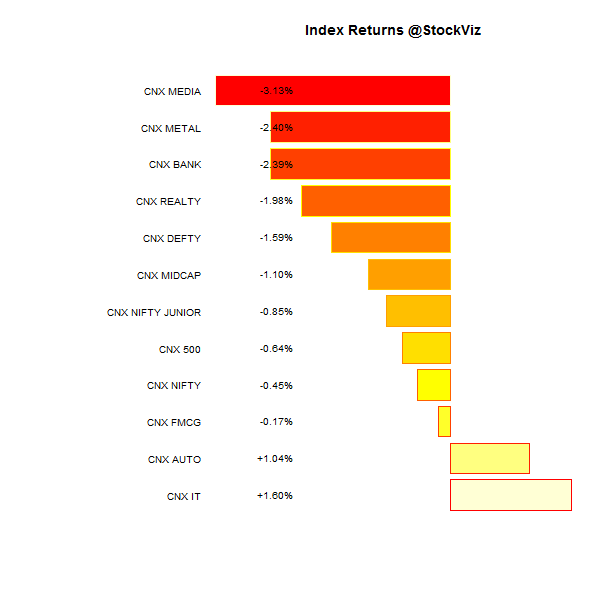

The Nifty ended the week -0.45% (-1.59% in USD terms.)

Equities

Commodities

| Energy |

| Brent Crude Oil |

-0.06% |

| Ethanol |

-2.87% |

| Heating Oil |

-0.20% |

| Natural Gas |

+4.28% |

| RBOB Gasoline |

-0.14% |

| WTI Crude Oil |

-0.42% |

| Metals |

| Copper |

-0.93% |

| Gold 100oz |

+1.33% |

| Palladium |

-0.27% |

| Platinum |

+0.83% |

| Silver 5000oz |

-2.45% |

| Agricultural |

| Cattle |

-2.98% |

| Cocoa |

+0.65% |

| Coffee (Arabica) |

-5.78% |

| Coffee (Robusta) |

-7.01% |

| Corn |

-0.21% |

| Cotton |

+2.18% |

| Feeder Cattle |

-2.25% |

| Lean Hogs |

-3.43% |

| Lumber |

+7.05% |

| Orange Juice |

+0.71% |

| Soybean Meal |

+2.34% |

| Soybeans |

+5.83% |

| Sugar #11 |

-0.92% |

| Wheat |

+0.60% |

| White Sugar |

-0.62% |

Credit Indices

| Index |

Change |

| Markit CDX EM |

-0.94% |

| Markit CDX NA HY |

-0.18% |

| Markit CDX NA IG |

+1.57% |

| Markit CDX NA IG HVOL |

+2.63% |

| Markit iTraxx Asia ex-Japan IG |

+5.84% |

| Markit iTraxx Australia |

+3.13% |

| Markit iTraxx Europe |

+2.10% |

| Markit iTraxx Europe Crossover |

+18.10% |

| Markit iTraxx Japan |

+1.89% |

| Markit iTraxx SovX Western Europe |

+3.59% |

| Markit LCDX (Loan CDS) |

-0.02% |

| Markit MCDX (Municipal CDS) |

-0.21% |

Credit blew out. No sector was spared with even the high quality Investment Grade (IG) index getting hit. Japanese equities down almost 5%, Asian IG spreads +5.84%. What a mess…

