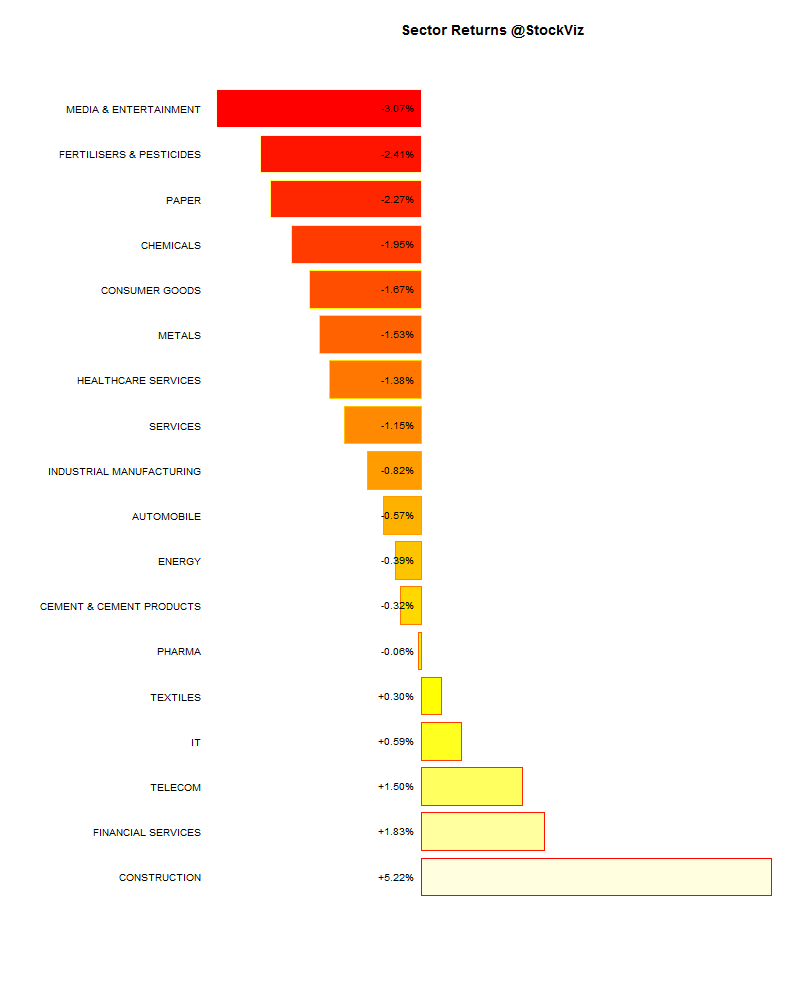

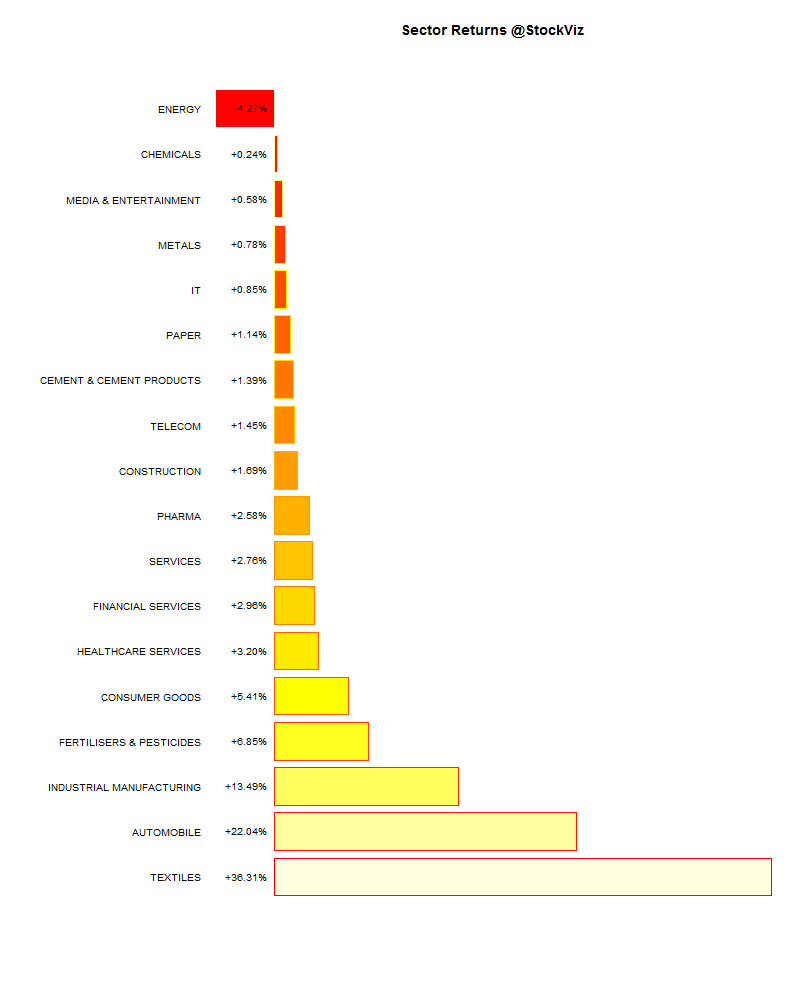

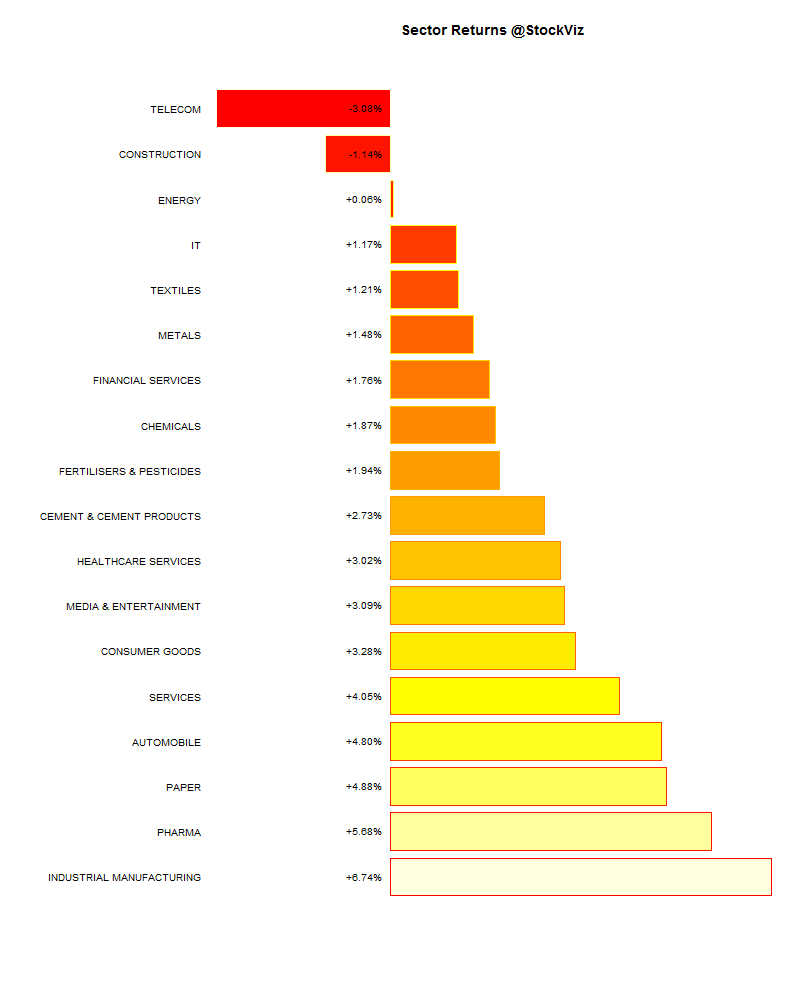

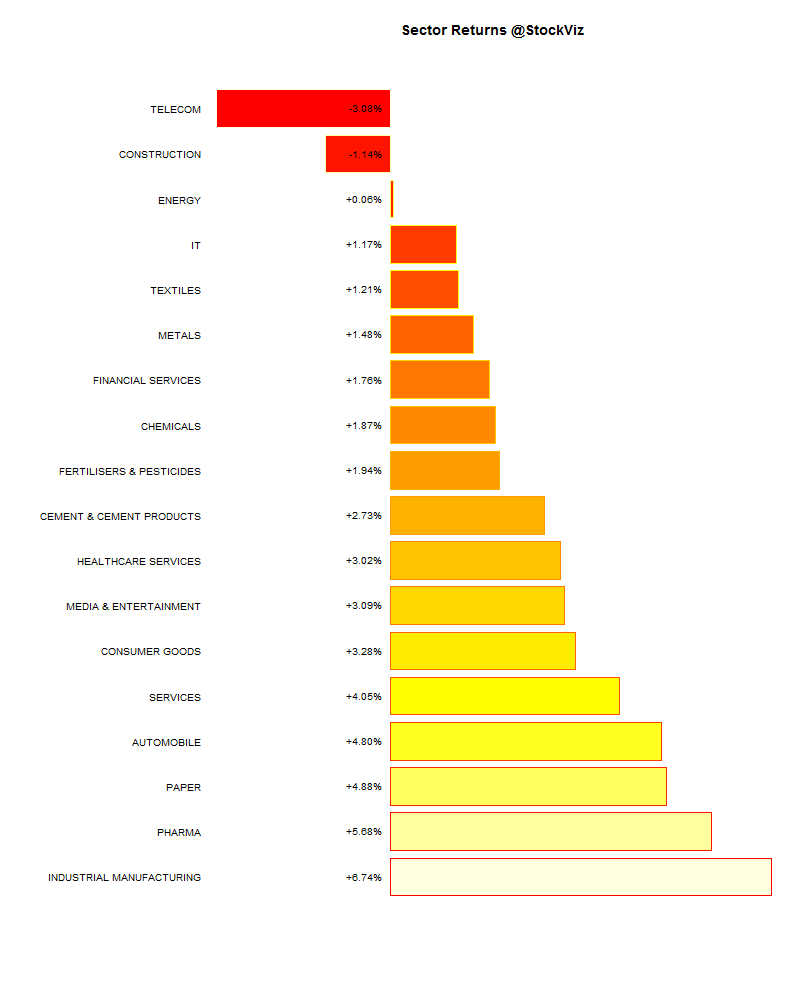

Sector Performance

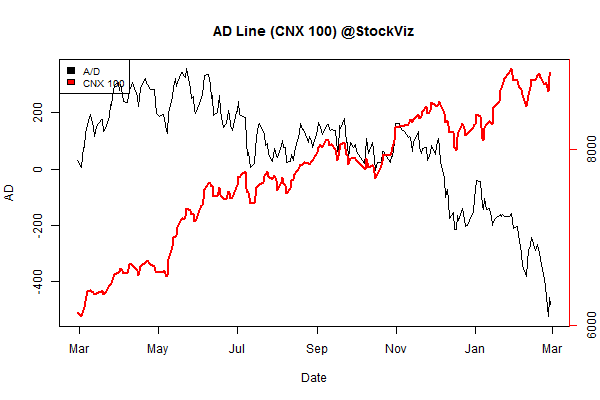

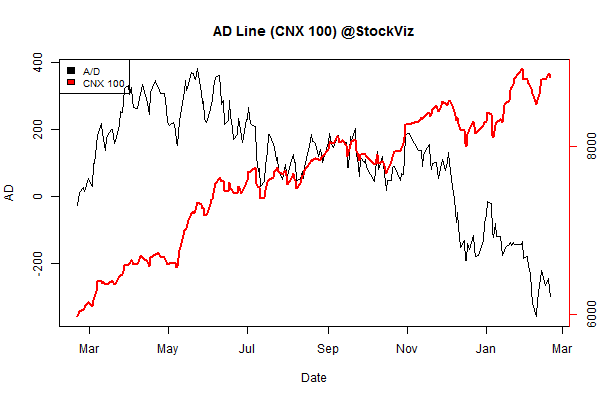

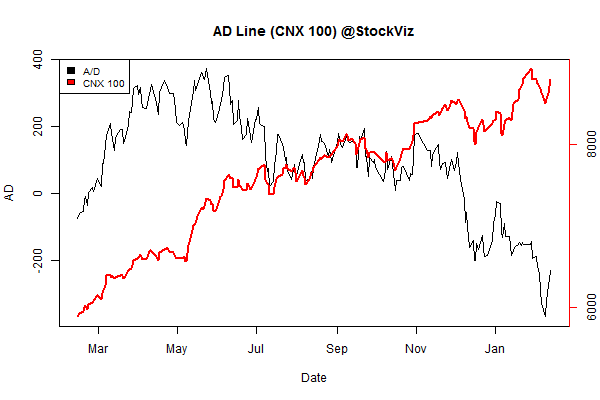

