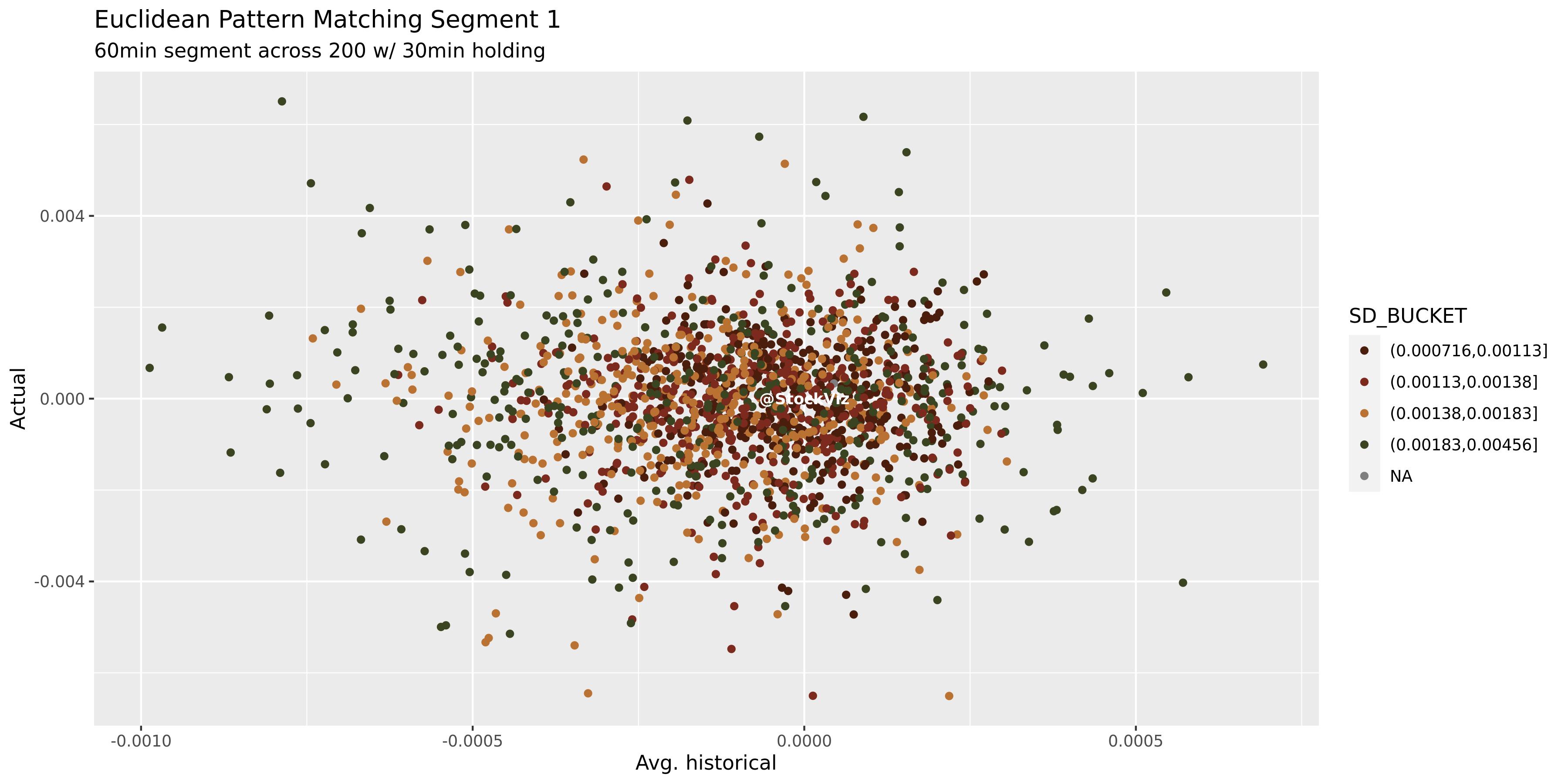

Hypothesis: If a price segment is similar to a set of historical segments, then there should be a correlation between historical and future returns.

Setup: Take 60-minute segments of 1-minute bars. Match them with 200 of the most recent days’ with times aligned. Take the top 40 days with the closest match and calculate their median next 30-minute returns. Plot the median vs. actual.

Simplifications:

- Non-overlapping segments. Its can be argued that patterns don’t start and stop and perfectly aligned boundaries.

- Most-recent 200 day look-back period. What if that’s not enough? Or too much?

- 30-minute prediction. Too short? Too long?

Verdict: There is no discernable relationship.

Code: github