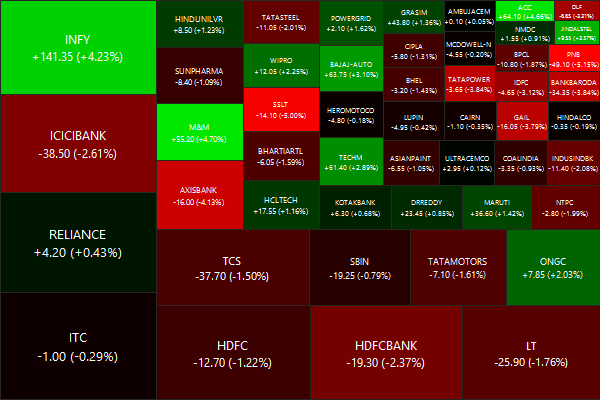

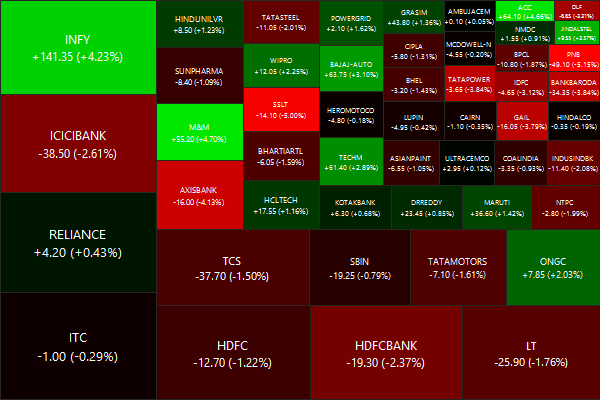

Nifty Heatmap

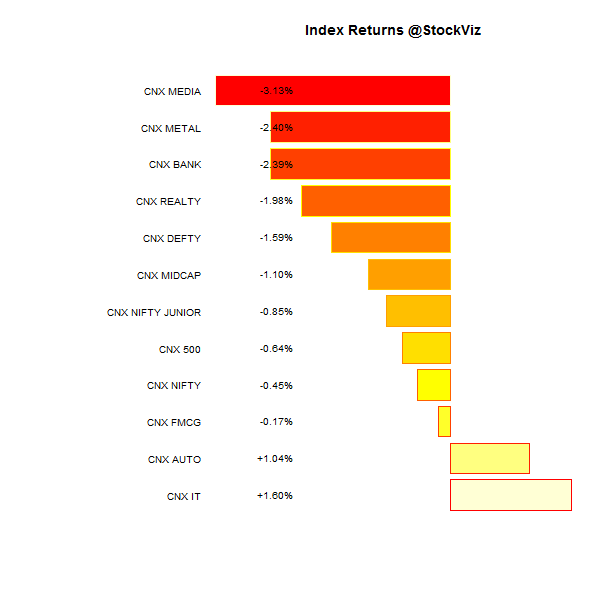

Index Returns

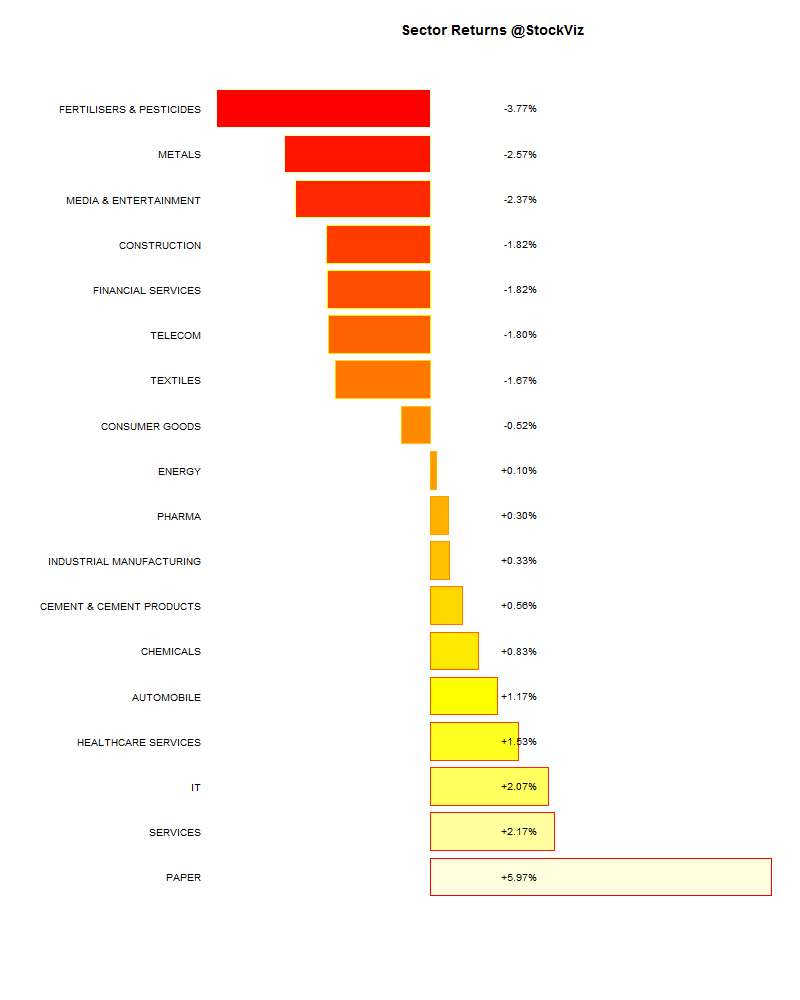

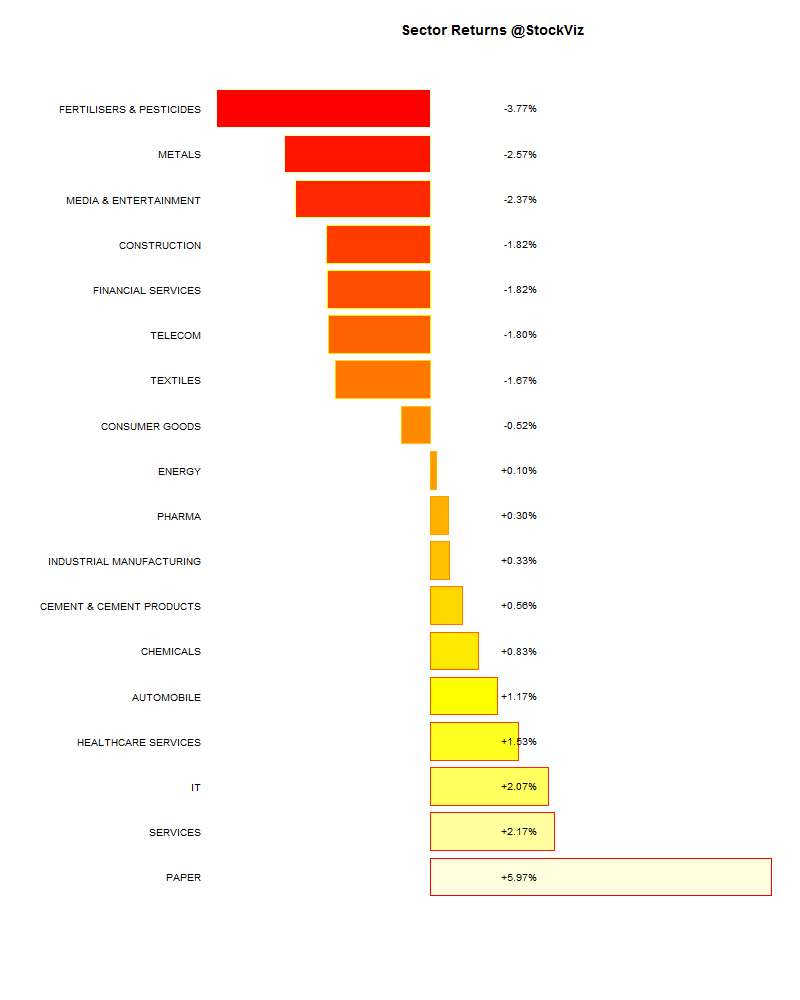

Sector Performance

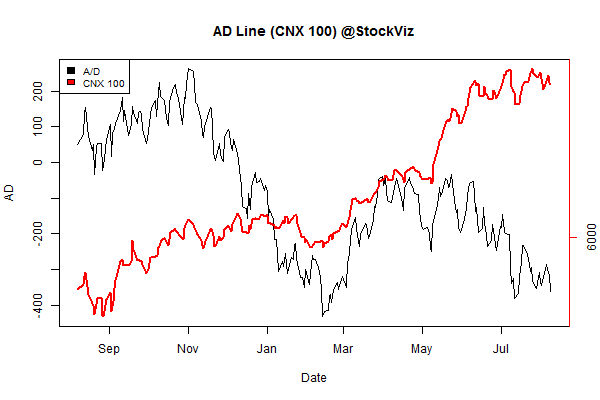

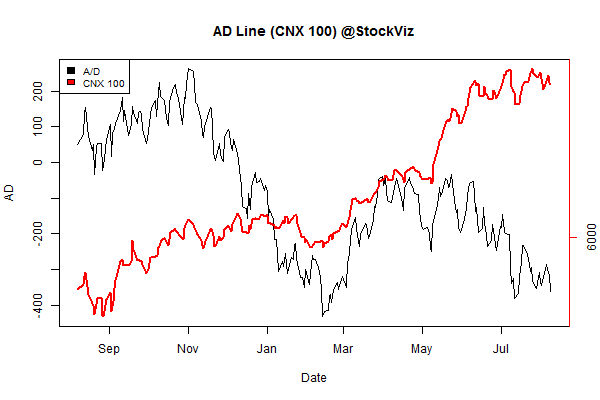

Advance Decline

Market Cap Decile Performance

| Decile |

Mkt. Cap. |

Advance/Decline |

| 1 (micro-cap) |

-7.55% |

59/73 |

| 2 |

+1.64% |

68/64 |

| 3 |

+0.28% |

65/67 |

| 4 |

+0.26% |

67/65 |

| 5 |

-0.83% |

65/67 |

| 6 |

-1.03% |

66/66 |

| 7 |

-0.28% |

70/62 |

| 8 |

-1.34% |

64/68 |

| 9 |

-1.13% |

64/68 |

| 10 (mega-cap) |

-0.51% |

66/66 |

Most of the market bled out. Large-caps continued to out-perform the rest of the market.

Top Winners and Losers

UPL swung like a yo-yo. Up 5.65% last week, down 8.75% this week. Most analysts maintain a target of Rs. 400 (Rs. 303.50 on Friday.) What gives?

ETFs

Surprisingly, JUNIORBEES ended in the green while NIFTYBEES ended red.

Investment Theme Performance

Most strategies ended in the red.