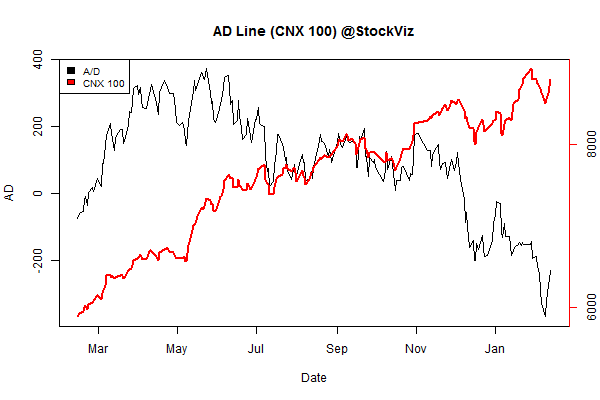

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Adv/Decl |

| 1 (micro) |

-5.53% |

57/76 |

| 2 |

-3.58% |

60/72 |

| 3 |

-3.05% |

61/71 |

| 4 |

-2.19% |

55/77 |

| 5 |

-1.60% |

58/74 |

| 6 |

-1.09% |

69/64 |

| 7 |

-0.20% |

65/67 |

| 8 |

+0.47% |

67/66 |

| 9 |

+0.73% |

64/68 |

| 10 (mega) |

+0.39% |

66/67 |

The rally was primarily driven by large caps…

Top Winners and Losers

Shriram Transport is easily one of the most volatile stocks out there… And will DLF be able to survive a Kejriwal – Raje 1-2 punch?

