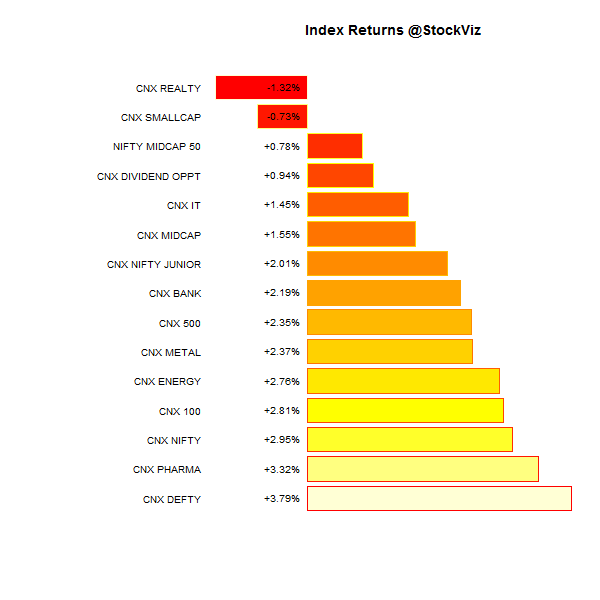

The Nifty ended the week +2.95% (+3.79% in USD terms.)

