Is there a away to time factors?

Factor investing is the process of constructing portfolios of stocks by isolating certain statistical properties that have shown to out-perform over the long term. For example, investing in stocks that rank high in the “Quality” factor. Here are some factors that were discussed previously on FreeFloat:

No Holy Grail

While factor portfolios are expected to out-perform over the long-term (say, 30 years,) there is a strong chance that they under-perform over an individual’s holding period (5-10 years.) This leads to sub-par investment returns due to out-of-favor factors.

For example, Value vs. Growth.

Is Value/Growth Dead?

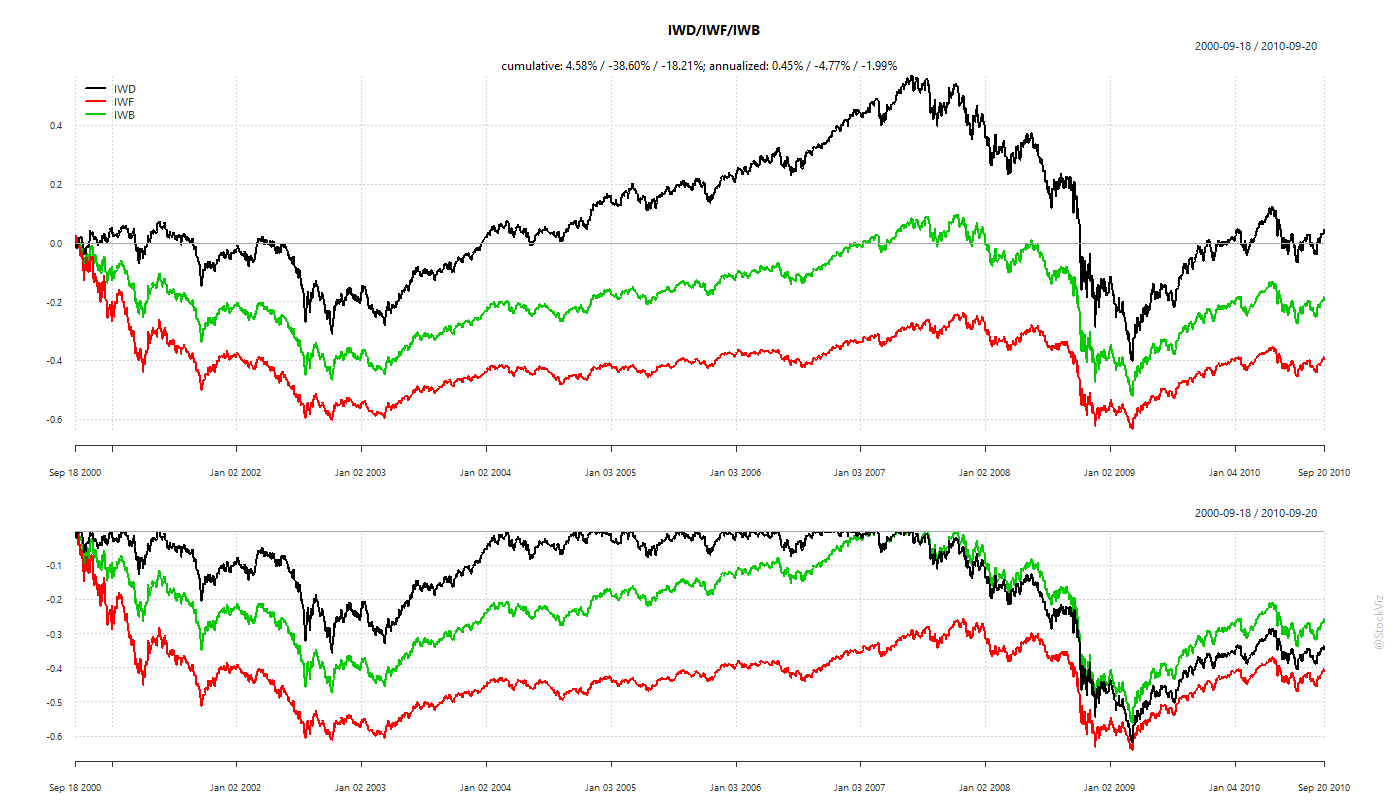

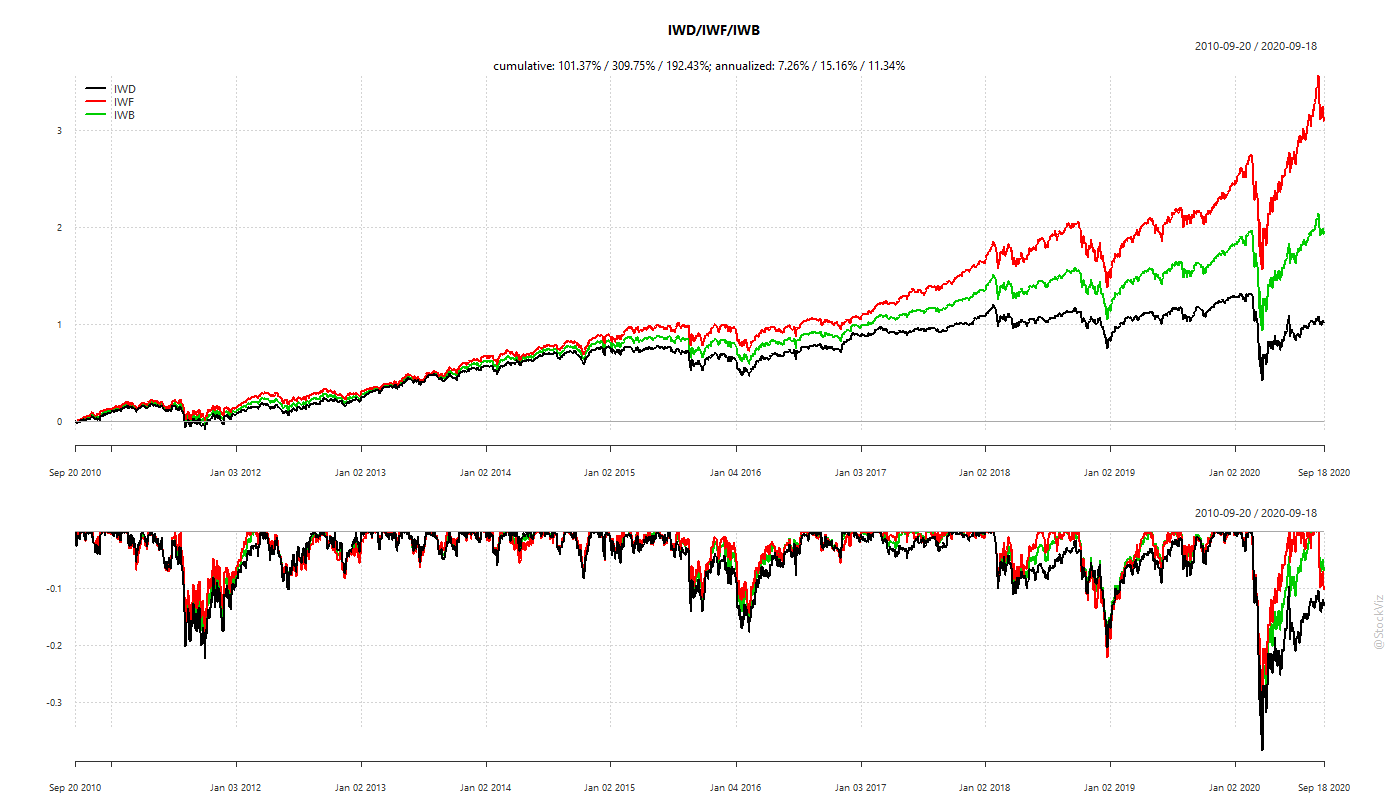

Consider IWD, the iShares Russell 1000 Value ETF, IWF, the iShares Russell 1000 Growth ETF and IWB, iShares Russell 1000 ETF.

2000 through 2010, value out-performed.

2010 through 2020, growth out-performed.

