Howard Marks of Oaktree Capital on risk:

You can read the whole thing here:

Invest Without Emotions

Howard Marks of Oaktree Capital on risk:

You can read the whole thing here:

| MINTs | |

|---|---|

| JCI(IDN) | +0.63% |

| INMEX(MEX) | +1.14% |

| NGSEINDX(NGA) | -0.48% |

| XU030(TUR) | +1.71% |

| BRICS | |

|---|---|

| IBOV(BRA) | +0.31% |

| SHCOMP(CHN) | +5.95% |

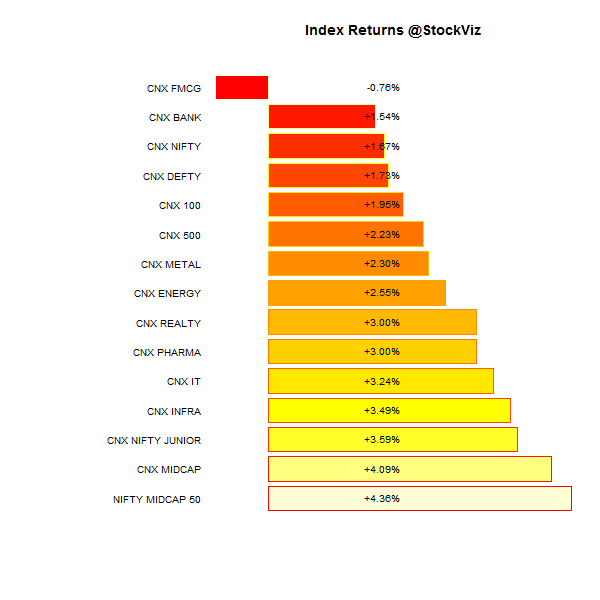

| NIFTY(IND) | +1.67% |

| INDEXCF(RUS) | +3.67% |

| TOP40(ZAF) | +1.20% |

| Energy | |

|---|---|

| Brent Crude Oil | -1.73% |

| Ethanol | -8.18% |

| Heating Oil | -0.90% |

| Natural Gas | -5.58% |

| RBOB Gasoline | -6.24% |

| WTI Crude Oil | -1.13% |

| Metals | |

|---|---|

| Copper | +0.96% |

| Gold 100oz | -1.59% |

| Palladium | -0.87% |

| Platinum | -1.15% |

| Silver 5000oz | -2.05% |

| MINTs | |

|---|---|

| USDIDR(IDN) | +0.50% |

| USDMXN(MEX) | -0.35% |

| USDNGN(NGA) | +0.12% |

| USDTRY(TUR) | -0.17% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -0.00% |