Equities

| MINTs | |

|---|---|

| JCI(IDN) | +1.88% |

| INMEX(MEX) | +1.51% |

| NGSEINDX(NGA) | -2.86% |

| XU030(TUR) | -3.83% |

| BRICS | |

|---|---|

| IBOV(BRA) | +2.39% |

| SHCOMP(CHN) | +1.47% |

| NIFTY(IND) | +2.95% |

| INDEXCF(RUS) | +5.27% |

| TOP40(ZAF) | +1.21% |

Commodities

| Energy | |

|---|---|

| Brent Crude Oil | -1.13% |

| Ethanol | +6.41% |

| Heating Oil | -0.97% |

| Natural Gas | -4.59% |

| RBOB Gasoline | -1.68% |

| WTI Crude Oil | -0.31% |

| Metals | |

|---|---|

| Copper | -2.21% |

| Gold 100oz | -0.35% |

| Palladium | +3.60% |

| Platinum | -1.31% |

| Silver 5000oz | -2.01% |

Currencies

| MINTs | |

|---|---|

| USDIDR(IDN) | -0.86% |

| USDMXN(MEX) | -1.25% |

| USDNGN(NGA) | -0.36% |

| USDTRY(TUR) | +1.02% |

| BRICS | |

|---|---|

| USDBRL(BRA) | -1.07% |

| USDCNY(CHN) | -0.15% |

| USDINR(IND) | -0.61% |

| USDRUB(RUS) | +0.00% |

| USDZAR(ZAF) | -0.62% |

| Agricultural | |

|---|---|

| Cattle | -1.08% |

| Cocoa | +2.47% |

| Coffee (Arabica) | +4.01% |

| Coffee (Robusta) | +0.10% |

| Corn | +3.91% |

| Cotton | -0.81% |

| Feeder Cattle | +1.05% |

| Lean Hogs | -16.80% |

| Lumber | +0.03% |

| Orange Juice | +4.40% |

