About 33 companies have listed in the NSE so far, on an average, they have yielded 0% return.

Congratulations to the winners:

| JUBLINDS | 19% |

| LOVABLE | 31% |

| SUDAR | 33% |

| AANJANEYA | 71% |

| HFCL | 74% |

| KBIL | 93% |

| TCIDEVELOP | 100% |

| KICL | 110% |

| CMAHENDRA | 130% |

| INDTERRAIN | 200% |

Invest Without Emotions

About 33 companies have listed in the NSE so far, on an average, they have yielded 0% return.

Congratulations to the winners:

| JUBLINDS | 19% |

| LOVABLE | 31% |

| SUDAR | 33% |

| AANJANEYA | 71% |

| HFCL | 74% |

| KBIL | 93% |

| TCIDEVELOP | 100% |

| KICL | 110% |

| CMAHENDRA | 130% |

| INDTERRAIN | 200% |

Image via Wikipedia

We had briefly discussed stock and enterprise valuation metrics before. These metrics are collectively called termed “Fundamentals”, i.e., these multiples are intrinsic to the company and not dependent on the broader market. Fundamental investors invest on a stock looking at it’s valuation relative to its peers, its future earnings potential, free cashflow, dividends, etc. There is another breed of investors that trade based on a stock’s past market data, primarily price and trading volume.

Technical analysts examine what investors think about a particular stock and whether or not they have the wherewithal to back up their opinions; these two concepts are called psych (psychology) and supply/demand. They employ models based on price and volume transformations, such as the relative strength index (RSI), moving averages (SMA), price correlations, business & stock market cycles and recognition of chart patterns. The basic underlying premise is that:

Technical trading fits nicely into programmed trading – computers are way faster at calculating and executing trades than people. By removing fundamental metrics out of the picture and focusing on pure market driven computation, machines can act in a very quantitative and non-subjective fashion.

Technical analysis alone may not be the best option for most investors. No matter how strong the technicals are, fundamentals eventually catch up. The best approach to investing is one that combines both the approaches: shortlist stocks based on fundamentals and watch their technicals at regular intervals. Execute only when the technicals flash green (or red).

Image by Getty Images via @daylife

Any discussion on inflation is incomplete without calling out its counterpart: deflation. According to Wikipedia, deflation is a decrease in the general price level of goods and services. Deflation occurs when the annual inflation rate falls below 0% (a negative inflation rate). Inflation reduces the real value of money over time; conversely, deflation increases the real value of money – the currency of a national or regional economy. This allows one to buy more goods with the same amount of money over time.

One can argue that deflation is the natural state of an advanced economy given the up-and-to-the-right advancement in technology. Technology is a natural deflator: it increases productivity (allows the same number of employees to produce more), Moore’s law gives us more processing power for the same dollar, it reduces communication costs (reducing the need to travel as much) and makes globalization more efficient (allowing businesses to shift production to lower wage/more productive regions). It also has the effect of making certain commodities irrelevant, for example, the invention of plastic tooth brushes caused a total collapse in the boar’s hair market.

However, technology deflation is a function of economies of scale and is more or less independent of monetary policy. New technologies and products come down in price over time, regardless of the state of the economy, monetary policy, or income distribution.

Another view of deflation is that it is caused a collapse in final demand. A fall in demand causes businesses to liquidate inventory and cut production. A cut in production would lead to cuts in workforce. Unemployment would further destroy demand, thereby creating a deflationary cycle. Since the same rupee can now buy more goods, it negatively affects people/companies who are in debt (you’ll have to repay today’s Rs. 90 debt a year from now with today’s Rs. 100, given a deflation of 10%.)

Given the high-debt loads of “important” industries, deflation is a bigger nightmare for governments and central banks than inflation. Given the recent actions of the US Fed and the UK Bank of England, it appears that there is no limit to what central banks will do to prevent deflation: set short-term rates to zero, print copious amount of new money, buy debt that nobody else wants and influence sentiment by fudging statistics.