| USDCNY(CHN) | -0.04% |

| USDINR(IND) | -0.18% |

| USDRUB(RUS) | +0.87% |

| USDZAR(ZAF) | +0.59% |

| Agricultural | |

|---|---|

| Cattle | +3.42% |

| Cocoa | -3.62% |

| Coffee (Arabica) | +1.24% |

| Coffee (Robusta) | +1.28% |

| Corn | -4.01% |

| Cotton | -1.55% |

| Feeder Cattle | +3.42% |

| Lean Hogs | +10.34% |

| Lumber | -0.83% |

| Orange Juice | -0.73% |

| Soybean Meal | +1.53% |

| Soybeans | +0.98% |

| Sugar #11 | -3.65% |

| Wheat | -4.14% |

| White Sugar | -2.32% |

| Index | Change |

|---|---|

| Markit CDX EM | -0.35% |

| Markit CDX NA HY | -0.23% |

| Markit CDX NA IG | +0.85% |

| Markit CDX NA IG HVOL | +0.36% |

| Markit iTraxx Asia ex-Japan IG | -4.93% |

| Markit iTraxx Australia | -1.97% |

| Markit iTraxx Europe | +0.18% |

| Markit iTraxx Europe Crossover | -0.53% |

| Markit iTraxx Japan | -3.44% |

| Markit iTraxx SovX Western Europe | +0.00% |

| Markit LCDX (Loan CDS) | +0.00% |

| Markit MCDX (Municipal CDS) | +0.00% |

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | +1.33% | 67/71 |

| 2 | +4.14% | 73/64 |

| 3 | +3.09% | 75/62 |

| 4 | +4.68% | 72/65 |

| 5 | +4.56% | 72/64 |

| 6 | +4.59% | 79/59 |

| 7 | +3.92% | 77/60 |

| 8 | +3.25% | 70/67 |

| 9 | +3.46% | 67/70 |

| 10 (mega) | +2.07% | 70/68 |

| TATACHEM | +9.88% |

| CROMPGREAV | +11.91% |

| UPL | +19.68% |

| BHEL | -7.51% |

| MCDOWELL-N | -4.79% |

| CONCOR | -4.41% |

| JUNIORBEES | +2.89% |

| CPSEETF | +2.74% |

| INFRABEES | +2.59% |

| NIFTYBEES | +1.37% |

| BANKBEES | +1.30% |

| PSUBNKBEES | +0.18% |

| GOLDBEES | -1.66% |

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | +0.01 | +0.18% |

| GSEC SUB 1-3 | -0.10 | -0.15% |

| GSEC SUB 3-8 | +0.35 | -1.15% |

| GSEC SUB 8 | +0.23 | -1.42% |

Most investment policies today are Big Bets on world peace. The history of the 20th Century has shown that previously dominant empires can fall. In 1899, which was 15 years before the start of World War I, the Major Powers were:

Here’s the cumulative return of a dollar invested in Austro-Hungarian market:

Britain was a dominant global power at the dawn of the 20th Century. The real return on $1 invested in British equities in 1899 is $372. France returned $36 in the same period. The US? $1,248. And the US was still a promising emerging market country at that time (as was Argentina.)

If you wanted to project equity risk and return expectations, what figure would you use? The US 1,248 real return, the British 372 or the French 36 real return figure?

Source: The One Big Bet made by most buy-and-hold portfolios

The Nifty ended the month +3.02% (+2.63% in USD terms)

| MINTs | |

|---|---|

| JCI(IDN) | +0.94% |

| INMEX(MEX) | +5.16% |

| NGSEINDX(NGA) | -1.34% |

| XU030(TUR) | -2.68% |

| BRICS | |

|---|---|

| IBOV(BRA) | +9.81% |

| SHCOMP(CHN) | +0.71% |

| NIFTY(IND) | +3.02% |

| INDEXCF(RUS) | +1.97% |

| TOP40(ZAF) | -1.28% |

| Energy | |

|---|---|

| Brent Crude Oil | -2.83% |

| Ethanol | +4.96% |

| Heating Oil | -1.19% |

| Natural Gas | +5.86% |

| RBOB Gasoline | -7.51% |

| WTI Crude Oil | -2.81% |

| Metals | |

|---|---|

| Copper | -2.79% |

| Gold 100oz | +0.26% |

| Palladium | +3.93% |

| Platinum | -2.71% |

| Silver 5000oz | -5.83% |

| MINTs | |

|---|---|

| USDIDR(IDN) | +0.95% |

| USDMXN(MEX) | -1.04% |

| USDNGN(NGA) | +0.24% |

| USDTRY(TUR) | +0.99% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -1.29% |