| Soybean Meal | -2.39% |

| Soybeans | -14.24% |

| Sugar #11 | -1.30% |

| Wheat | +0.82% |

| White Sugar | -0.65% |

Credit Indices

| Index | Change |

|---|---|

| Markit CDX EM | +0.62% |

| Markit CDX NA HY | +0.94% |

| Markit CDX NA IG | -4.44% |

| Markit CDX NA IG HVOL | -4.23% |

| Markit iTraxx Asia ex-Japan IG | -5.10% |

| Markit iTraxx Australia | -1.06% |

| Markit iTraxx Europe | -3.07% |

| Markit iTraxx Europe Crossover | -11.24% |

| Markit iTraxx Japan | +1.25% |

| Markit iTraxx SovX Western Europe | -1.44% |

| Markit LCDX (Loan CDS) | -0.06% |

| Markit MCDX (Municipal CDS) | -2.73% |

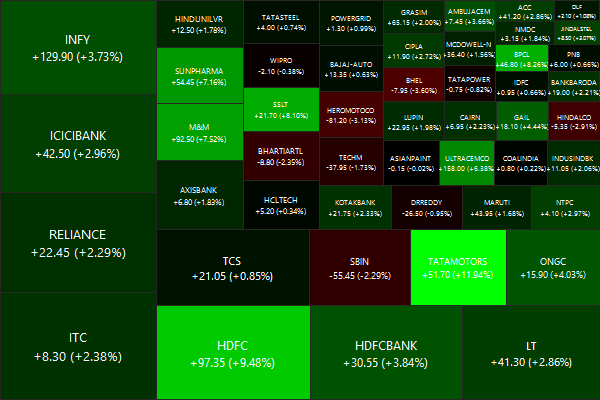

Nifty Heatmap

Index Returns

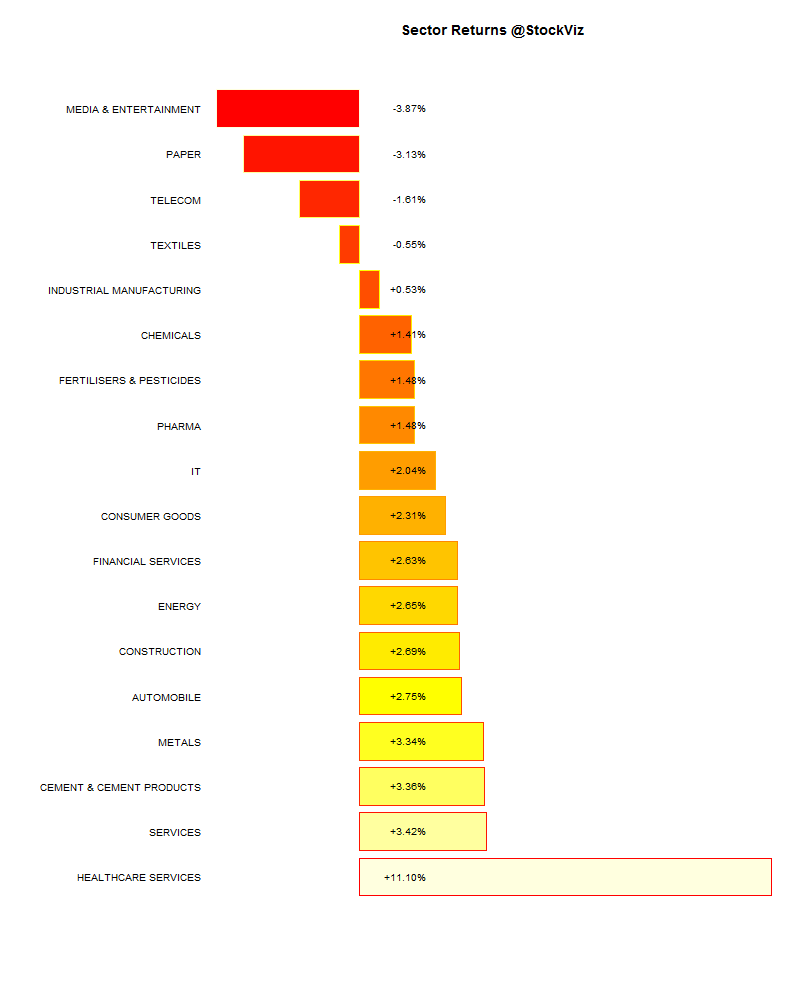

Sector Performance

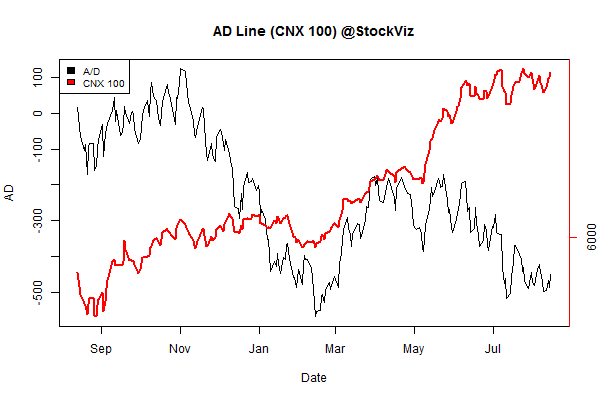

Advance Decline

Market cap decile performance

| Decile | Mkt. Cap. | Adv/Decl |

|---|---|---|

| 1 (small) | -4.44% | 73/61 |

| 2 | -4.14% | 60/74 |

| 3 | +0.07% | 64/69 |

| 4 | -0.04% | 65/69 |

| 5 | +0.03% | 64/68 |

| 6 | -0.93% | 63/72 |

| 7 | -0.34% | 68/65 |

| 8 | +0.13% | 66/67 |

| 9 | +0.67% | 65/69 |

| 10 (mega) | +2.85% | 65/69 |

Top winners and losers

| JSWSTEEL | +10.32% |

| APOLLOHOSP | +11.29% |

