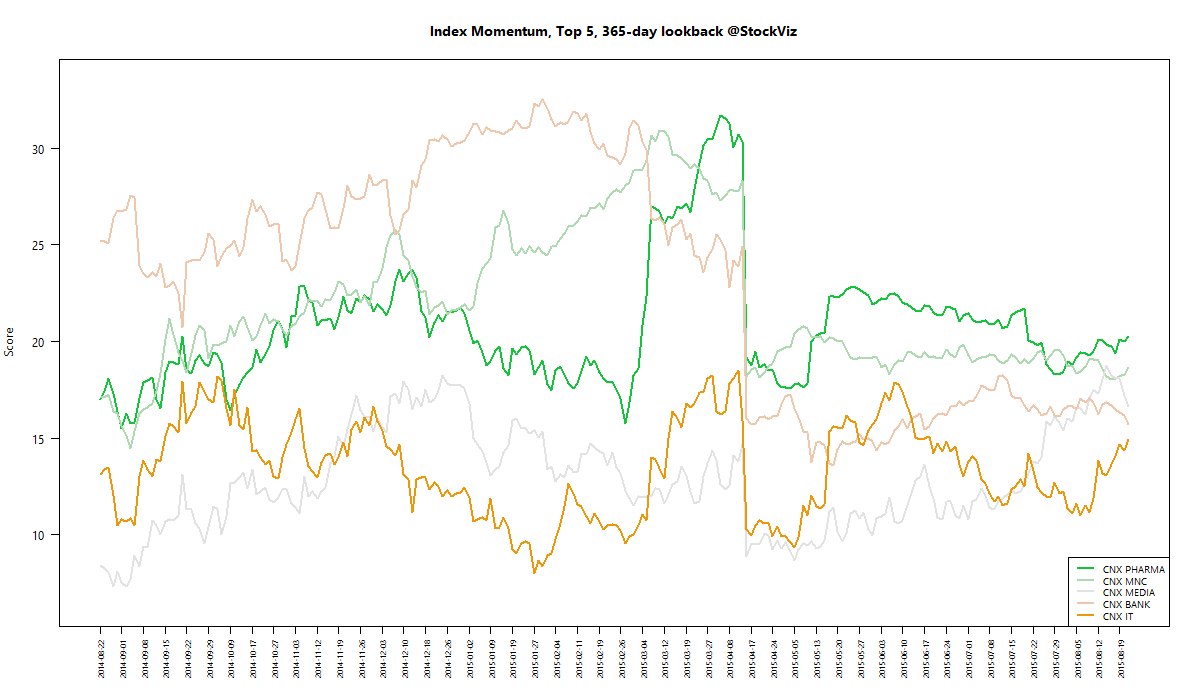

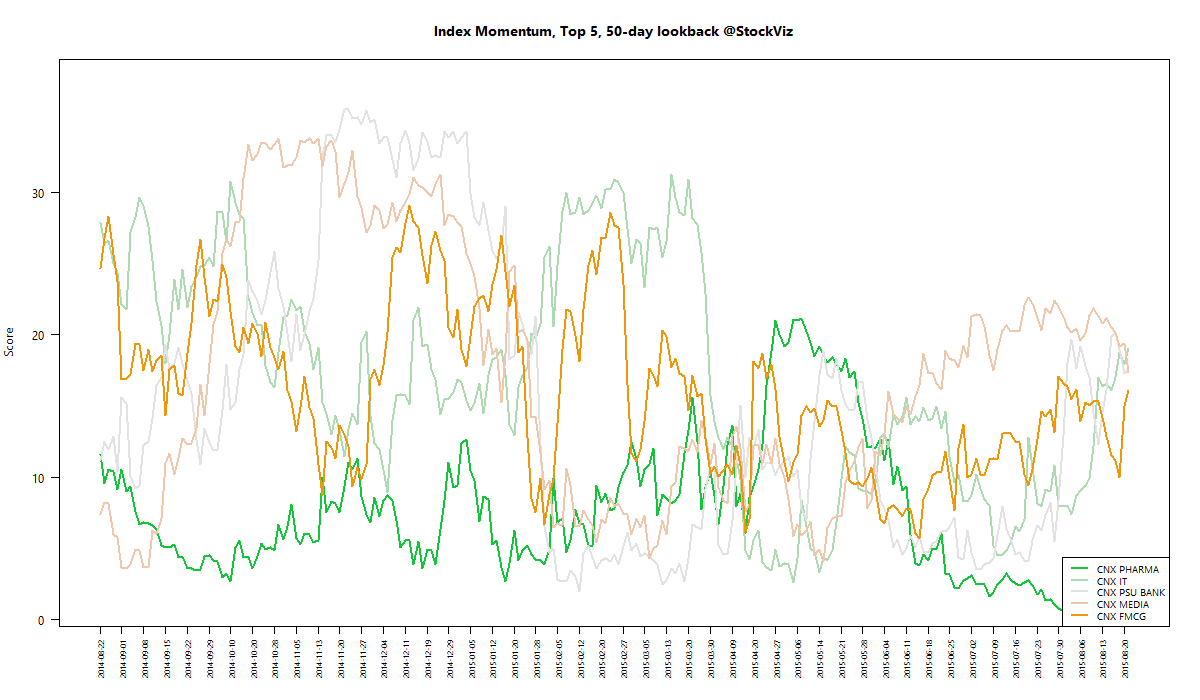

MOMENTUM

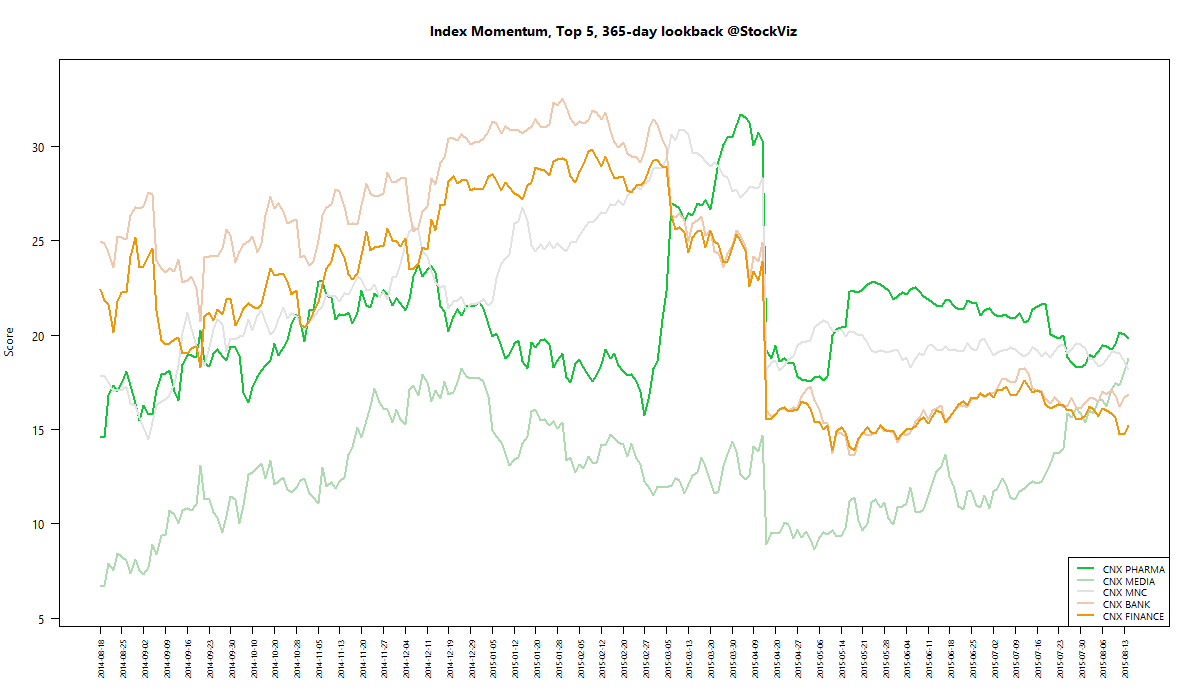

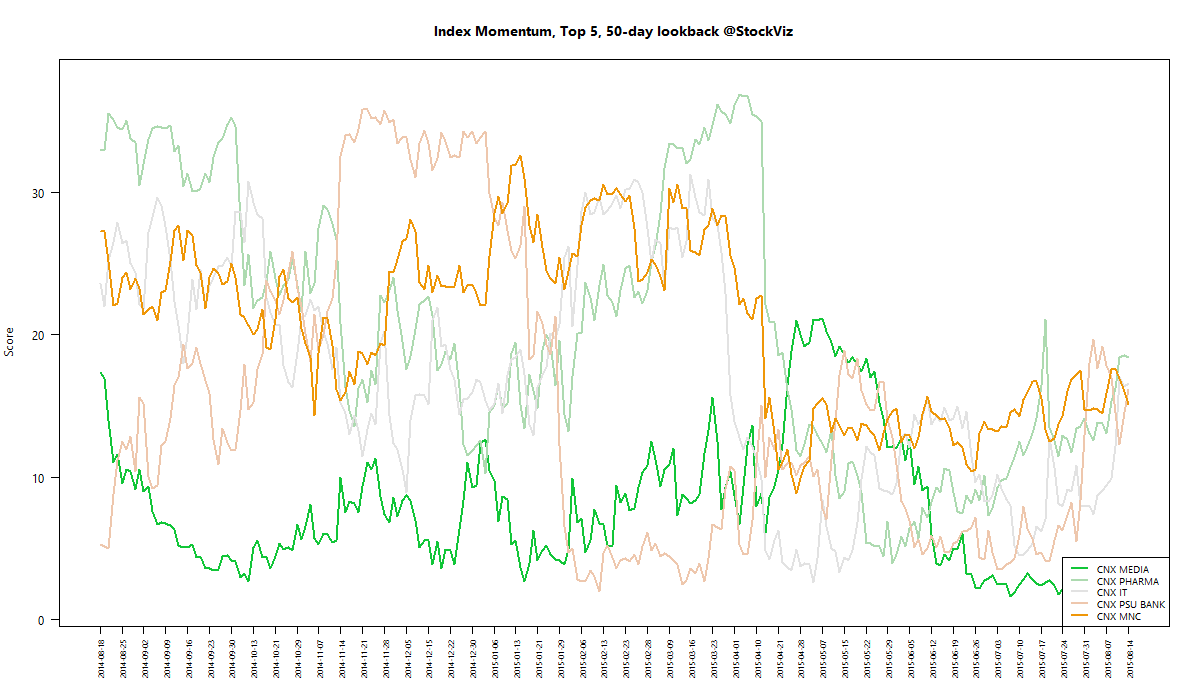