| USDCNY(CHN) | -0.49% |

| USDINR(IND) | -0.07% |

| USDRUB(RUS) | +4.01% |

| USDZAR(ZAF) | -0.22% |

| Agricultural | |

|---|---|

| Cattle | -1.08% |

| Cocoa | +1.78% |

| Coffee (Arabica) | -0.89% |

| Coffee (Robusta) | -3.00% |

| Corn | +0.49% |

| Cotton | +8.76% |

| Feeder Cattle | -0.88% |

| Lean Hogs | -16.68% |

| Lumber | +7.11% |

| Orange Juice | +6.06% |

| Soybean Meal | +12.51% |

| Soybeans | -10.93% |

| Sugar #11 | -5.96% |

| Wheat | +4.01% |

| White Sugar | -3.31% |

| Index | Change |

|---|---|

| Markit CDX EM | -0.74% |

| Markit CDX NA HY | +0.63% |

| Markit CDX NA IG | -4.36% |

| Markit CDX NA IG HVOL | -9.19% |

| Markit iTraxx Asia ex-Japan IG | -3.92% |

| Markit iTraxx Australia | -1.64% |

| Markit iTraxx Europe | -5.20% |

| Markit iTraxx Europe Crossover | -16.58% |

| Markit iTraxx Japan | -1.29% |

| Markit iTraxx SovX Western Europe | -1.68% |

| Markit LCDX (Loan CDS) | -0.18% |

| Markit MCDX (Municipal CDS) | -5.31% |

| TATAMOTORS | +17.53% |

| M&MFIN | +18.72% |

| BPCL | +19.68% |

| RPOWER | -19.41% |

| JINDALSTEL | -15.21% |

| RCOM | -14.11% |

| JUNIORBEES | +3.75% |

| NIFTYBEES | +3.33% |

| BANKBEES | +3.21% |

| CPSEETF | +2.03% |

| PSUBNKBEES | +0.97% |

| INFRABEES | +0.12% |

| GOLDBEES | +0.06% |

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | +0.13 | +0.62% |

| GSEC SUB 1-3 | +0.10 | +0.32% |

| GSEC SUB 3-8 | -0.17 | +0.63% |

| GSEC SUB 8 | -0.17 | +0.37% |

| Industrial Value | +8.34% |

| Balance-sheet Strength | +7.66% |

| Quality to Price | +7.24% |

| Financial Strength Value | +6.64% |

| Market Elephants | +6.10% |

| Enterprise Yield | +6.02% |

| Growth with Moat | +5.96% |

| Momentum 200 | +5.39% |

| Efficient Growth | +4.71% |

| Long Term Equity* | +4.39% |

| Magic Formula Investing | +3.61% |

| IT 3rd Benchers | +2.89% |

| Refract: PPFAS Long Term Value Fund | +2.29% |

| Consistent10* | +0.05% |

| Market Fliers | -7.54% |

| ADAG Mania | -11.45% |

Some “truths” stick around long after they have been debunked simply because they get repeated often enough. For example, Malcolm Gladwell’s “10,000-hour rule”, spinach being a good source of iron, and the myth about “educating” the investor.

Take Ponzi schemes for instance. In the US, in the first six months of 2014, at least 37 Ponzi schemes were uncovered, with a total of more than $1 billion in potential losses. In India, people bought “Certificate of Goat Keeping” in a polled livestock breeding racket. And in spite of abundance of literature, investors continue to chase performance.

“Attempts to correct irrational investor behavior through education have proved to be futile. The belief that investors will make prudent decisions after education and disclosure has been totally discredited. Instead of teaching, financial professionals should look to implement practices that influence the investor’s focus and expectations in ways that lead to more prudent investment decisions.”

Source:

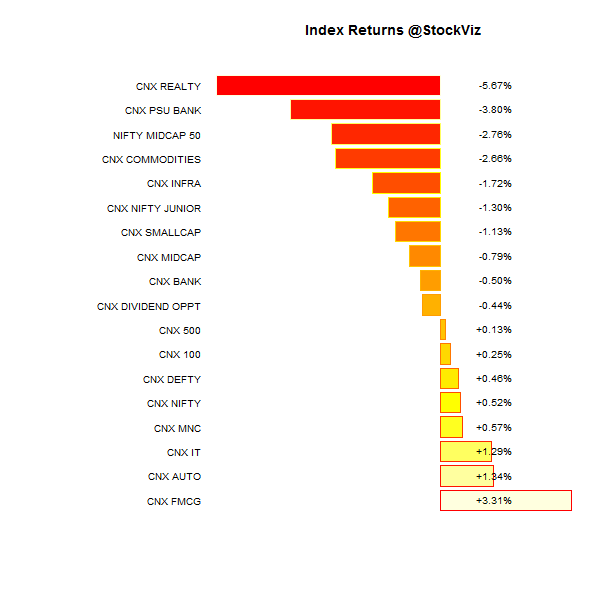

The Nifty ended the week +0.52% (+0.46% in USD terms.)

| MINTs | |

|---|---|

| JCI(IDN) | -1.19% |

| INMEX(MEX) | +1.21% |

| NGSEINDX(NGA) | -0.08% |

| XU030(TUR) | +1.92% |

| BRICS | |

|---|---|

| IBOV(BRA) | +5.11% |

| SHCOMP(CHN) | -1.05% |

| NIFTY(IND) | +0.52% |

| INDEXCF(RUS) | -2.85% |

| TOP40(ZAF) | -0.77% |

| Energy | |

|---|---|

| Brent Crude Oil | +0.94% |

| Ethanol | +1.57% |

| Heating Oil | +0.86% |

| Natural Gas | +6.38% |

| RBOB Gasoline | -4.09% |

| WTI Crude Oil | +2.51% |

| Metals | |

|---|---|

| Copper | -1.88% |

| Gold 100oz | +0.61% |

| Palladium | +2.14% |

| Platinum | +0.23% |

| Silver 5000oz | +0.00% |

| MINTs | |

|---|---|

| USDIDR(IDN) | +0.14% |

| USDMXN(MEX) | -0.37% |

| USDNGN(NGA) | +0.19% |

| USDTRY(TUR) | -0.64% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -2.02% |

