Once the darling of the BRICs, India is now nothing more than a “gasping elephant” and is in danger of becoming the first ‘fallen angel’ among emerging economies.

Last week, Fraport AG, the world’s second-largest airport operator, said it plans to exit Delhi International Airport Ltd (DIAL) and will also shut its business development office in India due to lack of opportunities.

Contrast this with 2009 when the UPA won the elections with a decisive mandate, investors gave it a resounding thumbs up hoping that the new-found political stability would usher in a wave of reforms and revive investment climate.

Far from pushing the pedal to speed up reforms, the Manmohan Singh government has squandered the advantage it enjoyed by enmeshing itself in a series of scams, policy paralysis, ministerial tiffs, mismanagement of political events, fiscal profligacy, etc.

Far from pushing the pedal to speed up reforms, the Manmohan Singh government has squandered the advantage it enjoyed by enmeshing itself in a series of scams, policy paralysis, ministerial tiffs, mismanagement of political events, fiscal profligacy, etc.

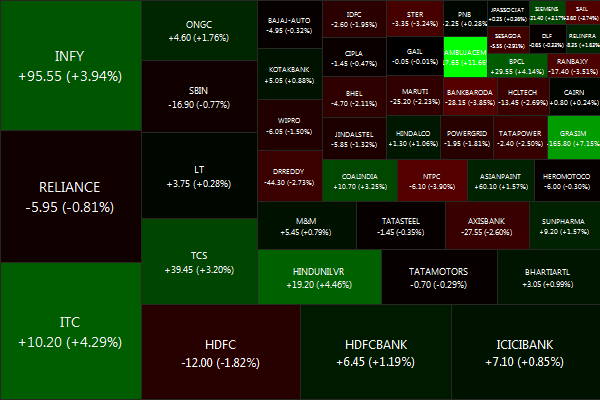

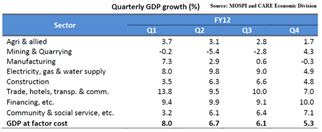

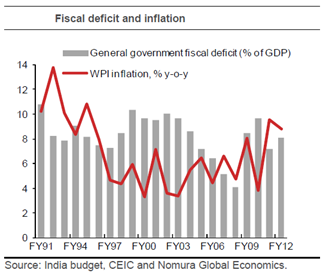

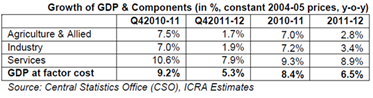

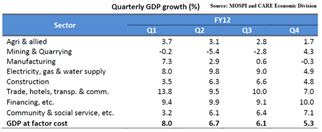

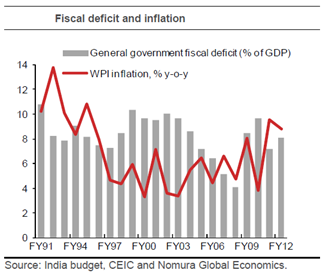

This has resulted in growth tumbling to a nine-year low in Jan-March quarter, fiscal slippages and inflation staying stubborn above 7% due to supply side bottlenecks, rendering monetary policy useless and hindering investments.

Adding to the gloom, global ratings agency S&P rubbed salt into the wounds of investors when it warned that it could downgrade India’s credit rating to junk due to slowing GDP growth and political roadblocks to economic policymaking.

The agency, in its report titled “Will India be the first BRIC fallen angel?”, said that the main reason behind the country’s political impediment to economic liberalization was the nature of the leadership within the Centre and not the allies supporting it or the “unhelpful” Opposition.

The agency, in its report titled “Will India be the first BRIC fallen angel?”, said that the main reason behind the country’s political impediment to economic liberalization was the nature of the leadership within the Centre and not the allies supporting it or the “unhelpful” Opposition.

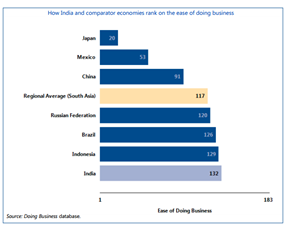

Apart from asking RBI to cut policy rates and make credit cheaper, Pranab and his economic battery of advisors have done little to steer the economy from its troubles. Given India’s external financing needs, augmenting foreign inflows are crucial.

