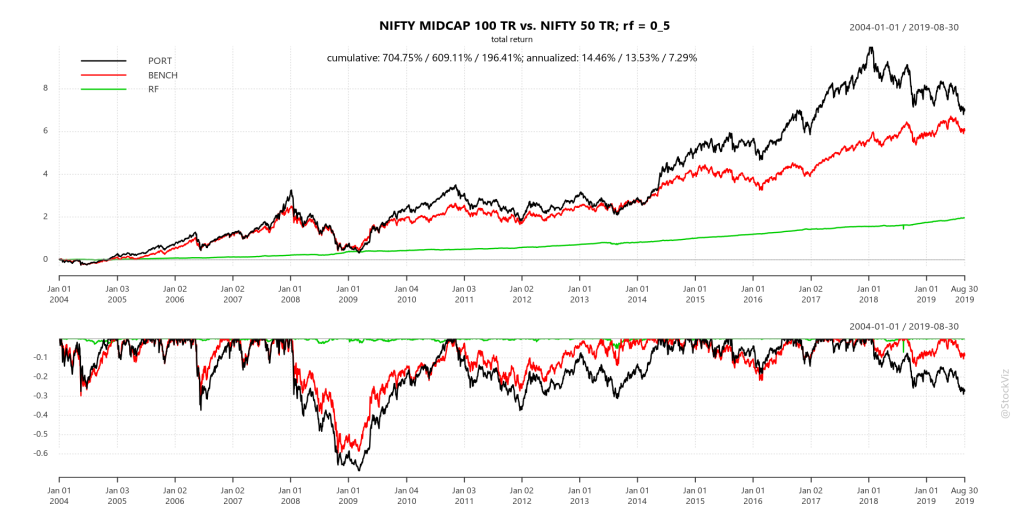

It is generally believed that mid-caps give better returns than large-caps. But if you compare their historical returns, the difference is minuscule.

But mid-caps have often inflicted a lot of pain on their investors – spending most of their time in drawdowns. There is no diversification benefit because both of them play in the same circus. If you are a buy-and-holder, why bother with mid-caps at all?

Check out the notebook on pluto. You can play around with it once you login with your github account.