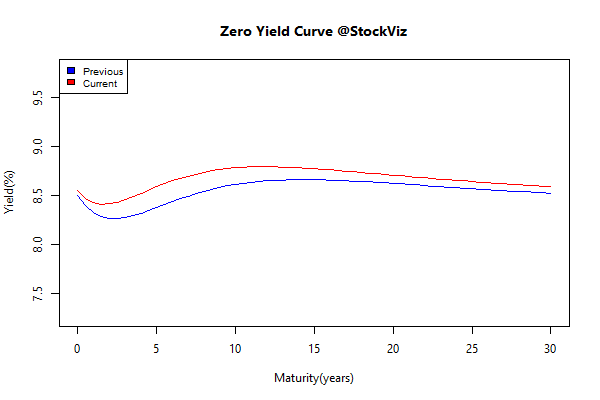

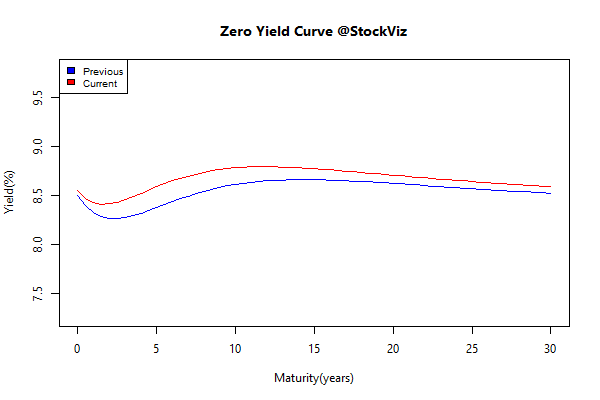

Yield Curve

Is it officially time to panic? The yield curve inverted this week…

Total return bond indices

| Sub Index |

Change in YTM |

Total Return(%) |

| GSEC TB |

+0.01 |

+0.16% |

| GSEC SUB 1-3 |

+0.24 |

-0.23% |

| GSEC SUB 3-8 |

+0.26 |

-1.47% |

| GSEC SUB 8 |

+0.13 |

-1.43% |

Yields went up across the term-structure…

