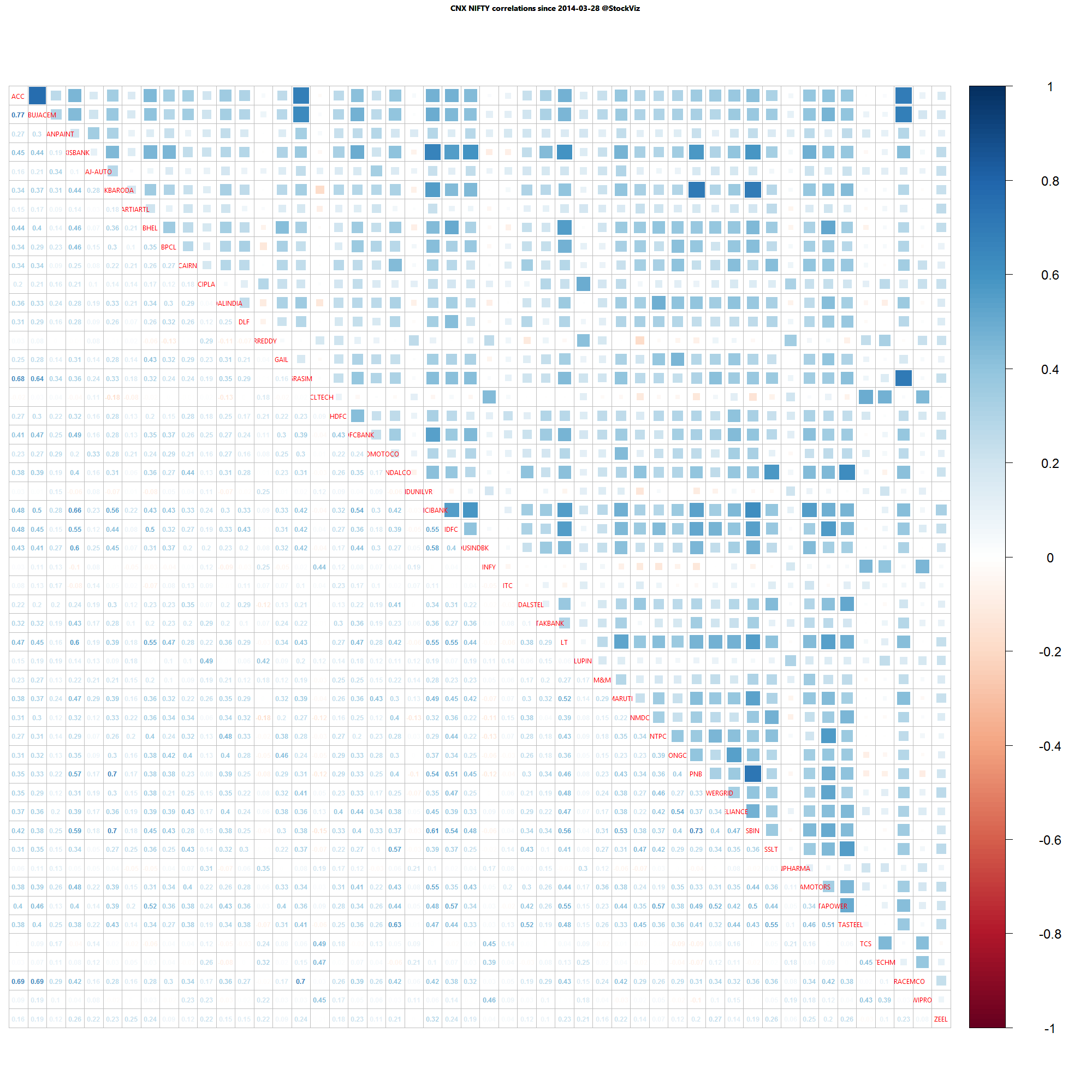

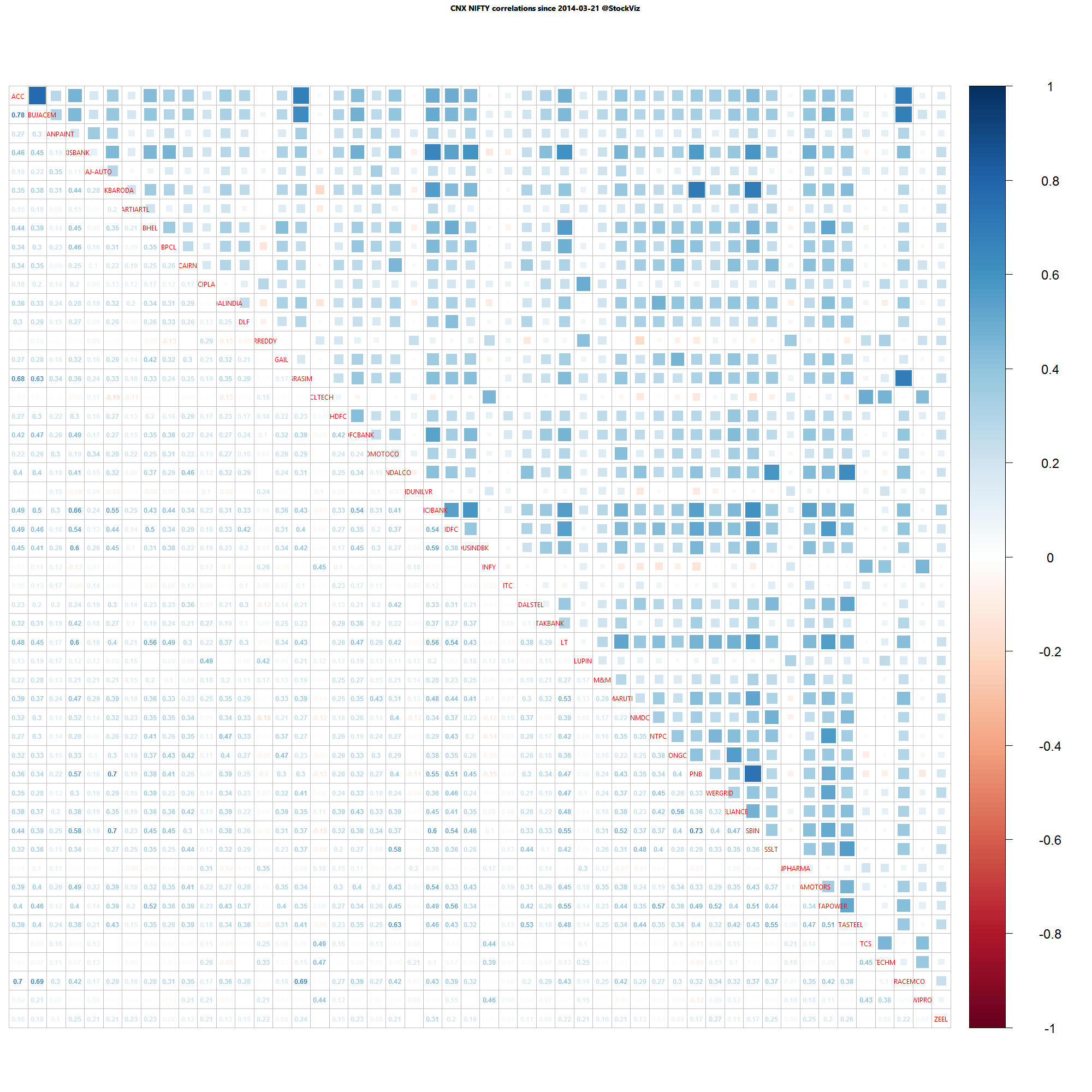

Nifty one year daily return