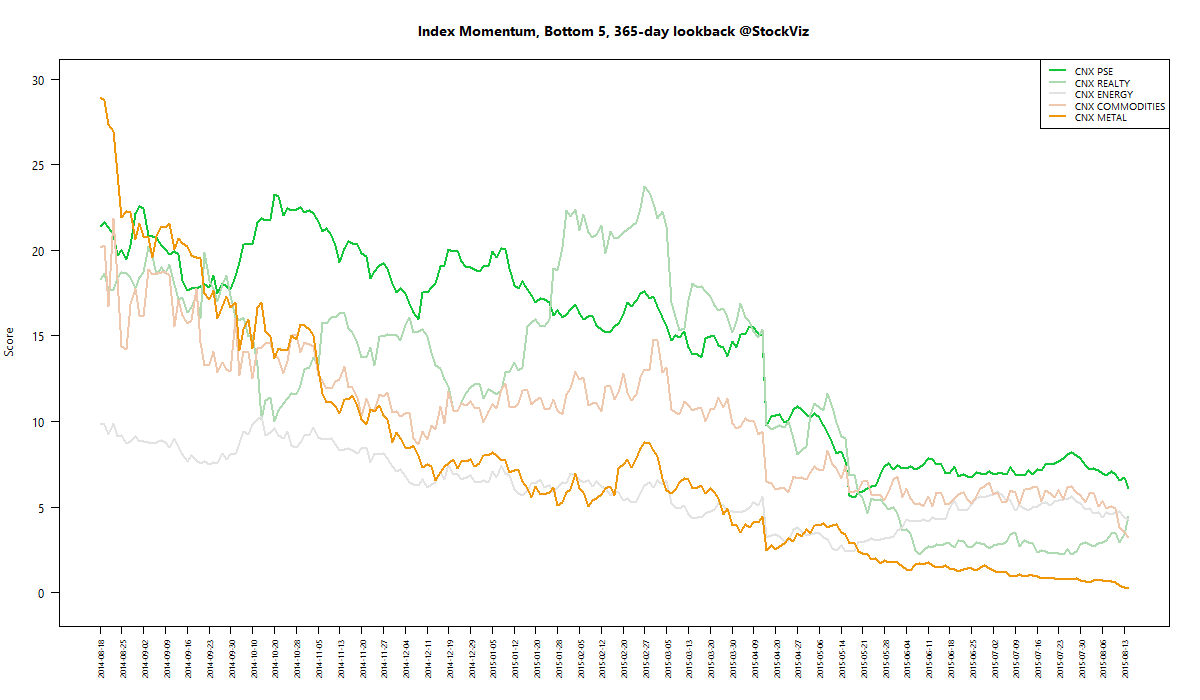

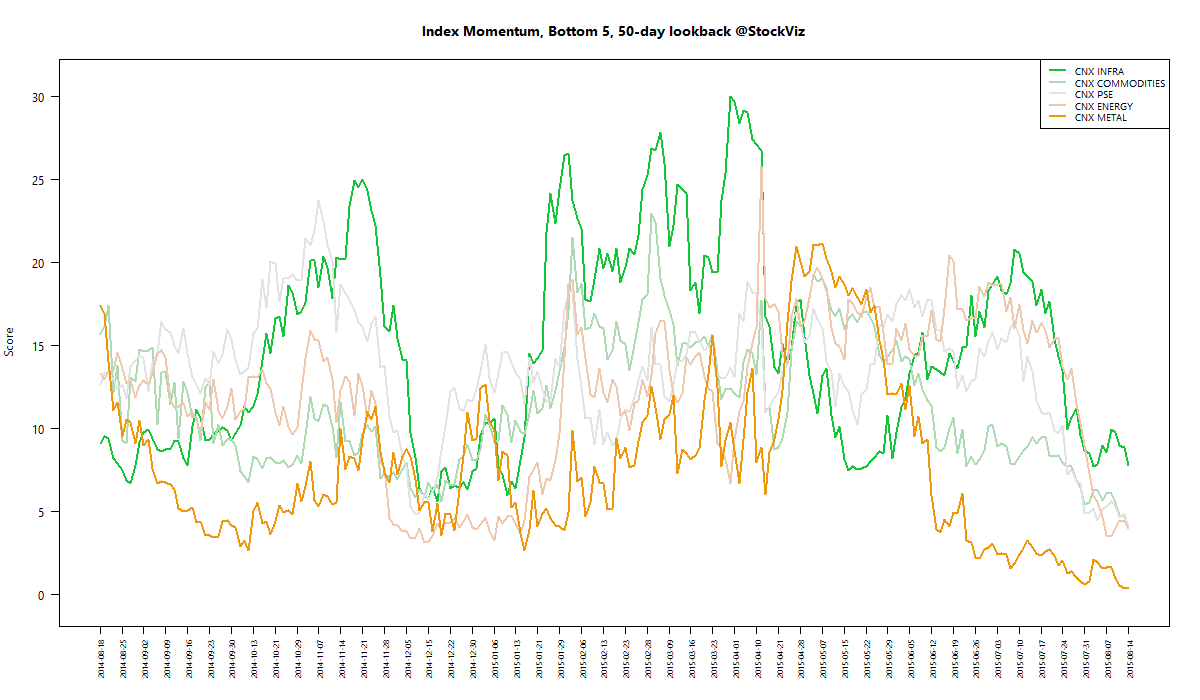

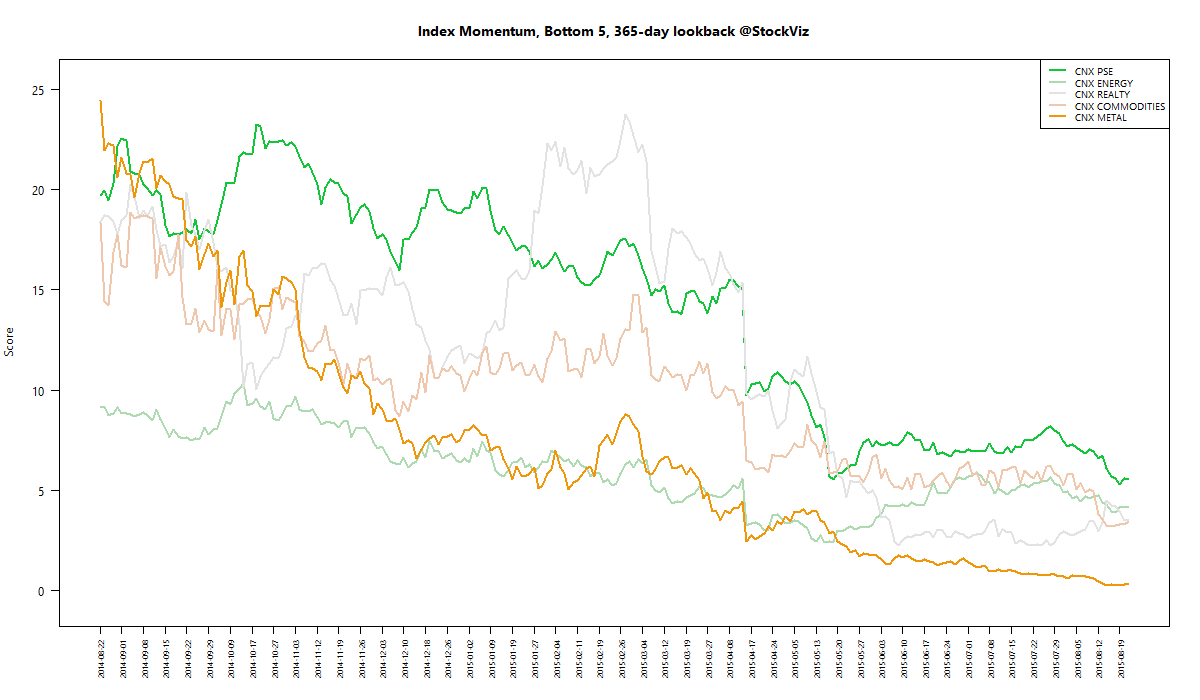