Whether you were a “Value” investor or a “Growth” investor, you saw 10-years (!) of under-performance.

Persistence of Out-performance

To avoid under-performing, an investor can:

Market-cap index (avoid choosing.)

Predict (good luck with that.)

Follow the herd (FOMO.)

Turns out, option #3 works pretty well and is robust.

Individual factors can be reliably timed based on their own recent performance.

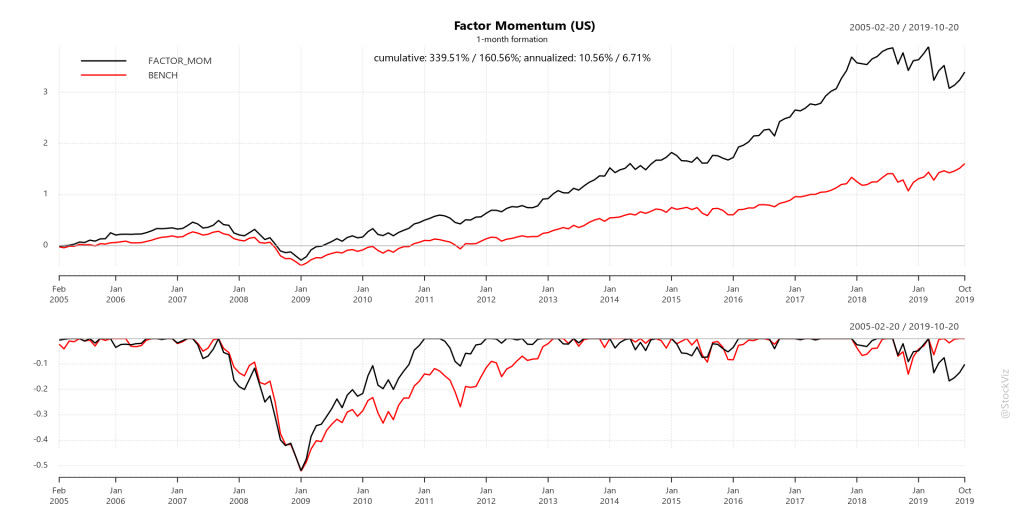

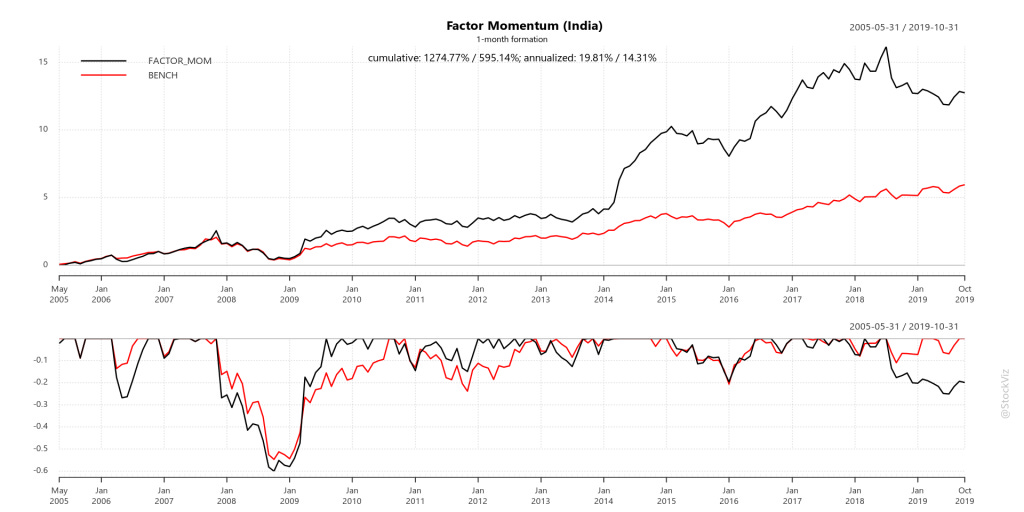

Factor Momentum Everywhere – Tarun Gupta, Bryan T. Kelly (AQR)