correlations

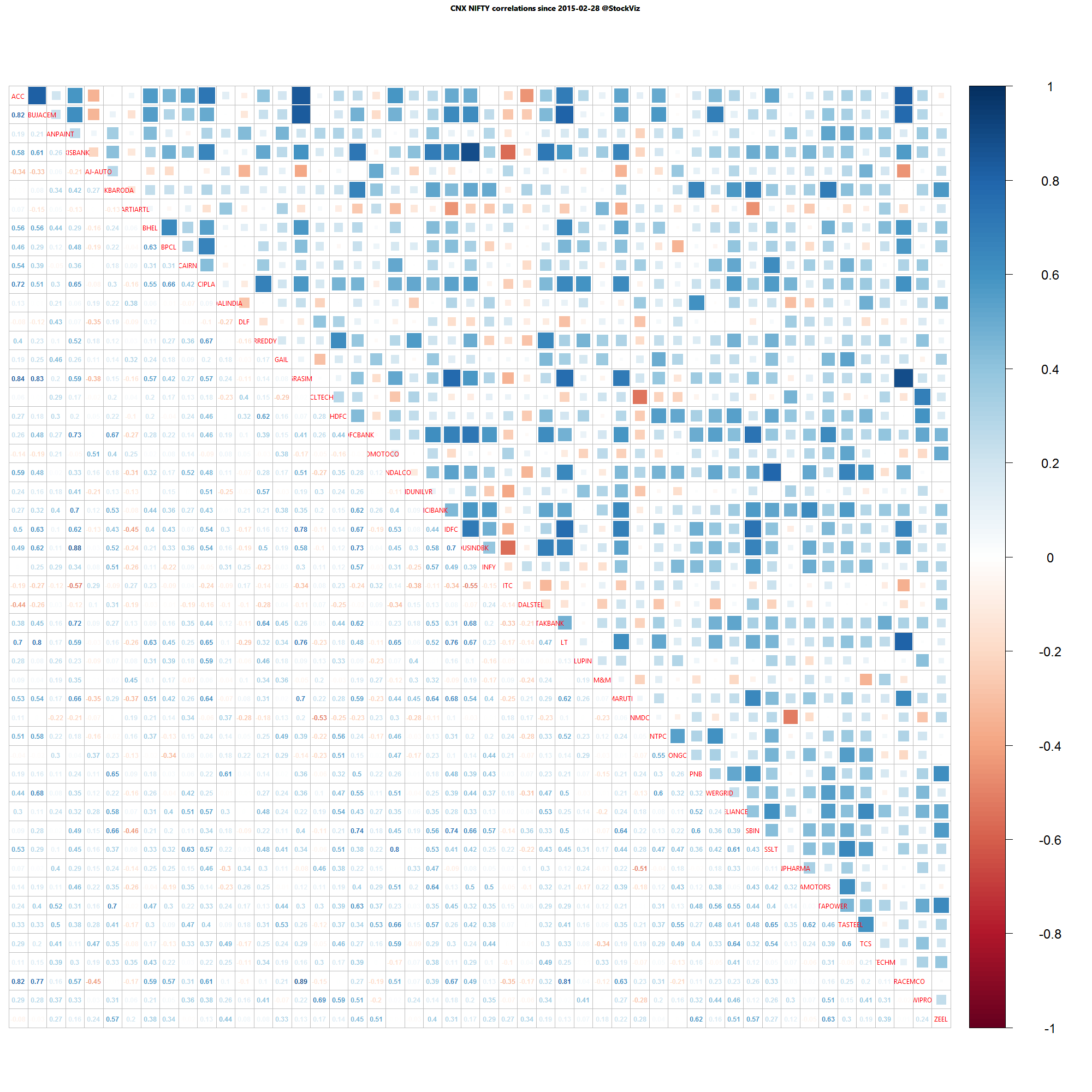

Nifty one month daily return correlations

