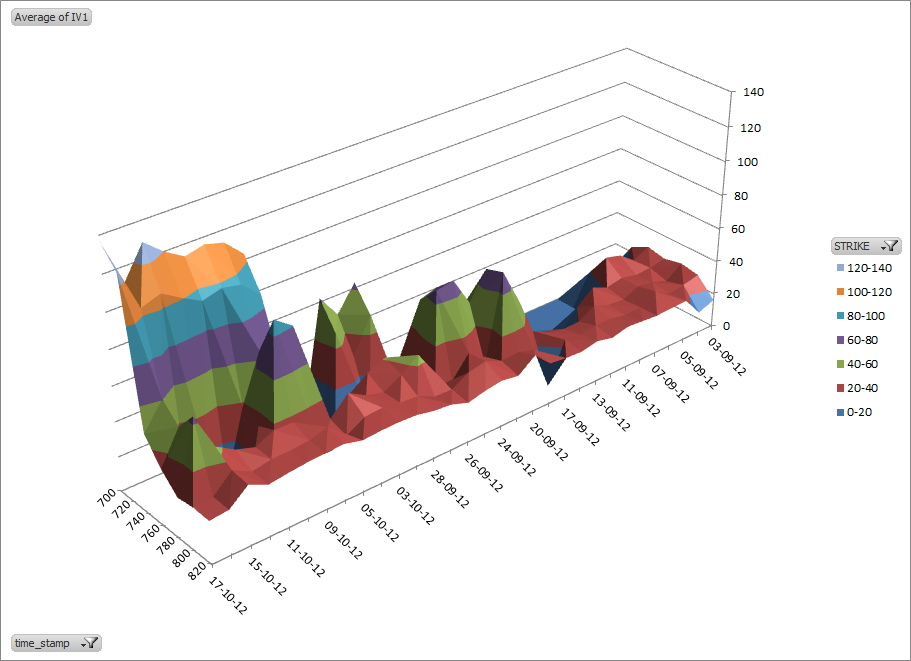

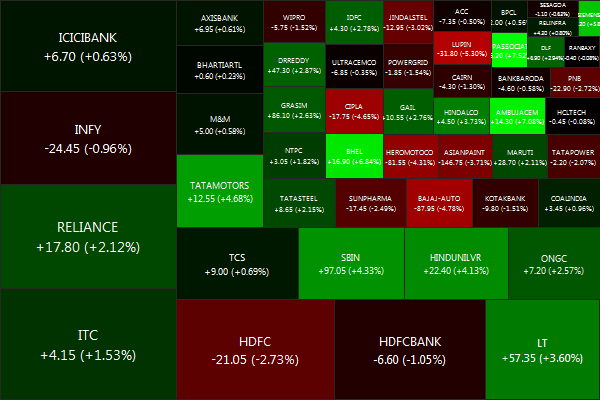

Volatility surfaces is an important trading tool for option traders. Here’s a vol chart of RELIANCE OCT25 options. Note the spike in IV around earnings announcement, the fall-off in IV above and below the ATM strike (800), the spike in vol and the dramatic drop in lambda due the “fat finger” trade on the 5th. [stockquote]RELIANCE[/stockquote]

Our option strategy model, however, is not flashing any profitable trades in this scrip right now, owing to the uncertainty around the trend of the underlying and the high IV around earnings season.