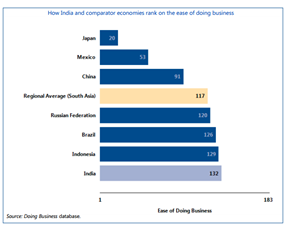

But the about-face in foreign direct investment policy for retail and insurance sectors coupled with uncertain regulatory actions like GAAR and retrospective amendments have scared foreign investors, drying up fund flows.

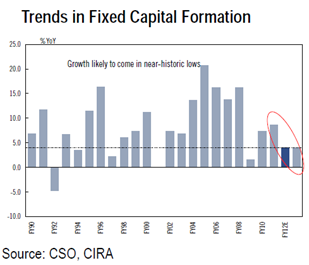

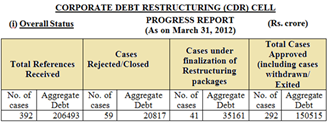

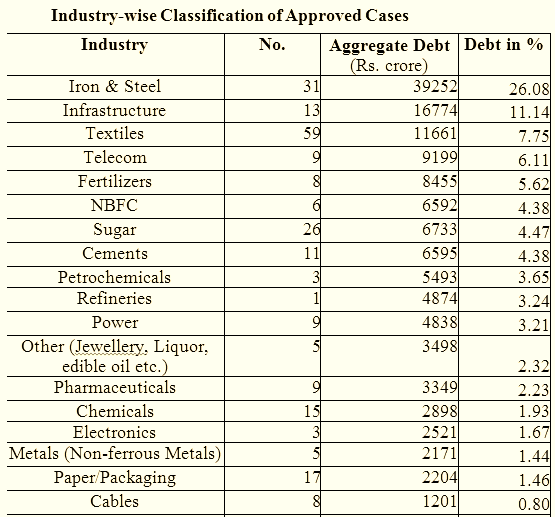

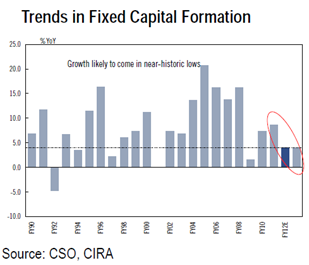

Infrastructure projects have missed deadlines due to policy hurdles/ inaction and power and coal shortages. Investment growth has decelerated sharply as rising interest rates and policy paralysis stifled gross fixed capital formation with trends slowing from the 17%YoY CAGR seen during FY04-08 to 4% y-o-y in FY12.

India’s problems are entirely self-inflicted as policy making has come to a standstill. Instead of setting its house in order by addressing power distribution losses, meeting infrastructure project deadlines and plugging the twin deficits, the government has taken the easy way out, i.e., blamed its ills on overseas problems like the sovereign debt crisis in Europe and a slowing US economy.

India’s problems are entirely self-inflicted as policy making has come to a standstill. Instead of setting its house in order by addressing power distribution losses, meeting infrastructure project deadlines and plugging the twin deficits, the government has taken the easy way out, i.e., blamed its ills on overseas problems like the sovereign debt crisis in Europe and a slowing US economy.

And now it is betting on lower oil prices and a normal monsoon to revive the economy. Failure on these coupled with a bad external shock and weak economic management could see growth falling to 4-5% levels, a ‘remote’ scenario that S&P feels is possible.

feels is possible.

Placating foreign investors by harping on long-term fundamentals and growth dynamics have run their course. Time has come to get rid of policy bottlenecks by addressing land acquisition and environmental clearance problems, policy and execution reforms, taking steps to enhance farm productivity, eliminating supply-side constraints, etc.

On the expenditure front, credible fiscal consolidation is needed. Failure to meet the projected 5.1% deficit target will damage India’s standing and deepen the crisis of confidence.

The writing on the wall is clear and there is no simple fix- it is either perform or perish.