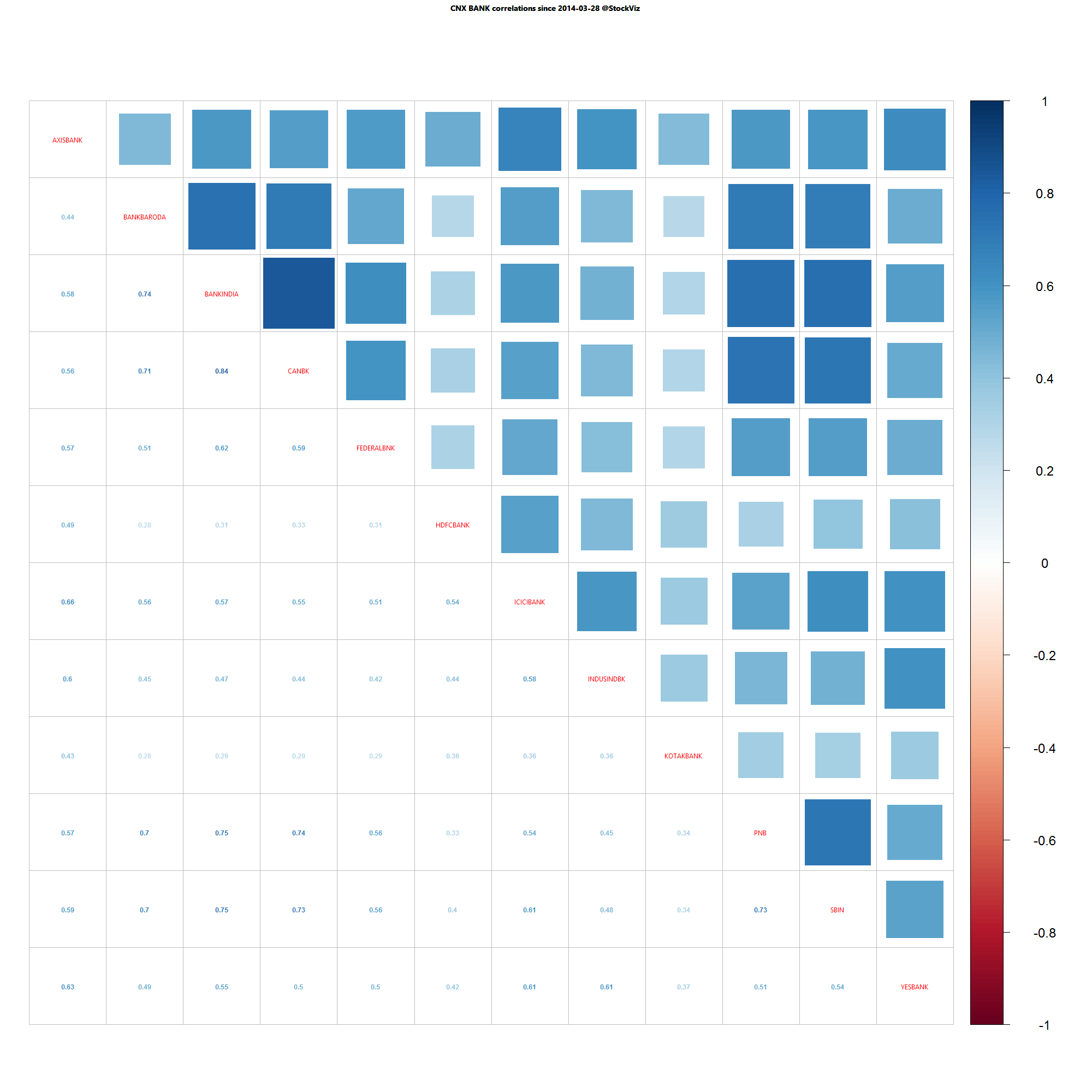

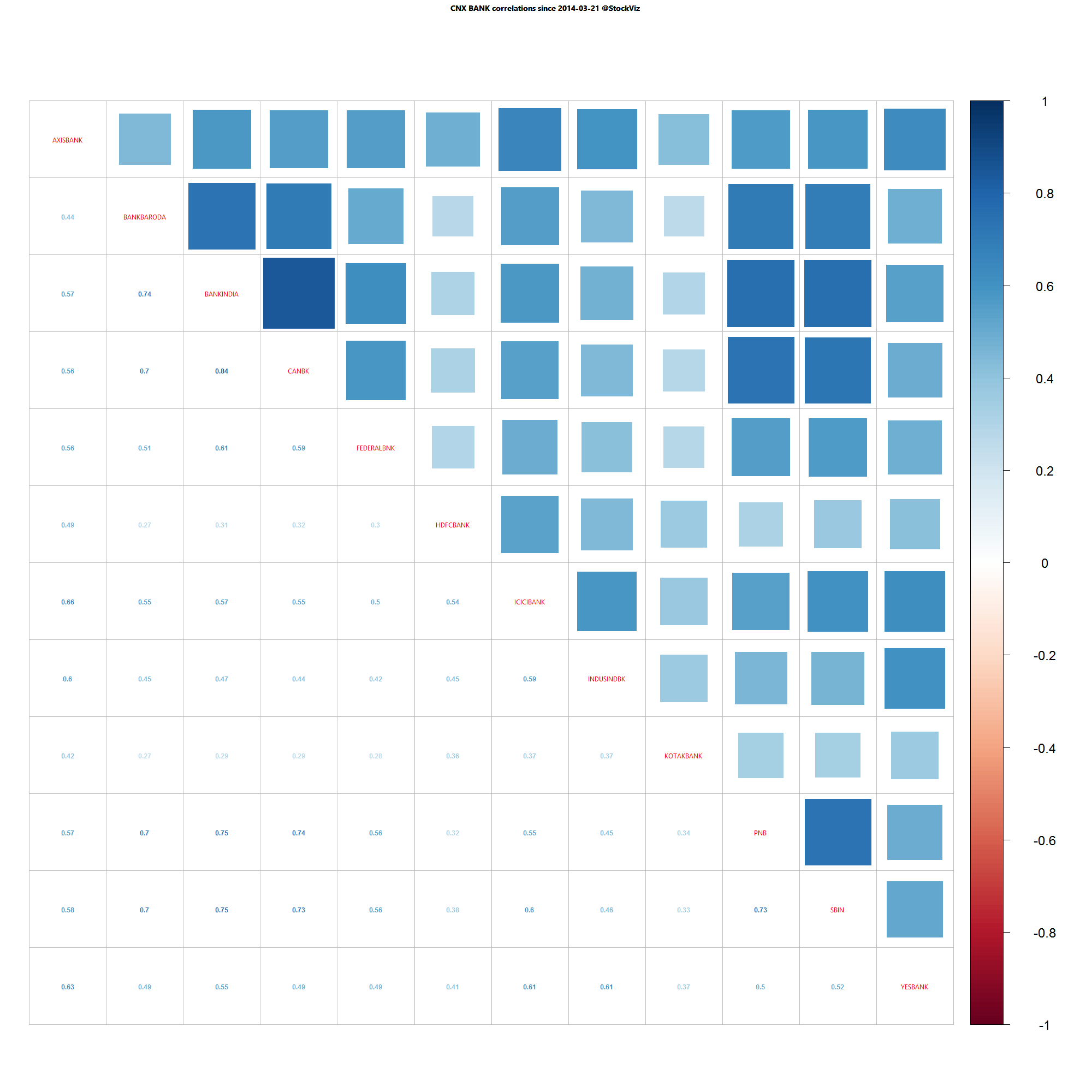

Bank Nifty one year daily return correlations

