Social science research is said to have a WAGS problem. Most of their research is based on White American Graduate Students and fail to replicate in the real world.

Finance has a similar problem where, thanks to the depth of the data available on the US markets, most investment research is based on American data.

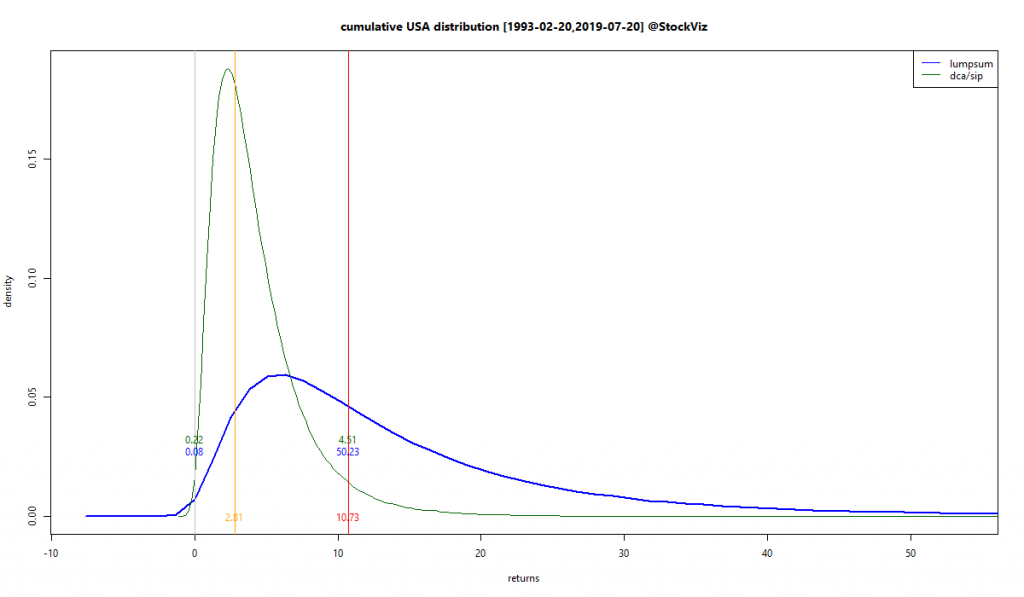

And US data clearly demonstrates the superiority of Buy and Hold. Over a 25+ year period, the probability of ending up with a loss is less than 0.1%

If future returns are in the same vein as their past returns, US investors would be fools not to buy and hold forever.

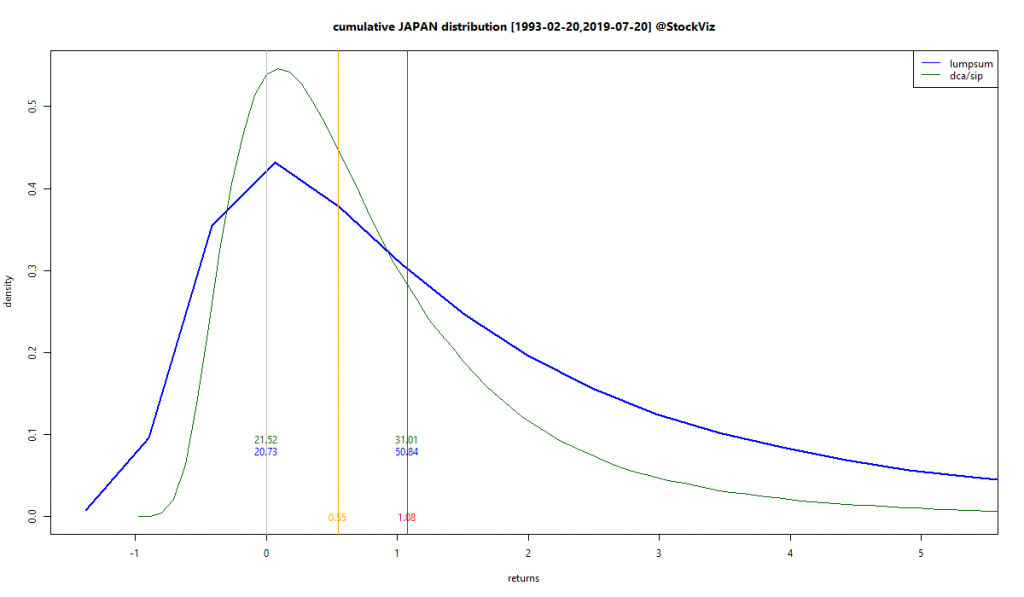

However, this does not mean that the rest of the world should do the same thing. Every market is different. The Japanese experience is a study in contrast.

The probability of a negative outcome is a whopping 21% for them. i.e., there is a one-in-five chance that investors will not make any money investing in Japanese equities. If past is indeed prelude.

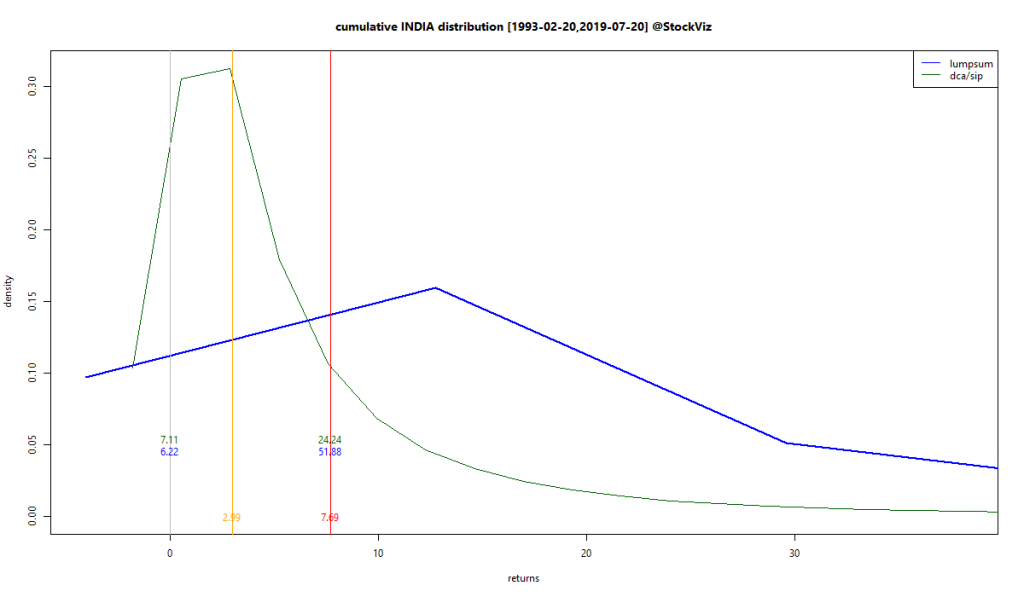

Indian investors have been better off than their Japanese counterparts. There is only a 6% chance of not making any money investing in Indian equities.

All this goes to show that the US is a statistical outlier. “Buy and Hold” working in the US is an outlier. In every other market, there is a non-trivial chance that you will not make any money buying-and-holding equities.

When you look at research based on US markets, keep in mind that the probability distribution of returns that it is based on are an outlier. Anything that is long US equities will “look good.”

All investing is forecasting. And these probabilities will change – we are talking about equity markets after all. But know this before you adopt the “buy and hold” mantra.