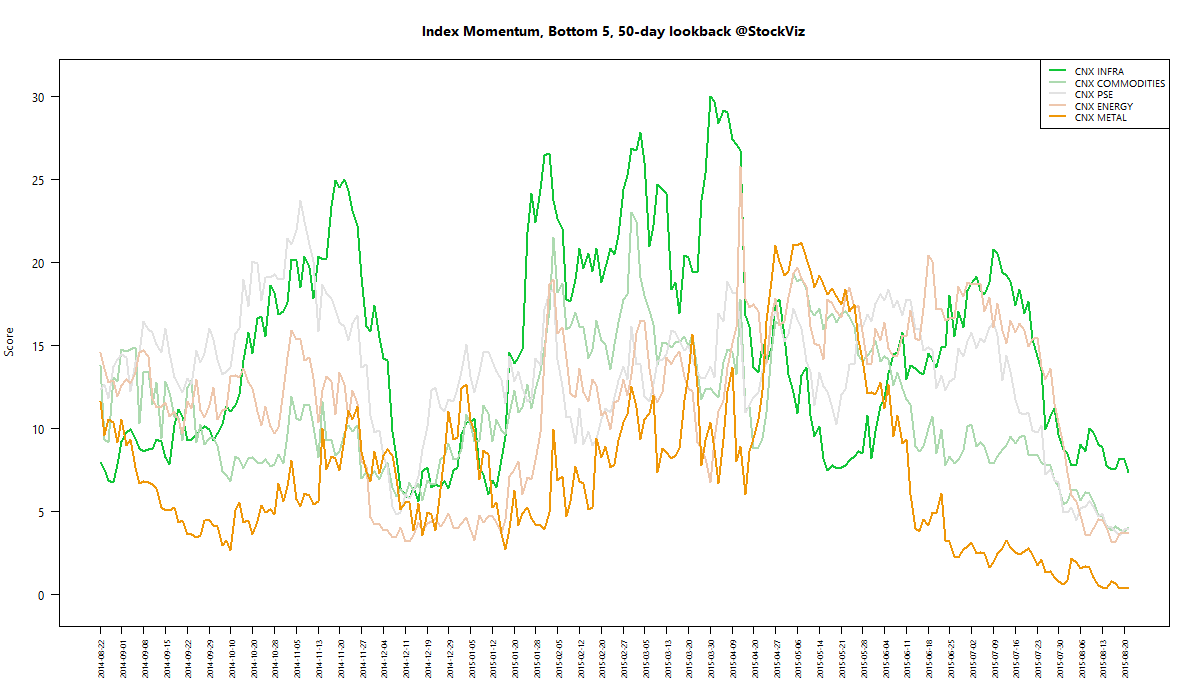

We run our proprietary momentum scoring algorithm on indices just like we do on stocks. You can use the momentum scores of sub-indices to get a sense for which sectors have the wind on their backs and those that are facing headwinds.

Traders can pick their longs in sectors with high short-term momentum and their shorts in sectors with low momentum. Investors can use the longer lookback scores to position themselves using our re-factored index Themes.

