Simple portfolio asset allocations should start with a mix of equities and bonds. Typically, a 60/40 or a 70/30 split between them is suggested as a good starting point. The big questions are:

- What are the trade-offs between 60/40 and 70/30?

- Should you stick to large-caps or use mid-caps for the equity leg?

- Should you rebalance every month or is an annual rebalance enough?

- Should you invest the legs separately or opt for an equity-oriented balanced fund?

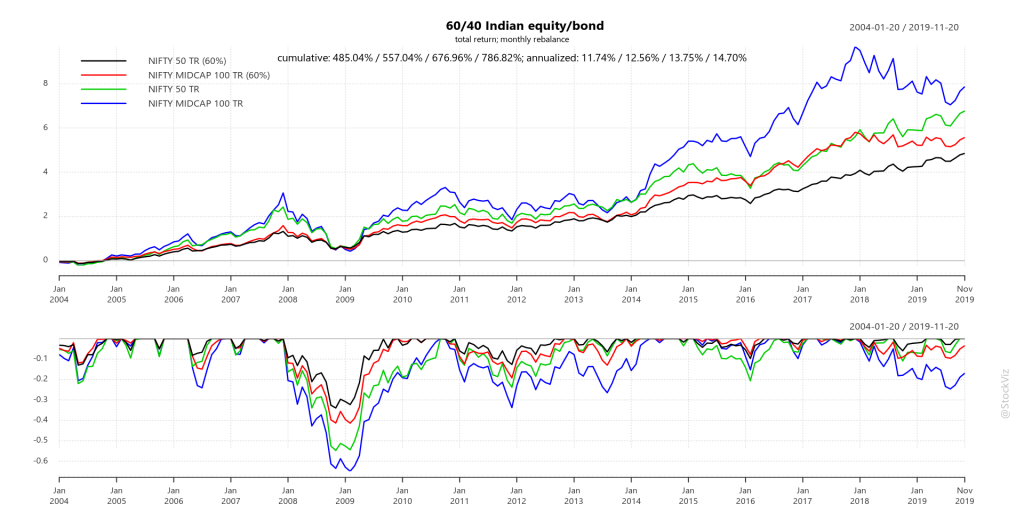

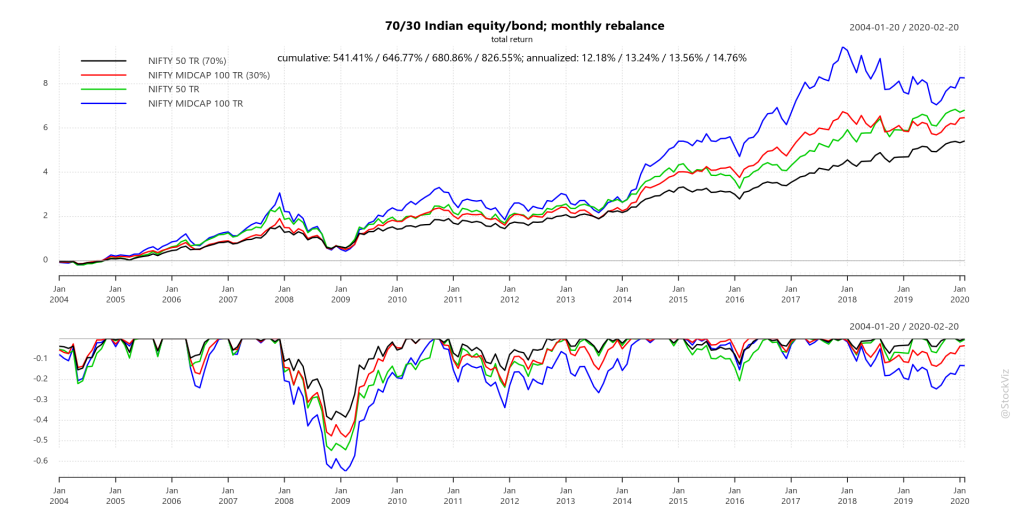

60/40 vs. 70/30 * Large vs. Mid-caps

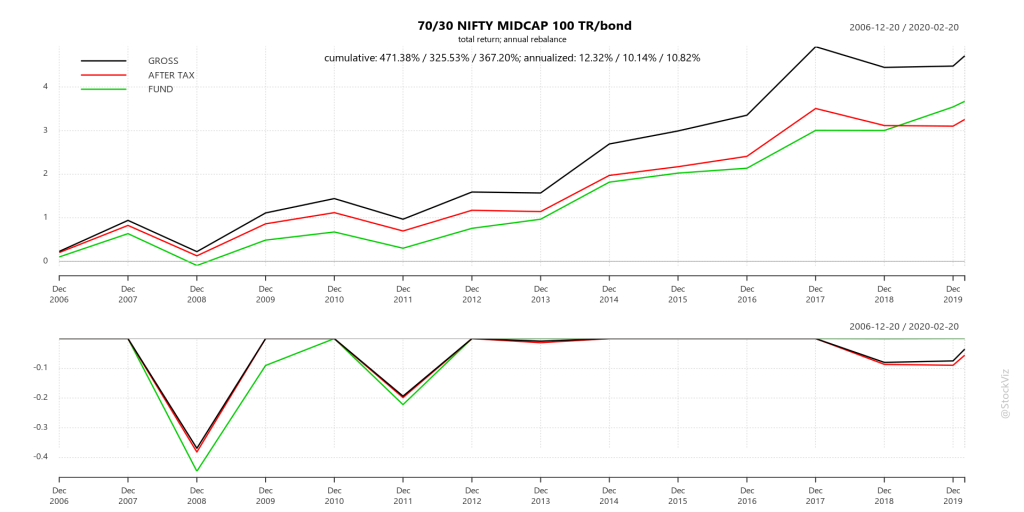

From a drawdowns point of view, using the large-cap NIFTY 50 index seems to deliver a smoother ride to the investor. However, there is hardly any difference between the drawdown profile of the 60/40 vs. that of the 70/30. From a returns point of view, a 70/30 portfolio has about a point over the 60/40.