Rule: Buy whatever worked in the last month

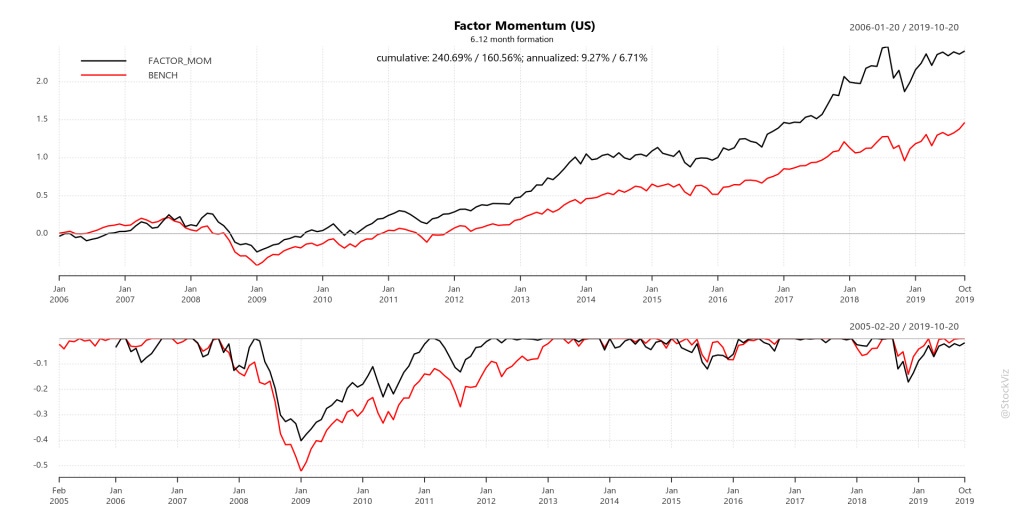

Worked in the US

Worked in India

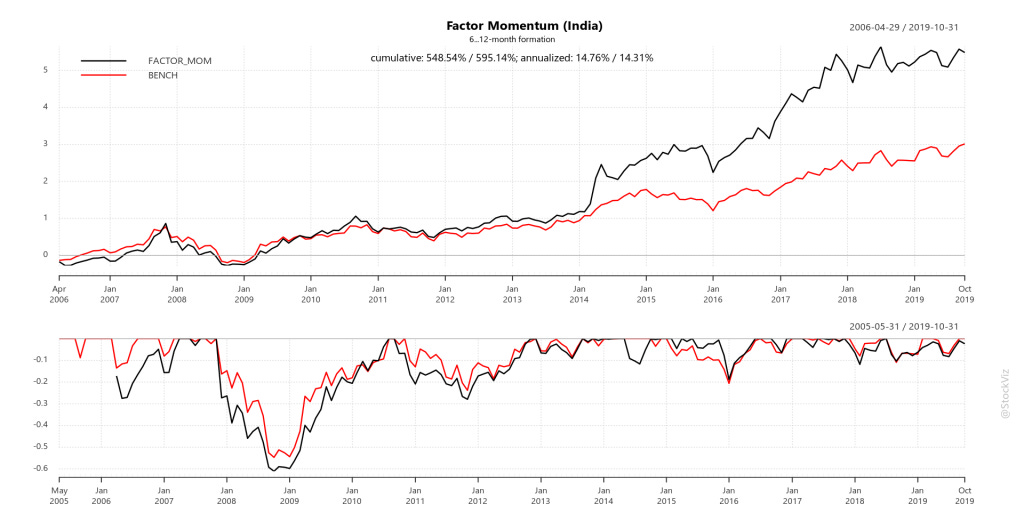

The problem, however, is that India has STT (Securities Transaction Tax) that the US doesn’t. And with a high turn-over strategy, STT can completely sap whatever alpha was produced.

Rule: Buy the one with the Best Average Returns over the last 6-12 months

Worked in the US

Worked in India

Forward-Test

The back-test showed that for the US markets, investors can rotate into the factor that performed the best in the last month. And for India, investors can average into the one that had the best average 6-12 month returns.