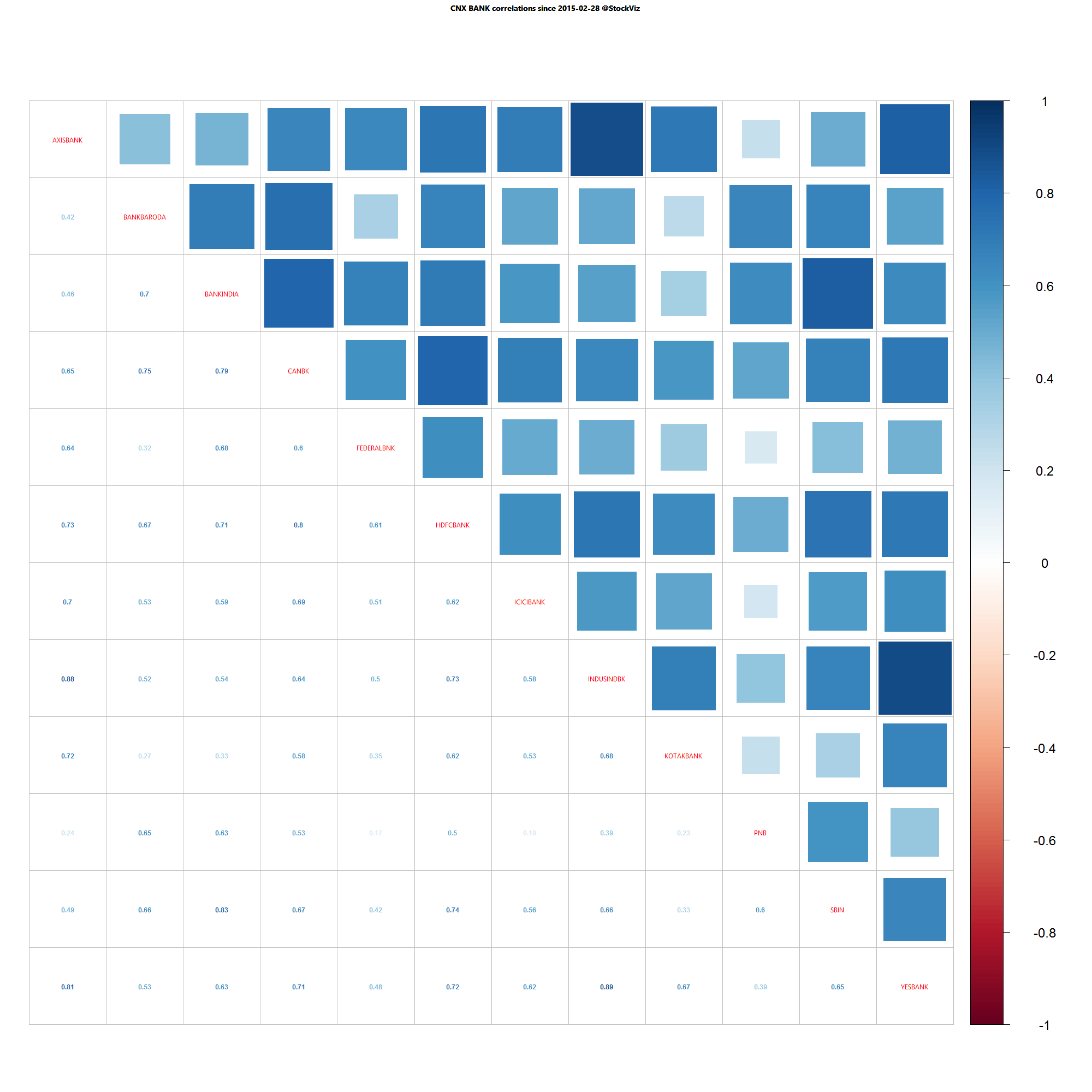

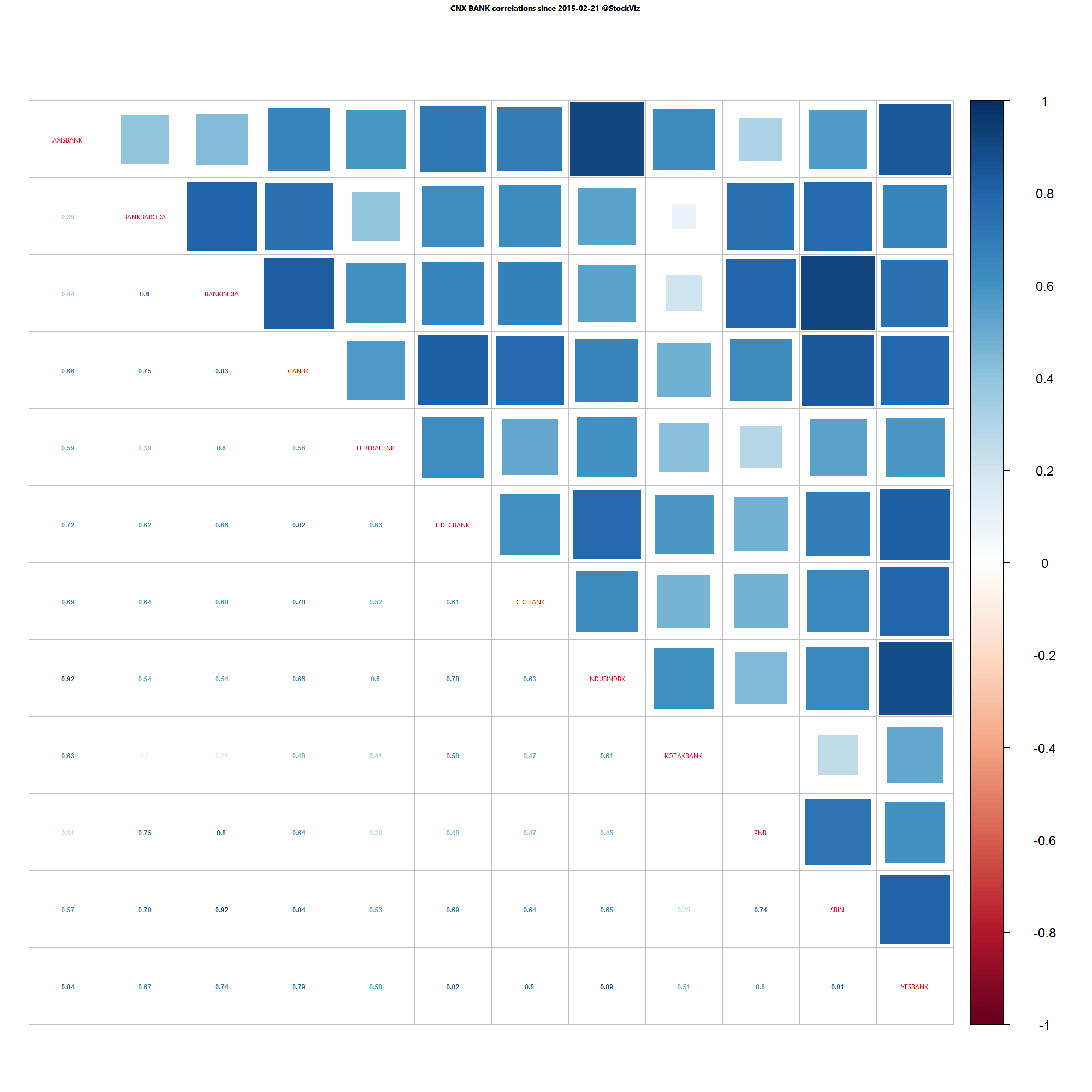