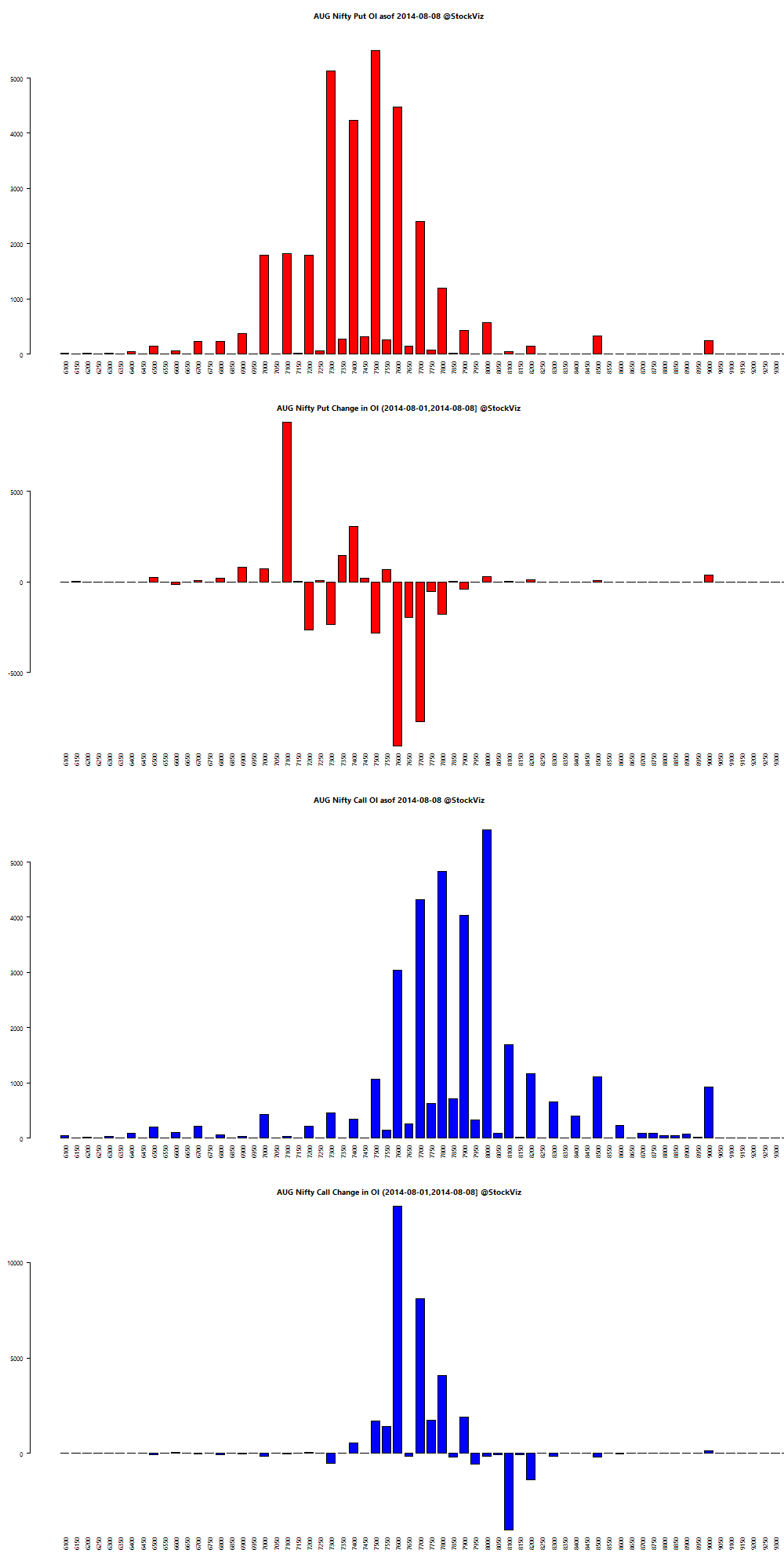

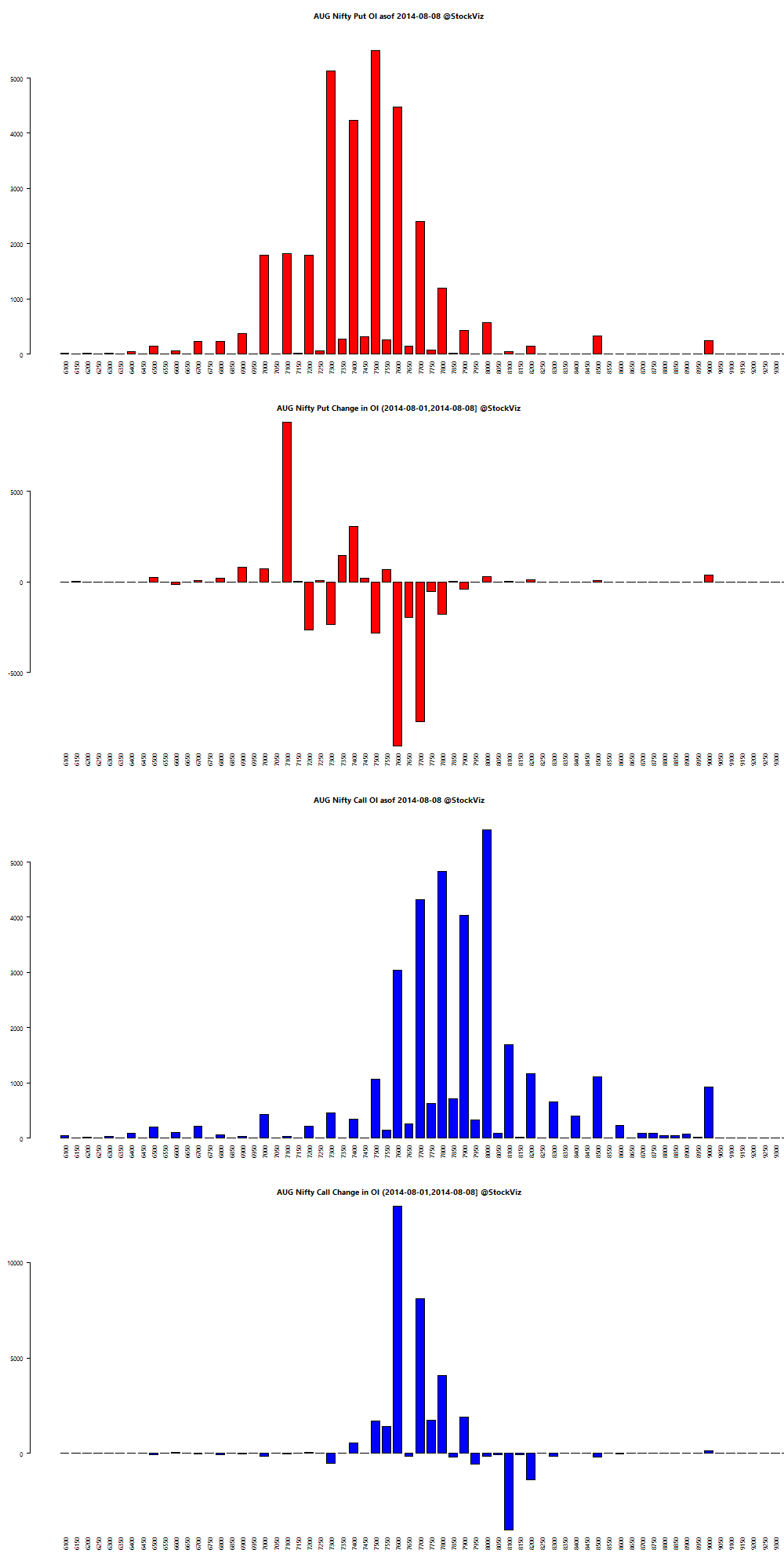

August Nifty OI

August Bank Nifty OI

Thought for the weekend

An introspection that is worth a read. My favorite:

Everything is mediocre. Most jobs are mediocre. Most people’s work is mediocre. Most products and experiences are mediocre. Most lives drift to mediocre. When you rise above the mediocrity, people will notice.

What is yours?

Read: Thirty Things I’ve Learned