If you had invested in this fund in April 2006, would you still be invested in it?

Between 2006-04-03 and 2019-03-08 (13-years), SBI Magnum MIDCAP FUND – REGULAR PLAN – GROWTH has returned a cumulative 268.66% vs. NIFTY MIDCAP 100 TR’s cumulative return of 321.39%. Annualized returns are 10.96% and 11.96%, respectively.

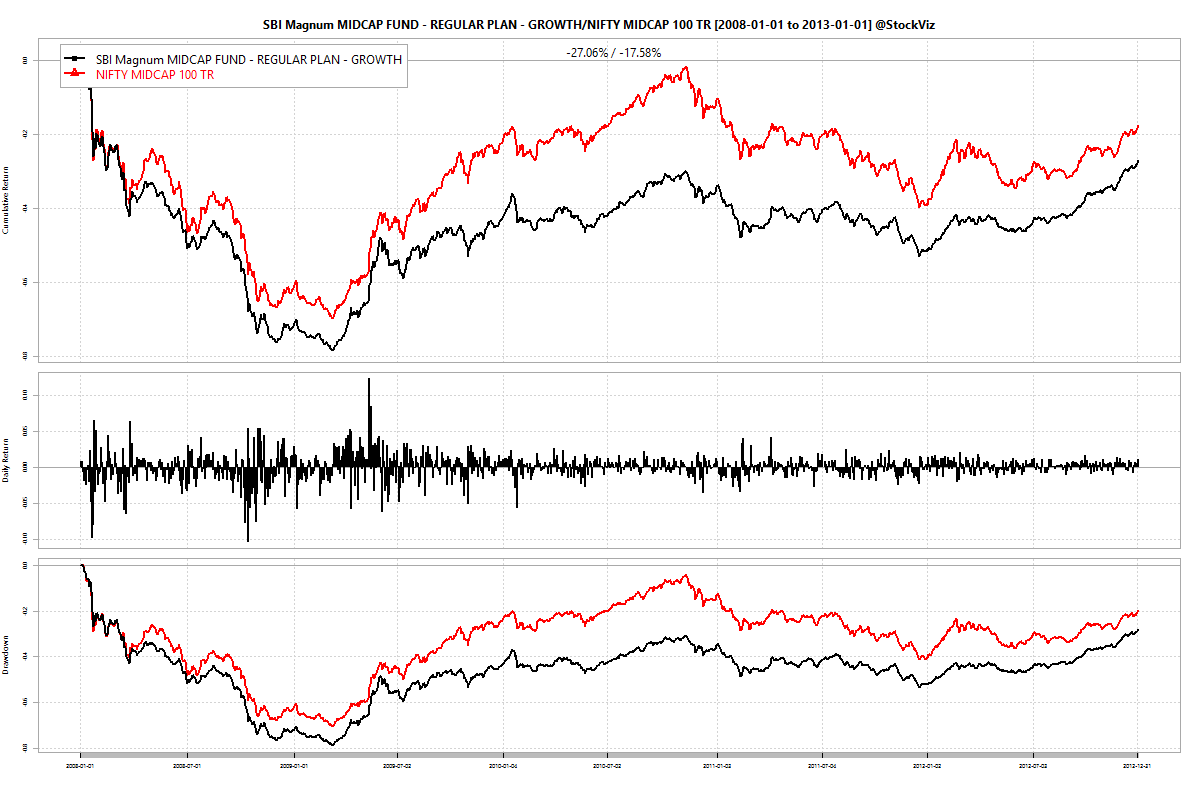

A point of out-performance, a gallon of pain:

Between 2008-01-01 and 2013-01-01 (5-years), SBI Magnum MIDCAP FUND – REGULAR PLAN – GROWTH has returned a cumulative -27.09% vs. NIFTY MIDCAP 100 TR’s cumulative return of -1.54%. Annualized returns are -6.34% and -0.31%, respectively.

When it comes to discretionary active management, the problems are many:

- There are over 40 asset management companies. Almost all of them have a midcap fund. Almost all of them claim to be “value” investors.

- Value, as described in Graham And Dodd, cannot scale to the 10’s of thousands of crores that these funds collectively manage.

- So almost all funds are, at best, index plus a value and/or GARP and/or quality tilt.

- And occasionally, fund managers blow it. They hop over to other funds. Or retire.

- And occasionally, the investing style goes through a bad patch.

- And usually, the business of fund management (accumulating assets) wins over the profession of fund management (superior risk adjusted returns.)

There is no way that any investor can dodge all these minefields. So, the risk that a mutual fund investor takes = market risk + manager risk + style risk + capacity risk.

Investors should primarily allocate to index funds (take only market risk.) Actively managed discretionary mutual funds should be a niche.

Comments are closed, but trackbacks and pingbacks are open.