Bank Nifty one month daily return correlations

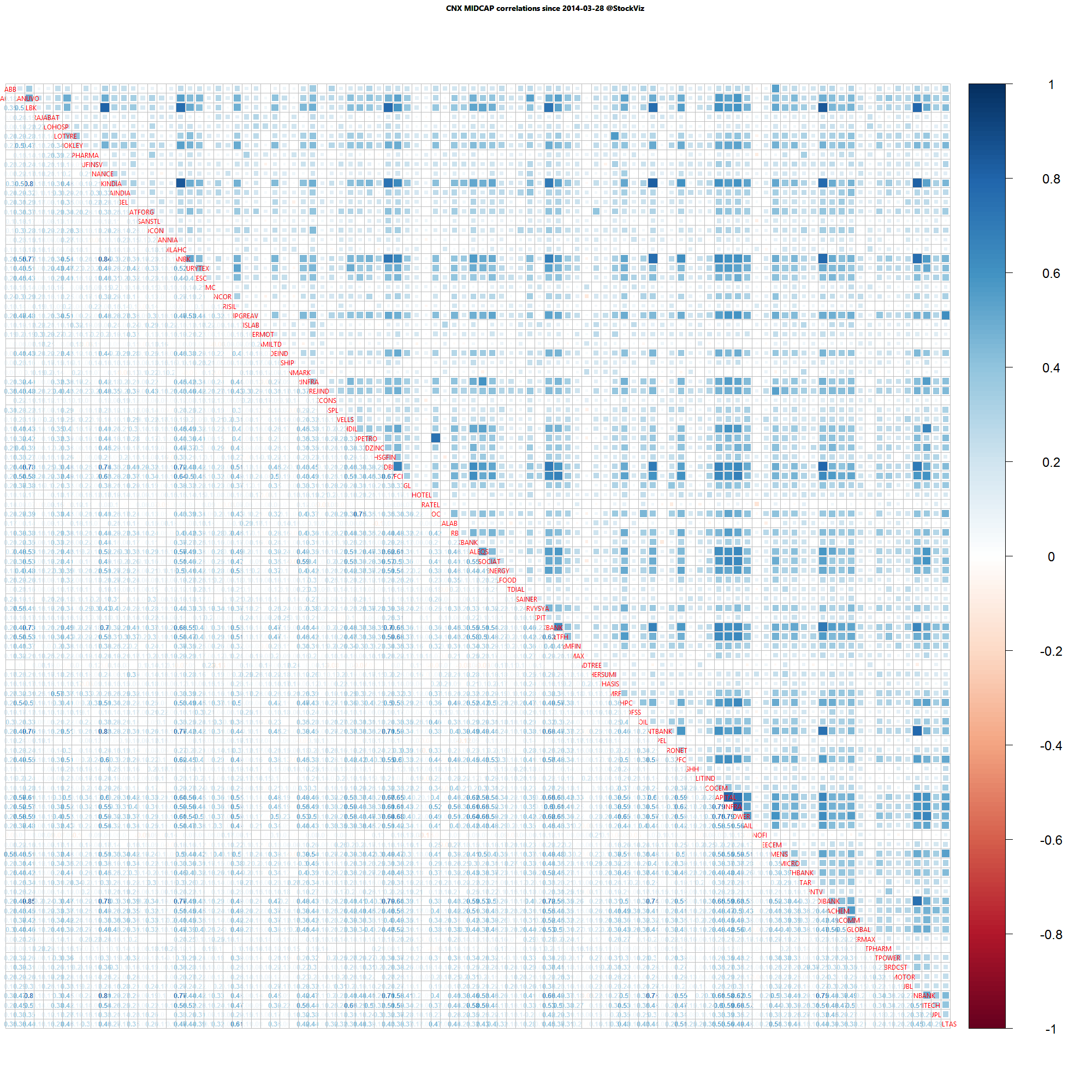

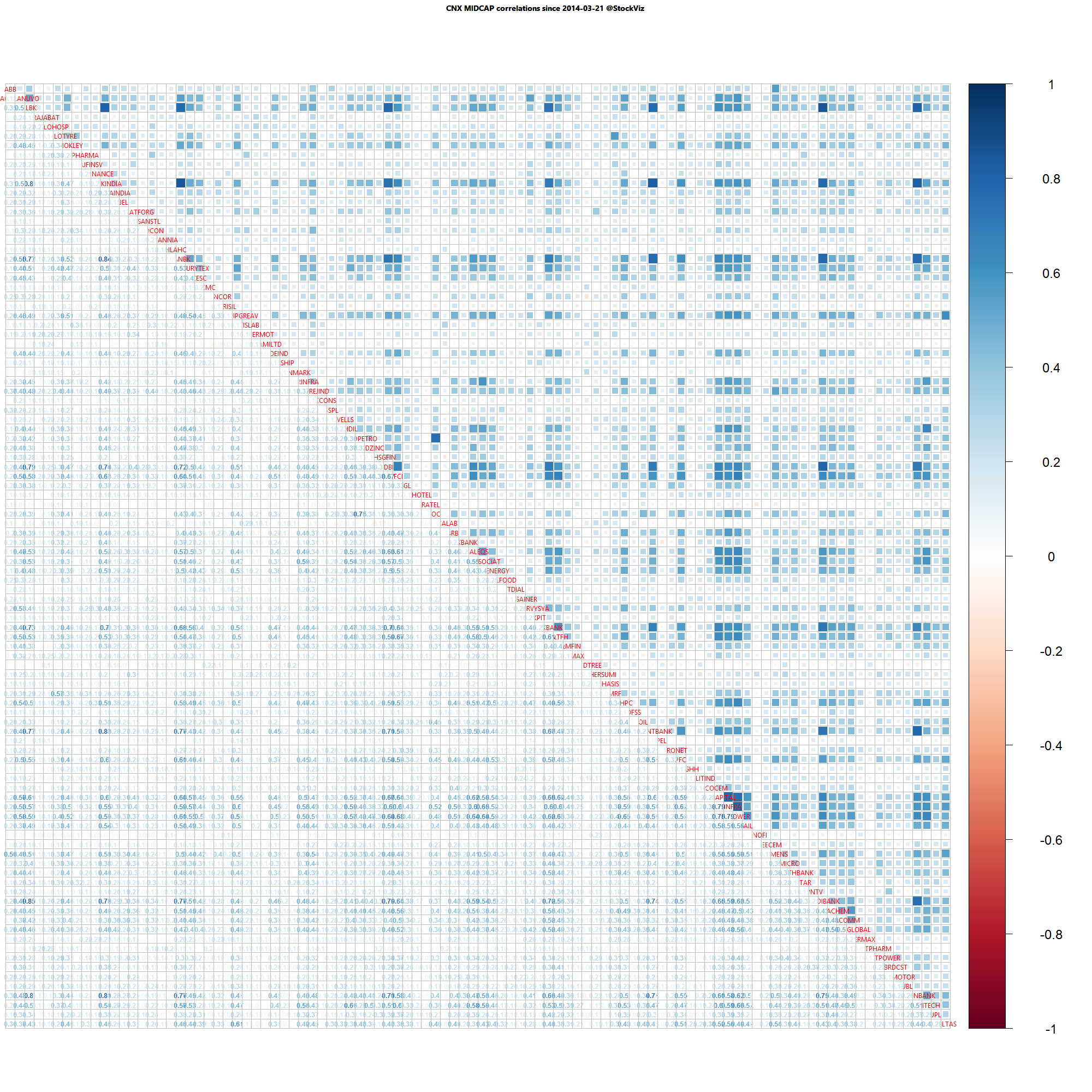

