Computers are great at repetitive number crunching, humans are great at intuition – StockViz now enables you to combine your intuition with StockViz’s proprietary option strategy algorithms for winning trades.

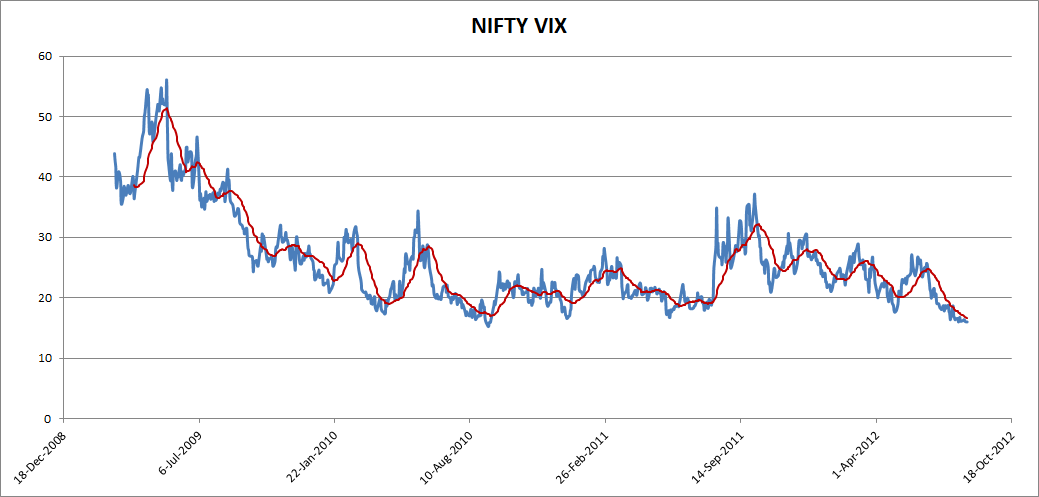

You may have read literature on the do’s and don’ts of option trading, like enter trades only when there’s sufficient liquidity, look-out for mean-reversion of implied volatility, choose between strangles and straddles, etc. But unless you are a programmer with access to live option pricing, you were pretty much at the mercy of broker calls to guide you through this process. But not any more!

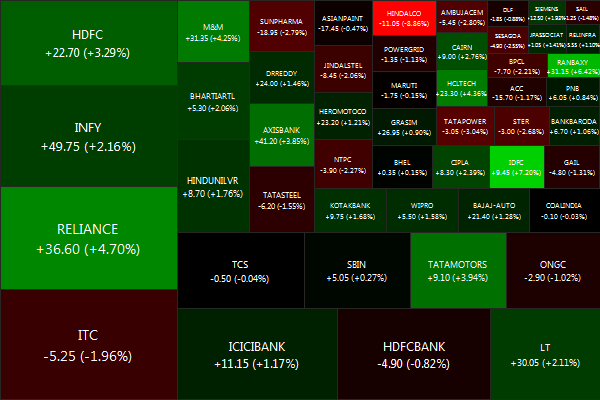

By using a combination of technical analysis on the underlying, liquidity filters, corporate action corrections and our proprietary relative-value model, we surface option strategies for you to trade. In essence, you get a fresh set of possible trades, every 30 minutes, that is algorithmically generated by crunching through the latest information available.

