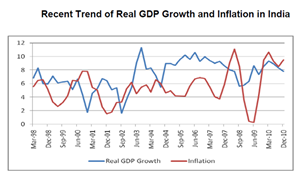

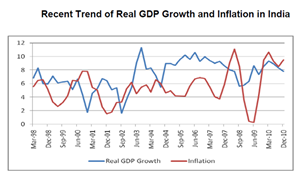

Inflation to India is what deflation is to Europe. The persistently high inflation since 2006, especially food prices, have raised serious structural economic concerns. It is no secret that RBI has failed miserably in controlling price pressure with its so-called interest rate hikes. While RBI has lost its face, the common man has lost his ‘weight’.

Several factors like capital stock deficiency, demand-side drivers, import price pressures, embedded inflation expectations, weak monsoon, etc have played their part at various intervals to keep food prices elevated for an elongated period of time.

For the second month in a row, consumer price inflation- a more realistic cost-of-living index as it captures retail prices- remained at double-digit level in May.

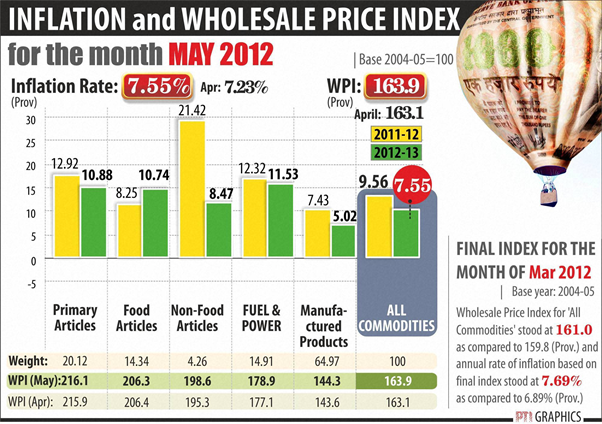

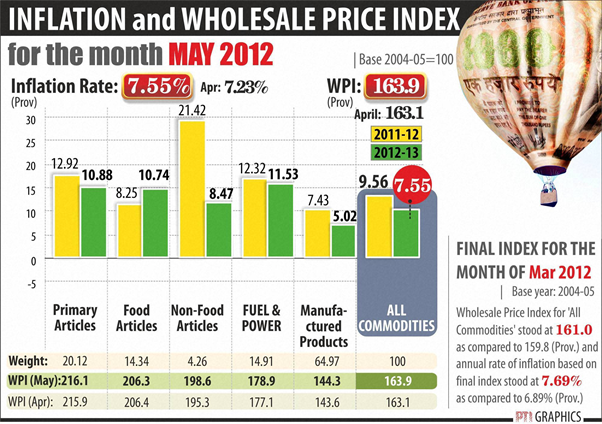

Retail inflation rose 10.36% in May, marginally up from 10.26% in April. In cities, it was even higher at 11.52%, compared to 9.57% in rural India. The Wholesale Price Index (WPI)-based inflation in May stood at 7.55%.

The reason why RBI’s monetary tool has been ineffectual in taming inflation is because the current food price-driven inflation is fuelled by supply side constraints rather than just aggregate demand.

The reason why RBI’s monetary tool has been ineffectual in taming inflation is because the current food price-driven inflation is fuelled by supply side constraints rather than just aggregate demand.

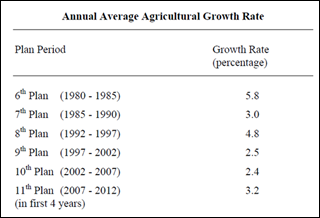

Although current year production of cereals has been very strong, food inflation is still in double-digits as food consumption patterns have changed with the populace moving towards high protein food like milk, eggs fish, vegetables from cereals. While measures like centrally-sponsored welfare schemes, high subsidies, sixth pay commission wage hike, etc have boosted disposable income and created demand for goods and services, the government has been unable to increase supply to meet the rising demand. Inadequate infrastructure and lack of manufacturing capacity and poor stock management has meant grains continue to rot while humans go hungry.

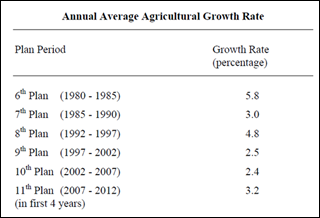

Instead of rooting for repo rate cuts, Pranab and co would do well to increase agricultural output and productivity to alleviate pressures on food prices. These would include a focus on technology, improved supply chain, water management, rural infrastructure, agricultural diversification, and private sector investment in marketing and agro industry. Reducing farm subsidies and raising productivity is needed to reform the agriculture sector.

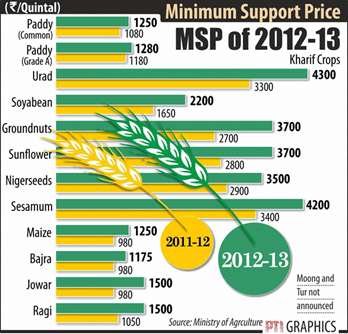

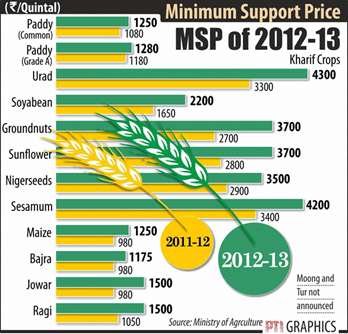

Sustained wage pressure (thanks to MGNREGS, the government’s flagship employment programme and higher crop MSPs) has kept food price inflation high even in years of record food production as was the case in 2010-11.

Import price pressures have also been a crucial factor for overall inflation. Inadequate pass-through of international crude oil prices has failed to curb wasteful consumption leading to a high degree of suppressed inflation. Any rise in global commodity prices will put upward pressure on prices in India.

Import price pressures have also been a crucial factor for overall inflation. Inadequate pass-through of international crude oil prices has failed to curb wasteful consumption leading to a high degree of suppressed inflation. Any rise in global commodity prices will put upward pressure on prices in India.

Recent RBI survey pattern reveals high inflation expectations among Indian households. Since food price hikes are driven by supply-side shocks, it has led to speculative behaviour by traders, thus feeding into high inflation expectations. The onion crisis in late-2010 is a stark example of this.

Also, the steep hike in minimum support prices (MSP) of various kharif crops last week and in the last five years have added to the structural uptrend in food price inflation and complicated RBI’s job. The sharp MSP hike, at a time of high inflation also shows the utter lack of policy co-ordination between the central bank and the government in achieving price stability.

Also, the steep hike in minimum support prices (MSP) of various kharif crops last week and in the last five years have added to the structural uptrend in food price inflation and complicated RBI’s job. The sharp MSP hike, at a time of high inflation also shows the utter lack of policy co-ordination between the central bank and the government in achieving price stability.

While hyperinflation may be a matter of history, India is in the midst of an inflationary spiral that threatens to push economy into further chaos.