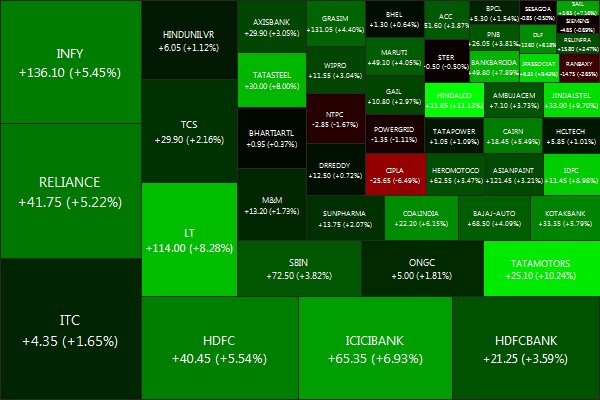

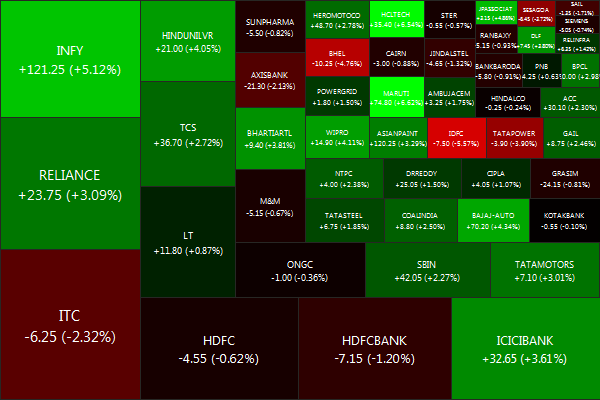

The NIFTY ended on a bullish note, shooting up +4.06% for the week.

Biggest losers were CIPLA (-5.61%), RANBAXY (-2.12%) and NTPC (-1.95%).

And the biggest winners were HINDALCO (+10.76%), TATAMOTORS (+10.01%) and JPASSOCIAT (+9.10%).

Advancers lead decliners 44 vs 6 Gold: +1.00%, Banks: +5.22%. Infrastructure: +4.25%,

Gold: +1.00%, Banks: +5.22%. Infrastructure: +4.25%,

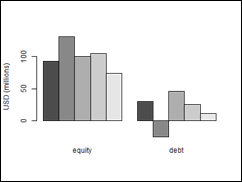

Net FII flows for the week: $502.88 mm (Equity) and $87.94 mm (Debt)

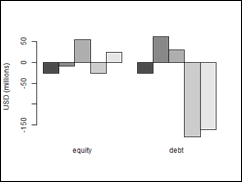

Net domestic institutional flows for the week: -$153.30 mm (Equity) and $1,278.60 mm (Debt)

Between now and Christmas the US Fed is pumping $85 billion per month of free money into the markets (and $40 billion a month thereafter). Our government finally grew a pair of cohones and cleared FDI in retail and civil aviation. Things are finally looking good and unless Europe does something really asinine, we are all set for a bull run into the end of the year. Cheers!

Daily news summaries are here.