Corporate India’s worry lines do not simply end with high input costs, slackening demand, rising credit costs, and low business sentiment. Lured by buoyant share prices, companies went overboard with their fascination for Foreign Currency Convertible Bonds (FCCBs) and raised foreign capital to fund their expansion plans from 2005-06 to 2007-08 when the bubble was just about to burst.

Riding on their heady valuations, the conversion price on such bonds was set at a steep premium, about 25-150 per cent higher than the prevailing stock price at the time of issuance and they carried zero or very low coupons.

But the crash in stock prices post the 2008-financial crisis has caught many companies that opted for the FCCB route on the wrong foot.

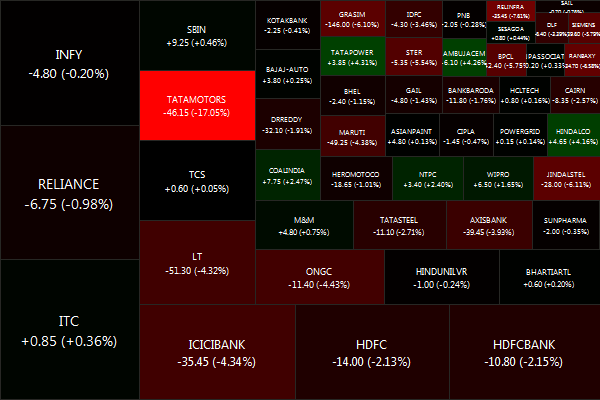

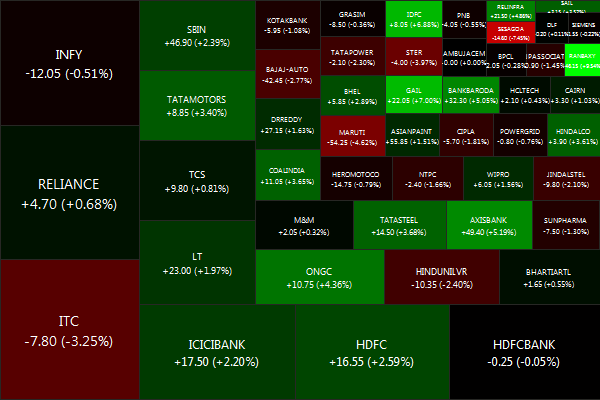

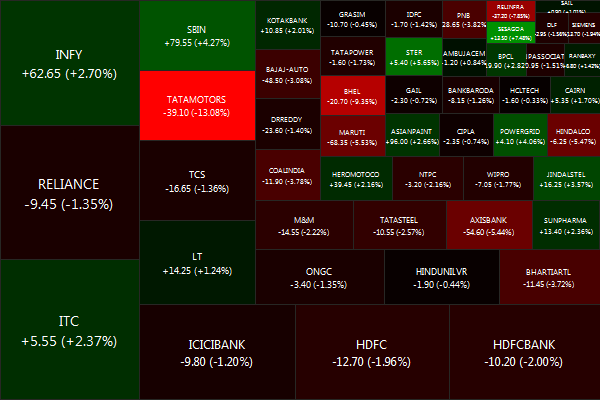

Although the benchmark indices have largely recovered and are about 20% below their 2008-highs, the share prices of companies with outstanding FCCBs are way below their peaks.

Although the benchmark indices have largely recovered and are about 20% below their 2008-highs, the share prices of companies with outstanding FCCBs are way below their peaks.

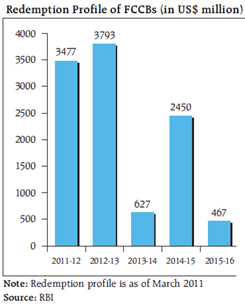

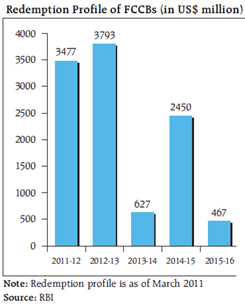

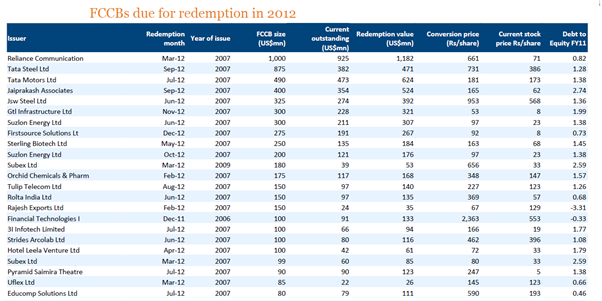

FCCBs worth more than US$ 7 billion is maturing by March 2013. With the first option of equity conversion knocked off, redemption pressure stares at issuers as they have to either buyback or repay the bond holders. Ratings agency CRISIL estimates that FCCBs worth Rs 220 – 240 billion may not get converted into equity shares as the current stock prices of issuing companies are significantly below their conversion price.

