In our previous blog post on using SMAs to trade ETFs (SMA Strategies using ETFs,) we saw how using SMAs reduced drawdowns and boosted returns. We also saw how our Tactical Midcap 100 Theme out-performed mid-cap mutual funds even after taking into account STT and brokerage costs. Given the increased interest in our newly launched Tactical Midcap 150 Theme, we added transaction cost analysis to our backtests to give investors an idea of what gross and net returns of different SMA look-backs look like over buy and hold.

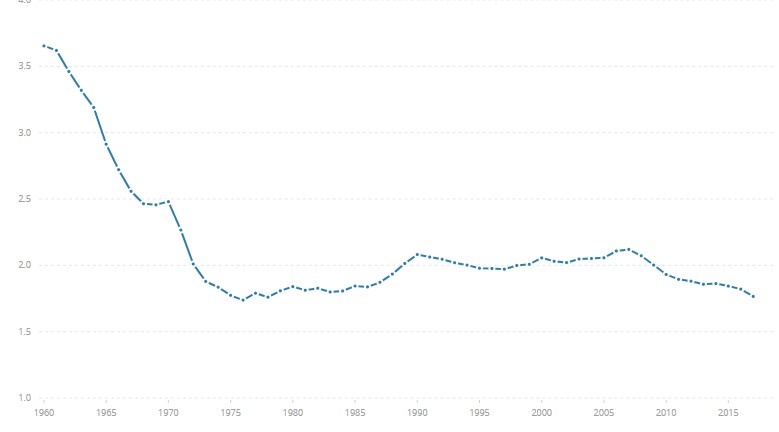

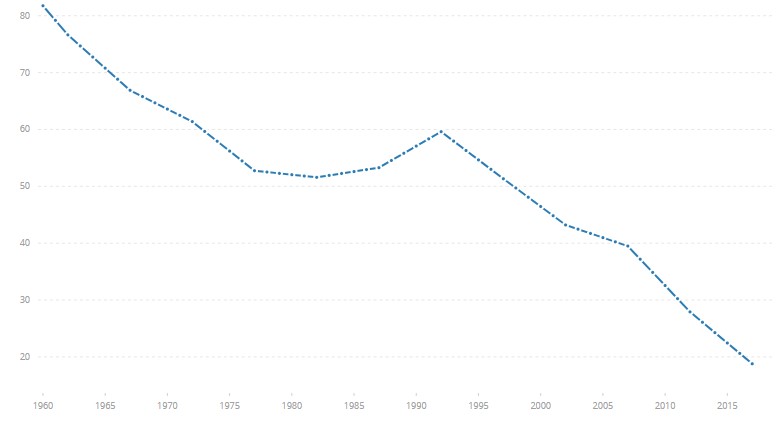

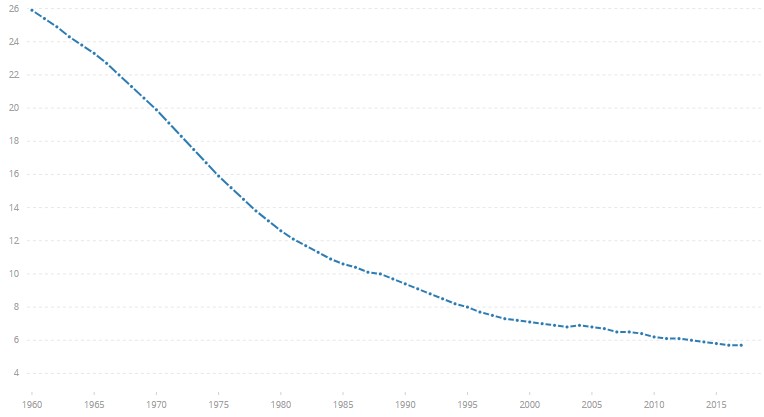

Annualized Returns

Take-away

1) SMA strategies on the NIFTY 50 index do not produce excess returns over buy-and-hold. However, the 200-day SMA did keep an investor out of the worst of the 2008 drawdown at a reasonable cost.

2) For other indices, perhaps counter-intuitively, 20-day SMA beat 10-day SMA both in Gross and Net returns.

3) SMA strategies will under-perform buy-and-hold when markets are generally trending up. However, they will out-perform when markets turn negative.

The RETFMID150 ETF tracking the NIFTY MIDCAP 150 index, continues to be well traded on the NSE. You can access the SMA(20) strategy shown above through our Tactical Midcap 150 Theme.

Code and additional charts on github.