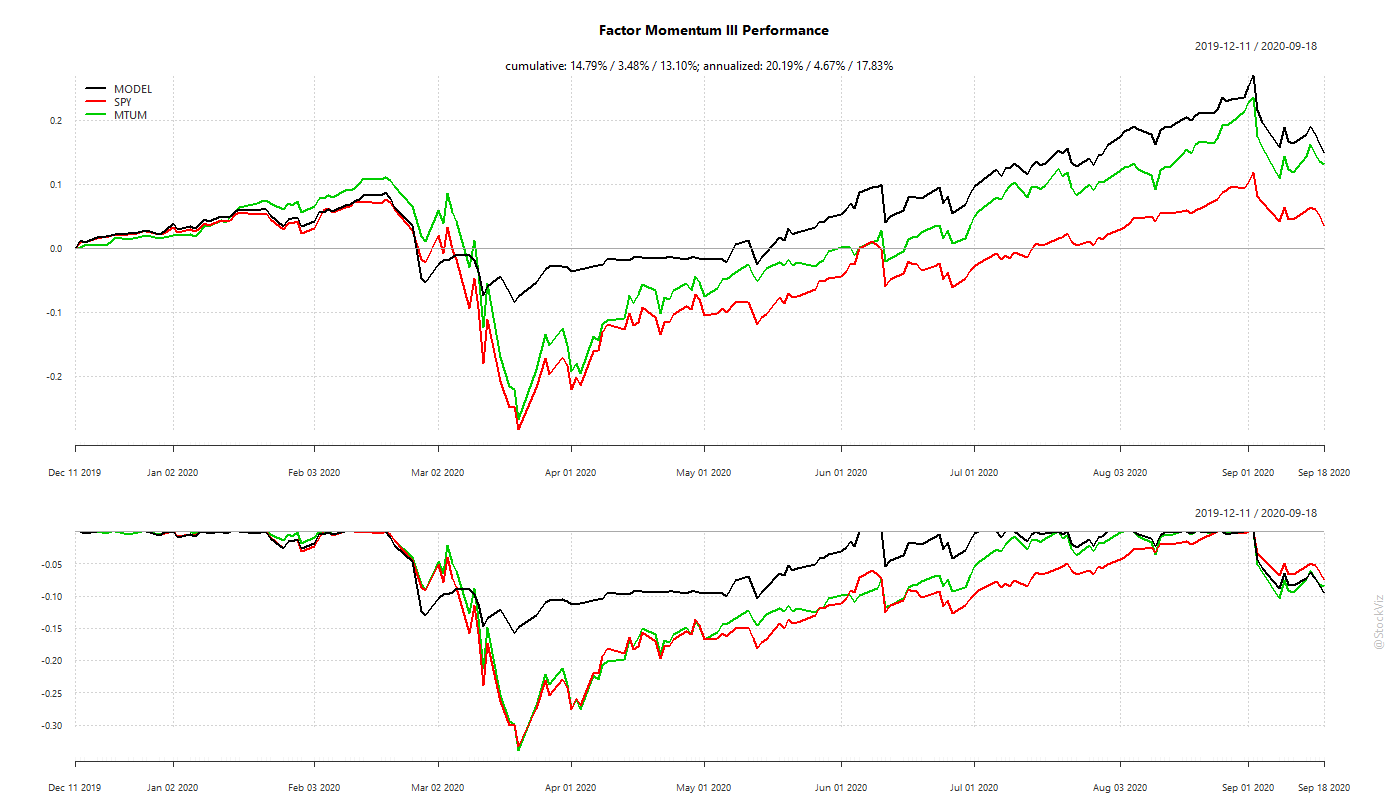

US

The Factor Momentum strategy beat plain-vanilla momentum (MTUM) and S&P 500 (SPY). It also avoided the Corona Cliff in March 2020.

