Momentum and growth investing are not the same and investing in a market-cap weighted index is not the same as momentum investing.

Momentum Investing

One-liner: A portfolio that is long the stocks that have gone up in price over the last one year will out-perform the market.

There are a number of ways to measure price appreciation. Mainly:

- Relative: Compare how price has appreciated in comparison to the market. Rank from largest to smallest.

- Absolute: Rank returns from largest to smallest.

- Acceleration: Compare how price has appreciated in the last 6-months vs. how price appreciated in the prior 6-month period. Rank from largest to smallest.

The one-year formation period is by no means carved in stone. Some portfolios measure momentum over different time-periods and blend them together.

Additionally, the following preference overlays can be applied:

- Stocks with lesser volatility.

- Stocks that rise up in price gradually (linear) over ones that have gone up like a hokey stick (parabolic.)

- Liquid stocks over illiquid ones to reduce trading frictions.

- A trailing stop-loss over strict scheduled rebalancing to manage stock-specific risk.

Growth Investing

One-liner: A portfolio that is long the stocks whose earnings have grown at an above-average rate relative to the market will out-perform the market.

There are number of ways to measure earnings growth. Mainly:

- Total sales: Compare this year’s revenue over previous years’.

- EBITDA: Compare this year’s operating performance over previous years’.

- EPS: Compare this year’s earnings per share over previous years’.

All these measures involve gotchas. For example, any of the following actions taken by the company will boost revenue:

- Increase the asset base – setup a new factory.

- Increase leverage – take on more debt/buy-back stock.

- Compromise on margins – lower prices.

Also, there could be temporary structural shocks – natural disasters/policy shifts – that takes out supply/boosts short-term demand for a company’s/sector’s products.

Market-cap Weighted

One-liner: A committee meets every six months and creates a basket of stocks primarily based on their market cap (number of shares outstanding x price.) This basket defines the market.

Passive investors invest in such a basket through index funds or ETFs and get on with their lives.

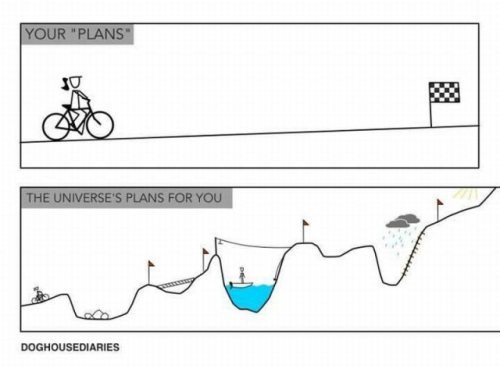

The long-arch

All investment strategies have their day/year/decade under the sun and neither are necessarily “better” than the other. It depends on the investor’s task at hand. As an analogy, whether you use a flat-head or a Phillips screw is all nuance when compared to task at hand: screwing. But it is important to know the difference between these investing approaches and not get confused between them.