ETF Performance

Hopefully, gold will put in a couple of years of negative returns and Indian savers will finally get over it…

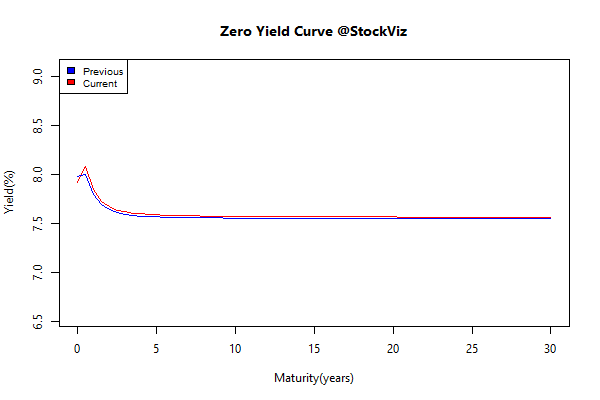

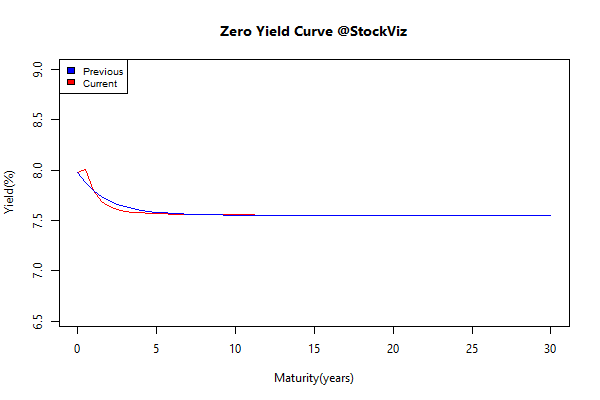

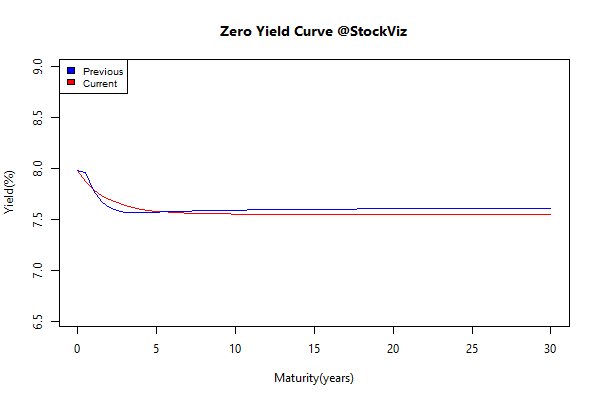

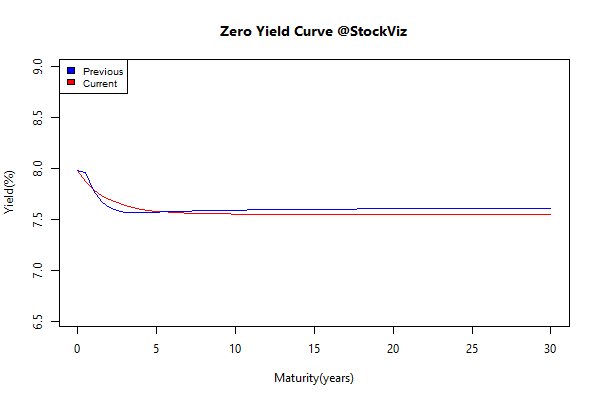

Yield Curve

Bond Indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.13 |

+0.11% |

| GSEC SUB 1-3 |

+0.22 |

-0.05% |

| GSEC SUB 3-8 |

+0.12 |

-0.22% |

| GSEC SUB 8 |

+0.05 |

-0.30% |

Too much supply? Budget jitters? Plain-old reversion to mean?

Investment Theme Performance

Almost all strategies out-performed the Nifty…

Equity Mutual Funds

Bond Mutual Funds

Thought for the weekend

Successful enterprises have a cycle of life. Startups build a product or service, enter the market and attract customers. Once they’re over these initial hurdles, they enter a growth phase, rapidly increasing their revenue and market share with big gains year-over-year. They continue to work on their product, fine-tuning it as revenue starts to flatten and margins stabilize at lower but still attractive levels.

As these companies mature, growth slows even more, eventually flattening out — yet operational expenses continue to climb as they strive to compete with new players in the market. Finally, unable to keep up, burdened with bloated budgets, companies spiral into negative growth, marked by layoffs, high burn rates and eventual bankruptcy or liquidation.

Source: The Arc of Company Life