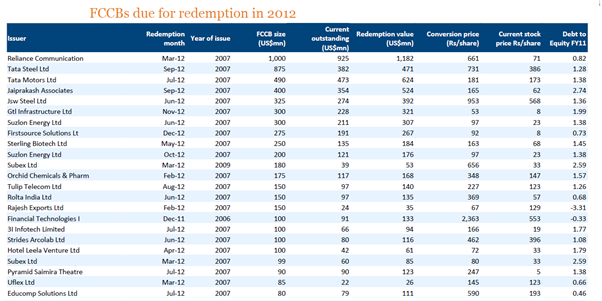

Take the case of Jaiprakash Associates [stockquote]JPASSOCIAT[/stockquote]. The Gaur-controlled entity issued FCCBs worth $400 million in Sept 2007, with the conversion price set at Rs 165 per share for bondholders. The stock is now quoting at Rs 64.00.

The same is the case with Tata Steel [stockquote]TATASTEEL[/stockquote], Suzlon [stockquote]SUZLON[/stockquote], RCom [stockquote]RCOM[/stockquote], Subex [stockquote]SUBEX[/stockquote], Educomp Solutions [stockquote]EDUCOMP[/stockquote], GTL Infra [stockquote]GTL[/stockquote] and others. RCom escaped the noose by tapping Chinese banks for refinancing its $1.18-bn FCCBs that were due on March 1, 2012. Suzlon, whose shares have lost about 60 percent in the last one year, is also in talks to raise $300 mn to refinance its FCCBs maturing on June 12.

Suzlon is currently trading at Rs 21.70 while the conversion price of its foreign currency bonds maturing this year are set at Rs 97, making them unattractive for bondholders to convert into shares.

If companies with low promoter holding opt for downward revision of the conversion price, it will only lead to further dilution of their equity stake and drag their share prices lower.

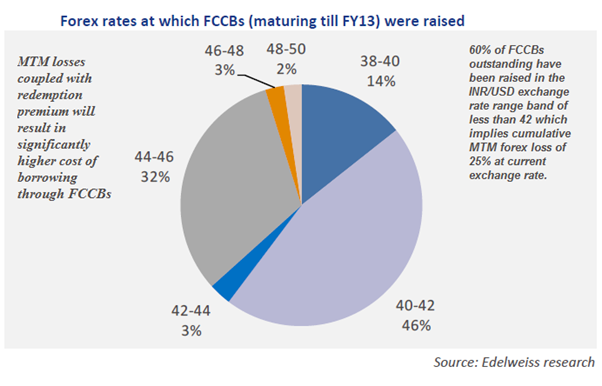

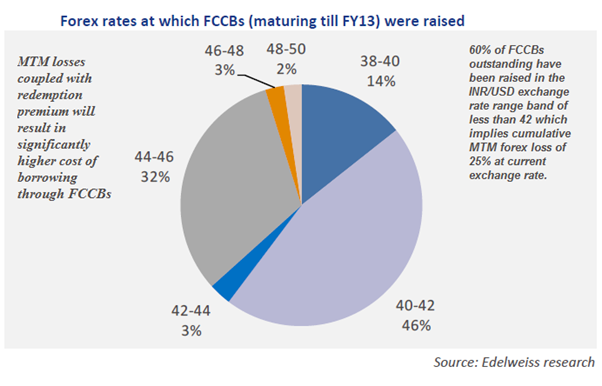

Moreover, the recent rupee fall has dealt a crude blow to companies. For example, a company would now need to pay an amount of about Rs 5,504 crore (based on current rupee value of Rs 55.04 per US dollar) towards the principal amount to a bondholder of $1 billion, while a similar loan amount would have been worth about Rs 4,400 crore at the start of 2010 when the rupee was quoted at Rs 44.

During these times of severe liquidity crunch, plummeting currency, highly leveraged balance sheets and tight cash flows, the upcoming redemptions can leave many companies paralyzed.

Unable to meet debt obligations or restructure terms of repayment with bondholders can lead to messy legal fights and winding up petitions as seen in the dispute between Wockhardt [stockquote]WOCKPHARMA[/stockquote] and its investors. The countdown has begun and the coming months will determine if India Inc can survive the redemption pressure or is another crisis looming?