To summarize: just like how inflation is the rise in general levels of prices of goods, deflation is a fall in price levels, usually brought on by a collapse in demand. Inflation tends to favour debtors while deflation favours savers.

Image via Wikipedia

According to Wikipedia, inflation is a rise in the general level of prices of goods and services in an economy over a period of time.When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation also reflects an erosion in the purchasing power of money – a loss of real value in the internal medium of exchange and unit of account in the economy.

In order to understand where inflation comes from, lets begin something that we all intuitively understand: demand & supply. As demand for a good goes up, for the same level of supply, the price goes up.

Here, S is the supply curve, D is the demand curve, P is the price level and Q is the quantity of the product sold.

So if Demand increases from D1 to D2, price increases from P1 to P2.

What causes the shift in the Demand and Supply curves?

In India, as recently as Nov/Dec 2010, we had a supply-side shock in onions. In a matter of weeks, prices of onions shot up 3x-4x the regular price. This is typical in local food supplies (happens to tomatoes and sugar on a regular basis as well.) Typically, supply-side shocks are acts of nature and can be handled by warehousing enough supplies to tide over bouts of disruption. For example, if we had sufficient food-processing capabilities, we should not be seeing seasonal spikes and cliffs in food prices.

Typically, supply-side shocks also come from herding behaviour of suppliers: seeing onion prices hit Rs. 50, they may plant more onions for the next season, resulting in a glut and collapsing price. The glut causes them to reign-in onion growing for the next season resulting in shortages and higher prices. It also comes from distortion in pricing signals. For example, the government sets a floor-price for most grains. The floor-price typically has more to do with favouring a particular demographic than with market levels. This distortion in pricing signals means that the farmer is now forever dependent on the government both as his largest customer and as a price setter.

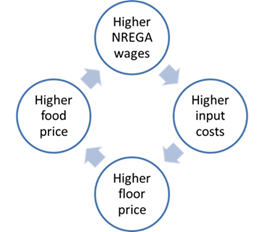

Another way inflation gets embedded is when there is a shortage in labour market that leads to increasing wages that in turn leads to increasing end prices. And seeing end prices increase, labour starts demanding higher wages, leading to an inflationary spiral. The NREGA program has been accused of st oking such a spiral by setting a floor on rural wages. Higher NREGA wages meant land-owners had to compete with the government for labour, resulting in higher input costs which were then compensated by higher floor prices for grains. Higher food prices meant that NREGA wages had to increase to keep up.

oking such a spiral by setting a floor on rural wages. Higher NREGA wages meant land-owners had to compete with the government for labour, resulting in higher input costs which were then compensated by higher floor prices for grains. Higher food prices meant that NREGA wages had to increase to keep up.

Inflation also goes up when the government increases the amount of money in the system either by running huge deficits or by just printing money (Quantitative Easing, in the US Fed’s words). When you have more money chasing the same amount of goods, inflation has nowhere to go but up. In fact, currency debasement has been the preferred choice of governments to tide over funding gaps when tax hikes are no longer feasible. For example, Roman coins – the silver denarius, was 95% silver when they were first introduced. By 117 AD, it was 85% silver, in 180 AD it was 75% and by 211 AD (Caracalla’s reign) it was 50%. But the real crisis came after Caracalla, between 258 and 275, in a period of intense civil war and foreign invasions. The emperors simply abandoned, for all practical purposes, a silver coinage. By 268 there was only 0.5% silver in the denarius. The fascinating account of the fall of the Roman empire can be read here.

So there you go. To summarize, the most common reasons for inflation are:

We discussed some key equity metrics in our previous post. Multiples like PE, PB, etc. help you focus on the equity part of the capital structure while valuing a company. However, in order to get a true picture of the financial health of the company, an investor needs to focus on the Enterprise Multiples as well. Some of the key enterprise multiples are:

For readers who are interested in a thorough treatment of valuation metrics, a good primer from UBS is can be found here. Happy investing!

[scribd id=50425904 key=key-c9a35x6n1znw16ph4rc mode=list]