| TATAMOTORS | +11.94% |

| RCOM | -4.69% |

| BHEL | -3.60% |

| HEROMOTOCO | -3.13% |

ETFs

| NIFTYBEES | +2.64% |

| BANKBEES | +2.22% |

| INFRABEES | +0.45% |

| JUNIORBEES | -0.50% |

| GOLDBEES | -0.76% |

| PSUBNKBEES | -2.31% |

Investment Theme Performance

| Industrial Value | +2.16% |

| Enterprise Yield | +1.87% |

| Balance-sheet Strength | +1.74% |

| Growth with Moat | +1.39% |

| Consistent10* | +1.35% |

| Long Term Equity* | +1.26% |

| Efficient Growth | +1.25% |

| Magic Formula Investing | +1.24% |

| CNX 100 50-Day Tactical | +1.14% |

| IT 3rd Benchers | +0.36% |

| Financial Strength Value | +0.31% |

| Momentum 200 | -0.01% |

| Refract: PPFAS Long Term Value Fund | -0.01% |

| Quality to Price | -0.22% |

| Market Elephants | -0.22% |

| ADAG Mania | -1.13% |

| Market Fliers | -1.29% |

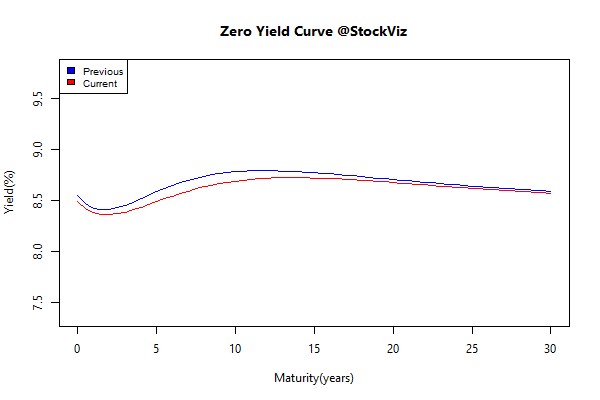

Yield Curve

Bond Indices

| Sub Index | Change in YTM | Total Return(%) |

|---|---|---|

| GSEC TB | +0.21 | +0.08% |

| GSEC SUB 1-3 | -0.02 | +0.32% |

| GSEC SUB 3-8 | -0.29 | +1.44% |

| GSEC SUB 8 | -0.27 | +1.95% |

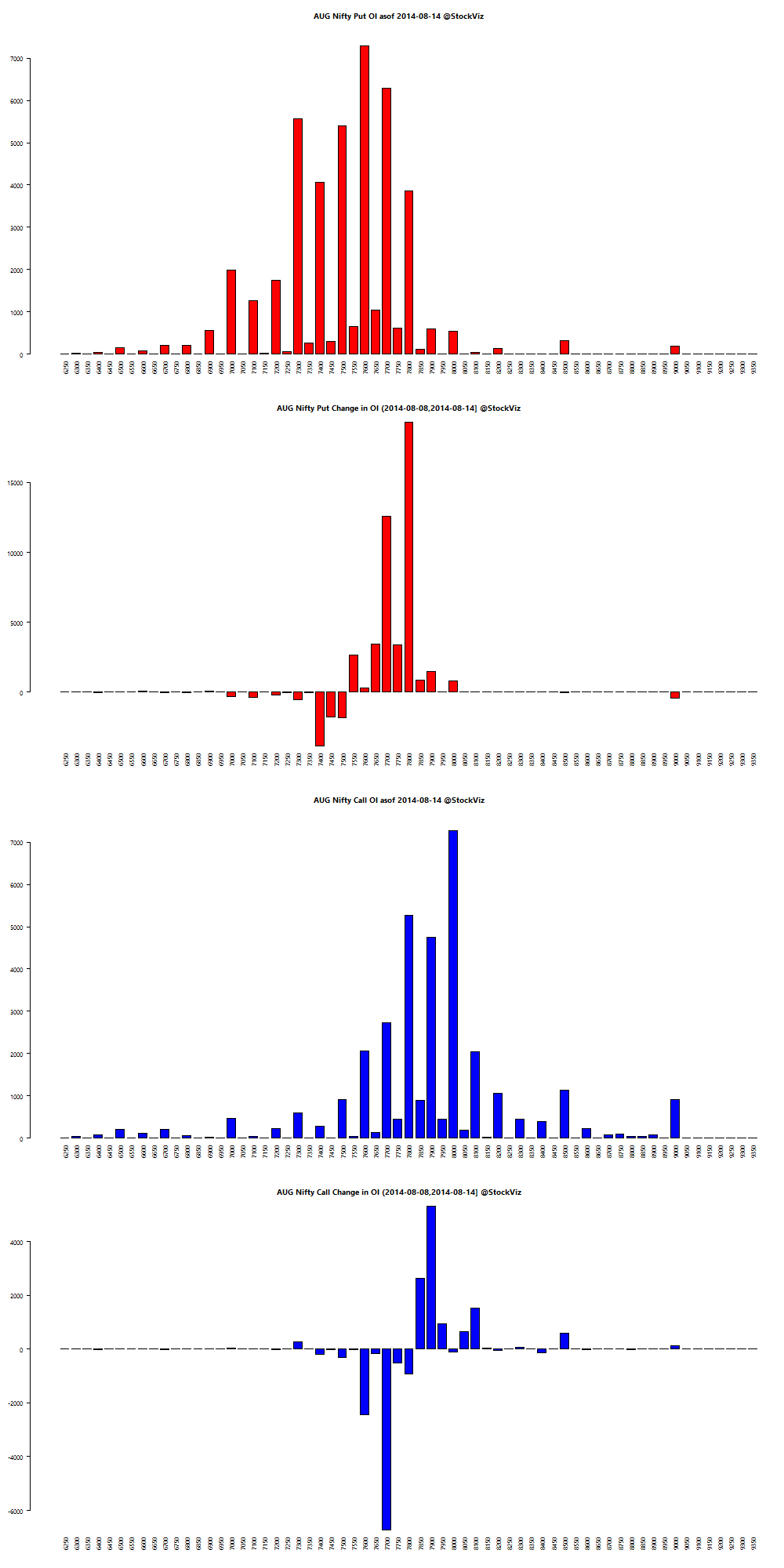

August Nifty OI

Both 7800 puts and 7900 calls were added.