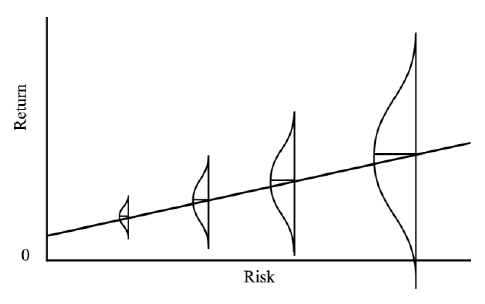

Read an interesting article in the FT by Tim Harford about forecasting. Was hit by a couple of “aha moments”.

First:

Keynes’s track record over a quarter century running the discretionary portfolio of King’s College Cambridge was excellent, outperforming market benchmarks by an average of six percentage points a year, an impressive margin.

The secret to Keynes’s profits is that he abandoned macroeconomic forecasting entirely. Instead, he sought out well-managed companies with strong dividend yields, and held on to them for the long term. Keynes, the most influential macroeconomist in history, realized not only that such forecasts were beyond his skill but that they were unnecessary.

And here’s the other gem:

Most forecasters aren’t actually seriously and single-mindedly trying to see into the future. If they were, they’d keep score and try to improve their predictions based on past errors. They don’t.

This is because their predictions are about the future only in the most superficial way. They are really advertisements, conversation pieces, declarations of tribal loyalty…

Read the whole thing: How to see into the future