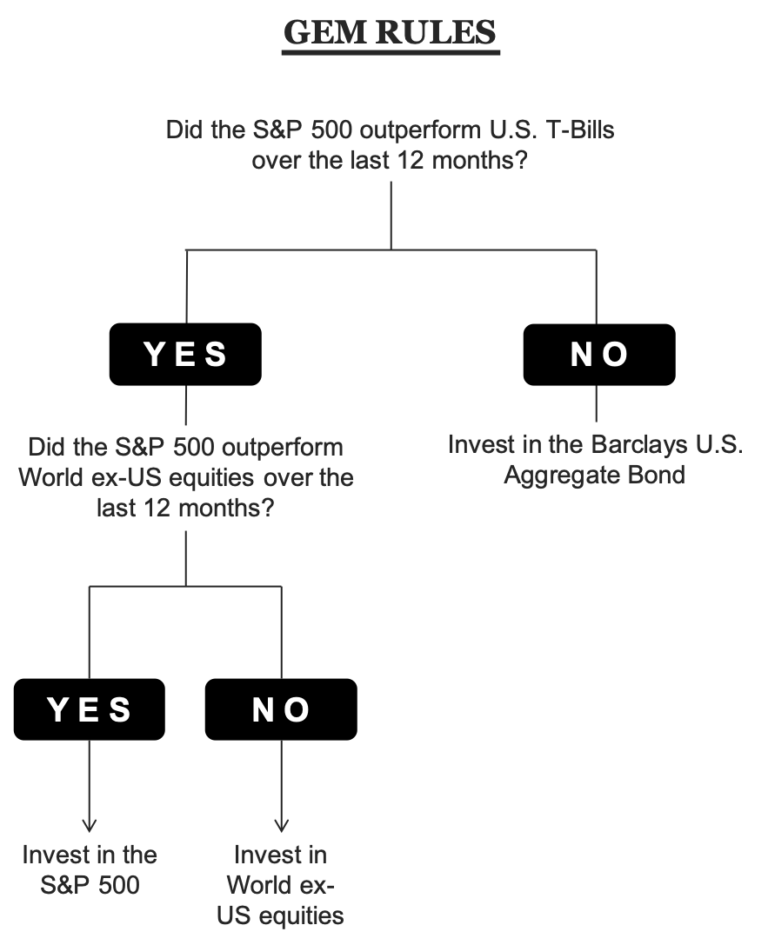

In our previous post on Global Equities Momentum, we explored how we could potentially replace the indices used in the GEM decision tree with their momentum counterparts to boost returns. Corey Hoffstein (@choffstein) pointed out that given the excess turnover of momentum strategies, measuring their trend maybe adding too much noise. Also, could using value indices, given their lower turnover, make more sense?

We setup the following backtest to fix the first problem and explore the second.

- We will use the S&P 500 index to make the first decision of the GEM model: Should we invest in equities or bonds?

- Once we get past #1, we will use different sets of indices to make the next one: USA or ex-USA? And trade the same.

- We will use the MSCI USA PRIME Value index to represent US Value and MSCI ACWI ex USA PRIME Value index and MSCI WORLD ex USA PRIME Value index, in turn, to represent international value.

USA/All World ex-USA Value GEM

USA/Developed World ex-USA Value GEM

- The GEM models both show vastly better returns and shallower drawdowns compared to buying and holding the underlying indices alone.

- There is not a lot of difference between the two GEM models.

- However, there are no equivalent ETFs for investors interested in implementing either of these GEM models.

In contrast, USA Momentum/MSCI World ex-USA Momentum:

Not only does the momentum GEM vastly outperform the value GEMs, it can be easily implemented with the MTUM and IMTM etfs.

Before jumping into any of these strategies, it is worth asking: Is this just data mining? How can we be sure that these backtests are statistically valid? By the same token, how can we be sure that even the dual-momentum model is robust? Gary Antonacci’s GEM backtest goes as far back as 1971 but we only have MSCI index data starting from 1995 or later. Besides, we are not sure if it is even possible to construct a reasonable momentum index going that far back. So, caveat emptor!

Code and more charts on github.