You can see how the momentum algorithm has performed on individual stocks here.

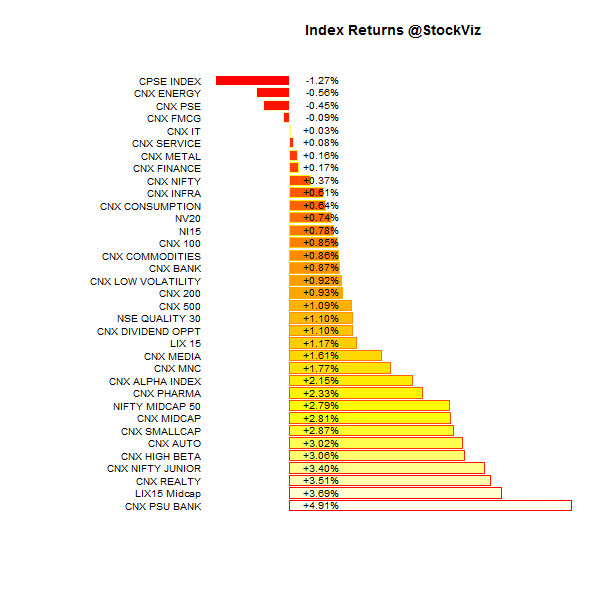

Here are the best and the worst sub-indices:

