Can options trading predict the underlying’s returns? Center of Volume Mass: Does Options Trading Predict Stock Returns? Bernile, Gao, Hu (SSRN) tries to answer the age-old question.

They construct an options volume weighted strike-spot ratio and use that the predict the underlying’s next-day returns.

We rely on the volume-weighted strike-spot ratio to characterize the central location of the distribution of trading activity along the moneyness of available option contracts on the same stock. The ratio of the contract’s strike price (K) and the underlying stock price (S) measures the option moneyness, whereby call (put) options are out-of-the-money when K/S is above (below) one. After normalizing K/S by subtracting one, we calculate the weighted average of the normalized K/S ratio across available contracts using as weights the number of lots traded on each contract during the same period (V WKS, hereafter). V WKS

reflects the center of mass in the options volume distribution along strike prices of available contracts and takes on higher (lower) values when the trading volume is tilted more toward OTM (ITM) calls and ITM (OTM) puts.

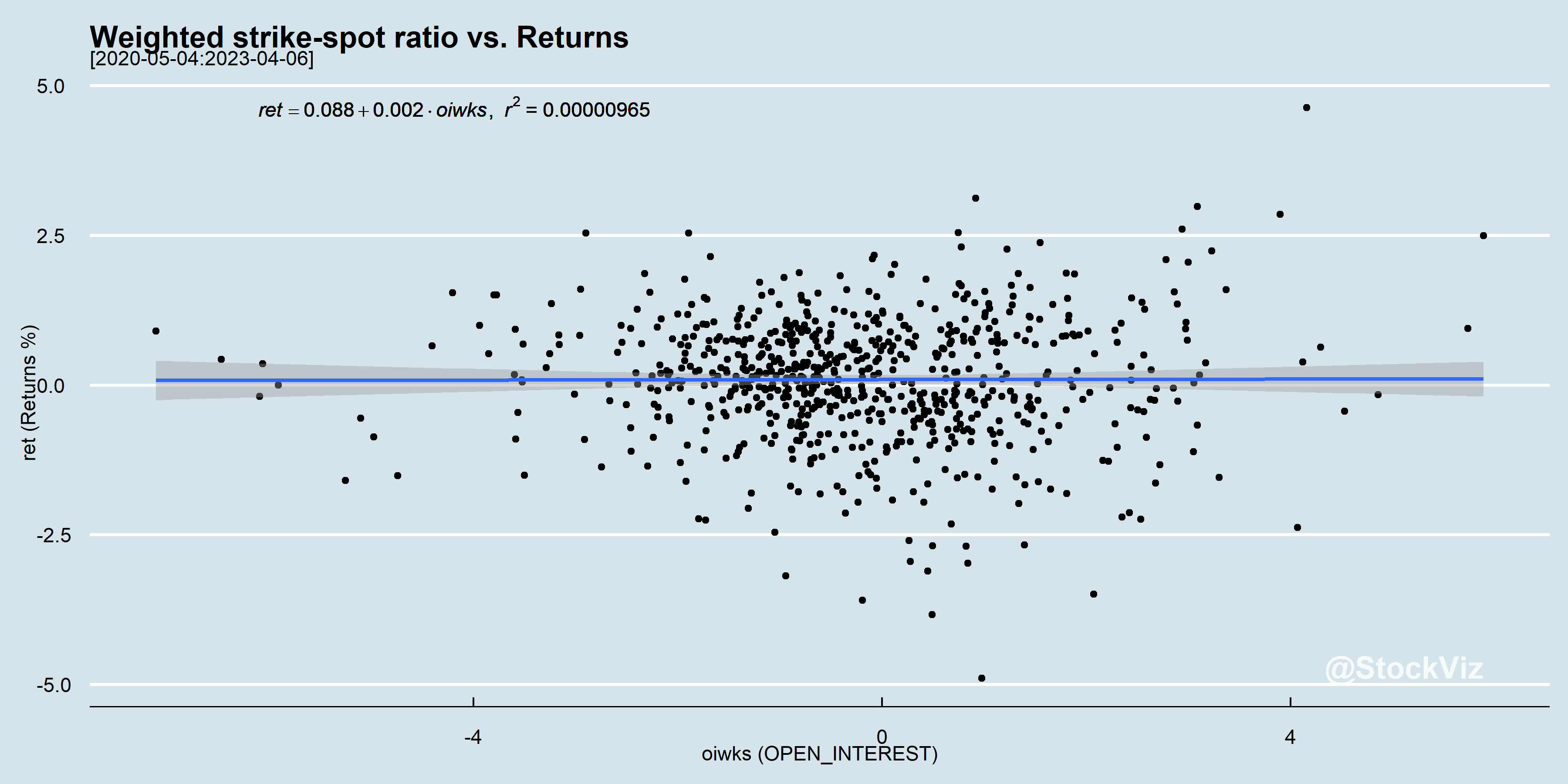

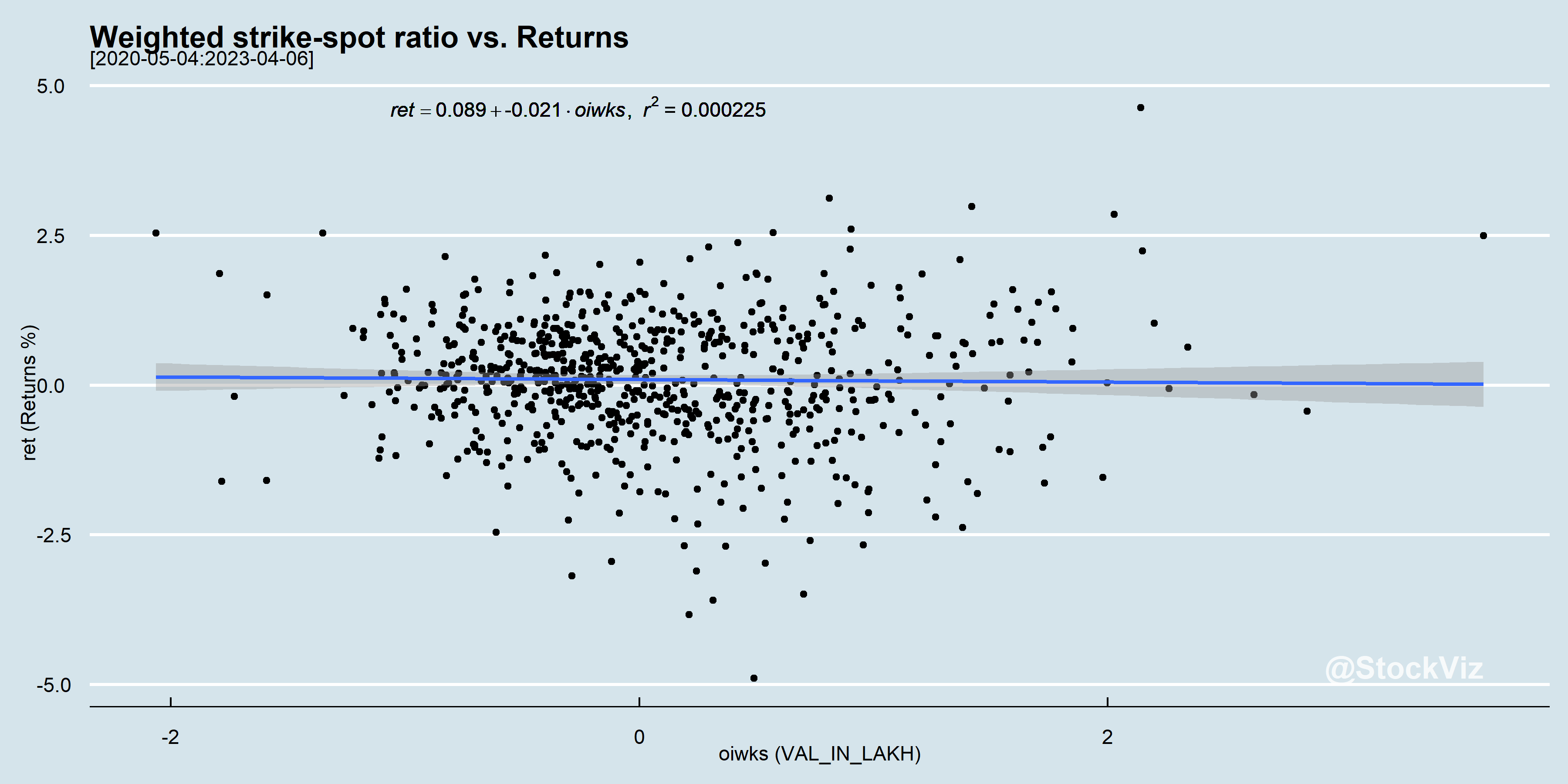

While their results look promising, we setup a very simple backtest to see if it can be used to trade the NIFTY. Sadly, both net Open Interest and Value traded fail to show any effect on next-day returns.

I guess this is one more for the #fail pile.

Code and charts are on github.