Midcap one year daily return correlations

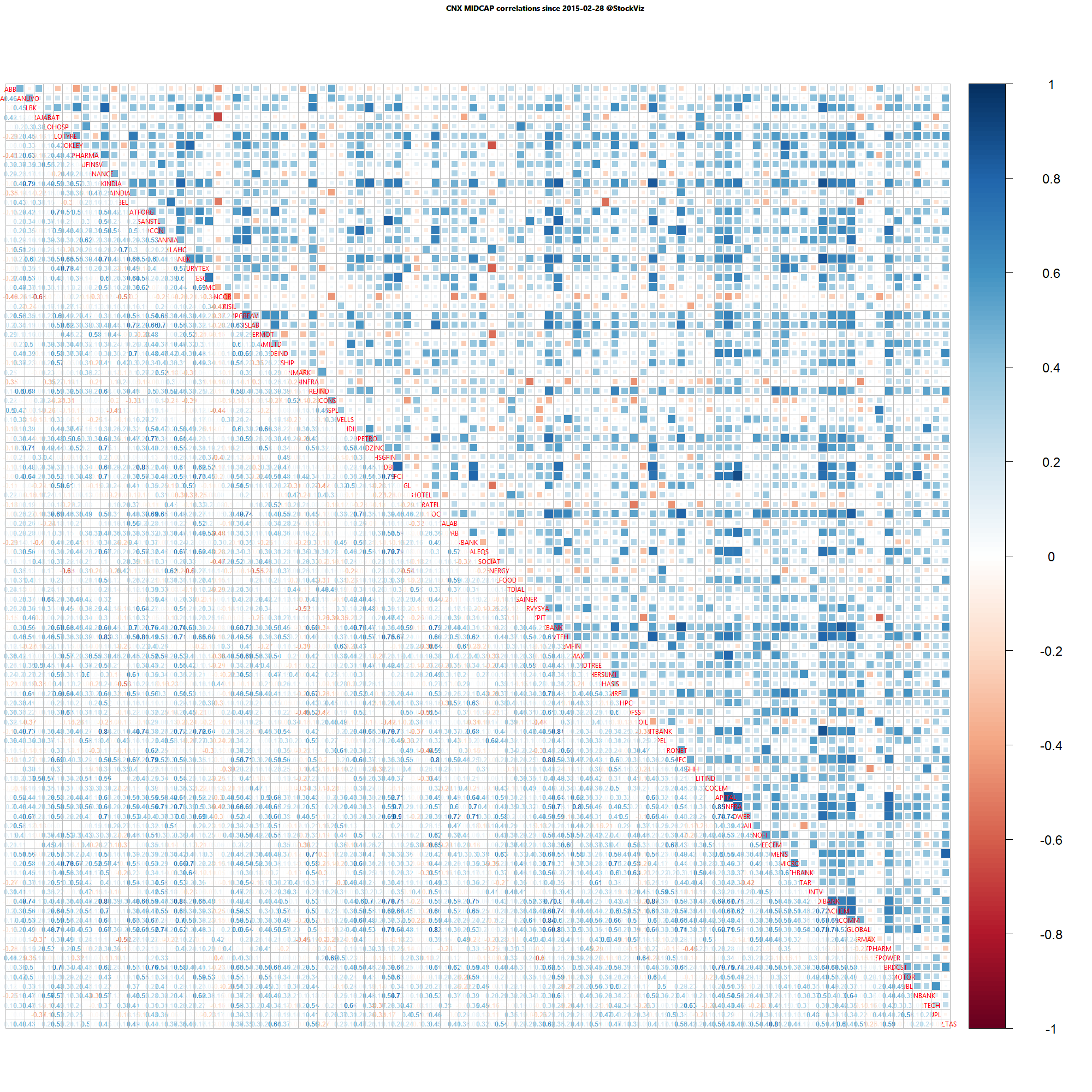