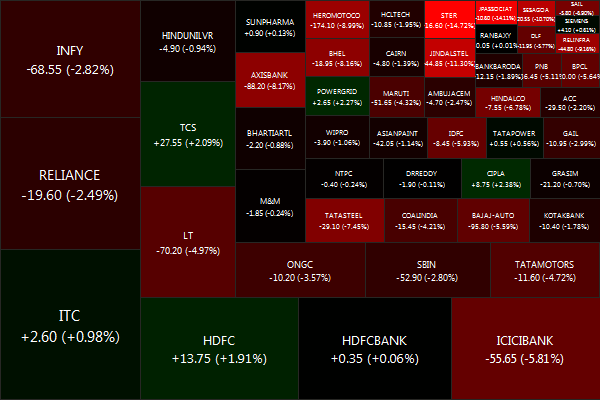

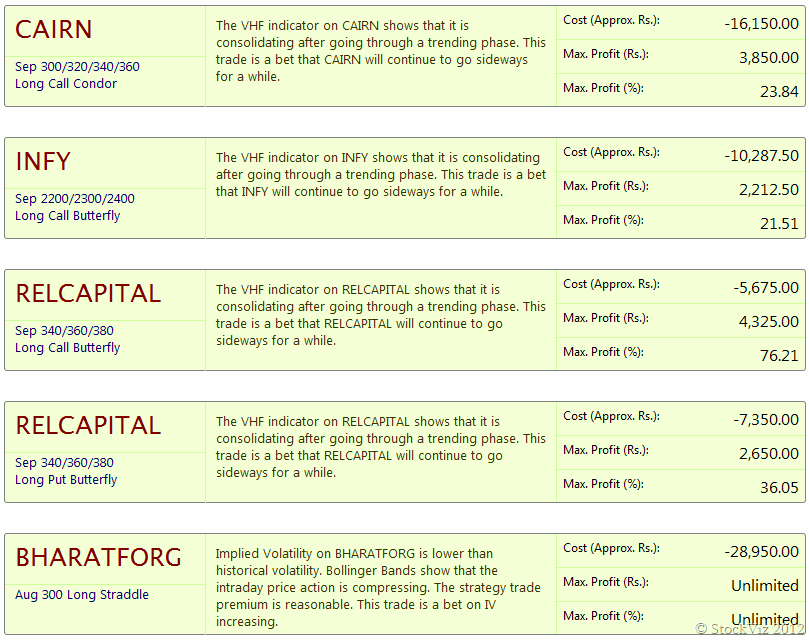

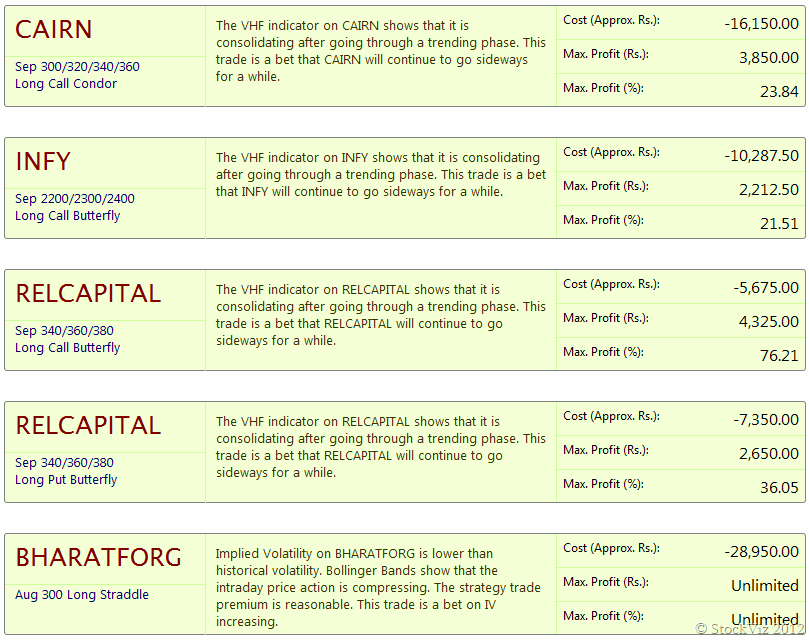

A preview of trade ideas generated:

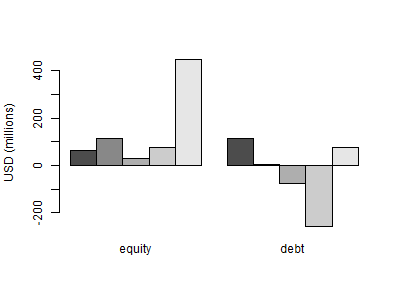

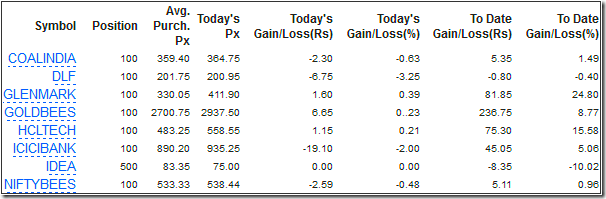

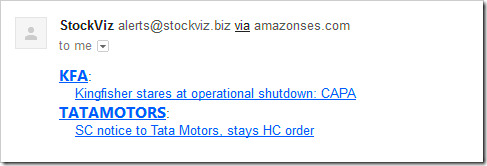

You can dive into each trade and get a sense of what the payoffs are – all with a single click. And once you are comfortable with the risk you are taking, you can add the option strategy to your portfolio and stay on top of the trade.

Login to StockViz by clicking on

and

Go Algo!