| USDCNY(CHN) | -0.15% |

| USDINR(IND) | +0.07% |

| USDRUB(RUS) | +2.80% |

| USDZAR(ZAF) | -0.23% |

| Agricultural | |

|---|---|

| Cattle | +2.84% |

| Cocoa | -0.10% |

| Coffee (Arabica) | +7.11% |

| Coffee (Robusta) | +2.72% |

| Corn | -1.91% |

| Cotton | +0.58% |

| Feeder Cattle | +1.24% |

| Lean Hogs | +5.69% |

| Lumber | -0.54% |

| Orange Juice | +2.30% |

| Soybean Meal | +1.62% |

| Soybeans | -6.68% |

| Sugar #11 | -0.96% |

| Wheat | -0.27% |

| White Sugar | -0.73% |

| Index | Change |

|---|---|

| Markit CDX EM | -0.13% |

| Markit CDX NA HY | -0.02% |

| Markit CDX NA IG | -0.34% |

| Markit CDX NA IG HVOL | -1.60% |

| Markit iTraxx Asia ex-Japan IG | -1.81% |

| Markit iTraxx Australia | -0.53% |

| Markit iTraxx Europe | -2.39% |

| Markit iTraxx Europe Crossover | -15.19% |

| Markit iTraxx Japan | -1.89% |

| Markit iTraxx SovX Western Europe | -1.60% |

| Markit LCDX (Loan CDS) | +0.06% |

| Markit MCDX (Municipal CDS) | -4.63% |

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (micro) | -7.31% | 69/70 |

| 2 | -4.28% | 64/73 |

| 3 | -0.70% | 65/73 |

| 4 | -0.68% | 60/79 |

| 5 | -0.67% | 75/63 |

| 6 | -0.80% | 67/71 |

| 7 | -0.85% | 69/70 |

| 8 | -0.45% | 69/69 |

| 9 | -1.05% | 68/70 |

| 10 (mega) | +0.25% | 68/71 |

| GODREJCP | +6.11% |

| GSKCONS | +6.78% |

| BAJAJFINSV | +9.10% |

| JINDALSTEL | -20.86% |

| RPOWER | -13.36% |

| DLF | -8.96% |

| NIFTYBEES | +0.74% |

| INFRABEES | +0.42% |

| JUNIORBEES | -0.10% |

| GOLDBEES | -0.12% |

| BANKBEES | -0.22% |

| PSUBNKBEES | -2.08% |

| Financial Strength Value | +4.34% |

| Enterprise Yield | +2.04% |

| IT 3rd Benchers | +1.64% |

| Efficient Growth | +1.26% |

| Market Elephants | +0.96% |

| Momentum 200 | +0.86% |

| Growth with Moat | +0.59% |

| Long Term Equity* | +0.49% |

| Refract: PPFAS Long Term Value Fund | +0.40% |

| Balance-sheet Strength | +0.35% |

| CNX 100 50-Day Tactical | +0.32% |

| Magic Formula Investing | +0.30% |

| Quality to Price | +0.13% |

| Consistent10* | -0.34% |

| Industrial Value | -3.00% |

| Market Fliers | -4.14% |

| ADAG Mania | -7.54% |

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | +0.07 | +0.12% |

| GSEC SUB 1-3 | +0.07 | +0.15% |

| GSEC SUB 3-8 | -0.15 | +0.69% |

| GSEC SUB 8 | -0.11 | +0.95% |

New research throws doubt on the classical idea that people are driven by relentless and consistent pursuit of self-interest to maximise their well-being. Nobel laureate Daniel McFadden: “We are in fact challenged by choice and we use all kinds of ways such as procrastination to avoid having to make choices. One of the reasons is that there are risks associated with making choices.”

This would have happened to us more than once: you like a stock, but you don’t like its price. You come up with a level at which you would buy it and then… forget all about it. Never again!

You can now subscribe to price alerts for Indices, ETFs and stocks by clicking on the orange ‘Alert’ button on their pages.

You can manage your alerts by navigating to the ‘Alerts’ tab on your ‘Portfolio’ page. Make sure you check the ‘Notify me via PushBullet’ box.

Go to PushBullet.com and sign in with the same email address that you use for your StockViz account. And voila! Whenever your alerts are triggered, you will receive a notification on all the devices that you have PushBullet installed! Ain’t that cool!