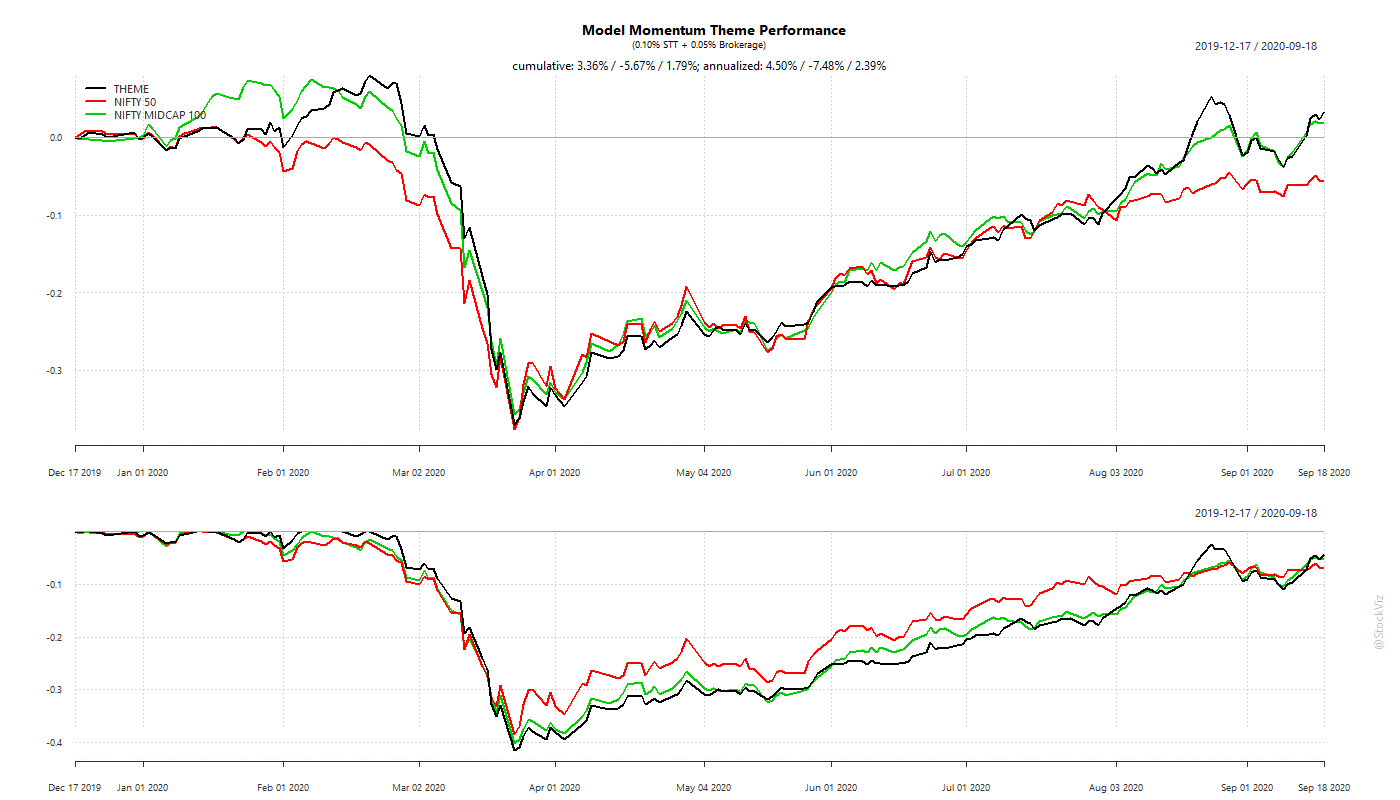

India

The Indian version of the Factor Momentum strategy is a mixed bag. Since it averages over a longer time-period, it is (understandably) slow to respond to sudden events. The dive during the Corona Cliff and subsequent performance is inline with the back-test. Thus far, it has marginally out-performed NIFTY 50 and MIDCAP 100 after STT and brokerage and we remain optimistic about its future.

Conclusion

Factor Rotation holds promise. Research, back-tests and forward-tests confirm. The trade-off is pretty clear as well: shorter look-backs/shallower draw-downs vs. transaction costs. Since trading US equities is nearly friction free, investors can use shorter look-backs. Indian investors will have to stomach deeper draw-downs given transaction taxes.