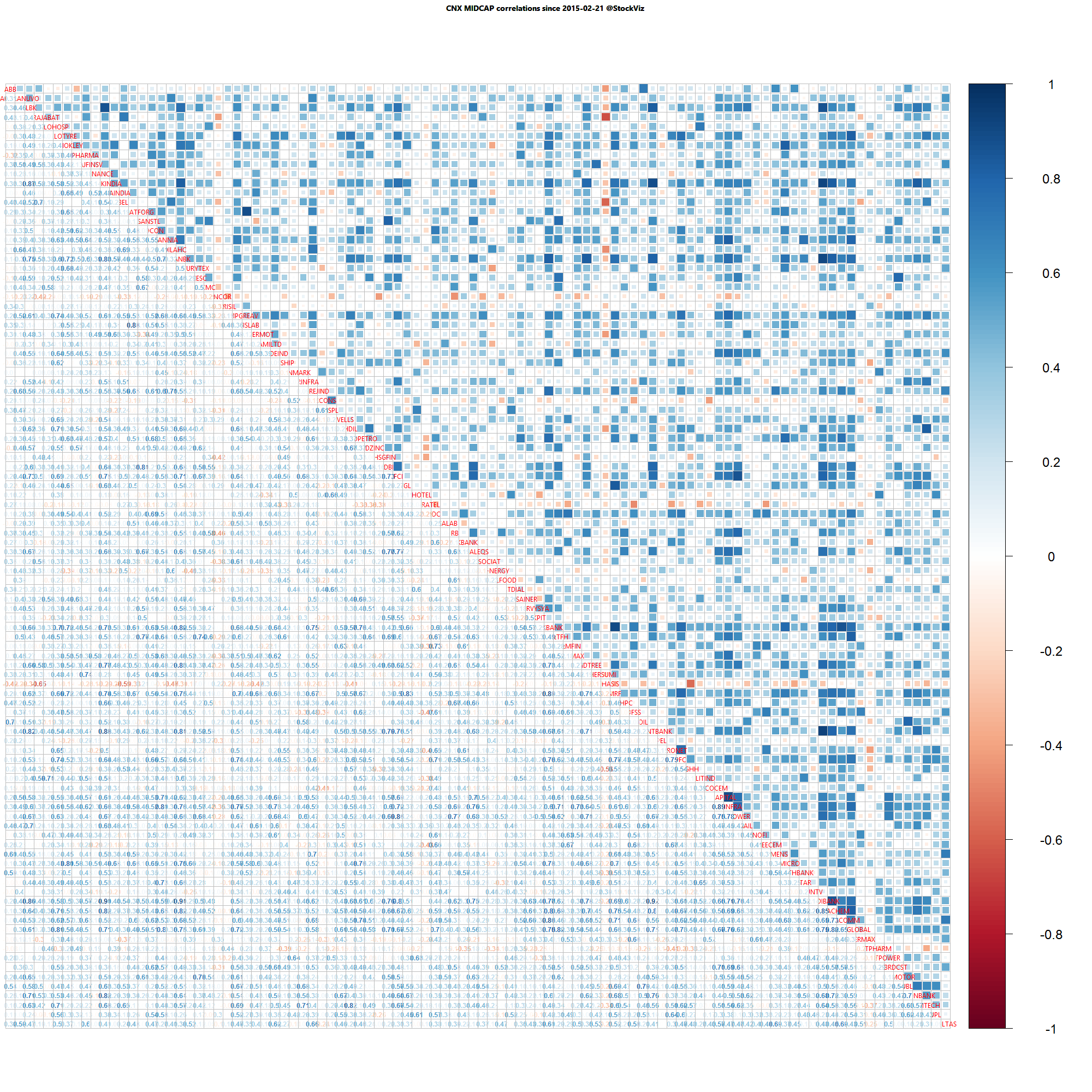

Midcap one month daily return correlations

A lot of thick blue squares mean that positive correlations are high. Red squares mean negative correlations are high. Whites are the doldrums.