Back in 2016, we ran a sniff test on Intraday Momentum: The First Half-Hour Return Predicts the Last Half-Hour Return (pdf). We promised an update so here it is (eight years later).

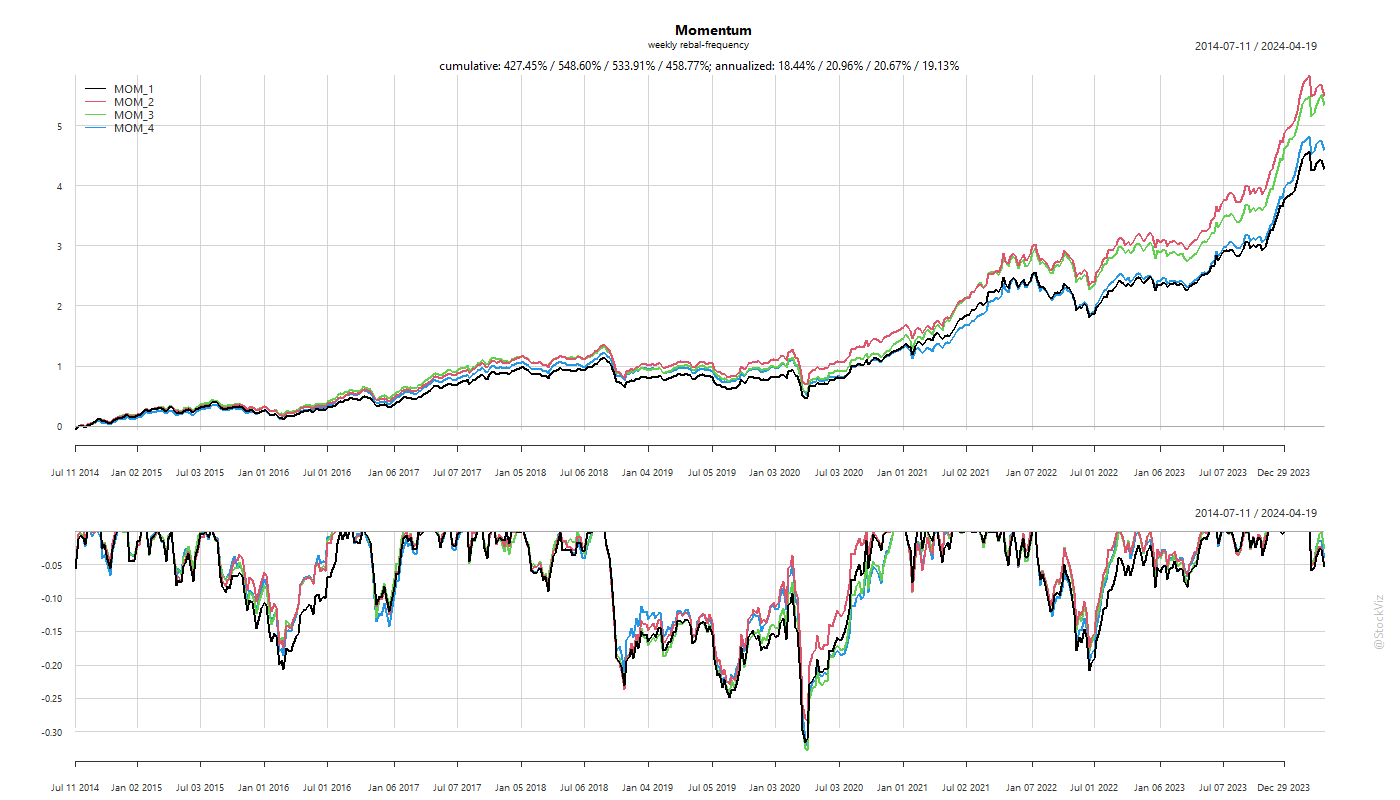

We ran the strategy with both the first 15min and 30min formations with and without considering gaps. It continues to not work with the three indices we used: NIFTY, BANK NIFTY and MID SELECT. Here’s the one for the NIFTY. The rest are on github.

Some strategies may benefit from becoming well known. However, a vast majority of them don’t. This one belongs to the former.