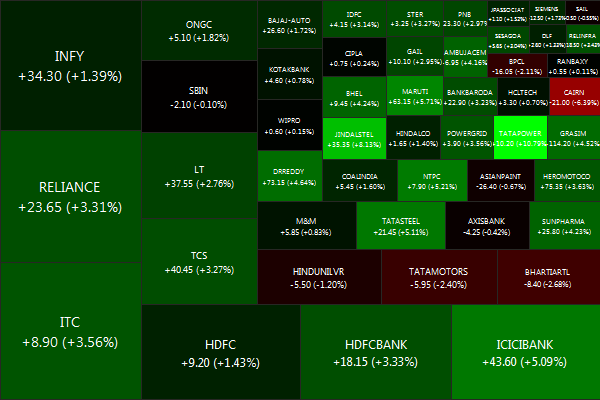

The NIFTY ended on a bullish note, shooting up +3.11% for the week. Biggest losers were CAIRN (-5.69%), BPCL (-2.52%) and TATAMOTORS (-1.88%). And the biggest winners were TATAPOWER (+10.79%), JINDALSTEL (+8.39%) and MARUTI (+6.14%).

Advancers lead decliners 42 vs 7

Gold: -1.64%, Banks: +2.95%. Infrastructure: +6.51%,

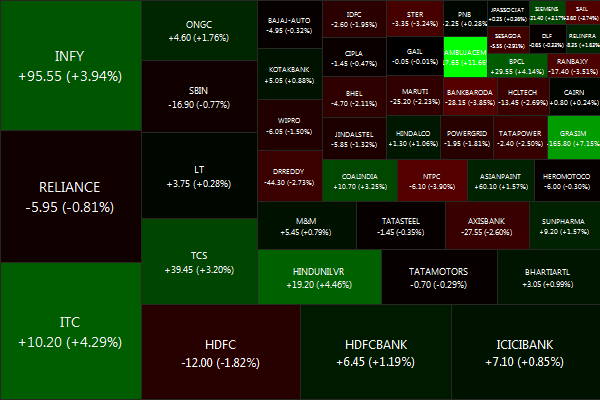

Europe soared on Friday following the summit agreement overnight. Stoxx 50 +4.9%, Germany +4.3%, France +4.7%, Italy +7% , Spain +5.8%, U.K. +1.4%.Dow +2.37% to 12901. S&P +2.7%. Nifty +2.52% to 5279

Some perspective from Floyd Norris: There has been 18 European summit meetings since the beginning of 2010, before this one; decisions seeming to indicate action were announced after 10. Over those 10 two-day stretches The MSCI European stock index was up 9.6%. But over the entire two-and-a-half-year period, the European stock index is down 17%. The pattern has been that relief because disaster was averted is followed by disappointment and eventually by a new crisis. Europe has found ways to fund whichever country (or banks) was in trouble, but has not found ways to enable those countries to become economically competitive while remaining in the euro zone. Read the while thing in NY Times.

“People need to stop spending money they don’t have. The solution to too much debt is not more debt. All this little agreement does is give them (banks) a chance to have even more debt for a while longer” – Jim Rogers

Also, FT collected all the EU-skepticism in one place.

Have a nice weekend!

Daily news summaries are here.