So, risk-averse investors should probably go with a large-cap 70/30 mix. And for those who want reach a bit, a mid-cap 70/30 should do the trick.

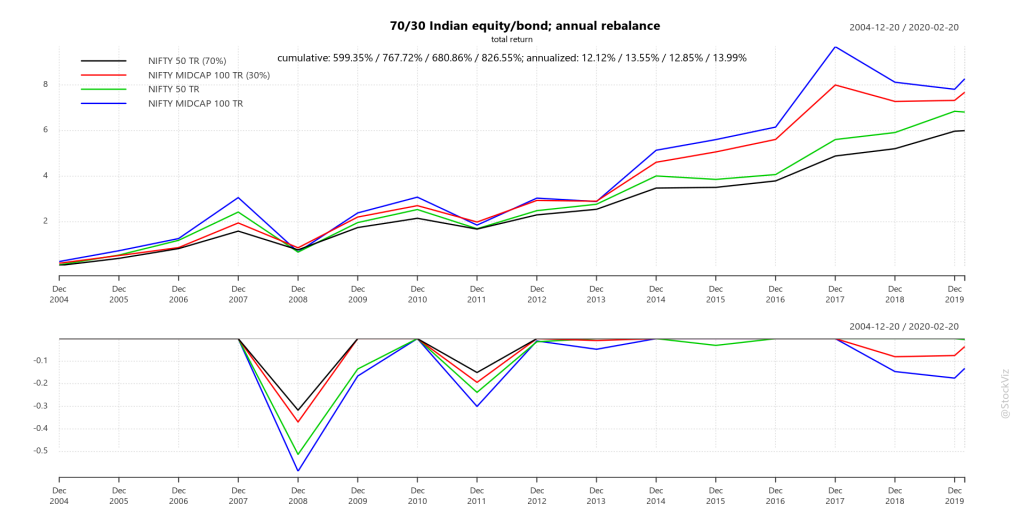

Monthly vs. Annual Rebalance

The less frequently you rebalance your portfolio, the less you pay out in transaction costs. However, with a lower frequency of rebalances, you run the risk of one piece of your portfolio overshadowing the rest and dictating the overall risk of the portfolio.

For a 70/30 portfolio, it appears that an annual rebalance has negligible effect on portfolio returns or drawdowns.

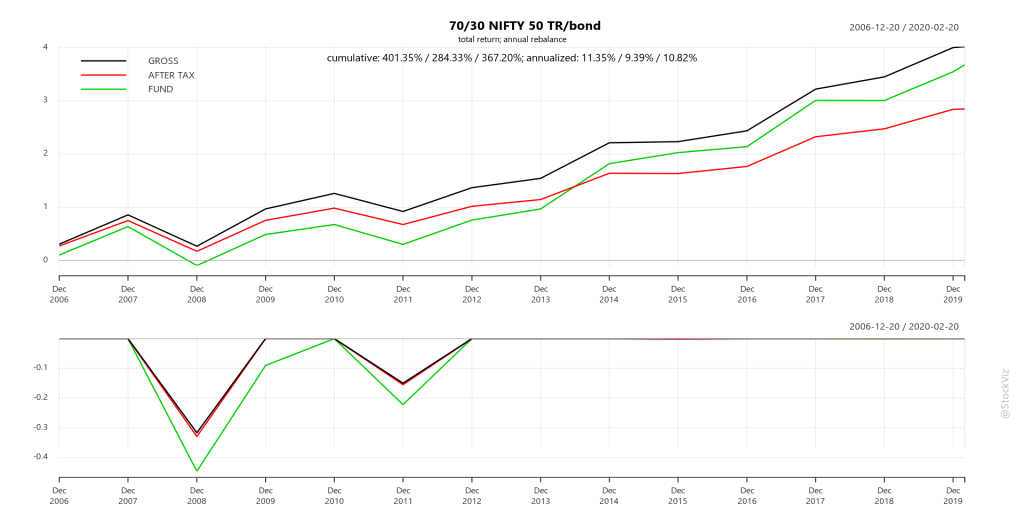

Tax impact – DIY vs. Mutual Fund

If you choose to implement the legs of the portfolio separately, then you create a taxable event every time you rebalance. A mutual fund, on the other hand, has no such drag.

Taxes seem to lop-off about 2% of annualized returns in the DIY portfolio while the mutual fund gets to compound it throughout. In both the large-cap and mid-cap scenarios, an equity-oriented hybrid fund comes out ahead.

If you were set this up as an SIP, then it is possible to avoid selling positions by just buying the asset that has fallen below its target. So taxes predominantly dent lumpsum investment returns.

Conclusion

If you are an SIP investor, then a DIY 70/30 large-cap or mid-cap portfolio (if you are willing to bear a bit more volatility) should do the trick. But lumpsum investors should probably shop around of a decent equity-oriented hybrid fund.

Related: Allocating a Two-Asset Portfolio

Check out the code for this analysis on pluto: 60/40 and 70/30. Questions? Slack me!