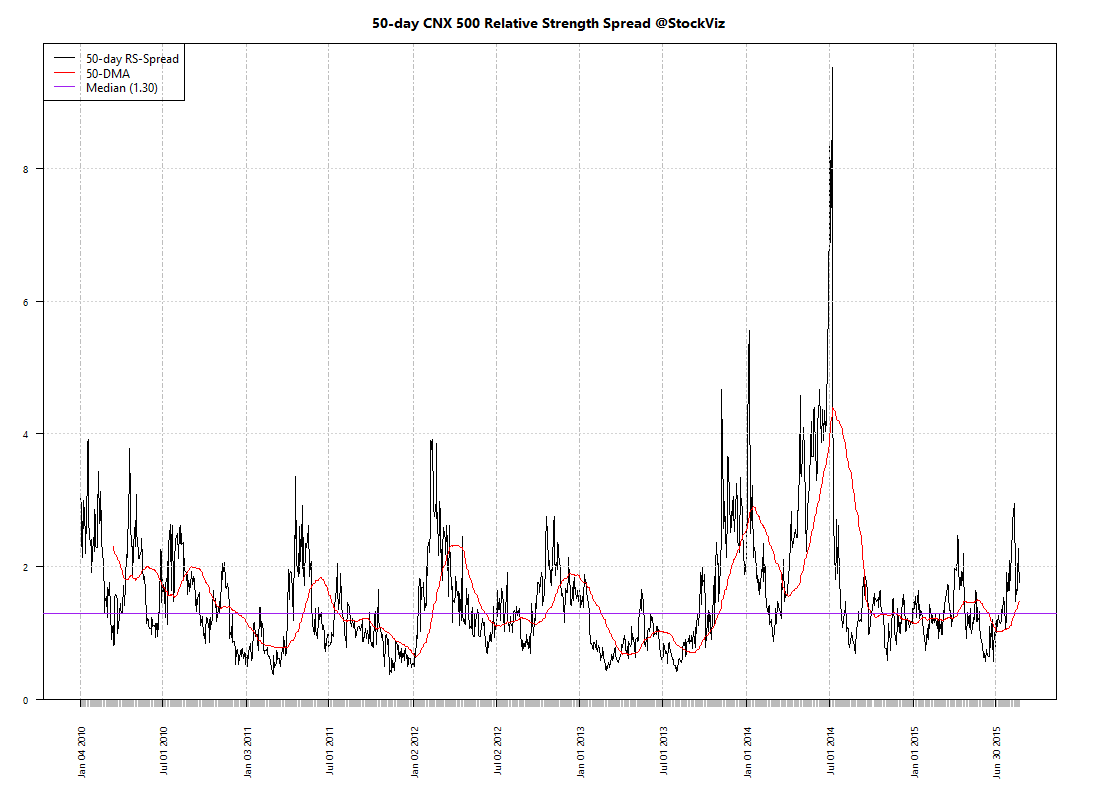

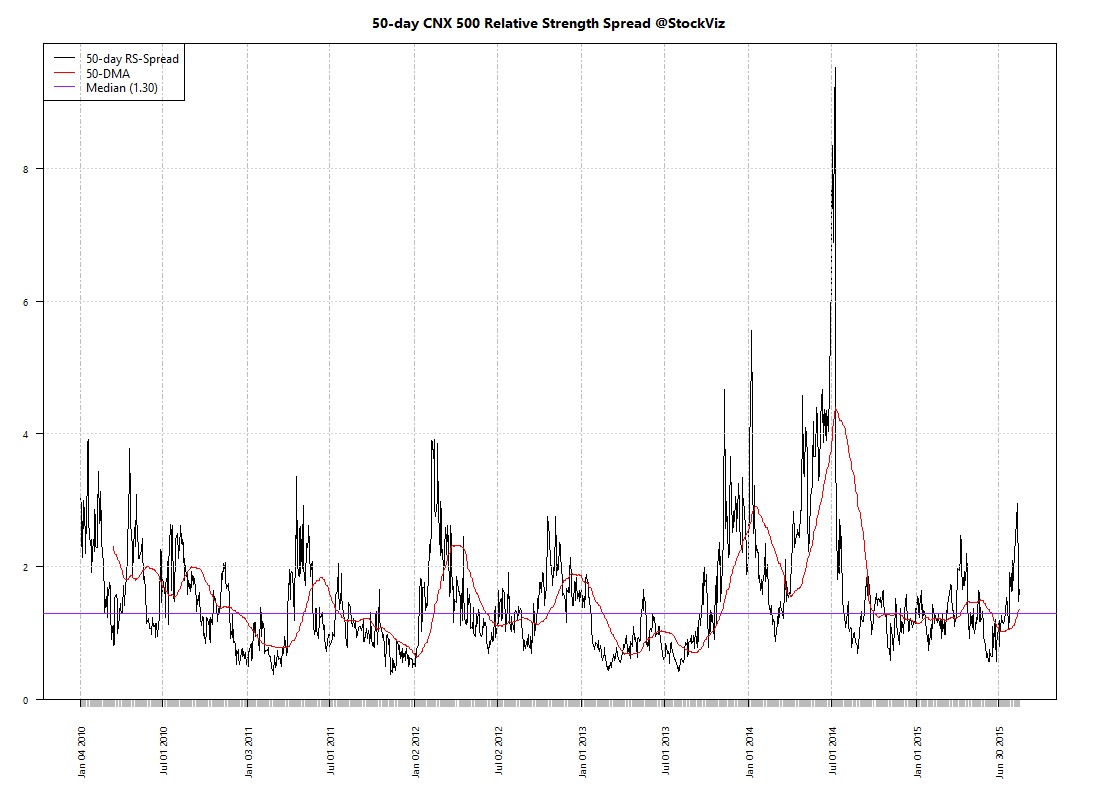

Relative Strength Spread

Refactored Index Performance

50-day performance, from June 15, 2015 through August 21, 2015:

Trend Model Summary

| Index | Signal | % From Peak | Day of Peak |

|---|---|---|---|

| CNX AUTO | SHORT |

7.89

|

2015-Jan-27

|

| CNX BANK | LONG |

12.15

|

2015-Jan-27

|

| CNX COMMODITIES | LONG |

34.50

|

2008-Jan-04

|

| CNX CONSUMPTION | SHORT |

3.78

|

2015-Aug-05

|

| CNX ENERGY | LONG |

33.41

|

2008-Jan-14

|

| CNX FMCG | SHORT |

7.13

|

2015-Feb-25

|

| CNX INFRA | LONG |

50.11

|

2008-Jan-09

|

| CNX IT | LONG |

87.40

|

2000-Feb-21

|

| CNX MEDIA | LONG |

20.08

|

2008-Jan-04

|

| CNX METAL | LONG |

66.83

|

2008-Jan-04

|

| CNX MNC | SHORT |

3.39

|

2015-Aug-10

|

| CNX NIFTY | SHORT |

7.74

|

2015-Mar-03

|

| CNX PHARMA | LONG |

2.61

|

2015-Apr-08

|

| CNX PSE | LONG |

31.90

|

2008-Jan-04

|

| CNX PSU BANK | SHORT |

35.02

|

2010-Nov-05

|

| CNX REALTY | SHORT |

91.14

|

2008-Jan-14

|

| CNX SERVICE | SHORT |

8.30

|

2015-Mar-03

|